Rowan Simpson isn't your typical "suit and tie" venture capitalist. If you’ve spent any time in the New Zealand tech scene, you know the name, but you might not know the actual grit behind the portfolio. He was employee number three at Trade Me. He was an early face at Xero. He’s the guy who saw the potential in Vend and Timely when they were basically just scribbles on a napkin and a lot of caffeine.

But here’s the thing. Most people look at a guy like Rowan and think he’s got some magical crystal ball. They think rowan simpson investor technology is a formula where you just plug in a "disruptive" idea and out pops a billion-dollar exit.

Honestly? That’s total rubbish.

The Near-Death Experiences Nobody Talks About

We love a good success story. We love the $750 million Trade Me exit. But we rarely talk about 2001, when Trade Me was essentially broke. Rowan has been incredibly vocal about this—the "near-death experiences" that every iconic company faces.

In 2001, Trade Me was a fragile two-year-old startup. The dot-com bubble hadn't just burst; it had vaporized. Nobody wanted to touch an internet company. Sam Morgan was pitching to every VC in the country, and they were all saying "no" (and some weren't even being polite about it).

Rowan actually left. He packed his bags for London because the business model—free classifieds supported by ads—was failing. He didn't think there would be a company to come back to. It was only after they implemented "success fees" as a desperate last resort that the engine started to hum.

👉 See also: Ripple XRP Holdings Increase: What Most People Get Wrong

Lesson learned: Success is rarely about the "Eureka" moment. It’s about not dying while you figure out how to actually make a buck.

Why Being Wrong is a Competitive Advantage

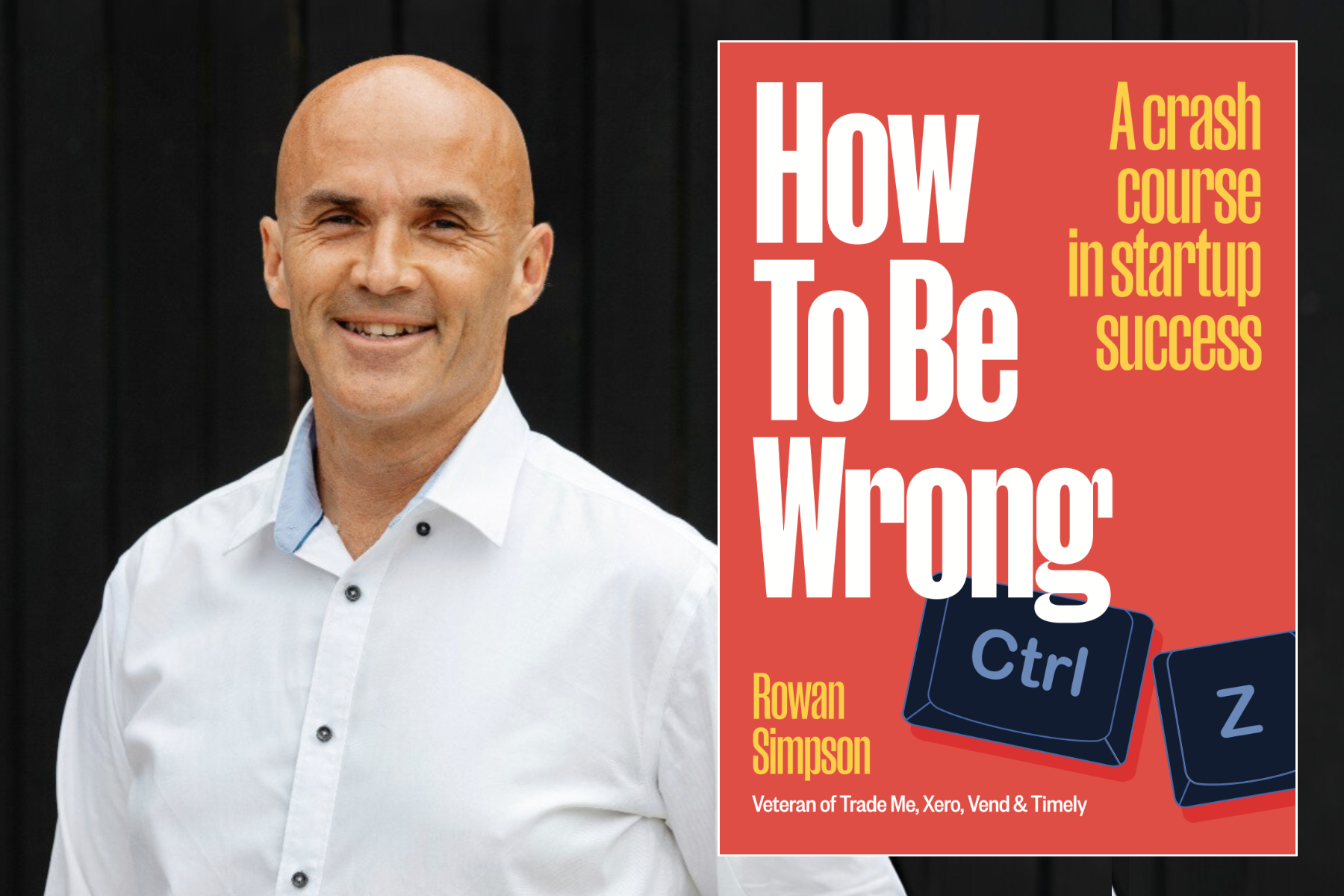

Rowan recently released a book called How to Be Wrong. It’s a bit of a middle finger to the "fake it 'til you make it" culture that infects Silicon Valley. In the world of technology, your ego is usually your biggest expense.

He argues that the most successful founders aren't the ones who are always right. They’re the ones who are the fastest at realizing they’re wrong.

- The Lone Genius Myth: Rowan hates the idea of the "lone hero" hacking away in a bedroom. He insists that if you can’t convince at least one other person to join your crazy mission, your idea probably isn't that great.

- The Funding Fallacy: There’s this constant whine in New Zealand (and elsewhere) about a "shortage of capital." Rowan calls BS on this. He argues that there isn't a shortage of money; there’s a shortage of quality. If a business is making money and showing momentum, investors will crawl over broken glass to get in.

The "Steam Train" Metaphor

If you want to understand the rowan simpson investor technology philosophy, you have to understand the steam train.

Rowan views the startup as the engine. The investor is the tender—the little carriage behind the engine that carries the coal. The tender is useless without the engine. Yet, so many investors act like they’re the ones pulling the company along.

He prefers to stay in the tender. He provides the fuel (capital and advice), but he knows the founders are the ones doing the heavy lifting. This humble approach is why he’s been able to back winners like:

- Vend: He was there when it was just Vaughan Fergusson and a dream to kill the old-school cash register.

- Timely: He backed Ryan Baker and Andrew Balgarnie when they were "scrappy" and already executing without needing his money.

- Hnry: A more recent win, helping freelancers deal with the nightmare of taxes.

What He’s Looking for Right Now (Hoku Group)

Through his family office, Hoku Group, Rowan is still very much in the game. But he isn't spray-and-praying. He’s looking for "scrappy execution."

He’s recently moved into sectors like energy and environment. For instance, Hoku Group led a Series A round for Lightyears Solar in 2024. Why solar? Probably because it fits his criteria: a real problem, a tangible solution, and a team that doesn't spend all day posting "thought leadership" on LinkedIn.

He also has a stake in Atomic, a company focused on customer engagement. He likes businesses that solve the "unsexy" problems—the plumbing of the internet.

Actionable Insights for Founders and Investors

If you’re trying to emulate the Rowan Simpson track record, stop looking for the next "Uber for X." Instead, focus on these three things:

- Audit Your "Wrongness": When was the last time you killed a feature or a project because the data told you it sucked? If you can't remember, you're moving too slow.

- Focus on the Data Model, Not the Hype: When Rowan built Flat Hunt (which Trade Me eventually bought), he didn't care about the business model initially. He cared about the data. How does the information flow?

- Stop Pitching, Start Selling: If you want an investor like Rowan, show them a list of paying customers. Nothing talks louder than revenue.

Technology changes every five minutes. AI is the current shiny toy. But the fundamentals of building a company—finding a problem, assembling a team of generalists, and surviving the "near-death" phase—remain the same.

🔗 Read more: Three Star Photography Brooklyn: Why This Studio Became a Neighborhood Staple

Rowan Simpson’s career is proof that you don't need to be a genius to win in tech. You just need to be less wrong than the other guy.

How to apply this today

If you're a founder, go through your current strategy and find one thing you're "hoping" is true but have no evidence for. Kill it or test it by Friday. If you're an investor, look at your portfolio and ask: "Am I the engine or the tender?" If you're trying to lead the founders, you're probably in the wrong carriage.