If you've ever looked at the exchange rate for 1 INR to QAR, you probably noticed something pretty quickly. It’s tiny. Usually, we’re talking about 0.04 or 0.05 Qatari Riyals for every single Indian Rupee. It feels like pocket change, right? But here’s the thing: nobody actually exchanges a single rupee. When you're an expat in Doha sending money home, or a business owner in Mumbai importing goods from Qatar, that tiny decimal becomes the difference between a high-profit month and a massive headache.

Honestly, the relationship between these two currencies is fascinating because it isn’t just about numbers on a screen. It’s about oil, labor markets, and the fact that the Qatari Riyal is basically glued to the US Dollar.

Why the 1 INR to QAR Rate Feels Stuck

The Qatari Riyal (QAR) is pegged to the US Dollar at a fixed rate of $1 USD = 3.64 QAR$. This has been the case since 2001. Because of this, the Riyal doesn’t really "move" on its own. It just follows the Dollar around like a shadow.

👉 See also: Paul Graham Founder Mode: Why the Best Leaders are Scrapping the Management Playbook

When you check the 1 INR to QAR rate, what you’re actually seeing is the strength or weakness of the Indian Rupee against the US Dollar, filtered through the lens of the Riyal. If the Rupee weakens against the Greenback, your Riyals suddenly buy a lot more back in Kerala or Punjab. If the Indian economy is booming and the Rupee strengthens, that 10,000 QAR you’re sending home doesn’t go quite as far as it did last month.

It’s a bit of a rollercoaster for the millions of Indian expats living in Qatar. They watch the exchange rate like hawks. A shift of just 0.002 can mean thousands of extra rupees on a large transfer.

The Reality of "Zero Fee" Transfers

We’ve all seen those neon signs in exchange houses promising "Zero Commission" or "No Fees."

Don't believe them.

Banks and exchange houses aren't charities. If they aren't charging a flat fee, they are making their money on the "spread." This is the gap between the mid-market rate—the one you see on Google or XE—and the rate they actually give you.

Suppose the real market rate for 1 INR to QAR is 0.044. An exchange house might offer you 0.042. That tiny difference is how they pay for their rent, staff, and profit. Over a large transaction, that "hidden" cost can be way more expensive than a flat 15 QAR transfer fee. You've gotta do the math every single time.

Why the Rupee Fluctuates So Much

India is a massive importer of oil. Qatar is a massive exporter of gas and energy. You'd think that would make the 1 INR to QAR relationship simple, but it's messy.

- Global Crude Prices: When oil prices spike, India has to spend more of its foreign reserves to buy fuel. This usually puts downward pressure on the Rupee.

- Foreign Institutional Investors (FIIs): When big US or European funds pull money out of the Indian stock market, they sell Rupees and buy Dollars. Since the QAR is pegged to the Dollar, the Rupee drops against the Riyal too.

- RBI Intervention: The Reserve Bank of India doesn't like it when the Rupee becomes too volatile. They often step in to buy or sell Dollars to keep the Rupee from crashing. This indirectly stabilizes the 1 INR to QAR rate.

Sending Money? Watch Out for These Traps

Timing is everything. But honestly, trying to "time the market" is a fool’s errand for most people. If you need to send money for your family’s rent or a medical emergency, you can’t wait three weeks for a 1% shift in the exchange rate.

However, if you're looking at a major investment—like buying property in India—waiting for the right 1 INR to QAR window is crucial.

Lately, we’ve seen the Rupee hovering near record lows against the Dollar. For someone earning in Riyals, this is actually a "discount" on Indian assets. You are essentially getting more India for your Qatar-earned money.

The Digital Shift in Doha

A few years ago, you had to stand in line at an exchange house on a Friday afternoon. It was a ritual. Now, apps like Ooredoo Money or Qatar Islamic Bank's mobile portal have changed the game. These platforms often provide slightly better rates for 1 INR to QAR than the physical counters because their overhead is lower.

Plus, the speed is insane. Direct bank-to-bank transfers via UPI rails can sometimes land the money in an Indian account within minutes.

Beyond the Exchange Rate: The Economic Tie

Qatar and India aren't just trading currency; they're trading futures. India is one of the largest buyers of Qatari Liquefied Natural Gas (LNG). In early 2024, QatarEnergy and India’s Petronet signed a massive 20-year deal to extend LNG supplies.

👉 See also: Why Ida Co-op Still Matters to the Future of Michigan Agriculture

When these multi-billion dollar deals happen, they create a massive demand for currency. While these specific trades are often settled in Dollars, the sheer volume of trade keeps the 1 INR to QAR corridor one of the busiest in the world.

There's also the remittance factor. India receives more remittances than any other country on Earth. A huge chunk of that comes from the GCC, with Qatar being a heavy hitter. This constant flow of Riyals being converted to Rupees provides a weird kind of "support level" for the exchange market.

Technical Factors You Might Ignore

Inflation is the silent killer of currency value. India’s inflation rate usually runs higher than Qatar’s. Historically, this means the Rupee tends to depreciate against the Riyal over long periods.

If you look at a 10-year chart of 1 INR to QAR, the trend line is pretty clear. The Rupee has lost significant value. This isn't necessarily a sign of a "bad" economy; it's just the reality of a developing nation versus a high-income, resource-rich state.

How to Calculate Your Real Value

If you want to know what your money is actually worth, don't just look at the 1 INR to QAR rate. Look at Purchasing Power Parity (PPP).

A Riyal in Doha might buy you a small coffee. The equivalent amount in Rupees in a smaller Indian city might buy you a full meal. This is why "sending money home" is such a powerful wealth-building tool for expats. You are earning in a high-value currency and spending in a high-volume, lower-cost environment.

Actionable Steps for Better Rates

Don't just walk into the first bank you see. That's the easiest way to lose 3% of your hard-earned money.

- Compare Mid-Market Rates: Check a neutral source like Google or Reuters for the "real" 1 INR to QAR price. Use that as your benchmark.

- Check the Spread: If Google says 0.044 and your app says 0.041, you are paying a heavy hidden fee.

- Use Digital Wallets: Often, telecom-linked wallets in Qatar offer promotional rates or lower fixed fees for transfers to India.

- Avoid Weekend Transfers: The Forex market closes on weekends. Many exchange houses "pad" their rates on Saturdays and Sundays to protect themselves against market gaps when the world reopens on Monday. You usually get better rates on Tuesday or Wednesday.

- Verify the Recipient Bank: Some Indian banks charge an "incoming remittance fee." Make sure you’re using a NRE or NRO account that is optimized for foreign transfers.

The relationship between the Rupee and the Riyal is a living thing. It breathes with the price of oil and the heartbeat of Indian industry. By staying informed on the 1 INR to QAR fluctuations, you aren't just moving money—you're managing your wealth.

Keep an eye on the US Federal Reserve's interest rate decisions. Since the Riyal is pegged to the Dollar, whatever the Fed does in Washington D.C. eventually hits the pockets of every Indian worker in Qatar. It's a small world, and the currency markets prove it every single day.

To get the most out of your money, set up rate alerts on your favorite finance app. When the Rupee dips to a certain level against the Riyal, you'll get a notification. That's your cue to hit "send." Small movements might seem like nothing, but over a lifetime of work, those fractions of a Riyal add up to a significantly more comfortable future back home.

Key Takeaways for Currency Conversion

- The Qatari Riyal's peg to the USD means the 1 INR to QAR rate is mostly a reflection of the Rupee's health against the Dollar.

- Hidden "spreads" are often more expensive than visible transaction fees.

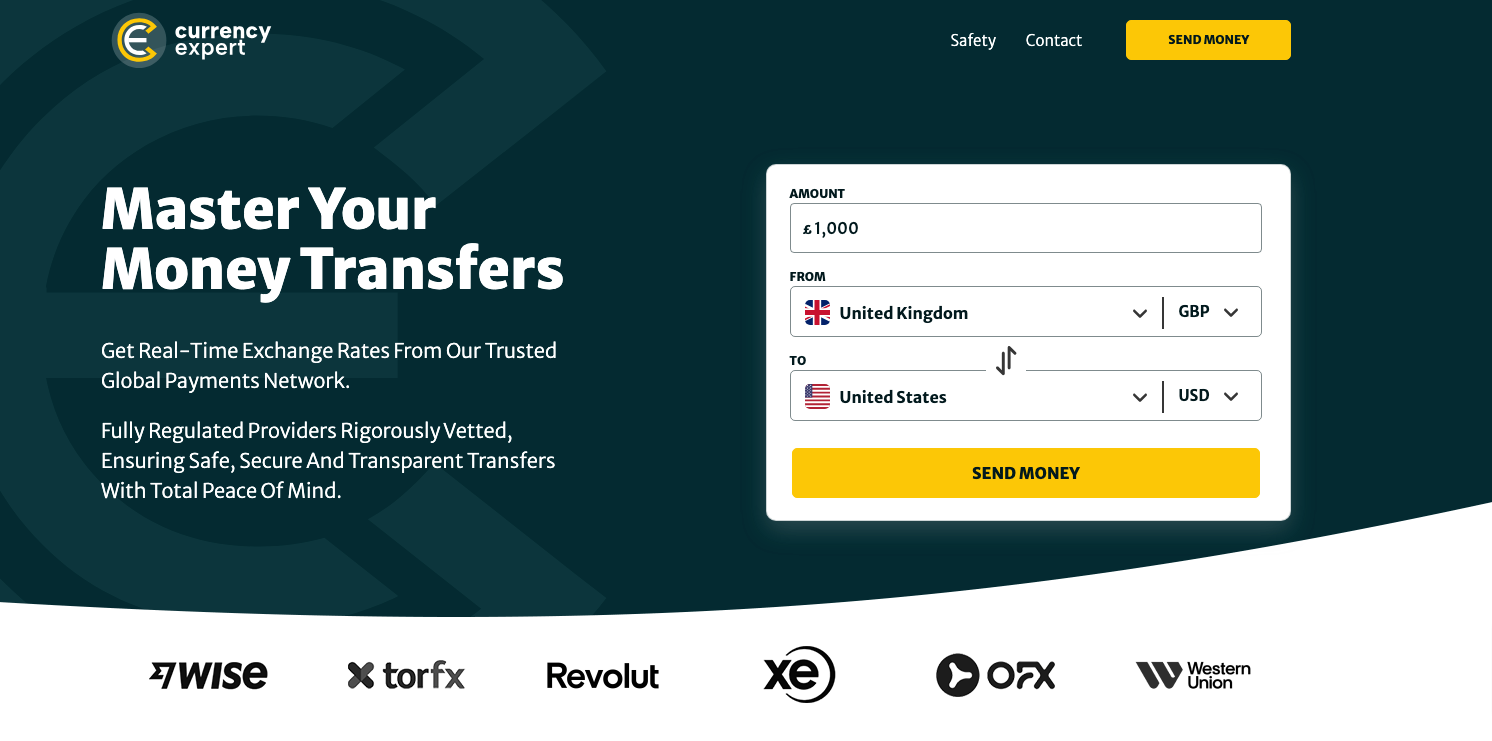

- Digital transfer methods in Qatar are generally outperforming traditional brick-and-mortar exchange houses in both speed and cost.

- Economic deals, specifically in the LNG sector, provide the backbone for the long-term stability of this currency pair.