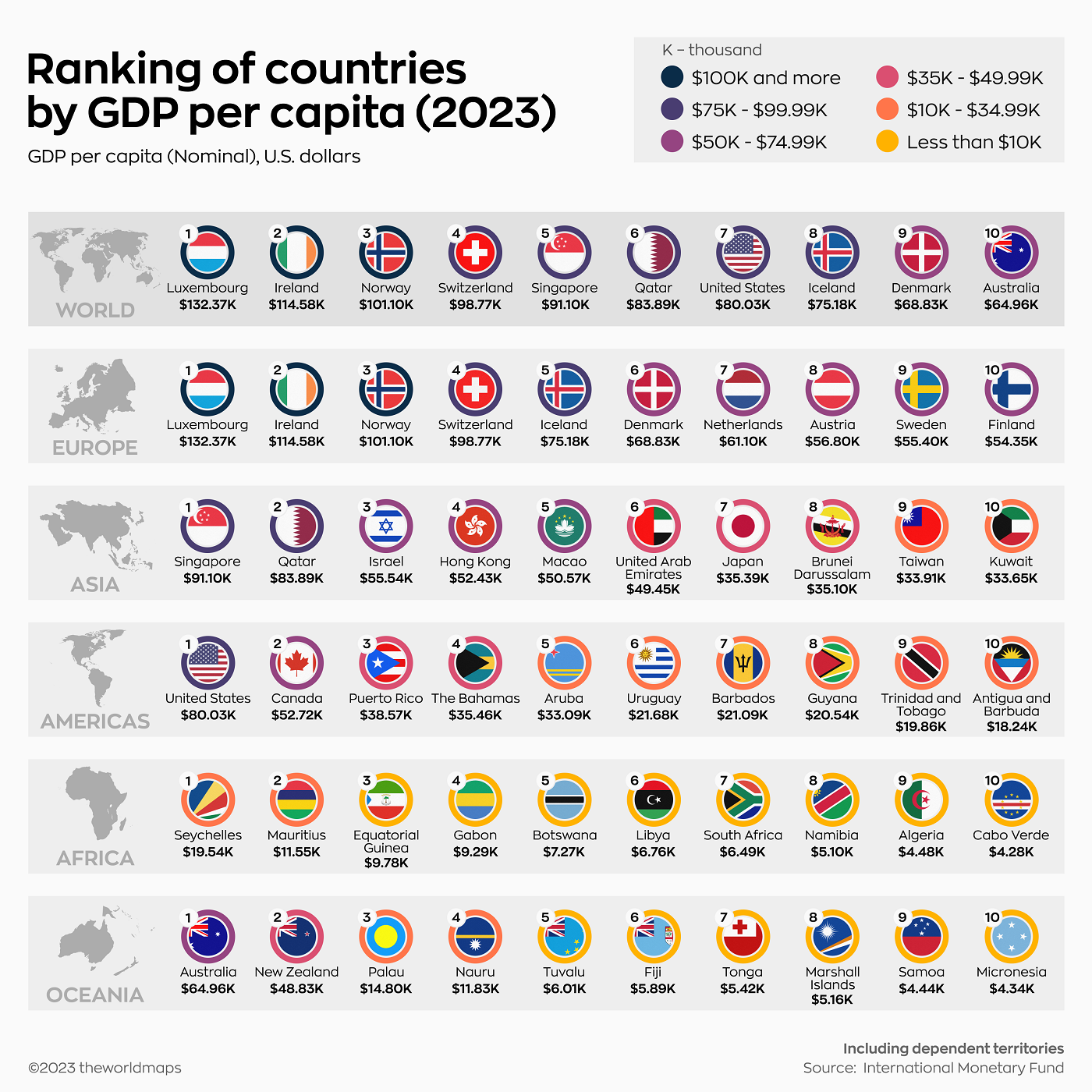

Ever looked at those lists of the world’s richest nations and wondered why the United States, with its massive $31.82 trillion economy, often sits at number nine or ten? Or why a tiny country like Luxembourg, which you could drive across in about an hour, consistently takes the crown? Honestly, when you rank countries by GDP per capita, you aren't just looking at who has the most money in the vault. You're looking at a very specific, slightly flawed, but incredibly revealing slice of economic life.

Basically, GDP per capita is the total economic output of a country divided by its population. It’s the "size of the pie" shared among the "number of guests." In 2026, the global economic map looks a bit like a jigsaw puzzle where the smallest pieces are often the most valuable.

Why the Top Spots Are Always Tiny

You’ve probably noticed the same names on every list: Luxembourg, Ireland, Singapore, and Qatar. It’s not a coincidence. These are "portal" economies.

Take Luxembourg. As of early 2026, its GDP per capita is hovering around $141,080. That’s wild. But here’s the thing—a huge chunk of that wealth is generated by people who don't even live there. Thousands of workers commute from France, Germany, and Belgium every single day. Their work counts toward Luxembourg’s GDP, but they aren't counted in the population denominator. It’s a mathematical quirk that inflates the numbers.

Ireland is another head-scratcher. With a 2026 GDP per capita projection of roughly $135,250, it looks like the wealthiest place on Earth. In reality, Ireland is a hub for multinational corporations like Apple, Google, and Pfizer. They book their profits there because of the tax structure. It’s "leprechaun economics," a term famously coined by economist Paul Krugman. The money is there, but it doesn't always end up in the pockets of the person buying a pint in a Dublin pub.

The 2026 Heavy Hitters (Nominal vs. PPP)

When we rank countries by GDP per capita, we usually look at two different numbers: Nominal and PPP (Purchasing Power Parity).

- Nominal GDP is the raw dollar amount. It’s what your money is worth on the international currency market.

- PPP is "burger math." It adjusts for the cost of living. If a haircut costs $10 in India but $50 in New York, PPP tries to account for that difference so we can see how much people can actually buy.

In 2026, the International Monetary Fund (IMF) and World Bank data show a fascinating split.

- Luxembourg: Still king. Its financial sector is a beast.

- Ireland: Massive, but largely driven by corporate accounting.

- Switzerland: Roughly $118,170. This is "real" wealth—innovation, banking, and high-end manufacturing.

- Singapore: The gateway to Asia, sitting at about $99,040.

- Norway: Oil and gas wealth managed by the world’s most sensible sovereign wealth fund.

- United States: At $92,880, the U.S. is the only "giant" economy in the top ten. It’s an anomaly. Usually, as population goes up, GDP per capita goes down. The U.S. breaks that rule.

The Guyana Explosion

If you want to see something truly crazy, look at Guyana. A few years ago, it wasn't even on the radar. Now, thanks to massive offshore oil discoveries, its growth rate is vertical. In 2026, Guyana’s GDP per capita is projected to be around $34,310.

For context, that puts it ahead of countries like Portugal and close to the Czech Republic. Is every person in Guyana suddenly living like a king? No. The infrastructure is still catching up. This is the danger of using a single number to define "wealth." The money is flowing in, but distribution takes decades.

What Most People Get Wrong About These Rankings

I’ll be honest: these lists can be misleading. A high GDP per capita doesn't mean a "better" life.

Look at the U.S. vs. the Netherlands. The U.S. has a higher GDP per capita, but the average American works about 25% more hours than a Dutch worker. If you have $90k but no time to spend it, are you "richer" than someone with $75k and six weeks of vacation?

The Blind Spots

- Inequality: If one billionaire lives in a village of 99 paupers, the "average" GDP per capita makes them all look like millionaires.

- Unpaid Work: GDP doesn't count the mom staying home with kids or the guy fixing his own roof.

- Environment: A country could strip-mine its entire landscape, sell the gold, and have a massive GDP for one year before the economy collapses because the land is dead.

The "Middle Income Trap" and Emerging Stars

While we obsess over the top 10, the real action is in the middle. Countries like Vietnam, Indonesia, and India are the ones to watch.

India’s per capita income is still low—around $3,050—but its total economy is now the 4th largest in the world, passing Japan. When a country with 1.4 billion people starts moving the needle on per capita wealth, it shifts the entire planet's gravity.

Actionable Takeaways: How to Use This Data

If you’re an investor, a student, or just a curious human, don't just look at the rank. Look at the why.

💡 You might also like: How Do You Start Your Own Clothing Line Without Losing Your Mind (and Your Savings)

- Check the PPP: If you’re thinking about digital nomad life or retiring abroad, the nominal rank is useless. Look at the PPP to see how far your dollar actually goes.

- Look for Trends, Not Totals: Guyana’s massive jump tells a story of resource wealth. Ireland’s jump tells a story of tax policy. Switzerland’s steady climb tells a story of high-value stability.

- Diversify Your Metrics: Pair GDP per capita with the Human Development Index (HDI) or the Gini Coefficient (which measures inequality).

Rankings are a fun starting point, but they’re just a snapshot. The real wealth of a nation is usually hidden in the stuff that's hardest to count—health, free time, and whether the average person can actually afford to buy a house in the country they're supposedly "enriching."

To get a true sense of global standing, your next move should be comparing these 2026 GDP figures against the 2026 World Happiness Report or Cost of Living Indexes. You'll quickly see that the "richest" countries aren't always the places where people are the most satisfied.