You’ve probably seen it on the evening news or a flickering monitor at the bank. That jagged line climbing a mountain or diving off a cliff. It's the chart of the dow, a visual heartbeat of the American economy that everyone talks about but surprisingly few people actually read correctly. Most folks just glance at the color. Green is good, red is bad, right? Well, sort of, but if you're actually trying to manage your own money or understand why your 401(k) just took a haircut, looking at the surface isn't enough.

The Dow Jones Industrial Average (DJIA) isn't just a number. It's a price-weighted index of 30 massive, "blue-chip" companies. This matters because it means a stock with a higher share price has a bigger impact on the chart than a company with a lower share price, regardless of how big the company actually is. It’s a bit of a weird, old-school way to do things—most modern indices like the S&P 500 use market cap—but the Dow persists because it’s the oldest barometer we've got. It’s the legacy.

✨ Don't miss: Amazon Changes Free Shipping: What Really Happened With Your Deliveries

Why the Chart of the Dow Often Lies to You

When you pull up a chart of the dow on your phone, you're usually looking at a "line chart." It’s clean. It’s simple. It’s also incredibly misleading.

Line charts only track the closing price. They ignore the chaos that happens between 9:30 AM and 4:00 PM. If the Dow opens down 400 points, rallies back, and closes flat, the line chart looks like a straight horizontal line. You’d never know the world was ending for three hours in the middle of Tuesday. To really see what's happening, you have to switch to candlesticks. Each "candle" shows you the open, the high, the low, and the close. It shows you the fight between buyers and sellers.

The other big lie is the "point" system. "The Dow is up 500 points!" sounds like a massive deal. In 1980, when the Dow was hovering around 800, a 500-point jump would have been a world-altering event. Today, with the Dow sitting comfortably in the tens of thousands, 500 points is just a Tuesday. Always look at the percentage. A 1% move is a 1% move, whether the index is at 1,000 or 40,000.

The Price-Weighting Problem

Think about UnitedHealth Group (UNH) and Coca-Cola (KO). Both are in the Dow. However, as of early 2026, UnitedHealth's share price is significantly higher than Coca-Cola's. Because the Dow is price-weighted, a 1% move in UnitedHealth moves the entire chart of the dow much more than a 1% move in Coke.

It’s an quirk that drives math-minded investors crazy. If a company does a stock split, its influence on the Dow drops instantly, even though the company's value hasn't changed. This is why many institutional investors prefer the S&P 500 or the Nasdaq, but the Dow remains the "Main Street" index. It’s what your grandfather checked in the paper, and it’s what the headlines scream about when things go sideways.

Identifying the Real Trends in the Noise

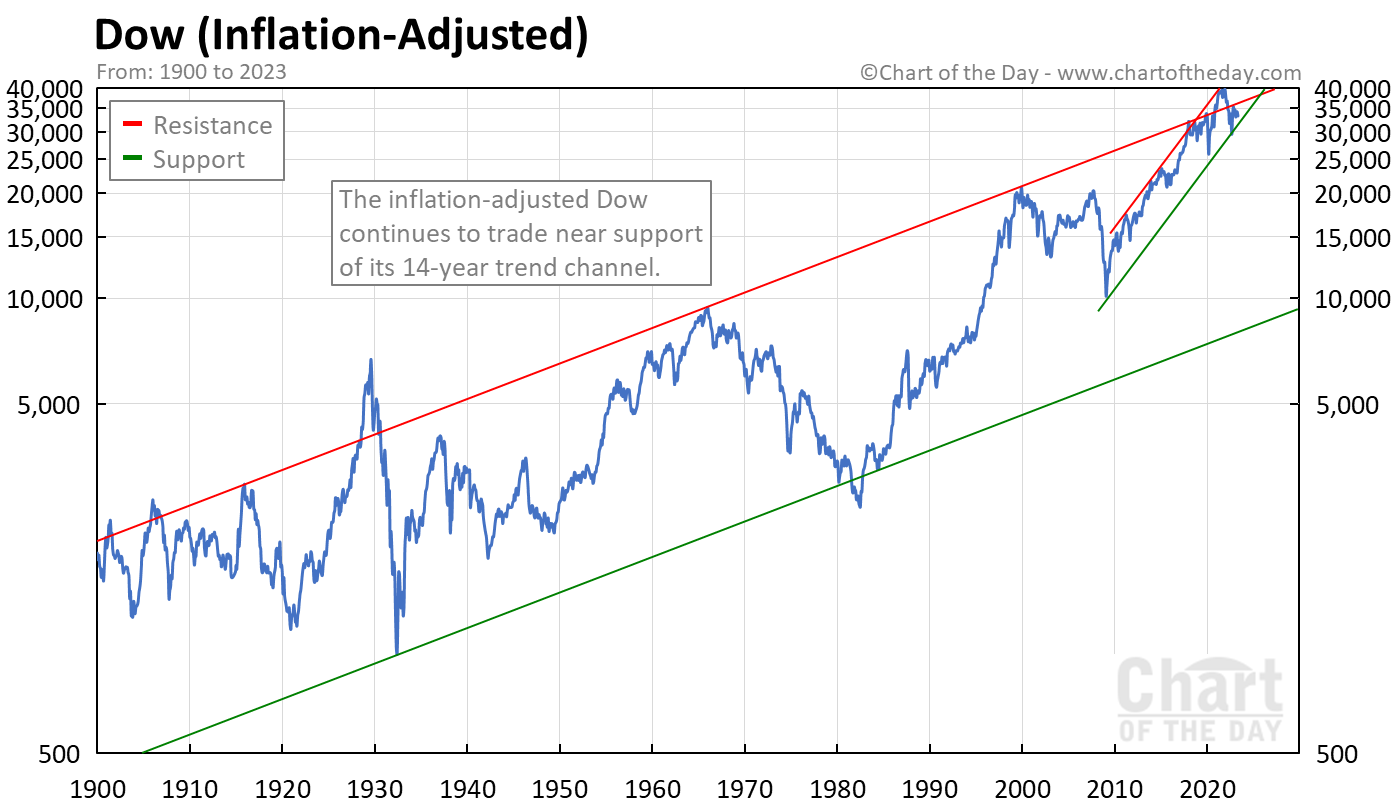

Markets don't move in straight lines. They move in waves. If you look at a long-term chart of the dow—say, a 10-year or 20-year view—the noise of daily politics and quarterly earnings starts to fade. You see the massive structural shifts. You see the 2008 financial crisis, the 2020 pandemic crash, and the subsequent recoveries.

Technical analysts spend their whole lives staring at these patterns. You’ve probably heard of "support" and "resistance." Support is like a floor. It’s a price level where buyers usually step in because they think the Dow is "cheap." Resistance is the ceiling. It’s where people start selling because they think the market is "expensive."

- Support: If the Dow hits 38,000 and bounces back up three times in a month, 38,000 is your support.

- Resistance: If it tries to break 42,000 but keeps falling back, that's your resistance.

- Breakouts: When the chart finally smashes through that ceiling, it’s often a sign of a new bull run.

But honestly? Most of these "patterns" are just psychological scars left on the collective brain of the market. People remember where they lost money, and they remember where they made it. That memory is what creates the lines on the chart.

💡 You might also like: Why a Solid Wedding Photography Agreement Template is Actually Your Best Friend

Moving Averages: The Trend's Best Friend

If the daily squiggles are too much for you, look at the 50-day and 200-day moving averages. These are just the average closing prices over those time periods, smoothed out into a single line. When the current price of the Dow is above its 200-day moving average, the trend is generally up. When it dips below, it’s time to pay attention.

There's this thing called the "Death Cross." Sounds metal, right? It happens when the short-term 50-day average crosses below the long-term 200-day average. It’s often seen as a bear market signal. Conversely, the "Golden Cross" is when the short-term line crosses above the long-term one. These aren't crystal balls, but they do help strip away the emotion of a bad news cycle.

Volume and the "Wall of Worry"

A chart of the dow without volume data is like a car without a fuel gauge. Volume tells you how much conviction is behind a move. If the Dow jumps 400 points on low volume, nobody is actually buying the move. It’s "thin" trading. It could reverse in a heartbeat. But if the Dow drops 2% on massive volume? That’s a "distribution day." It means the big institutional players—the pension funds and the hedge funds—are heading for the exits.

They say the market likes to climb a "wall of worry." This means that when everyone is terrified and the news is nothing but doom and gloom, the chart often starts to grind higher. Why? Because the "bad news" is already priced in. Everyone who was going to sell has already sold.

The Companies That Move the Needle

Remember, the Dow is only 30 stocks. It’s a very exclusive club. When Apple (AAPL) or Microsoft (MSFT) has a bad day, the chart of the dow feels it. But because it’s only 30 companies, it can sometimes be "wrong" about the broader economy. There are thousands of small-cap companies that might be struggling while the Dow's 30 giants are doing just fine because of their international reach or massive cash reserves.

It’s a lopsided view of the world.

If you’re looking at the Dow to gauge the health of the "tech" sector, you’re looking in the wrong place. The Nasdaq is for tech. If you’re looking for the "total market," look at the Russell 3000. The Dow is for the "Establishment." It’s banks (JPMorgan Chase), retailers (Walmart), and industrial titans (Caterpillar).

Contextualizing the History

Go back and look at a chart of the dow from 1929. The "Great Crash." It took the Dow until 1954 to sustainably pass its 1929 peak. That’s 25 years of waiting. Fast forward to the 2020 COVID crash—the fastest bear market in history followed by an incredibly rapid recovery. The "speed" of the chart has changed because of high-frequency trading and instant information. We don't wait for the morning paper anymore. We react in milliseconds.

Actionable Steps for Using the Dow Chart

Reading the chart isn't about predicting the future. No one can do that. It’s about managing risk. If you see the Dow hitting all-time highs while the volume is falling, that’s a red flag. If you see it bouncing off a long-term support level during a period of extreme fear, that might be an opportunity.

- Stop looking at daily points. Switch your view to percentage changes to get a realistic sense of volatility.

- Zoom out. Look at the weekly or monthly chart. The "daily noise" will kill your nerves; the "monthly trend" will build your wealth.

- Check the "Internals." Use a tool to see how many of the 30 Dow stocks are actually trading above their 200-day moving average. If the index is going up but only 10 stocks are doing the heavy lifting, the rally is fragile.

- Watch the VIX. The VIX is the "Fear Index." When the VIX spikes, the chart of the dow usually tanks. They have an inverse relationship.

- Ignore the "Price Target" Pundits. No one knows where the Dow will be in six months. Use the chart to see where it is and where it has been. Use that to set your stop-losses or entry points.

The Dow is an imperfect, weirdly weighted, old-fashioned relic. But it’s our relic. It’s the primary way the world measures the American industrial machine. Just make sure when you’re looking at that line, you understand what’s actually pulling the strings behind the scenes.

💡 You might also like: 1 US Dollar Equals How Many Pounds: Why the Number You See on Google Isn't Always Real

Don't just watch the line. Understand the weight of the companies moving it. Keep an eye on the volume to see if the big money is actually participating. Use the 200-day moving average as your "sanity check" whenever the headlines get too loud. Most importantly, remember that the chart shows the past, and while history rhymes, it never repeats exactly the same way.