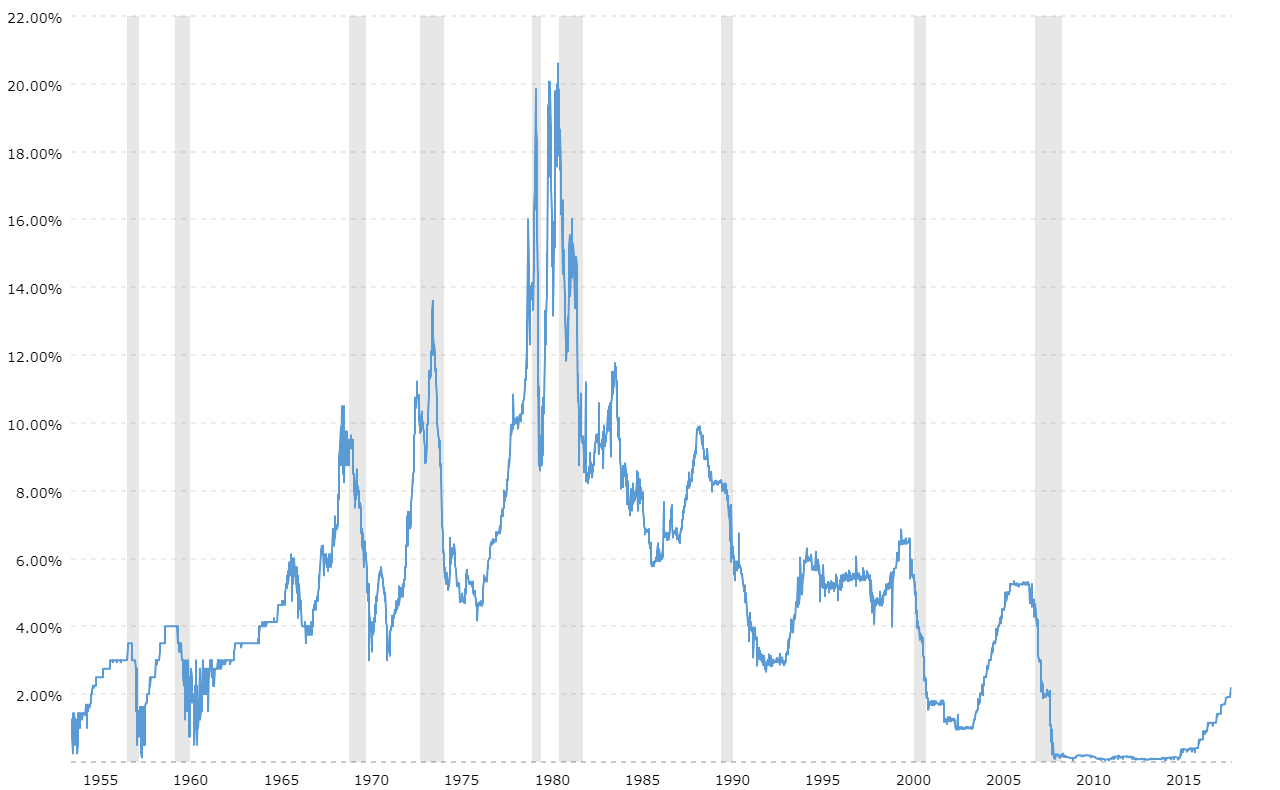

If you've ever looked at a fed funds rate graph, you've basically looked at the heartbeat of the American economy. It’s a jagged line. Sometimes it stays flat for years, hugging the floor like it’s scared of heights. Then, suddenly, it shoots up. Those spikes? They make your mortgage more expensive. Those dips? They’re usually the Federal Reserve's way of screaming "Mayday" during a recession. Honestly, most people just see a chart with some percentages and dates, but if you know how to read between the lines, that graph tells the story of every boom and bust since the 1950s.

Interest rates are the "price of money." When the Federal Reserve's Open Market Committee (FOMC) meets in that big building in D.C., they aren't just guessing. They're looking at inflation and employment. If you look at a long-term fed funds rate graph, you'll notice it doesn't just wander aimlessly. It reacts. It’s a tool.

The Volcker Shock and Why the 80s Look So Weird

Take a look at the early 1980s on any historical chart. It looks like a mountain range. Paul Volcker, the Fed Chair at the time, decided to break the back of inflation by hiking rates to nearly 20%. Imagine that. Twenty percent. Today, people lose their minds when the rate hits 5%. Volcker was willing to cause a massive recession to stop prices from spiraling. It worked, but it was painful.

When you see those massive vertical climbs on the graph, you're seeing a central bank that is desperate to cool down an overheating economy. The "neutral rate"—where the economy is neither speeding up nor slowing down—is a moving target. In the 80s, that target was miles higher than it is now. Why? Because people expected high inflation. Once you expect prices to go up 10% every year, you demand higher wages, and companies raise prices to pay those wages. It’s a loop. Volcker used the fed funds rate like a sledgehammer to smash that loop.

How to Spot a Recession Before It Hits

There is a trick to reading these charts. Look for the "effective" rate versus the "target" rate. Usually, they’re almost identical. But more importantly, look at what happens right before the gray shaded bars on a St. Louis Fed (FRED) graph. Those gray bars represent recessions.

Almost every single time, you see the line go up, plateau for a bit, and then fall off a cliff.

The Fed raises rates to stop inflation. They keep them high until something "breaks." Once the economy starts shedding jobs, they pivot. They slash the rate. Look at 2008. The fed funds rate graph shows a steep drop from over 5% down to zero in what feels like a heartbeat. That wasn't a policy choice; it was an emergency. For nearly seven years after that, the line stayed at zero. We call that the "Zero Lower Bound." It was uncharted territory. It changed how an entire generation thought about debt.

The Modern Era of "Easy Money"

Between 2009 and 2016, the graph is a flat line at the bottom. This is where things get weird. When money is free—or close to it—investors take risks. They buy tech stocks. They flip houses. They pour money into crypto. Because you can't get any return on a savings account, you have to go hunting for yield elsewhere.

👉 See also: How to File Class Action Lawsuit Claims Without Getting Scammed or Overwhelmed

Then came 2022.

After the pandemic, inflation didn't stay "transitory" like Jerome Powell hoped it would. If you look at the fed funds rate graph for 2022 and 2023, it’s one of the steepest climbs in history. It’s a vertical wall. The Fed was playing catch-up. They realized they’d left the "easy money" party going for too long and had to turn the lights off and call the cops.

Why the "Effective" Rate Isn't Always the "Target" Rate

You might hear news anchors talk about the Fed "setting" the rate. They don't actually set it like a thermostat. They set a target range. For example, they might say "we want the rate to be between 5.25% and 5.50%."

The actual rate—the Effective Federal Funds Rate (EFFR)—is determined by banks lending to each other overnight. The Fed uses "Open Market Operations" to nudge that rate into the target. They buy or sell government bonds to change the amount of cash floating around. If there’s too much cash, the rate drops. If they suck cash out of the system, the rate goes up.

- The Discount Window: This is where banks go when they can't get money anywhere else. It’s usually higher than the fed funds rate.

- Interest on Reserve Balances (IORB): The Fed pays banks to keep money at the Fed. This acts as a floor for the rate.

- Reverse Repos: Another tool used to soak up extra cash.

It’s a massive, invisible plumbing system. When you look at the fed funds rate graph, you’re seeing the result of trillions of dollars moving through these pipes every single day.

The Real-World Impact on Your Wallet

It’s easy to think of this as just "bank stuff." It isn't. The fed funds rate is the benchmark for almost all other interest rates.

📖 Related: Where is Tom Foley Today? Life After Politics and the 2026 Sports Scene

When that line on the graph goes up, banks raise the "Prime Rate." Your credit card interest is usually Prime + a certain percentage. So, if the Fed moves the needle by 0.25%, your credit card bill gets more expensive. Auto loans follow suit. Mortgages are a bit different—they track the 10-year Treasury yield—but they generally move in the same direction as the fed funds rate.

When the rate is low, the graph tells you it’s time to borrow. When it’s high, the graph is telling you to save. Simple, right? But the lag is the killer. It takes about 12 to 18 months for a change in the fed funds rate to really filter through the whole economy. That’s why the Fed is always worried about "overshooting." They might keep raising rates because inflation is still high, not realizing that the hikes they did a year ago are just about to hit the brakes on the economy.

Analyzing the 2026 Landscape

As we sit here in 2026, the fed funds rate graph has finally started to level off after the post-inflation spikes. Experts like Mohamed El-Erian or researchers at Goldman Sachs have spent the last few years debating where the "new normal" is. For a long time, we thought the neutral rate was around 2%. Now, many think it’s closer to 3% or 4%.

The world has changed. De-globalization, the green energy transition, and aging populations are all "inflationary" forces. This means the Fed might not be able to drop that line back to zero like they did in 2008 or 2020. We might be entering a "higher for longer" era. If you’re looking at the graph and expecting it to crash back to the floor, you might be waiting a long time.

Actionable Steps for Navigating Rate Changes

Don't just stare at the chart. Use the information. The fed funds rate graph is a roadmap for your personal finances.

1. Watch the Slope

If the line is trending up, prioritize paying down variable-interest debt. Your credit card APR is going to climb. Lock in fixed rates on loans while you can. Conversely, this is the time to look for high-yield savings accounts (HYSAs) and CDs. When the Fed hikes, the banks eventually have to pay you more to keep your money there.

2. Don't Fight the Fed

There’s an old saying on Wall Street: "Don't fight the Fed." If the graph shows rates are rising, the Fed is trying to slow the economy down. That usually means stock markets will be volatile and "growth" companies (like tech startups) will struggle because their future profits are worth less in today's dollars.

3. Look for the Pivot

The moment the line on the fed funds rate graph starts to curve downward is often a massive signal for the bond market. Bond prices move opposite to rates. If you buy a bond when rates are at the peak, and then the Fed starts cutting, your bond becomes much more valuable.

4. Check the FRED Database

For the most accurate data, go straight to the source. The Federal Reserve Bank of St. Louis (FRED) has the most interactive fed funds rate graph available. You can overlay it with inflation (CPI) or unemployment data. When you see inflation crossing over the fed funds rate, you know a policy shift is coming.

🔗 Read more: Lee Iacocca Net Worth: Why the 1 Dollar CEO Actually Died Worth Millions

The graph isn't just a historical record. It's a tool for prediction. If you see the rate staying high while unemployment starts to tick up, you can bet that the next move on that chart will be a downward slide. Being able to read that shift before it happens is the difference between being caught in a recession and being prepared for one. Money is never static; it’s always reacting to that one single line determined by a few people in a room in Washington. Keep an eye on the line. It tells you everything you need to know about where your money is going next.