You’ve seen the charts. You’ve probably also seen the Reddit threads or the flashy "finfluencer" ads claiming you can print money while you sleep using a Python script and a basic moving average crossover. Honestly? Most of that is complete garbage. Quantitative trading: how to build your own algorithmic trading business isn't about finding a magic "buy" button; it’s about building a high-frequency, data-driven enterprise that treats the market like a giant, messy math problem. It’s hard. It's grueling. But if you're the kind of person who finds beauty in a clean covariance matrix, it's the most rewarding business on earth.

Markets are efficient, or at least they try to be. To win, you need an edge that isn't just "I'm smart." You need infrastructure. You need a process that survives when the volatility index spikes and everyone else is panicking.

Most people fail because they treat it like a hobby. They write some code, throw $5,000 into a brokerage account, and get liquidated during a flash crash. If you want to actually build a business, you have to stop thinking like a trader and start thinking like a software engineer who happens to sell risk.

The Brutal Reality of Quant Infrastructure

You can’t run a serious quant business on a laptop with a spotty Wi-Fi connection. Well, you can, but you'll get eaten alive by slippage. Your infrastructure is your storefront. If it’s slow, you’re out of business.

Infrastructure starts with data. Not just the free stuff from Yahoo Finance, either. Serious players look at vendors like QuantConnect, Polygon.io, or Tiingo. You need "clean" data. This means it has been adjusted for splits, dividends, and corporate actions. If your backtest doesn't account for the fact that Apple split 7-for-1 back in 2014, your results are going to look like a fantasy. And fantasies don't pay the rent.

Then there's the execution engine. You’re basically building a bridge between your mathematical model and the exchange. Most retail-pro quants start with Interactive Brokers (IBKR) because their API is robust, even if it feels like it was designed in 1998. It’s reliable. Others might look at Alpaca for a more modern, RESTful experience. The choice depends on your frequency. If you’re trading once a day, the API doesn't matter much. If you're trading every five seconds, every millisecond of latency is money leaking out of your pocket.

Why Your Backtest is Probably Lying to You

This is where the dream usually dies. Overfitting. It's the silent killer of the quantitative trading business. You spend three weeks tweaking parameters until your equity curve looks like a straight line up to the moon. You’re a genius, right? Wrong. You’ve just discovered "p-hacking." You’ve found a set of rules that worked perfectly on the past but has zero predictive power for the future.

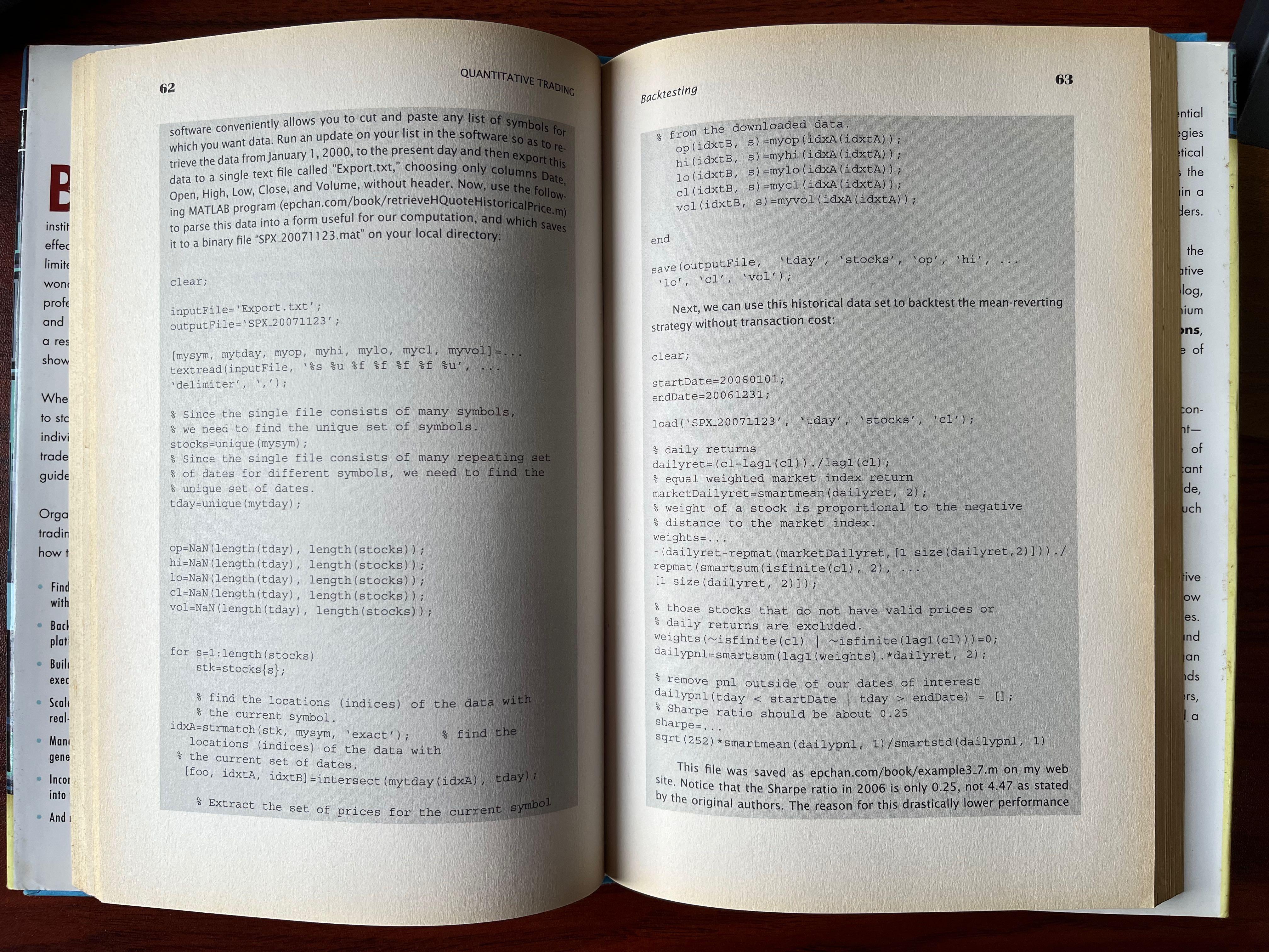

Real quants use "Out-of-Sample" testing. You train your model on 70% of the data and then—this is the hard part—you test it on the remaining 30% that the model has never seen. If the performance falls off a cliff, your strategy is trash. Toss it. Start over. Don't try to "fix" it by adding more variables. Adding more variables just makes the overfitting worse.

The Look-Ahead Bias Trap

Have you ever accidentally used tomorrow's closing price to decide today's trade? It happens more than you'd think in messy code. It makes your backtest look incredible. It also makes your live trading account go to zero. You have to be paranoid. Question every "perfect" result. In the real world of quantitative trading: how to build your own algorithmic trading business, if it looks too good to be true, it’s a bug in your Python script.

The Tech Stack: Python vs. C++ vs. Rust

Python is the king of the quant world for a reason. Libraries like Pandas, NumPy, and Scikit-learn are basically superpowers. You can prototype a strategy in an afternoon. But Python is slow. If you’re building a business that relies on speed—think market making or high-frequency arbitrage—you’re eventually going to hit a wall.

That’s when people move to C++ or, increasingly, Rust. Rust is the new darling of the quant space because it offers C++ speeds with memory safety that prevents your program from crashing at 2:00 AM because of a null pointer.

However, don't overengineer. If your strategy works on a daily timeframe, writing it in C++ is a massive waste of time. Use the simplest tool that gets the job done. Most successful independent quants stay in Python and use libraries like Numba or Cython to speed up the heavy lifting. Focus on the alpha, not the compiler.

🔗 Read more: Colorado Business License Lookup: What Most People Get Wrong

Risk Management: The Only Part That Actually Matters

You can have a mediocre strategy and survive with great risk management. You cannot have a great strategy and survive with mediocre risk management. One "fat finger" error or one "black swan" event can wipe out three years of profit in thirty minutes.

You need hard stops. You need position sizing rules based on volatility (look up the Kelly Criterion, but use it conservatively). You need a "kill switch" that shuts everything down if the portfolio drops by a certain percentage in a single day.

I once knew a guy who built a solid mean-reversion bot for crypto. It made 2% a week like clockwork. Then, a stablecoin de-pegged. His bot kept "buying the dip" because the math said it was an anomaly. It was an anomaly, alright. He lost 80% of his firm's capital in four hours because he didn't have a circuit breaker in his code.

The Costs Nobody Mentions

- Slippage: The difference between the price you want and the price you get.

- Commissions: They eat your soul if you trade high frequency.

- Borrow Costs: If you’re shorting stocks, you have to pay to borrow them.

- Taxes: Short-term capital gains are a beast.

If your backtest says you make 10% a year, but you haven't factored in these four things, you're actually losing money.

Finding Your Alpha: Where the Money Is

Where do you actually find an edge? It’s not in the RSI or MACD. Everyone has those. They’re priced in. Real alpha comes from "alternative data" or unique insights into market microstructure.

Maybe you’re analyzing satellite imagery of retail parking lots. Maybe you’re scraping social media sentiment (though that’s getting crowded). Maybe you’re looking at lead-lag relationships between correlated assets—like how copper prices might lead certain Australian mining stocks.

One of the most sustainable businesses in this space is Statistical Arbitrage. You’re not betting that a stock goes up; you’re betting that two stocks that usually move together have drifted apart and will eventually snap back. It’s boring. It’s consistent. It’s what the big firms like Renaissance Technologies or Two Sigma do, just on a much more massive scale.

Scaling Into a Legitimate Enterprise

Once you have a strategy that works with your own money, you have a choice. Do you keep it small, or do you turn it into a fund? Building a business around quantitative trading: how to build your own algorithmic trading business usually means eventually taking on outside capital.

This introduces a world of pain: legal fees, compliance, SEC filings, and investor relations. You’ll need a "Prime Broker." You’ll need an auditor. Unless you have at least $10 million in Assets Under Management (AUM), the overhead of running a formal hedge fund will probably kill you. Most independent quants are better off staying as "Proprietary Traders"—trading their own capital or joining a platform like Tower Research or Multi-Strategy funds that provide the capital and take a cut of the profits.

Actionable Steps to Get Started Today

If you’re serious about this, stop reading and start doing. But do it in this order so you don't go broke:

- Learn Python and SQL. You can't be a quant if you can't manipulate data. SQL is just as important as Python because that’s where your data lives.

- Master the basics of Statistics. If you don't know what a "Standard Deviation" or "Stationarity" is, you're gambling, not trading. Read Advances in Financial Machine Learning by Marcos López de Prado. It’s the Bible for this stuff.

- Build a Paper Trading Bot. Use a platform like QuantConnect. It allows you to trade in a simulated environment using real-time data. Do this for at least three months. If you can't make money with fake chips, you definitely won't make it with real ones.

- Solve for Survivorship Bias. Ensure your data includes companies that went bankrupt. If your backtest only looks at companies currently in the S&P 500, your results are fake.

- Start Small. When you go live, use the smallest position size possible. Live markets have "friction" that simulations don't. You need to see how your broker handles your orders when things get messy.

The world of algorithmic trading is a zero-sum game. When you win, someone else loses. Usually, that "someone else" is a person trading on emotion or an outdated system. To build a lasting business, you have to be the person who automates the emotion out of the room. It’s not easy, but for those who can code and count, it’s the ultimate frontier.

Good luck. You’re going to need it, but hopefully, your math is good enough that you won't rely on it.

Next Steps for the Aspiring Quant:

- Audit your data sources: Compare the "Adjusted Close" prices of three different vendors for a stock that recently split.

- Code a simple "Mean Reversion" strategy: Apply it to a pair of highly correlated ETFs (like GLD and IAU) and see how the transaction costs kill the profit.

- Read the docs: Spend an afternoon reading the API documentation for Interactive Brokers. It’s dry, but it’s the blueprint for your future business.