Uncle Sam eventually wants his cut. You’ve spent decades dutifully stuffing cash into your 401(k) or Traditional IRA, watching it grow tax-deferred, but the IRS isn’t exactly known for its infinite patience. At a certain point, they force you to start taking money out. This is where the RMD uniform lifetime table comes into play, serving as the cold, hard mathematical ruler that determines exactly how much you have to withdraw to satisfy the taxman.

It’s basically a life expectancy chart, but with a twist.

💡 You might also like: TikTok Creator Fund Calculator: Why Your Earnings Predictions are Usually Wrong

The IRS updated these tables back in 2022 to reflect the fact that, generally speaking, people are living longer than they used to. If you’re looking at an old financial blog post from 2019, the numbers are going to be wrong. Dead wrong. Using the outdated divisors could mean you’re taking out more money than necessary, which just results in a higher tax bill than you actually owe. Nobody wants that.

Why the RMD Uniform Lifetime Table is Your New Best Friend (or Worst Enemy)

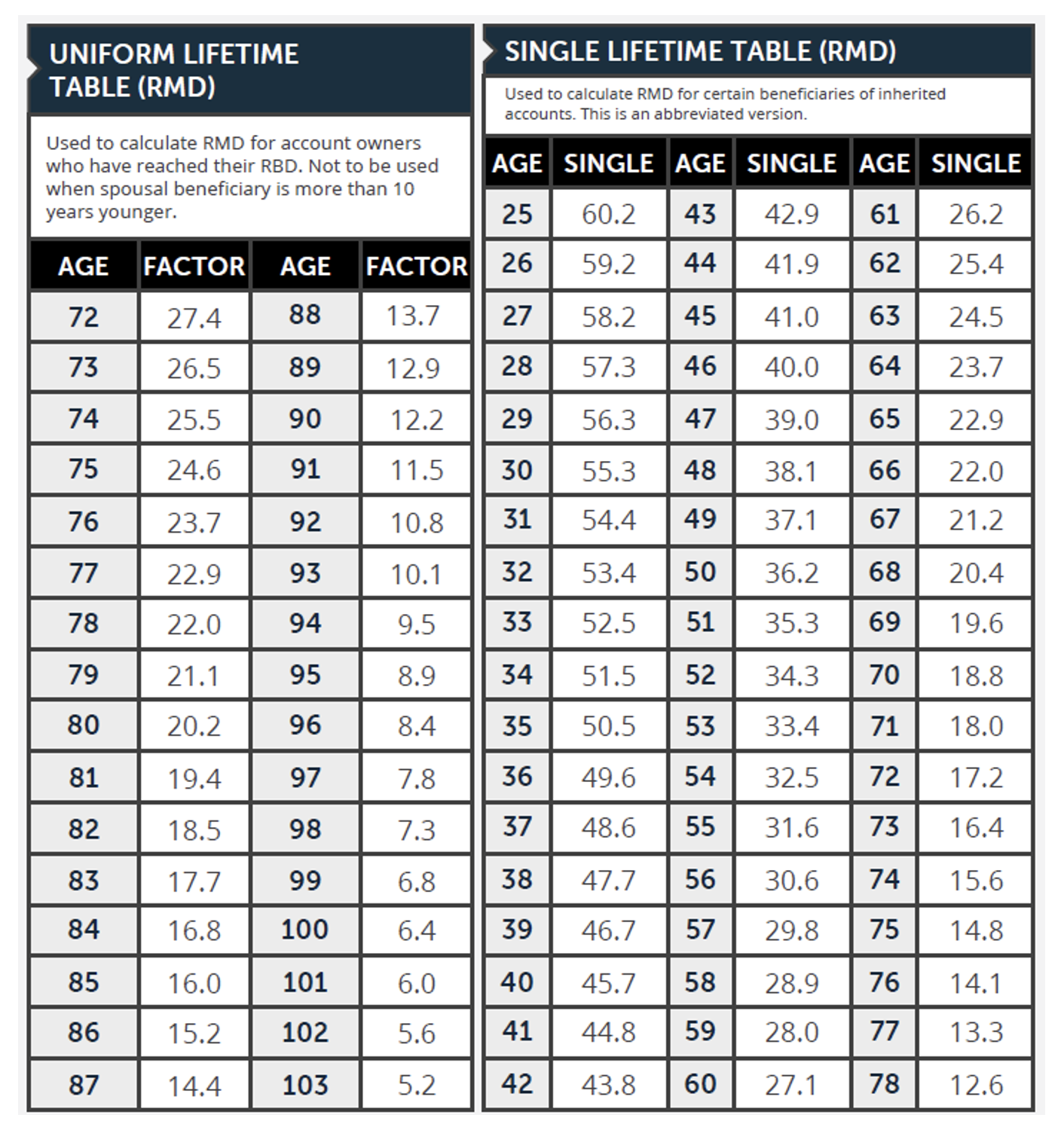

The table is designed for the "standard" retiree. If you’re an account owner whose spouse isn't more than 10 years younger than you—or if your spouse isn't the sole beneficiary—this is the table you use. It’s the default. It’s the baseline.

How does it actually work? You take your account balance as of December 31st of the previous year and divide it by a "distribution period" number found on the table. That number represents your remaining life expectancy in the eyes of the government. As you get older, that number gets smaller.

Small number? Big withdrawal.

Let's say you're 75. According to the current RMD uniform lifetime table, your distribution period is 24.6. If you have $500,000 in your IRA, you divide $500,000 by 24.6. That gives you an RMD of roughly $20,325. You have to take that out by December 31st, or you face a penalty.

And man, those penalties used to be brutal. It was 50% of the amount you failed to withdraw. Thanks to the SECURE 2.0 Act, that penalty has been slashed to 25%, and it can even drop to 10% if you fix the mistake quickly. But 10% is still 10% too much to give away for a simple math error.

The Age Goalposts Keep Moving

The SECURE 2.0 Act didn't just mess with penalties; it shifted when you actually have to start using the RMD uniform lifetime table. For a long time, the magic number was 70½. Then it became 72.

As of 2026, we are firmly in the transition period. If you turned 73 in 2024 or 2025, you’re already in the rhythm of taking distributions. However, if you were born in 1960 or later, your starting age for RMDs is actually 75. It’s a bit of a sliding scale that depends entirely on your birth year.

👉 See also: 7 dollars to pesos: Why your pocket change actually matters more than you think

Why does the IRS do this? They want to ensure that most of your retirement assets are distributed over your lifetime, rather than being passed on as a massive tax-free inheritance. They want their income tax. It's that simple.

Realities of the Table: A Prose Breakdown of the Numbers

Instead of staring at a massive grid of numbers, let's look at how the "divisor" or "distribution period" changes as you age. It’s not a linear drop. It’s a curve.

At age 73, the divisor is 26.5. This means you’re withdrawing about 3.77% of your account. By the time you hit 80, the divisor has dropped to 20.2, pushing your mandatory withdrawal up to nearly 5%. If you’re lucky enough (or perhaps unlucky, depending on your tax bracket) to reach age 90, the divisor is 12.2. Now you’re pulling out over 8% of your total balance every single year.

It gets aggressive. Fast.

If your investments aren't returning at least 8% at that age—and most conservative retiree portfolios aren't—your account balance will start to plummet. The RMD uniform lifetime table is literally designed to eventually empty the account.

Where People Trip Up

The most common mistake? Using the wrong balance. You must use the balance from December 31st of the year before the distribution year. If you’re calculating your 2026 RMD, you look at your statement from the end of 2025.

Another weird quirk: if you have multiple IRAs, you calculate the RMD for each one individually based on the RMD uniform lifetime table, but you can aggregate the total amount and take it out of just one account. However, you cannot do this with 401(k) plans. If you have three different 401(k)s from old jobs, you have to take a specific RMD from each individual plan.

It’s a paperwork nightmare that usually leads people to consolidate their old employer plans into a single IRA before they hit RMD age.

Exceptions to the Uniform Table Rule

While most people use the RMD uniform lifetime table, it isn't the only one in the IRS's toolkit. There's the Joint Life and Last Survivor Expectancy Table.

You only use that one if your spouse is your sole beneficiary and is more than 10 years younger than you. This is actually a gift from the IRS. A younger spouse has a longer life expectancy, which results in a larger divisor. A larger divisor means a smaller RMD. This allows you to keep more money in the tax-deferred account for longer, which is the ultimate goal for wealth preservation.

Then there’s the Single Life Expectancy Table. This is primarily used by beneficiaries who have inherited an account. If you inherited an IRA before the rules changed in 2020, you might still be using this. But for most "new" inheritors, the 10-year rule has replaced the old "stretch IRA" strategy, making the table less relevant for younger generations.

Strategic Moves to Outsmart the Table

If you hate the idea of forced distributions, you have options. But you have to act before the RMD uniform lifetime table kicks in.

Roth conversions are the heavy hitter here. By moving money from a Traditional IRA to a Roth IRA, you pay the taxes now so you don't have to take RMDs later. Roth IRAs (for the original owner) don't have RMDs. You can let that money sit and grow until you’re 100 if you want.

Another savvy move is the Qualified Charitable Distribution (QCD). If you’re 70½ or older, you can send up to $105,000 (indexed for inflation) directly from your IRA to a qualified charity. This counts toward your RMD but doesn't count as taxable income. It’s a massive win for people who are already giving to charity and want to lower their tax bracket.

The Impact of Longevity and Inflation

We have to talk about the reality of living in 2026. Inflation has been a rollercoaster, and while the RMD uniform lifetime table was updated recently to account for longer lives, it doesn't account for the purchasing power of your remaining dollars.

If you're forced to take out $30,000 but your cost of living has spiked by 15%, the RMD might actually feel "too small" for your needs. Conversely, if you don't need the money, the RMD can push you into a higher tax bracket, potentially increasing the cost of your Medicare Part B and Part D premiums (thanks to IRMAA surcharges).

👉 See also: Keller Williams Integrity First Realty Explained: What Really Happens Inside

It’s all connected. The RMD isn’t just a withdrawal; it’s a trigger for a dozen other financial dominos.

Practical Next Steps for Account Owners

Don't wait until December to look at the RMD uniform lifetime table. By then, your options for tax planning are almost zero.

First, verify your "starting age" based on your birth year. If you were born between 1951 and 1959, your age is 73. If you were born in 1960 or later, it's 75.

Second, check your beneficiary designations. If your spouse is significantly younger, ensure they are listed as the sole beneficiary so you can potentially use the more favorable Joint Life table instead of the Uniform table.

Third, consider a "dry run" calculation. Look at your current balances and see what your RMD will look like in five years. If that number looks like a tax bomb, start talking to a professional about Roth conversions or shifting your investment strategy toward more tax-efficient assets outside of your retirement accounts.

Finally, if you’re still working at age 73 or 75, check if your current employer’s 401(k) allows for a "still-working" exception. Some plans let you delay RMDs for that specific account as long as you are still employed and don't own more than 5% of the company.

The table is a tool, but it's also a mandate. Understanding the math today prevents a massive headache—and a massive bill—tomorrow.

Actionable Summary for Retirement Planning:

- Identify your specific RMD age (73 or 75) to avoid the 25% failure-to-withdraw penalty.

- Calculate your 2026 distribution using the December 31, 2025, account balance and the correct divisor from the IRS Publication 590-B.

- Evaluate a QCD strategy if you are charitably inclined, as this is the most effective way to satisfy the RMD requirement without increasing your Adjusted Gross Income (AGI).

- Consolidate old 401(k)s into a single IRA to simplify the calculation process and ensure no accounts are accidentally overlooked.