Stock market charts are everywhere. You see them on CNBC tickers, flashing red and green on Robinhood, or tucked into the corner of your 401k login page. But here is the thing: most people treat an S&P chart like a Rorschach test. They see what they want to see. If they are feeling optimistic, a slight dip looks like a "buying opportunity." If they are scared, that same dip looks like the edge of a cliff.

Charts don't lie, but they are very good at hiding the truth if you don't know how to filter the noise.

The S&P 500 isn't just a number. It is a market-cap-weighted index of the 500 largest publicly traded companies in the U.S. When you look at that jagged line moving across your screen, you are looking at the collective psychological state of millions of investors, from high-frequency trading algorithms in Manhattan to a guy checking his phone during a lunch break in Ohio.

What an S&P Chart is Actually Trying to Tell You

Basically, the chart is a scoreboard. But unlike a football game where the score is final at the end of four quarters, the S&P 500 scoreboard has been running since 1957. If you zoom out far enough, the chart looks like a beautiful, upward-sloping mountain range. Zoom in to a one-day view? It looks like a heart monitor for a caffeine addict.

Context is everything.

💡 You might also like: Lenovo Stock Price: What Most People Get Wrong About the AI PC Pivot

Most retail investors get trapped in the "daily noise." They see the S&P chart drop 1.5% because a Fed governor made a hawkish comment about interest rates, and they panic. Professional traders look at that same chart and check the "moving averages." These are just smoothed-out lines that show where the price has been over the last 50 or 200 days. If the current price is still above the 200-day moving average, the long-term trend is technically still "up." It’s sort of like a ship in a storm; as long as the hull is above water, the splashing on the deck doesn't mean you're sinking.

The Weighting Problem Nobody Mentions

You’ve probably heard people say "the market is doing great" when their own portfolio is actually bleeding. Why does that happen? It’s because the S&P 500 is top-heavy. As of early 2026, a handful of massive tech companies—think Microsoft, Apple, NVIDIA, and Alphabet—carry an enormous amount of weight.

If NVIDIA has a blowout quarter and jumps 10%, it can drag the entire S&P 500 higher, even if 400 other companies in the index are having a terrible day. This is called "concentration risk." When you look at an S&P chart, you aren't always seeing a broad economic recovery; sometimes, you're just seeing five or six tech giants carrying the world on their backs.

Support, Resistance, and the Psychology of "Getting Even"

Human beings are weird. We remember prices. If you bought the S&P 500 (via an ETF like SPY or VOO) at 5,000 and it dropped to 4,500, you are probably feeling some pain. If it climbs back up to 5,000, your first instinct might be to sell just to "get back to even."

This creates what analysts call "resistance."

Resistance is a level on the S&P chart where sellers consistently outnumber buyers. It’s a ceiling. On the flip side, "support" is the floor. It’s the price point where investors think, "Wow, this is a bargain," and they start buying in droves.

Honestly, these lines aren't magic. They work because enough people believe in them. It's a self-fulfilling prophecy. If every trader in the world thinks the S&P 500 will bounce at its 200-day moving average, they all set buy orders at that level. And guess what? The price bounces.

The Danger of the "All-Time High"

There is a common myth that you shouldn't buy when the S&P chart is at an all-time high. It feels counterintuitive, right? Why buy at the most expensive price ever?

But history tells a different story.

According to data from JPMorgan Asset Management, the S&P 500 actually spends a surprising amount of time at or near all-time highs during bull markets. Momentum is a real thing. Breaking through an old "resistance" level often signals that the market has found a new gear. Of course, nothing goes up forever, but waiting for a massive "crash" to enter the market is often a losing game called "market timing." Most people who wait for the crash end up missing the 20% gain that happened while they were sitting on the sidelines.

How to Spot a "Fakeout"

Charts can be deceptive. Sometimes the price will break above a resistance level, making everyone think a new rally is starting, only to reverse and crash lower. This is a "bull trap."

You avoid this by looking at volume.

If the S&P chart is moving up but the "volume" (the number of shares being traded) is low, it means there isn't much conviction behind the move. It’s like a car trying to drive uphill with no gas in the tank. It might roll forward for a bit, but it’s going to stall out eventually. A "real" breakout usually happens on high volume, meaning the "big money"—pension funds, hedge funds, and institutional banks—is actually putting cash to work.

Logarithmic vs. Linear Views

If you really want to look like a pro, stop looking at linear charts for long periods of time. A linear chart shows the same vertical distance for a 100-point move, whether the index is at 1,000 or 5,000. That’s silly.

A 100-point move at 1,000 is a 10% gain.

A 100-point move at 5,000 is a 2% gain.

Switch your S&P chart to "Logarithmic" (Log) view. This adjusts the scale so that the vertical distance represents the percentage change. This is the only way to see the true history of the market without the recent years looking like a vertical line that is about to explode. It puts the 2008 financial crisis and the 2020 COVID crash into their proper mathematical perspective.

The Yield Curve and the Chart's Secret Weapon

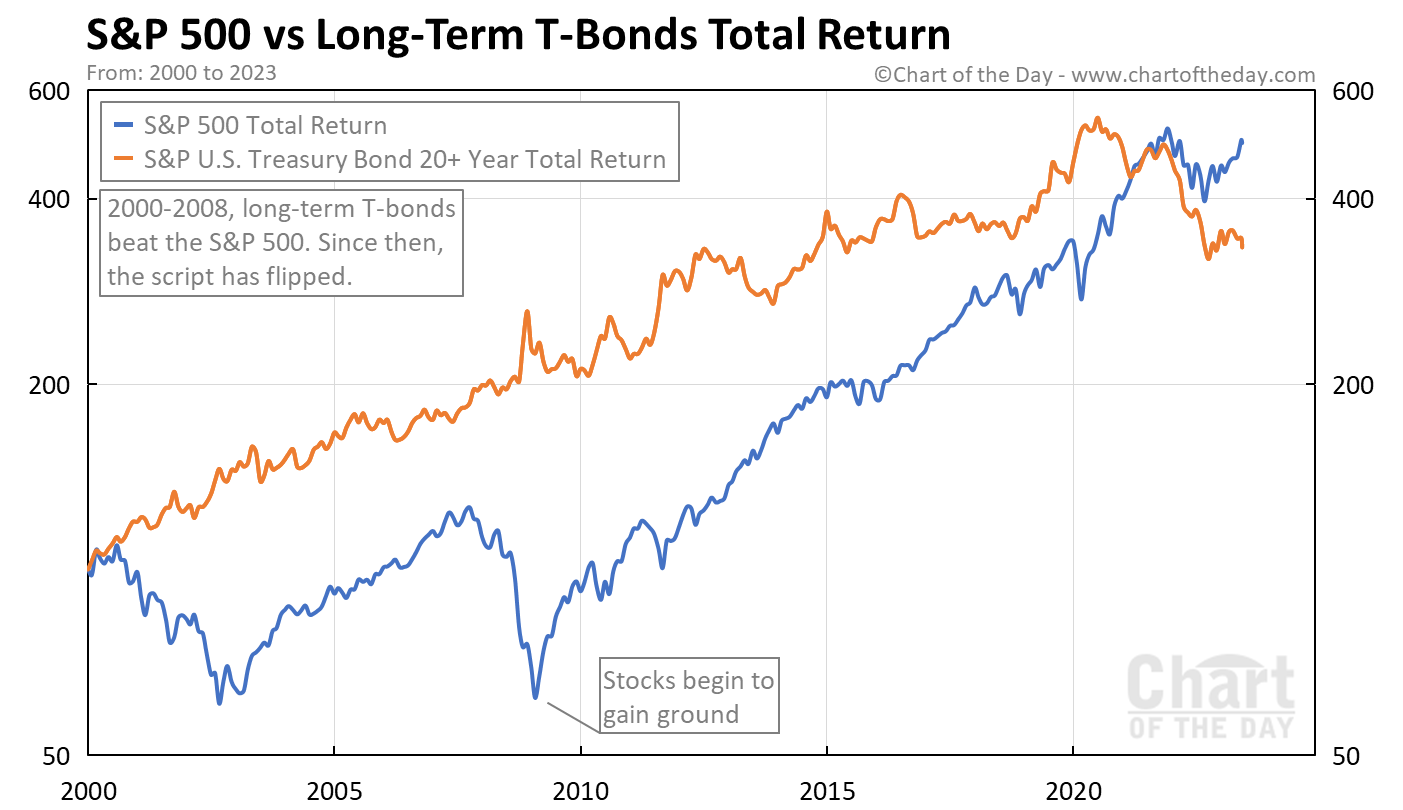

You can't talk about the S&P 500 without talking about bonds. Usually, when bond yields (like the 10-year Treasury) go up sharply, the S&P chart starts to look shaky. Why? Because if you can get a "guaranteed" 4% or 5% from the government, why would you risk your money in a volatile stock like Meta or Amazon?

Keep an eye on the relationship between the two. When yields spike, the "P/E multiple" (what people are willing to pay for earnings) usually shrinks. This is fundamental gravity. No matter how much hype there is around AI or tech, the S&P 500 still has to answer to the laws of interest rates.

Don't Ignore the VIX

There is another chart often paired with the S&P 500 called the VIX, or the "Fear Gauge." It measures volatility.

When the S&P 500 is drifting upward calmly, the VIX is usually low (under 15). When the S&P starts to tank, the VIX spikes. Smart investors look for "divergence." If the S&P is making new highs but the VIX is also starting to creep up, it suggests that professional traders are buying "insurance" (options) because they smell trouble. It’s a subtle warning sign that the party might be ending.

Actionable Steps for Using the S&P Chart Today

Stop staring at the 1-minute chart. Unless you are a day trader with a death wish and a high-speed fiber connection, it will only make you lose money through emotional overtrading.

- Check the Weekly Trend First: Open your charting tool and set the timeframe to "Weekly." This removes the daily drama and shows you the actual direction of the market. If the weekly trend is up, don't sweat a red Tuesday.

- Identify the "Big Floors": Look at where the S&P chart bounced in the last six months. Mark those levels. If the index approaches them again, that is where the "smart money" is likely to step in.

- Watch the RSI (Relative Strength Index): This is a little indicator at the bottom of many charts. If the RSI is over 70, the market is "overbought" (getting a bit too greedy). If it’s under 30, it’s "oversold" (people are panicking).

- Diversify Your View: Don't just look at the S&P 500. Check the "Equal Weight" S&P 500 (ticker: RSP). If the regular S&P is going up but the Equal Weight version is flat, you know the rally is being driven by only a few giant stocks, which is a fragile situation.

The most important thing to remember is that a chart is a map of where we've been, not a GPS for where we are going. It tells you the current path of least resistance. Respect the trend, understand the "weighting" of the companies inside it, and always, always zoom out when things start to feel stressful.

The market has survived wars, pandemics, and depressions. A bad candle on a Tuesday afternoon isn't the end of the world. It’s just a data point.