Ever looked at your bank balance after a trip to Stockholm and wondered why the Swedish Krona feels like play money until you try to buy a pint in London? It’s a weird dynamic. Right now, the SEK currency to GBP exchange rate is sitting around 0.0809. Basically, 100 Krona gets you about 8 quid.

But if you think that’s just a boring, static number, you’re missing the actual drama happening behind the scenes in 2026. The Krona has been on a bit of a tear lately. While everyone was watching the big players like the Euro or the Dollar, Sweden’s currency has quietly become one of the better performers.

💡 You might also like: Pembina Pipeline Share Price: Why Most Investors Get the Math Wrong

The Riksbank vs. The Bank of England

Honestly, the whole "who has the stronger currency" game usually comes down to who is more scared of inflation. In Sweden, the Riksbank—the world’s oldest central bank, by the way—has been holding its breath. As of January 2026, their policy rate is sitting at 1.75%.

They aren't in a rush to move.

On the flip side, the Bank of England (BoE) just trimmed the UK base rate to 3.75% in December. Even though 3.75% is higher than 1.75%, the direction is what matters to traders. The UK is cutting; Sweden is holding steady. When one country keeps rates flat and the other keeps cutting, the "flat" currency usually starts looking a lot more attractive to big investors.

🔗 Read more: NTPC Stock Price: Why Stability Is the New Growth Story in 2026

That’s why we’ve seen the SEK currency to GBP rate climb from the 0.072 levels we saw back in early 2025. It’s a slow-motion comeback.

Why the Krona is actually "Undervalued"

If you talk to the nerds at the IMF or Nordea, they’ll tell you the Krona has been undervalued for years. Some estimates suggest it’s been trading up to 17% below its actual worth based on labor costs and economic fundamentals.

Sweden isn’t just IKEA and Abba. They are a massive defense exporter. In 2026, defense spending across Europe is through the roof, and Sweden is reaping the rewards. That brings in foreign capital. It creates demand for Krona.

What’s driving the shift right now?

- Defense Exports: Sweden’s NATO integration has turned their defense sector into a powerhouse, contributing significantly to GDP.

- The VAT Factor: Sweden is planning to slash VAT on food from 12% to 6% this April. That’s expected to tank inflation numbers, which ironically gives the Riksbank more room to be "predictable" while others are volatile.

- UK Sluggishness: The UK economy is currently slogging through some mediocre growth. When the UK’s GDP looks "meh," the Pound loses its swagger.

Practical Reality: Changing Your Money

If you’re moving money from SEK to GBP today, don't just walk into a high-street bank. You’ll get absolutely fleeced. They often bake a 3-4% margin into the exchange rate.

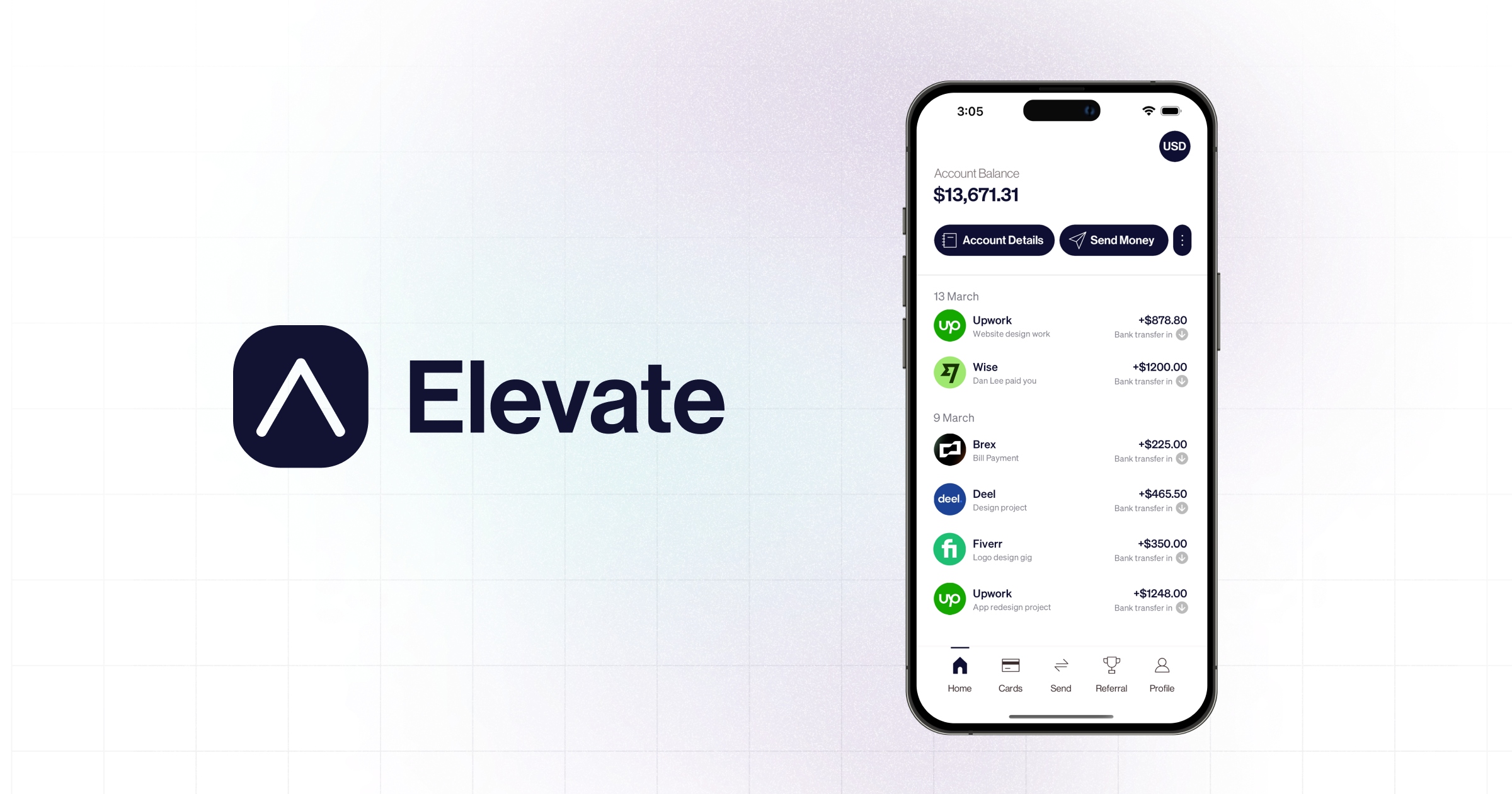

Use a specialist provider like Wise, Revolut, or Atlantic Money. Since the rate is roughly 1 SEK = 0.081 GBP, a tiny 1% difference in the spread on a 100,000 SEK transfer is the difference between getting £8,092 and getting £8,011. That's a fancy dinner you're handing over to the bank for nothing.

What to expect for the rest of 2026

Most analysts, including those at Bank of America, are "confidently bullish" on the Krona. They see the SEK currency to GBP pair continuing to edge higher as the UK continues its gradual rate-cutting cycle through the summer.

💡 You might also like: How Much Is 1 Pound of Gold Worth Today: Why Most People Get the Math Wrong

However, keep an eye on the February 5th Bank of England meeting. If they hold rates instead of cutting, the Pound might snap back.

Actionable Next Steps

- Monitor the 0.081 level: This is a psychological resistance point. If the rate breaks and stays above 0.082, the Krona might have a clear run toward 0.085.

- Lock in rates if you're a buyer: If you need Pounds and you have Krona, the current trend is your friend, but currency markets are fickle. Use a "limit order" with a broker to catch the rate if it spikes to your target.

- Watch the April VAT change: Once the Swedish VAT cut hits, inflation data will get messy. This usually causes a few days of currency "noise" that you can exploit if you're timing a transfer.

The SEK currency to GBP relationship isn't just about travel money anymore; it's a reflection of two very different European economic recovery stories. Sweden is playing the long, stable game, while the UK is trying to stimulate its way out of a slump.