The stock market is a giant machine designed to go up over time. Betting against it is already hard. Doing it with triple leverage? That’s basically like trying to juggle chainsaws while riding a unicycle on a tightrope. If you’ve spent any time looking at inverse exchange-traded funds, you’ve probably run into the short SPY ETF 3x category. Specifically, we are talking about the ProShares UltraPro Short S&P500 (SPXU) or the Direxion Daily S&P 500 Bear 3X Shares (SPXS).

These aren't your grandfather's index funds.

People buy these because they see a red day on Wall Street and think they can triple their profits on the way down. It sounds like a cheat code. If the S&P 500 drops 2%, a 3x inverse fund should pop 6%, right? On paper, yes. In reality, the math behind these products is a silent killer that most retail traders completely ignore until their portfolio is down 90% while the market is only down 10%.

The Brutal Reality of Daily Reset Math

Here is the thing about a short SPY ETF 3x. These funds are designed for a holding period of exactly one day. Not a week. Not a month. One single trading session.

The fund managers use swaps and futures contracts to rebalance the exposure every single afternoon. This "daily reset" creates a phenomenon called volatility decay, or "beta slippage." Imagine the S&P 500 is at 100. Day one, it drops 5%. Your 3x short fund goes up 15%. Great. But on day two, the market bounces back by 5.26% to get back to 100. Because your fund started day two at a higher valuation, that 5.26% gain in the market translates to a 15.78% loss for you.

Even though the market is back to exactly where it started, your fund is now lower than when you bought it.

You lose money in a sideways market. Honestly, you even lose money in a choppy downward market if the bounces are violent enough. This isn't just a "risk"—it's a mathematical certainty built into the prospectus of funds like SPXU. If you hold these for a year, even in a bear market, the "decay" eats your lunch. According to data from ProShares, the long-term chart of these funds looks like a slide to zero. Seriously, go look at a five-year chart of any 3x inverse ETF. It’s a graveyard of capital.

Why the 2022 Bear Market Tricked Everyone

In 2022, the S&P 500 (tracked by the SPY ETF) fell roughly 19%. You’d think a short SPY ETF 3x would be up nearly 60%. It wasn't. Because the descent was "jagged"—filled with massive bear market rallies—the actual returns were significantly lower than the theoretical 3x multiplier.

Traders who timed the exact peaks of those rallies made a killing. Everyone else who "bought and held" the short position got chopped up. This is why professional desk traders at firms like Goldman Sachs or Jane Street use these for intraday hedges, not as "investments." It's a tool. You don't use a sledgehammer to hang a picture frame, and you don't use a 3x inverse ETF to express a long-term bearish view on the American economy.

Understanding the "Path Dependency" Trap

The term "path dependency" sounds like boring academic jargon. It isn't. It's the reason you're losing money.

✨ Don't miss: Anthem Stock Price Today Per Share: Why the Name Change Still Confuses Everyone

Let's say the market moves like this over four days:

- Day 1: -2%

- Day 2: -2%

- Day 3: -2%

- Day 4: -2%

In this clean, hypothetical scenario, the short SPY ETF 3x performs beautifully. It compounds. Your gains start earning gains. But the market never moves in a straight line. It wobbles. It vibrates. Every time the market ticks green for a day, the 3x leverage works against you with triple the force, resetting your "basis" at a disadvantage.

If the market is volatile but flat over a month, a 3x inverse ETF can easily lose 5-10% of its value. Think about that. The market didn't move, and you lost 10%. That is the cost of the leverage and the daily rebalancing.

Regulation and the "Inverse" Warning

Financial regulators, including FINRA and the SEC, have issued multiple alerts about leveraged ETFs. They’ve basically told brokerage firms that these products aren't suitable for most retail investors. Some platforms, like Vanguard, won't even let you buy them. They’ve decided the headache of explaining to an angry customer why their "short" fund lost money during a market crash isn't worth the commission.

You also have to deal with the expense ratio. While a standard SPY ETF costs you pennies (around 0.09% per year), an inverse 3x fund usually charges around 0.90% to 1.0%. You are paying a premium for the privilege of watching your math decay.

When Does a Short SPY ETF 3x Actually Make Sense?

Is it all doom and gloom? No. There is a very specific time to use these.

If you are a day trader and you see a massive technical breakdown on the charts—maybe a "head and shoulders" pattern confirming or a disastrous CPI print—the short SPY ETF 3x is a surgical instrument. It allows you to get massive downside exposure without using a margin account or playing with complex options Greeks like Delta and Theta.

- Intraday Scalping: Buying at 10:00 AM and selling at 3:30 PM.

- Overnight Hedges: Holding through a specific event (like an Nvidia earnings call) when you own a lot of tech stocks and want to protect against a flash crash.

- Momentum Crashes: During high-velocity panics (like March 2020), these funds can go parabolic.

But notice the pattern: these are all short-term. The moment the "panic" turns into a "grind," the 3x short becomes a liability.

The Margin Call You Didn't See Coming

Leverage is a double-edged sword. Actually, it's more like a sword without a handle. If the S&P 500 gaps up 10% in a single day (it has happened in extreme volatility), your 3x fund drops 30%. If you are playing with money you can't afford to lose, that kind of draw-down is psychologically devastating. Most people "revenge trade" at that point, holding the position longer to "wait for it to come back."

Spoiler: It rarely comes back.

Because of the decay we talked about, the S&P 500 only has to recover a portion of its losses for the 3x short fund to stay stuck at the bottom. This is the "hole" you can't climb out of. If a fund drops 50%, it needs a 100% gain just to get back to even. When you are fighting against the natural upward drift of the market AND the daily reset math, the odds are heavily stacked against you.

Better Alternatives for the Average Bear

If you think the market is going down over the next six months, there are smarter ways to play it than a short SPY ETF 3x.

- Put Options: You have a capped risk (the premium you pay) and you don't deal with daily reset decay, though you do deal with time decay (Theta).

- Unleveraged Inverse ETFs: Funds like SH (ProShares Short S&P500) provide 1x inverse exposure. They still have some decay, but it's significantly less punishing.

- Raised Cash: Honestly? Just selling your longs and sitting in a high-yield money market fund or T-bills is often the best "short" trade. You make 4-5% interest while everyone else is losing 20%.

Practical Steps for Managing 3x Exposure

If you are determined to trade these, you need a system. Don't wing it.

First, set a hard stop-loss. Never let a 3x leveraged position "breathe." If it moves 5% against you, get out. The math of recovery is too hard. Second, watch the VIX. Leveraged inverse ETFs perform best when volatility is expanding. When the VIX starts to crush (volatility goes down), even if the market stays flat, your 3x short will likely lose value.

Third, never make this a core holding. This should be the "spice" in your portfolio, maybe 1% to 5% of your total capital, used strictly for tactical moves.

✨ Don't miss: Evaluate the food delivery company Postmates on delivery safety: What most people get wrong

Actionable Takeaways for Your Portfolio

- Check the Prospectus: Look for the words "Daily Objective." This is the fund's legal admission that it is not meant for long-term holding.

- Avoid "Averaging Down": This works for Apple or Microsoft because they are productive assets. It is a death sentence for a decaying leveraged ETF.

- Monitor Rebalance Times: The last 30 minutes of the trading day (3:30 PM to 4:00 PM EST) is when these funds are most active as they rebalance their swaps. Expect extreme volatility during this window.

- Verify Tax Implications: These are often taxed as ordinary income or have specific K-1 requirements depending on the structure, which can bite you in April.

The short SPY ETF 3x is a powerful weapon. But like any weapon, if you don't know how to handle it, you're more likely to hurt yourself than your target. Treat it as a rental, not a purchase. Get in, get the move, and get out. Anything else isn't trading—it's gambling against a house that has the math on its side.

Next Steps for Traders

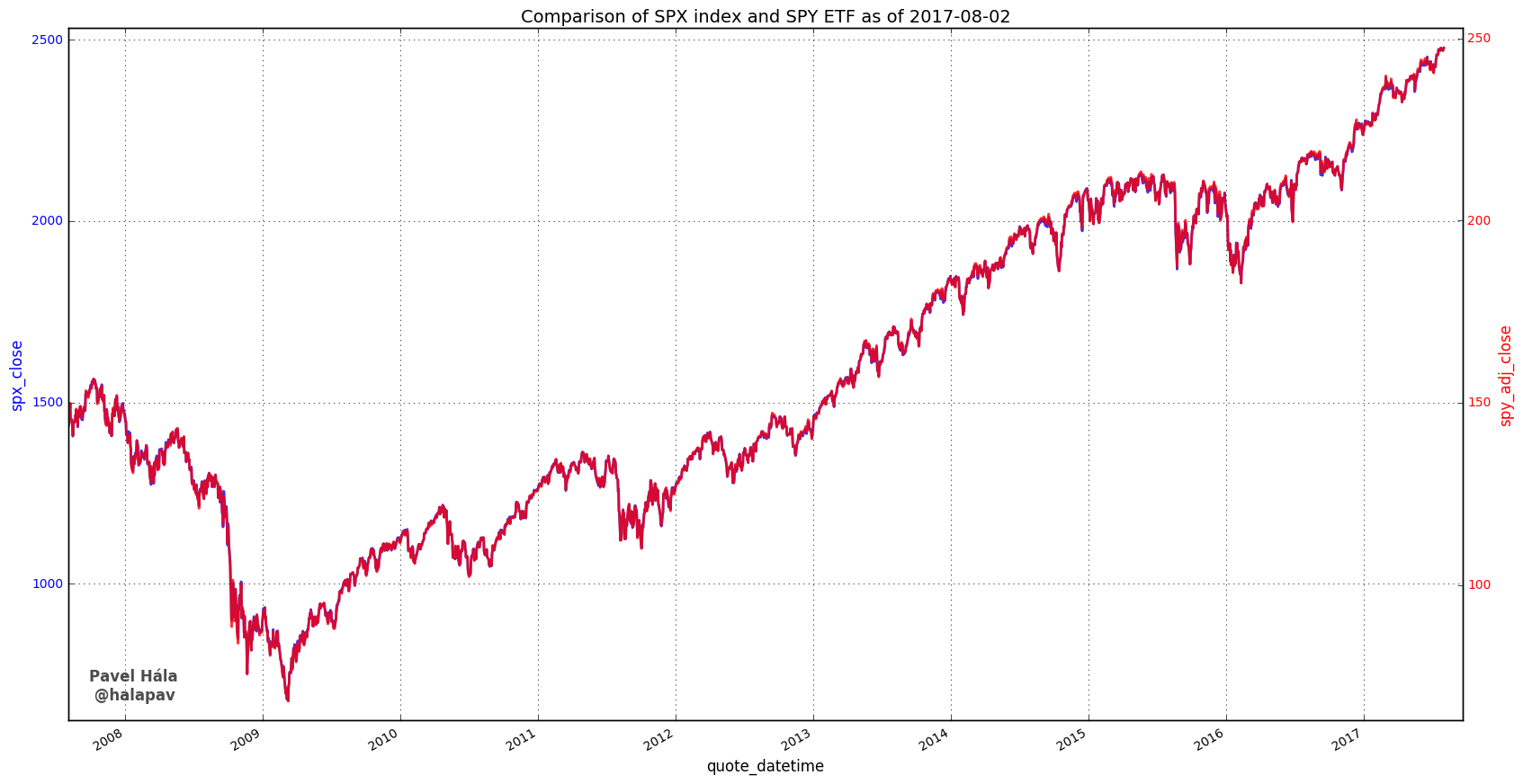

Before placing a trade on an inverse 3x fund, pull up a chart of SPXU and overlay it with the SPY. Change the timeframe to "5 Years." Witness the divergence for yourself. If you still want to trade it, ensure your position size is small enough that a 20% gap-up in the S&P 500 (which happens in rare, "limit up" scenarios) won't liquidate your account. Focus on technical levels like the 200-day moving average on the SPY; if the market is above that line, shorting with 3x leverage is statistically a losing game. Only use these tools when the primary trend is clearly broken and volatility is your friend, not your enemy.

Verify your broker's margin requirements for leveraged ETFs, as many firms have increased "maintenance margin" to 75% or even 100% for these specific symbols, meaning you can't use borrowed money to buy your "borrowed" exposure. Keep your trades tight, your stops closer, and your expectations grounded in the reality of mathematical decay.