You’re staring at a screen, watching the numbers flicker. If you’ve ever looked up saudi arabia currency to us dollar exchange rates, you’ve probably noticed something weird. The number almost never moves. It’s like a frozen clock. While the Euro is out here doing parkour and the Yen is riding a roller coaster, the Saudi Riyal (SAR) just... sits there.

Honestly, it’s not a glitch. It’s by design.

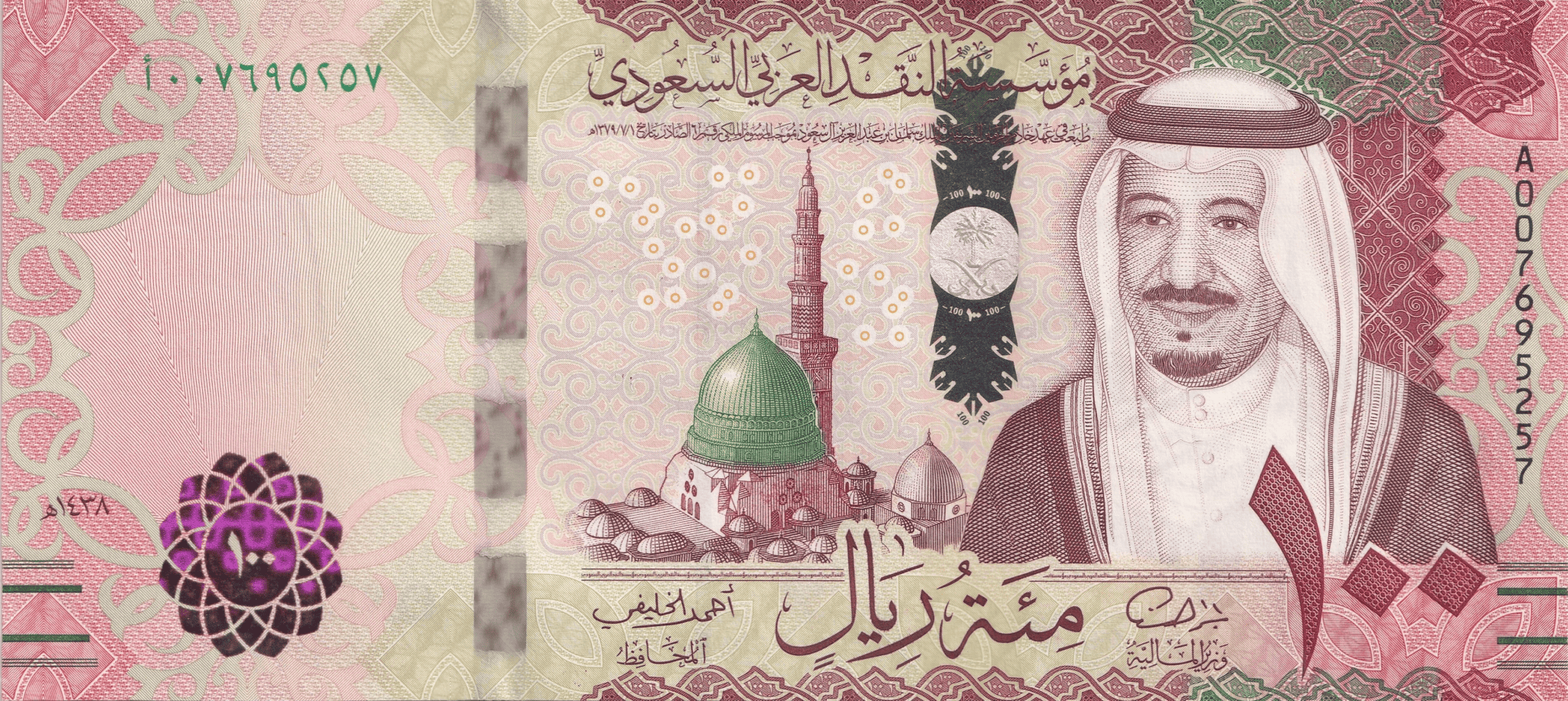

Since 1986, the Saudi Riyal has been locked in a committed relationship with the Greenback. Specifically, the rate is pegged at 1 USD to 3.75 SAR. This isn't just a "recommendation." It’s a foundational pillar of the global oil economy. But as we move through 2026, the world is changing. People are talking about "de-dollarization" and "petroyuans." Does that mean your Riyals are about to become a lot more—or less—valuable? Let’s get into the weeds.

The 3.75 Anchor: Why it hasn't budged in 40 years

Basically, Saudi Arabia decided a long time ago that volatility is bad for business. When you sell the world's most important commodity (oil) and you price it in dollars, having your own currency jump around like a caffeinated toddler is a nightmare.

The peg provides "predictability."

Think about it. If you're a massive construction firm in Riyadh building a "giga-project" like NEOM, you’re importing billions of dollars worth of tech from the US or Europe. If the Riyal crashed tomorrow, those projects would become instantly unaffordable. By keeping the saudi arabia currency to us dollar rate at 3.75, the Saudi Central Bank (SAMA) ensures that everyone knows exactly what a Riyal is worth tomorrow, next month, and next year.

How do they do it? Magic? Not quite. It’s deep pockets.

SAMA maintains massive foreign exchange reserves—we’re talking roughly $439 billion as of late last year. When the market tries to push the Riyal away from that 3.75 mark, the central bank steps in. They buy or sell dollars to force the price back into line. It is a brute-force approach to economic stability, and so far, it has worked.

The Federal Reserve shadow

There is a catch, though. Because the Riyal is pegged to the dollar, Saudi Arabia sort of loses the ability to have its own independent monetary policy. When the US Federal Reserve raises interest rates in Washington D.C., SAMA almost always has to follow suit within hours.

If they didn't, investors would just dump Riyals to go buy Dollars and earn higher interest, which would break the peg. So, if you're wondering why your car loan in Jeddah just got more expensive, don't just blame local banks. You can thank the folks at the Fed in the States too.

The 2026 Reality: Is the peg under pressure?

We’ve heard the rumors. Every few months, some "expert" on social media claims Saudi Arabia is about to ditch the dollar for the Chinese Yuan.

kinda hasn't happened.

💡 You might also like: Credence Resource Management LLC: Why They’re Calling and What to Do Next

While it's true that Saudi Arabia is diversifying its trade and joining groups like BRICS+, the dollar remains the undisputed king of their treasury. As of January 2026, the exchange rate is still holding firm at that familiar 0.2667 USD for 1 SAR.

- Oil Prices: Brent crude has been a bit of a tease lately, hovering around the $60-$70 range. Some analysts, including those from a recent Reuters poll, think it might soften further.

- The Deficit: The Kingdom is spending a lot on Vision 2030. We're talking trillions. This has led to a projected budget deficit of about 3.3% of GDP for 2026.

- Non-Oil Growth: Here is the cool part. The non-oil sector is actually booming. The PMI (Purchasing Managers' Index) recently hit 57.4, which means the "rest" of the economy is growing fast enough to take some pressure off the oil side.

How to actually convert your money without getting ripped off

If you're traveling or doing business, you need to know that the "official" rate and the "ATM" rate are two different beasts. You'll see 3.75 on Google, but your bank might charge you 3.82 or 3.85 after fees.

The "Hidden" Costs of saudi arabia currency to us dollar

Most people just go to an airport kiosk. Don't do that. Those booths are basically high-end muggings with better lighting. They’ll give you a rate of maybe 3.60 SAR per dollar if you're lucky.

- Use Digital Wallets: Apps like Revolut or STC Pay (very popular in the Kingdom) often give you much closer to the mid-market rate.

- Local Banks: If you have a local account at Al Rajhi or SNB, transferring to a US account is relatively straightforward, but watch the "transfer fee" which can be a flat $15-$30 regardless of the amount.

- The "No-Fee" Myth: If a place says "Zero Commission," they are lying. Well, they aren't charging a "fee," but they are baking their profit into a terrible exchange rate. Always check the math against the spot rate on your phone.

What experts say about the future

According to the International Monetary Fund (IMF) in their recent Article 4 consultations, the Saudi economy is "in a state of prosperity." That's fancy talk for "they're doing fine."

Fitch Ratings also weighed in recently, saying they don't expect any changes to the GCC pegged regimes in the medium term. They view the peg as a "firm commitment."

But there’s a nuance here. The Kingdom is starting to talk about alternative invoicing. This doesn't mean the Riyal will stop being worth 3.75 dollars. It just means they might start accepting other currencies for certain oil contracts. Think of it like a store that used to only take cash but now takes credit cards—it doesn't change the value of the dollar, just how you can pay.

Practical Steps for 2026

If you're holding a lot of Riyals and you're worried about the saudi arabia currency to us dollar stability, here is the deal:

- Don't panic buy dollars: Unless you see the Saudi foreign reserves drop below $200 billion (which hasn't happened in decades), the peg is safe. It's too expensive for them to break it.

- Watch the Fed: If the US starts cutting rates aggressively in late 2026, expect SAMA to do the same. This makes it a great time to look at refinancing debt in Saudi, but a bad time for savings account interest.

- Hedge your bets: If you’re an expat or a business owner, it’s always smart to keep a portion of your long-term savings in a diversified basket. Don't put everything in one currency, even one as stable as the Riyal.

The bottom line? The Riyal isn't going anywhere. It’s the anchor in a very stormy sea. While the world debates the future of the dollar, Riyadh is doubling down on stability to fund its futuristic cities.

Next steps for you:

- Check your bank’s spread: Log into your banking app and see what they’re actually offering for a SAR to USD transfer right now. If it’s more than 1% away from 3.75, it’s time to find a new service.

- Monitor SAMA's monthly bulletins: They publish these like clockwork. Look at the "Foreign Assets" section. As long as that number stays high, your Riyals are as good as gold—or at least, as good as dollars.