When people search for ross locher mailto: causeway capital management, they aren't usually looking for a generic bio. They’re looking for a bridge. Whether you’re an institutional investor trying to get a direct line to a senior research analyst or a job seeker trying to figure out how the "sausage is made" at a firm like Causeway, the intent is usually about access and insight.

Let’s be honest: finding a direct email address for a senior analyst at a major Los Angeles-based asset manager isn't supposed to be easy. These firms gatekeep their talent for a reason. But if you’re tracking the industrials or energy sectors, Ross Locher is someone you’ve likely come across in shareholder reports or sector deep dives. He’s not just another face in the crowd; he’s a pivotal part of the fundamental research engine at Causeway Capital Management.

Who is Ross Locher?

Basically, Locher is a Fundamental Senior Research Analyst. He’s been with Causeway since July 2015, which, in the world of high-turnover finance, is a pretty respectable tenure. He didn't just fall into this role. Before joining the team in LA, he spent four years at Brandes Investment Partners as an equity research associate.

While at Brandes, he cut his teeth on global industrials—specifically aerospace, defense, and construction. If you know anything about Brandes, you know they are "deep value" to their core. That’s likely where Locher developed the discipline required for the kind of rigorous, bottom-up analysis that Causeway is famous for.

He’s a CFA charterholder, which is sort of the "gold standard" (and a massive headache to study for) in the investment world. Education-wise, he’s got a BS in Management Science from UC San Diego and spent some time at Università Bocconi in Italy. That international exposure is actually pretty key when you’re analyzing global energy markets or multinational industrial conglomerates.

What He Actually Does All Day

Locher’s current beat covers the industrials and energy sectors. This isn't just looking at stock charts. It involves:

- Financial Modeling: Building out massive spreadsheets to predict how a company will perform three to five years down the line.

- Company Visits: Getting on planes to meet management teams and see factory floors firsthand.

- Sector Deep Dives: Understanding how a shift in global oil prices might ripple through the entire industrial supply chain.

- Internal Debates: Defending his "Buy" or "Sell" recommendations to a room full of portfolio managers who are paid to poke holes in his logic.

The Causeway Philosophy: Why It Matters

You can't talk about ross locher mailto: causeway capital management without talking about Sarah Ketterer and the firm's broader philosophy. Causeway is a value-oriented firm. They look for companies that are unloved, misunderstood, or temporarily beaten down by the market.

For an analyst like Locher, this means he’s often looking at the "unsexy" parts of the market. He isn't chasing the latest AI hype unless there's a tangible, undervalued industrial application for it. Instead, he’s looking at things like railway efficiency, aircraft engine maintenance cycles, or the long-term viability of traditional energy assets during a green transition.

💡 You might also like: Pete Ricketts Net Worth: Why the Nebraska Senator Is Richer Than You Think

His work directly feeds into the firm’s flagship funds, like the Causeway International Value Fund. When Locher finds an inefficiency in an industrial stock in France or a construction firm in Japan, that insight helps drive the alpha for the entire firm.

Why You Can't Just "Mailto" Him

If you're looking for a direct email link (the "mailto" part of the search), you’re probably going to hit a wall. Most major asset managers route their external communication through:

- Relationship Managers: For institutional clients.

- Product Specialists: For those with specific fund questions.

- General Inquiries: The "Contact Us" form on their website.

If you’re a professional trying to share research or an investor with a legitimate inquiry, the best route is typically through the firm’s main headquarters in Los Angeles or their official portal. Cold-emailing a Senior Research Analyst is rarely the most effective way to get a response unless you have a pre-existing professional relationship.

✨ Don't miss: Pound to US Dollar: Why the Exchange Rate is Doing Something Totally Weird Right Now

Navigating the Industry Like a Pro

If you’re trying to follow Locher’s work or the work of Causeway, don’t just look for an email. Look for their "Insights" section on the Causeway website. Locher occasionally contributes to these white papers—for instance, his analysis on "Deploying Innovation" in the industrial sector.

These papers are gold mines for seeing how he thinks. They show the nuance he brings to the table, acknowledging that while innovation is great, it’s only valuable if the company can actually monetize it without destroying its margins.

Actionable Steps for the Curious

If you’re a student, an aspiring analyst, or a curious investor, here is how you actually engage with this level of market expertise:

✨ Don't miss: The Crystal Palace: Why Alonzo Herndon Barber Shop Name Still Matters Today

- Read the Annual Reports: Look for the commentary on the Industrials and Energy sectors in Causeway’s mutual fund filings. This is where the analysts' fingerprints are most visible.

- Follow the Sector: If you want to understand Locher’s world, start tracking the aerospace and defense sectors. Understand how geopolitical tensions affect supply chains.

- Network the Right Way: If you are looking for career advice, don't just "mailto" a senior analyst. Reach out to associates or use LinkedIn to find common connections.

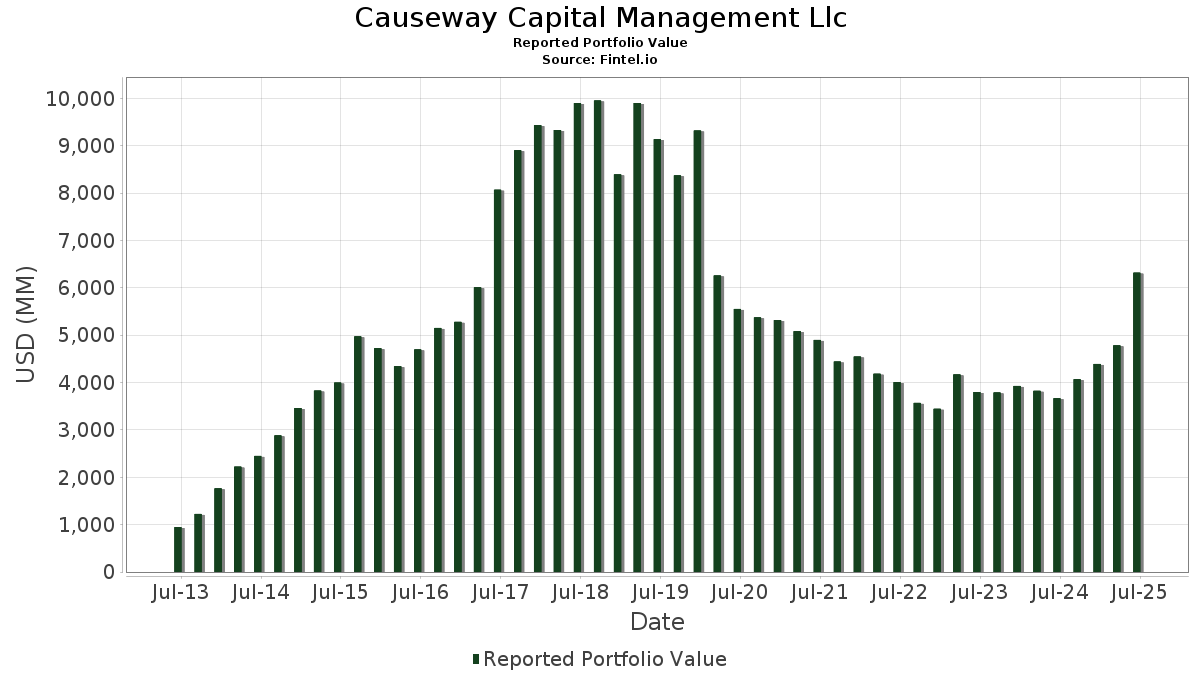

- Monitor Form 13F: Keep an eye on Causeway’s quarterly filings to see which industrial or energy stocks they are buying or selling. It’s the closest you’ll get to seeing the results of Locher’s research in real-time.

Ross Locher represents the backbone of fundamental investing: deep sector knowledge, a commitment to the CFA code of ethics, and a decade-plus of experience navigating the cycles of the global economy. While a direct email might be elusive, his impact on the portfolios at Causeway Capital Management is very much public record.