Honestly, if you've been watching the charts this morning, you might be feeling a little bit of whiplash. It’s Friday, January 16, 2026, and the precious metals market is doing that thing where it makes everyone second-guess their entire portfolio. After a week of breaking records and making headlines, the "big two" decided to take a breather.

Let’s get the raw numbers out of the way first. Gold prices today are hovering around $4,601 per ounce. That’s a slight dip, down about 0.3% from the session high. Meanwhile, silver prices today per ounce have taken a harder hit, sitting near $91.07, which is a roughly 1.6% drop since the market opened.

It feels like a lot. But you've got to look at the context.

Just two days ago, gold was screaming toward $4,650 and silver was flirting with $93.57. We are currently living through one of the most aggressive bull runs in history. A $20 drop in gold sounds like a disaster until you realize it’s still up 2% on the week. Silver is even crazier—it’s actually on track for a 13% weekly gain despite this morning's "crash."

Why the sudden red candles?

It basically comes down to a few things happening at once in the U.S. economy. Yesterday, the Labour Department dropped a report showing that weekly jobless claims fell to 198,000. That was way lower than the 215,000 everyone expected.

When the labor market looks this strong, the Federal Reserve gets a little less "generous."

Investors were betting on aggressive interest rate cuts in the first half of 2026. Now? Not so much. Because gold and silver don't pay a dividend or interest, they usually struggle when people think interest rates are going to stay higher for longer. The U.S. Dollar Index (DXY) firmed up to around 99.31 on the news, and when the dollar gets stronger, it usually pushes gold down.

Then there’s the geopolitical side. President Trump recently hinted that tensions with Iran might be cooling off a bit. He mentioned that fatalities from recent protests there were decreasing and that he didn't expect a wave of executions.

Less war talk equals less "fear buying."

The $100 silver and $5,000 gold targets

If you talk to the big institutional players, they aren't exactly crying about today's price action. In fact, many see it as a necessary cooling-off period. Citigroup recently raised their short-term targets, suggesting we could see gold at $5,000 and silver at $100 as early as March.

📖 Related: American Rare Earths Stock Price: Why Everyone Is Watching Halleck Creek Right Now

Why so bullish?

- Central Bank Appetite: Poland’s central bank just announced they want to hike their gold reserves to 700 tonnes. They aren't the only ones. Central banks have been buying over 1,000 tons annually for years now.

- The Gold-Silver Ratio: This is the big one for the "silver bugs." Last year, the ratio was over 100:1 (it took 100 ounces of silver to buy one gold ounce). Today, that ratio has collapsed to about 50:1. Silver is finally starting to behave like the industrial essential it is, especially with the massive demand for high-capacity batteries and solar tech.

- Debt Fears: Todd “Bubba” Horwitz and other macro analysts keep pointing back to the U.S. national debt. When the system feels shaky, people run to the things they can hold in their hands.

Regional variations: What you actually pay

One thing that drives me nuts about "spot price" reporting is that nobody actually buys at spot. You're going to pay a premium. If you're looking at physical gold rings or bars today, the prices look very different depending on where you are.

In Delhi, pure 24-carat gold is trading around Rs 1,16,216 per 8 grams. In Mumbai, it’s slightly lower at Rs 1,15,504. If you're in the U.S. buying a 1 oz American Eagle, expect to pay anywhere from $100 to $200 over the spot price of $4,601.

Silver premiums are even more "kinda" wild. Because the price of the metal is lower, the cost of minting and shipping represents a huge percentage of the total. Even though spot is $91, you’ll be lucky to find a reputable dealer selling physical coins for under $105 right now.

What most people get wrong about these prices

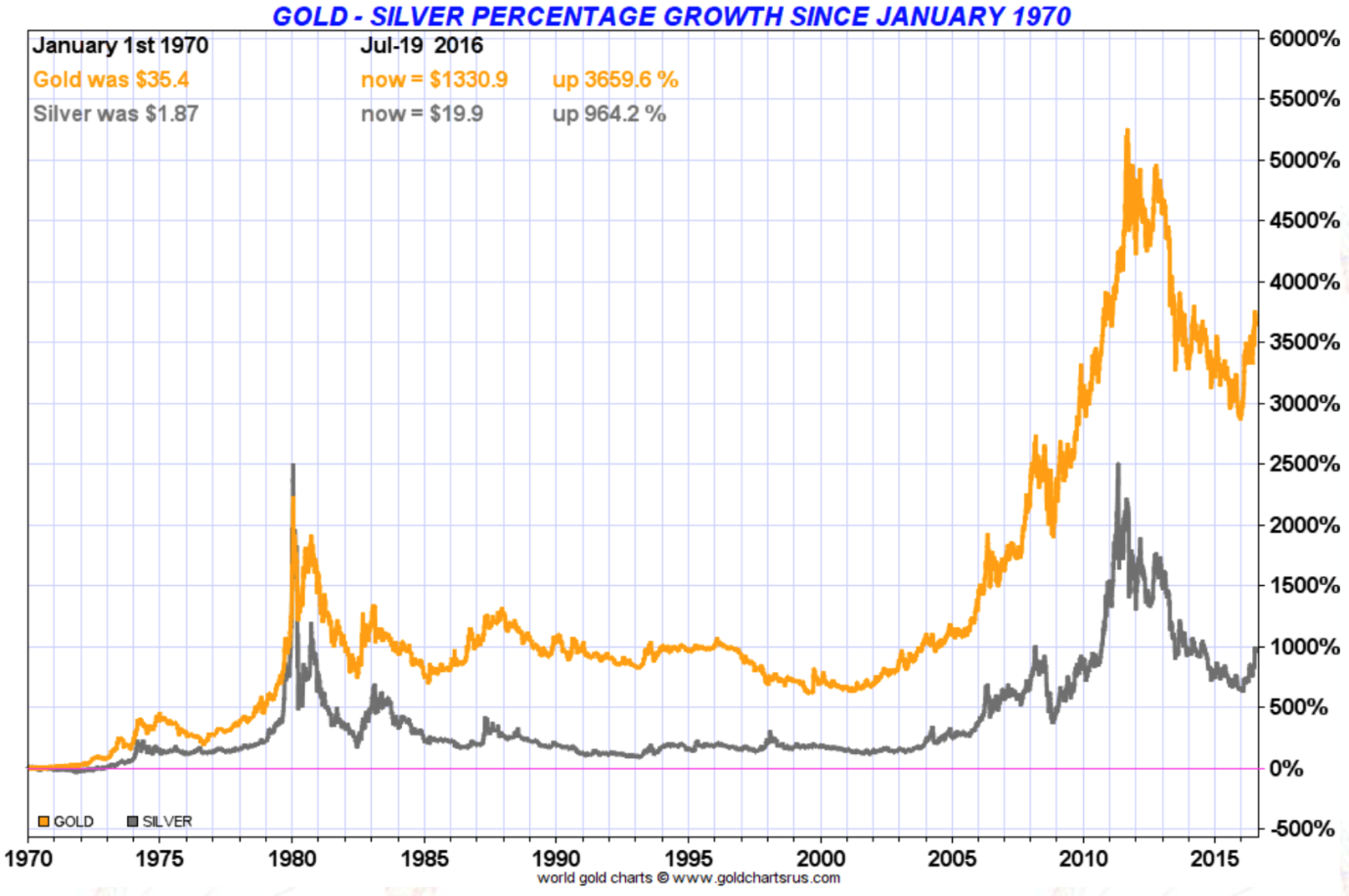

Most casual observers see a "dip" and think the party is over. They forget that silver gained 150% in 2025. Just since January 1st of this year, it’s up another 17%.

That is insane growth.

The volatility is the price you pay for the performance. In 2025, a 5% drop in a single day happened multiple times, yet the metal ended the year at record highs. We are currently in what technical analysts call a "price discovery phase." Basically, the market is trying to figure out what gold is worth when the old rules about inflation and debt don't seem to apply anymore.

✨ Don't miss: What Percentage of United Health Group is Owned by Vanguard: The Real Numbers

Support levels are shifting. For gold, experts are looking at $4,360 as the new "floor." For silver, the $79 to $80 range is the crucial support area. As long as we stay above those levels, the trend is still pointing straight up.

Actionable steps for today's market

Don't just stare at the tickers; have a plan. If you're looking to enter or adjust your position, here's how to handle the current price action:

- Check the Premiums: Before buying physical, compare the "spread" between different dealers. With prices moving this fast, some shops are slower to update than others. You might find a bargain by checking smaller, reputable local coin shops versus the giant online retailers.

- Dollar-Cost Average: If you're worried that $4,600 is the "top," don't buy your whole position today. Break it into four parts and buy once a week. If the price drops next Friday, your average cost goes down.

- Watch the 50-day EMA: For the technical folks, silver is currently sitting quite far above its 50-day Exponential Moving Average (which is around $64). History says that when the price gets too far ahead of its average, it eventually gets "pulled back" like a rubber band. Don't be shocked if we see more red days before we hit $100.

- Verify your "Digital" holdings: If you hold silver through a digital platform or an ETF, make sure it’s actually backed by physical metal. Some "paper" products have been under scrutiny lately for not having the vaults to back up the certificates.

The market is messy right now. It's loud, it's volatile, and it's expensive. But for those who have been holding since the $2,000 gold days, today's "dip" is just a small blip on a very large, very golden radar.