Money is weird. One day you’re looking at a flight to New York and it feels doable, and the next, the South African Rand takes a dive and suddenly that burger in Times Square costs as much as a steak dinner in Sandton. If you’ve spent any time tracking rands to usd conversion rates, you know it’s a total rollercoaster. It’s not just numbers on a screen. It’s your purchasing power evaporating while you sleep.

Most people think exchange rates are just about "the economy" in some vague sense. Honestly? It's way more personal. It's about how much Brent Crude is moving, what the U.S. Federal Reserve decided to do with interest rates at 2:00 PM on a Wednesday, and whether or not Eskom managed to keep the lights on this week.

✨ Don't miss: 2 Trillion Yen to USD: What This Massive Sum Actually Buys in Today's Economy

The Brutal Reality of the ZAR/USD Relationship

The South African Rand (ZAR) is what traders call a "proxy" for emerging markets. Basically, when global investors get scared, they dump the Rand first. It’s liquid. It’s easy to trade. It’s the "canary in the coal mine." When you look at rands to usd conversion over the last decade, the trend line looks like a very depressing ski slope. We’ve seen the Rand go from R7 to the dollar in the mid-2000s to swinging wildly between R17 and R19 in recent years.

Why does this happen? Well, the U.S. Dollar is the world's "safe haven." When things go sideways—think global pandemics, wars in Europe, or inflation spikes—everyone runs to the Greenback. South Africa, meanwhile, deals with "idiosyncratic risks." That’s just a fancy way for economists at banks like Goldman Sachs or Standard Bank to say "stuff going wrong at home." High unemployment, infrastructure hiccups, and political noise keep the Rand on its back foot.

It’s Not Just About South Africa

Surprisingly, the Rand can actually strengthen even when our local news is terrible. This happens when the "Carry Trade" is in full swing. Investors borrow money in currencies with low interest rates (like the Yen or sometimes the Dollar) and dump it into high-interest currencies like the Rand to pocket the difference. If the U.S. starts cutting its own interest rates, suddenly the ZAR looks a lot more attractive.

You’ve got to watch the "DXY"—the U.S. Dollar Index. If the DXY is pumping, the Rand is almost certainly dumping. It’s a seesaw. There’s very little the South African Reserve Bank (SARB) can do to stop a global dollar rally, even if they hike interest rates until everyone's mortgage hurts.

👉 See also: Stock Market Right Now: Why the 2026 Bull Run Feels Different

How the Conversion Actually Works (The Stuff Banks Hide)

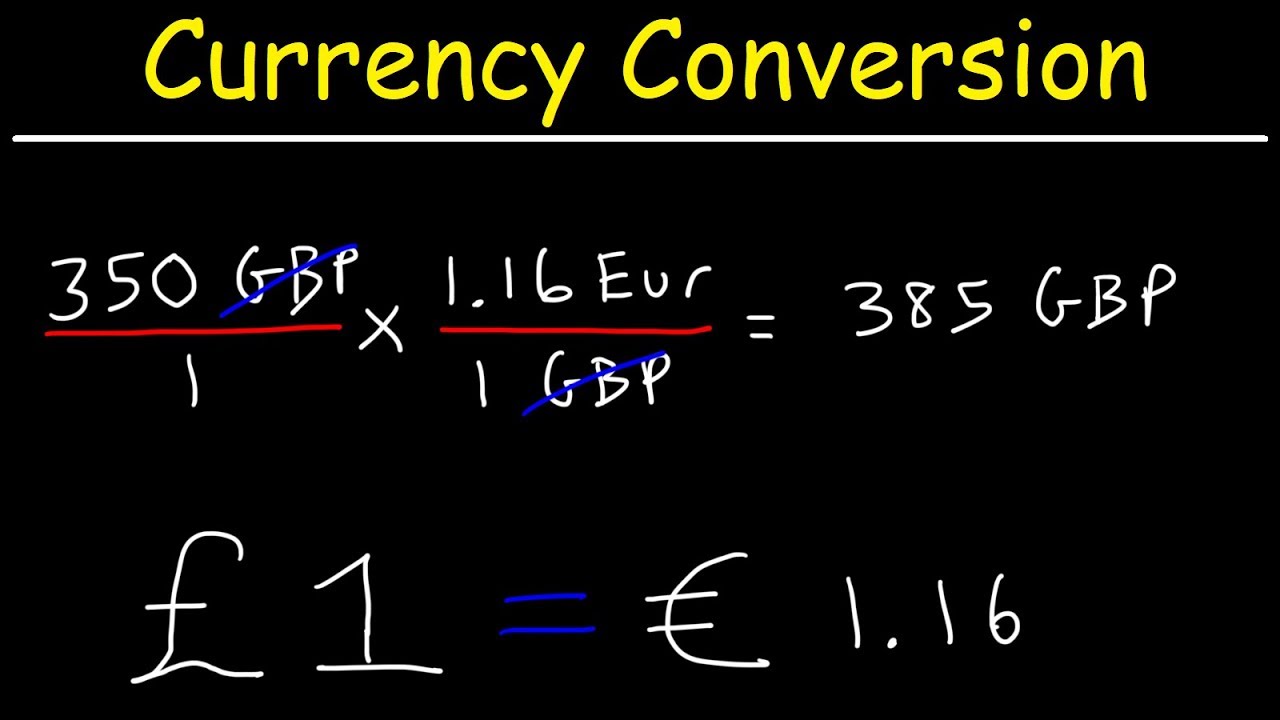

When you Google "rands to usd conversion," you see the "mid-market rate." This is the "real" rate—the halfway point between what buyers are offering and what sellers are asking.

But here’s the kicker: You will almost never get that rate.

If you go to a big bank like FNB, ABSA, or Standard Bank, they add a "spread." That’s their cut. If the mid-market rate is 18.50, they might sell you dollars at 18.90 and buy them back from you at 18.10. They win both ways. Then there are the "commission fees" and "SWIFT fees." It’s a racket, honestly.

Better Ways to Move Money

- Fintech Disrupters: Companies like Wise (formerly TransferWise) or Shyft are usually way cheaper than traditional banks because they use the mid-market rate and charge a transparent flat fee.

- Currency Brokers: If you’re moving a lot of money—say, for a house or an offshore investment—use a specialist like TreasuryOne or CurrencyDirect. They can often shave 1% or 2% off the bank's rate, which is massive when you're talking about hundreds of thousands of Rands.

- Crypto... maybe: Some people use stablecoins like USDC to bypass traditional banking rails. It’s fast, but you’ve got to be careful with the local "on-ramps" and "off-ramps" (like Luno or Revix) because their fees can eat your soul if you aren't paying attention.

Understanding Inflation’s Role in Your Conversion

Inflation is the silent killer of the ZAR. In the U.S., the Federal Reserve targets 2% inflation. In South Africa, the SARB targets a range of 3% to 6%. Because our prices generally rise faster than American prices, the Rand must depreciate over the long term to maintain "Purchasing Power Parity" (PPP).

Think about the Big Mac Index. If a Big Mac costs R50 in Joburg and $5 in New York, the "implied" exchange rate should be 10:1. If the actual exchange rate is 18:1, the Rand is technically "undervalued." But "undervalued" doesn't mean it’s going to get stronger anytime soon. Markets can stay irrational longer than you can stay solvent.

Practical Steps for Managing the ZAR/USD Rollercoaster

You can’t control the SARB or the Fed, but you can protect your own pocket.

Stop Timing the Market. Even the pros at Nedbank or Investec get it wrong. If you need dollars for a trip in six months, buy a little bit every month. This is called "Dollar Cost Averaging." Sometimes you’ll buy at R18.20, sometimes at R18.80. Over time, you’ll end up with a decent average and you won't have a heart attack if the Rand crashes the day before you fly.

Get an Offshore Account. It’s 2026; you don't need to be a millionaire to have a dollar account. Use apps like Shyft or even Revolut if you have a way to access it. Keeping some of your savings in USD acts as a "hedge." When the Rand loses value, your USD-denominated savings gain value in Rand terms. It balances out.

Watch the Commodity Prices. South Africa exports a lot of gold, platinum, and coal. When these prices go up, the Rand usually follows. If you see gold hitting all-time highs, it might be a good time to look for a slightly better rands to usd conversion rate. Conversely, if commodity prices are tanking, the Rand is going to feel the pain.

Mind the Tax Man. SARS allows you a "Single Discretionary Allowance" (SDA) of R1 million per calendar year for offshore transfers without needing a Tax Compliance Status (TCS) PIN. If you’re moving more than that, you need to get your paperwork in order. Don't try to be clever; they see everything.

👉 See also: Bradham Inventor of Pepsi NYT: What Most People Get Wrong About the Birth of a Giant

Look Beyond the Spot Rate. If you are a business owner importing goods, look into Forward Exchange Contracts (FECs). This lets you "lock in" a rate today for a payment you have to make in three months. You might pay a small premium, but it buys you certainty. In a country where the currency can move 3% in an hour because of a political speech, certainty is worth its weight in gold.

The Verdict on the Rand

The Rand is a volatile, high-beta currency. It’s sensitive, moody, and deeply influenced by things happening thousands of miles away in Washington and Beijing. While we all wish for a R12 dollar again, the structural reality suggests we should prepare for continued weakness over the long haul.

Protect yourself by diversifying. Don't keep all your eggs in a ZAR-shaped basket. Use modern fintech tools to avoid getting fleeced by "Big Five" bank spreads. Most importantly, keep an eye on the U.S. inflation data—because what happens in a grocery store in Ohio has a direct impact on how many Rands you need to buy a dollar tomorrow.

Next Steps for Your Currency Strategy:

- Audit your bank's spreads: Compare your bank's "sell" rate for USD against the mid-market rate on Google. If the difference is more than 2%, you’re being overcharged.

- Open a multi-currency digital wallet: Look into platforms like Shyft or Wise to hold USD balances and convert when the rate is favorable, rather than when you're desperate.

- Monitor the Fed: Follow the U.S. Federal Open Market Committee (FOMC) calendar. These meetings are the primary drivers of dollar strength and will dictate the short-term direction of the ZAR.