You're sitting there, staring at a question about a straddle. Or maybe it’s a municipal bond swap. Your brain feels like it’s been through a blender because you’ve spent three hours staring at the Series 7 curriculum. You think you know it. Then you take a series 7 free practice test and realize you actually know nothing.

It’s brutal.

🔗 Read more: Nintendo Of America Stock Symbol: What Most People Get Wrong

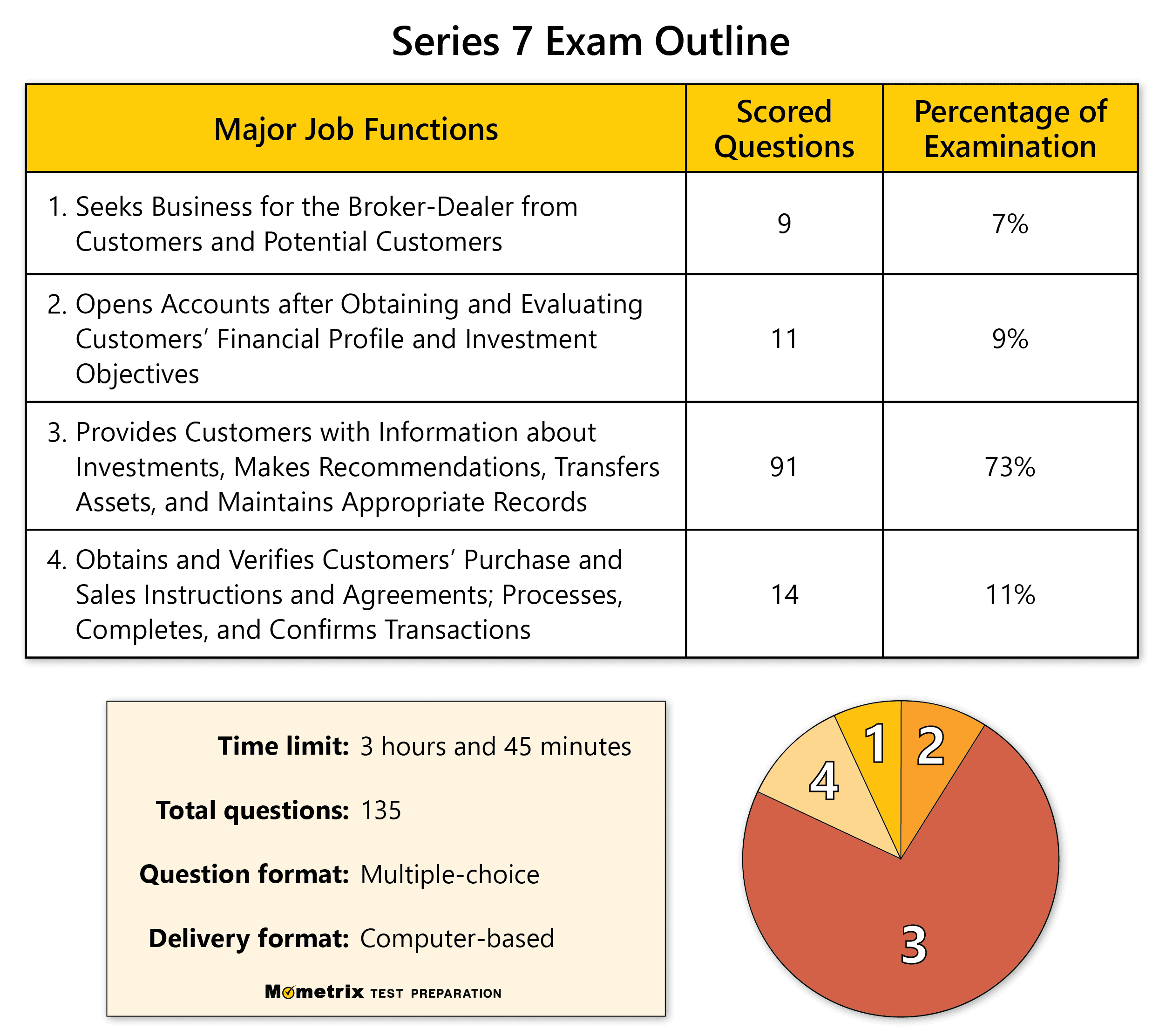

The Financial Industry Regulatory Authority (FINRA) doesn't make this easy. The Series 7—the General Securities Representative Qualification Examination—is a beast of a test. It’s 125 questions. You get three hours and 45 minutes. That sounds like a lot of time until you’re trying to calculate the tax-equivalent yield on a muni while your internal clock is screaming. Most people look for a free shortcut because prep courses from Kaplan or STC cost a fortune. But there is a right way and a very, very wrong way to use free resources.

The Problem with Most Free Practice Exams

Let’s be real. Most free tests you find via a random Google search are garbage. They’re either outdated—referencing rules that changed back in 2018—or they’re way too easy. If you’re scoring a 90% on a random blog’s practice quiz, don’t get cocky. You’re probably being fed "recall" questions.

Real FINRA questions are "application" questions.

They don't just ask you what a put option is. They give you a complex scenario involving a nervous retiree, a volatile tech stock, and a specific income requirement, then ask you to pick the best strategy. A bad series 7 free practice test misses that nuance entirely. It gives you a false sense of security that evaporates the second you walk into the Prometric testing center.

Honestly, the biggest trap is the "suitability" section. This makes up about 73% of the exam. That’s 91 questions focused on Function 3: Providing Customers with Information about Investments, Making Suitable Recommendations, Transferring Assets, and Maintaining Appropriate Records. If your practice test is just a bunch of definitions about T-bills and mutual funds, it’s wasting your time. You need to be tested on the "why," not just the "what."

Suitability is Where the Battle is Won

I’ve seen incredibly smart people—math whizzes and Ivy League grads—tank the Series 7. Why? Because they treated it like a math test. It’s a reading comprehension test disguised as a finance exam.

Take a look at how a question is actually built. It’s not just about the numbers. It’s about the "Rule 2111." FINRA requires that a broker has a reasonable basis to believe a recommendation is suitable for the customer based on their financial profile.

If a practice test asks: "What is the maximum loss on a long call?" and the answer is "The premium paid," that's a fine starting point. But a good test will ask: "Your client, a 30-year-old looking for aggressive growth with high risk tolerance, wants to leverage his position in XYZ stock. Which of the following is most appropriate?" Suddenly, you're not just reciting a definition; you're acting as a representative.

Why Your Scores Keep Stalling

Are you stuck in the 60s? It's a common plateau. You take a series 7 free practice test, get a 64%, cry a little, study for two days, and get a 66%. It’s maddening.

Usually, this happens because of "Option Anxiety." Options are the boogeyman of the Series 7. You have to understand calls, puts, spreads, and straddles. You need to know how to calculate the breakeven, the maximum profit, and the maximum loss for every single one of them.

But here’s a secret: the math is just addition and subtraction. People fail because they don't understand the direction of the trade. If you can't visualize whether the investor wants the stock to go up or down, the math won't save you.

Another huge hurdle is the "Muni" section. Municipal bonds have their own set of rules, tax implications, and disclosure requirements (shout out to the MSRB). Free tests often skim over the difference between a General Obligation (GO) bond and a Revenue bond. If you can't tell the difference between a legislative body's taxing power and a bridge's toll collection, you're going to lose points on at least 10-15 questions.

Finding Legit Resources Without Spending $500

You don't always have to buy the premium packages to get quality. Some reputable providers offer a series 7 free practice test as a "sampler" to get you to buy their full bank. Use these. They are usually high-quality because the company wants to prove their questions are as tough as the real thing.

- Knopman Marks: They often have a high-level diagnostic or sample questions. Their material is widely considered the gold standard for high-tier investment banks.

- Achievable: They have a very modern, mobile-friendly interface and usually offer a free trial or a handful of free chapters and quizzes.

- PassPerfect: Known for being "too hard." If you can pass a PassPerfect practice quiz, you can probably pass the actual exam. They sometimes offer free demos.

- FINRA's own site: They don't give you a full 125-question mock, but they provide a sample of the testing interface. Use this so you aren't surprised by the clunky software on game day.

Don't just take the test once. Take it, see what you missed, and then—this is the part everyone skips—read the "rationales." The rationale is the explanation of why the right answer is right and the wrong ones are wrong. If you don't read the rationales, you're just memorizing questions, and FINRA has a bank of thousands of questions. You will never see the same one twice.

The "Day Before" Strategy

Stop. Put the book down.

If you're taking a series 7 free practice test at 11 PM the night before your exam, you've already lost. Your brain needs recovery. The Series 7 is an endurance sport.

Most tutors, like the famous "Series 7 Guru" (Dean Tinney) or Brian Lee ("The Test Geek"), suggest focusing on the big picture in the final hours. Watch a high-level overview video. Review your "dump sheet."

What’s a dump sheet? It’s the stuff you memorize and scribble onto the scratch paper the second the timer starts. Formulas, the "Options Bell," and maybe the acronyms for the different types of orders (SLoBS over BLiSS).

Technical Depth: The Math You Actually Need

You don’t need a PhD. You need to know:

$Current Yield = Annual Interest / Current Market Price$

And you need to know it backwards. If the price of the bond goes up, the yield goes down. This inverse relationship is the heartbeat of the debt section of the exam.

Then there’s the Margin section. Many students pray they don’t get margin questions. But you will. You’ll need to calculate the "Long Market Value" (LMV) and the "Debit Balance" (DR) to find the "Equity" (EQ).

$LMV - DR = EQ$

It’s simple until they start asking about "Special Memorandum Accounts" (SMA) or what happens when the market value drops. A free practice test that ignores margin is doing you a massive disservice.

Moving Beyond the Freebies

Eventually, you might have to bite the bullet. If you’ve taken every series 7 free practice test on the internet and you're still not hitting a consistent 75-80%, it’s time to look at a "Q-Bank" (Question Bank).

Buying a standalone Q-Bank from someone like Kaplan is usually cheaper than a full course. It gives you 2,000+ questions that you can filter by topic. If you suck at "Customer Accounts," you can hammer 50 questions just on that. That’s how you actually pass.

Remember, the passing score is 72%. It doesn't matter if you get a 72% or a 99%; the certificate looks the same on your wall. But that 72% is a hard line. There is no curve. There is no "I was close."

Actionable Steps for Your Study Plan

- Take a baseline: Find a high-quality series 7 free practice test and take it cold. See where you stand without any help.

- Identify the "Big Three": Look at your results. Are you failing Options, Munis, or Suitability? These are the heavy hitters. Ignore the small stuff like "Investment Companies" until you master these.

- Build a Dump Sheet: Start writing down the formulas and charts you struggle with every single day. By exam day, you should be able to recreate it in under two minutes.

- Simulate the Environment: Don't take practice tests on your phone while watching TV. Sit at a desk. No music. No water. No breaks. Your brain needs to get used to the "lockdown" feeling of the testing center.

- Read the Full Question: FINRA loves to use the word "EXCEPT." They’ll give you three right answers and one wrong one. If you stop reading after the first "correct" option, you’re done.

- Watch the Clock: You have about 1.8 minutes per question. If you’re spending five minutes on a margin calculation, guess, mark it for review, and move on. You can't let one hard question rob you of three easy ones at the end of the test.

The Series 7 isn't an IQ test. It’s a "how much do you want this" test. It’s a test of discipline. Use the free tools to find your leaks, then plug them with focused study. You've got this, but only if you stop treating the practice tests like a game and start treating them like the job interview they actually are.