Saving for retirement usually feels like a chore you’ll get to "eventually," but the clock is ticking on your 2026 window. If you're hunting for the roth ira max contribution 2026 numbers, you’ve probably realized that the IRS doesn't just hand out these tax breaks to everyone without a few hoops to jump through. Honestly, the Roth IRA is arguably the greatest gift the government ever gave the middle class, yet most people treat it like a secondary savings account. That’s a mistake.

The 2026 limits are finally here, and they reflect the persistent nudge of inflation we've all been feeling at the grocery store. For the 2026 tax year, the Roth IRA max contribution 2026 limit is $7,500 for those under age 50. If you’ve hit that big 5-0 milestone, you get a "catch-up" contribution, bringing your total to $8,500.

It sounds simple. Just move the money, right? Not exactly.

The Income Trap Most People Ignore

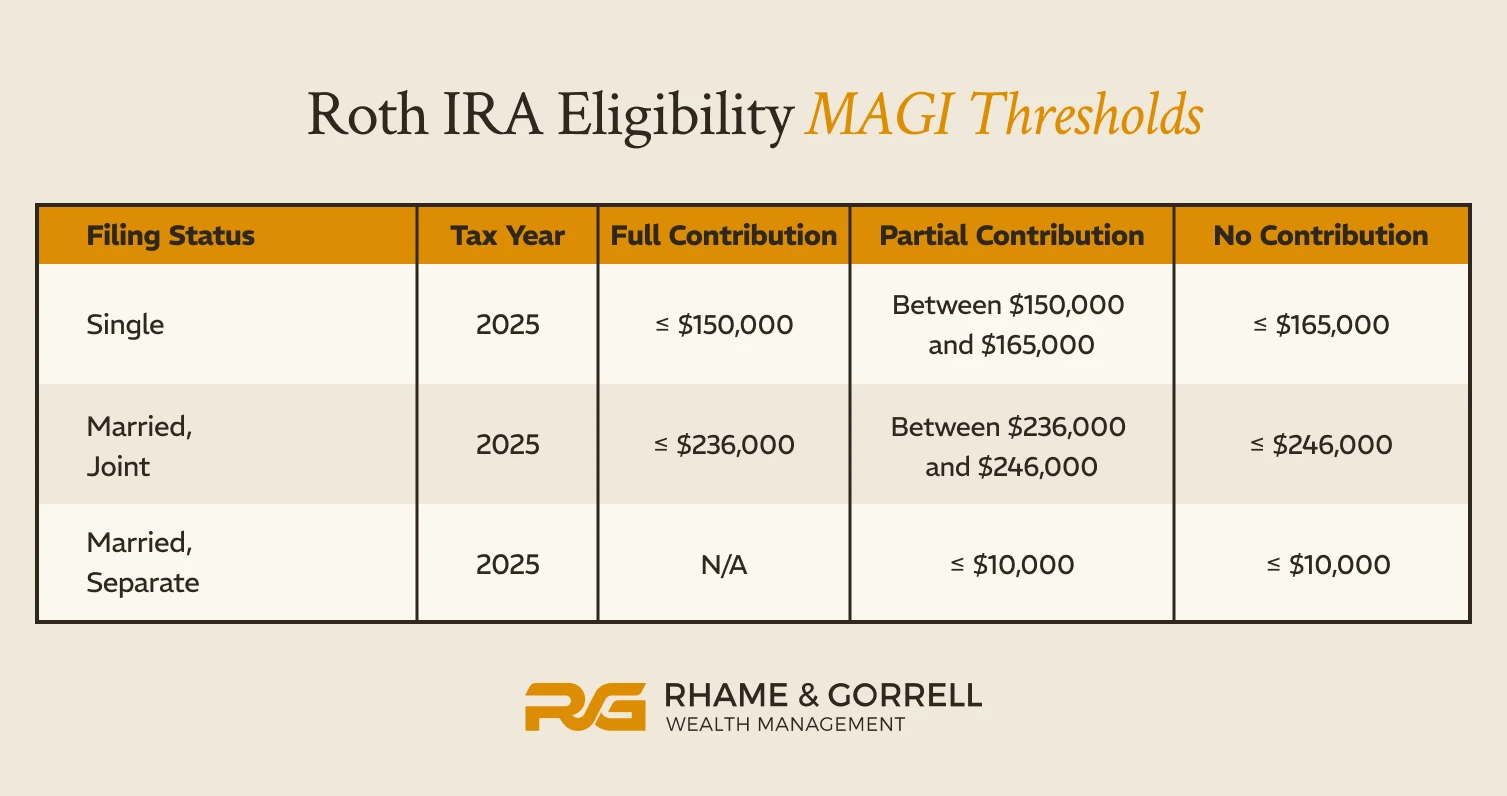

You can’t just dump $7,500 into a Roth if you make "too much" money. The IRS has these things called Modified Adjusted Gross Income (MAGI) limits. They basically say if you’re killing it in your career, you’re "too wealthy" for a standard Roth. For 2026, if you are filing as a single person, the phase-out range starts around **$150,000** and ends at $165,000. If you earn more than that upper limit, your direct contribution limit drops to zero. Zilch.

Married couples filing jointly have it a bit better. Your phase-out starts at $236,000 and cuts off completely at $246,000. These numbers are slight bumps from previous years, adjusted for cost-of-living increases.

It’s frustrating. You work hard, you get a raise, and suddenly the government locks the door to the best tax-free growth vehicle available. But wait. There’s a loophole. You’ve likely heard of the "Backdoor Roth." It’s not a scam, even though it sounds like something whispered in a dark alley. It’s a perfectly legal maneuver where you contribute to a Traditional IRA (which has no income limits for contributions) and then immediately convert it to a Roth.

Why the Roth IRA Max Contribution 2026 Matters Right Now

Compounding is a monster. But tax-free compounding? That's a different beast entirely.

Let's look at a real-world scenario. Say you’re 30 years old. You max out your Roth at $7,500 this year. You do it every year for 35 years. Assuming a 7% average annual return—which is fairly conservative compared to the historical S&P 500 average—you’d end up with over $1 million. The kicker? When you pull that money out at age 65, you pay zero dollars in federal income tax.

If that money was in a 401(k) or a Traditional IRA, you’d be handing a massive chunk of that million back to Uncle Sam. With a Roth, you pay the tax on the seed, not the harvest. In a world where we have no idea what tax rates will look like in 2060, paying the tax now is a hedge against future government spending sprees.

The "Hidden" Rules of the 2026 Tax Year

There is a weird nuance regarding the roth ira max contribution 2026 that catches people off guard: the earned income requirement.

You must have "earned income" to contribute. You can't just move $7,500 from your inheritance or your crypto gains into a Roth. If you only earned $3,000 working a part-time gig in 2026, your max contribution is $3,000, not $7,500. The IRS wants to make sure you’re actually working for that tax-free growth.

However, there is a "Spousal IRA" exception. If you’re a stay-at-home parent and your spouse works, they can contribute on your behalf. This is a massive win for single-income households. It allows the non-working spouse to build their own tax-free nest egg based on the working spouse's income.

What About the Five-Year Rule?

This is where things get sticky. Even if you hit the roth ira max contribution 2026 limit perfectly, you can’t just pull all the money out whenever you want. Well, you can pull your contributions out at any time for any reason. If you put in $7,500, you can take that $7,500 back out tomorrow.

✨ Don't miss: U.S. Stock Market Today: Why the Big Banks are Scaring Investors

The earnings—the profit your money made—are the problem.

To take earnings out tax-free and penalty-free, you generally have to be 59½ years old AND the account must have been open for at least five years. This "Five-Year Rule" starts on January 1st of the year you made your first contribution. If you start your first-ever Roth IRA in December 2026, the clock technically started on January 1, 2026.

2026 Strategy: Front-Loading vs. Dollar Cost Averaging

Most people wait until April 2027 to make their 2026 contribution. They treat tax day as the deadline. Technically, it is. But you’re losing time.

If you have the cash sitting in a low-interest savings account, "front-loading" your Roth on January 1, 2026, gives that money an extra 15 months of market exposure compared to waiting until the deadline. Over thirty years, those extra months add up to tens of thousands of dollars.

If you don't have $7,500 lying around—and let's be real, most don't—you should set up an auto-deposit. To hit the roth ira max contribution 2026, you need to save about **$625 a month**.

Break it down:

- $144 a week.

- $20 a day.

Basically, the cost of a decent lunch in 2026 prices.

Common Mistakes to Avoid Like the Plague

I see people do this all the time: they open the account, they transfer the money, and then they leave it.

They think the Roth IRA is the investment. It's not. It's just a bucket. You have to use the money inside the bucket to buy stocks, ETFs, or mutual funds. I’ve met people who left their Roth contributions in a "Settlement Fund" (basically a holding pen) for a decade. They earned 0.5% interest when the market was up 200%. Don't be that person.

Another trap is the "Excess Contribution." If you accidentally put in $8,000 when the limit is $7,500, the IRS will hit you with a 6% excise tax every year that extra money stays in the account. If you realize you over-contributed, you need to withdraw the excess and the earnings on that excess before you file your taxes.

Why Some Experts Say the Roth is Overrated (And Why They’re Mostly Wrong)

There is a school of thought, often led by traditionalists like some old-school CPAs, that says if you’re in a high tax bracket now, you should take the tax deduction of a Traditional IRA or 401(k) instead. The logic is: "I'm paying 35% tax now, but I'll only pay 15% when I'm retired."

Sure. On paper.

But that assumes tax brackets won't rise. It assumes you won't be successful and end up in a higher bracket later. Most importantly, it ignores the psychological freedom of a Roth. Having an account that says "$1,000,000" and knowing every cent is yours provides a level of retirement security a 401(k) can't touch. No "Required Minimum Distributions" (RMDs) either. You can leave that money in the Roth until you’re 100 if you want. You can even pass it to your kids tax-free.

High-Level Moves for the 2026 Tax Year

If you've already mastered the basics of the roth ira max contribution 2026, it's time to look at the "Mega Backdoor Roth." This is only available if your employer's 401(k) plan allows for after-tax contributions and in-service distributions. If you have this unicorn of a plan, you can potentially move up to $69,000 (the 2026 401k total limit) into a Roth environment.

Most people don't have access to that. But for those who do, it's a wealth-building cheat code.

For the rest of us, sticking to the $7,500 limit is the goal.

Actionable Steps to Max Out Your Roth in 2026

First, check your 2025 tax return. What was your MAGI? If you're close to that $150,000 (single) or $236,000 (joint) threshold, plan for a Backdoor Roth from the start. It’s cleaner than trying to fix a direct contribution later if you get a surprise year-end bonus.

Second, automate it. Set up a transfer for $625 on the 1st of every month. If that’s too steep, start with $100 and increase it by $50 every time you skip a night out.

Third, check your investment selection. If you’re more than 10 years from retirement, you likely shouldn't be sitting in bonds or cash. Look at low-cost broad market index funds like VTI or VOO.

Finally, keep a record. Even though the Roth is tax-free, the IRS still likes paperwork. Keep track of your "basis" (the total amount of your own money you’ve put in). This is vital if you ever need to withdraw your contributions early for an emergency.

Don't wait until the 2027 tax season to think about this. The roth ira max contribution 2026 is a use-it-or-lose-it opportunity. Once the deadline passes, you can never go back and "refill" that year's bucket. Every year you miss is a year of tax-free growth you've deleted from your future. Start the transfers now. Your 70-year-old self will thank you for being smart enough to act when you had the chance.