You’re finally doing it. The LLC is filed, the website is live, and the first few clients are actually paying. It feels great. Then, you read a horror story on Reddit or hear about a slip-and-fall at a local coffee shop that ended in a $50,000 settlement. Suddenly, that "insurance" tab you’ve been ignoring on your browser feels a lot more urgent. But here’s the thing: most entrepreneurs approach small business liability insurance like a tax—something you just pay to stay legal. That’s a massive mistake. If you buy the wrong policy, you aren't just wasting money; you're operating with a "closed" sign you just haven't hung up yet.

Buying insurance is basically placing a bet against yourself. You’re hoping you never need it, but you're terrified of what happens if you do. Honestly, the industry doesn't make it easy. They use terms like "aggregate limits" and "endorsements" that sound like they were written by a Victorian lawyer. But at its core, this is about one thing: making sure a single bad day doesn't erase years of hard work.

Why general liability isn't a "catch-all" safety net

A lot of people think General Liability (GL) covers everything. It doesn't. Not even close. If you accidentally spill coffee on a client’s $3,000 MacBook during a meeting, GL has your back. That’s "property damage." If a delivery driver trips over a loose rug in your studio and breaks their wrist, that’s "bodily injury." GL handles that too.

But what if you’re a consultant? What if you give a client advice that causes them to lose $100,000 in revenue? Your General Liability policy will sit there and do absolutely nothing. It isn't designed for professional mistakes. For that, you need Professional Liability, which most people call Errors and Omissions (E&O). It’s a totally different beast.

The distinction matters because of how claims actually happen in the real world. According to data from the Insurance Information Institute (III), the cost of litigation for small businesses can range from $3,000 to $150,000 even if you win the case. The lawyer fees alone can bankrupt a startup before the judge even bangs the gavel. You aren't just paying for the payout; you're paying for the defense.

The "Product" problem nobody talks about

If you sell a physical thing—be it hand-poured candles or custom bike frames—you have a specific risk called Product Liability. Even if you didn't "do" anything wrong, if a product you sold causes harm, you're in the crosshairs. Let's say a candle glass shatters because of a microscopic flaw you couldn't see. The medical bills for those stitches belong to you now. Most GL policies include some product coverage, but the limits are often surprisingly low. You’ve gotta check the "Product-Completed Operations" line on your declaration page. If it’s blank or looks tiny, you’re exposed.

The weird world of "Claims-Made" vs. "Occurrence" policies

This is where things get kinda crunchy. You need to know which one you have, or you might find yourself uninsured for a mistake you made two years ago.

An Occurrence policy covers you for incidents that happen during the policy period, regardless of when you actually file the claim. If you had an occurrence policy in 2024, and someone sues you in 2026 for something that happened back then, you're usually fine. It’s the "gold standard" for a reason.

Claims-made policies are different. They only cover you if the policy is active both when the event happened and when the claim is filed. This is common in Professional Liability. If you switch insurers or cancel your policy when you retire, you might need to buy something called "Tail Coverage." Without it, your past work is basically unprotected the second you stop paying premiums. It’s a trap that catches a lot of freelancers who think they can just "pause" their insurance during a slow month.

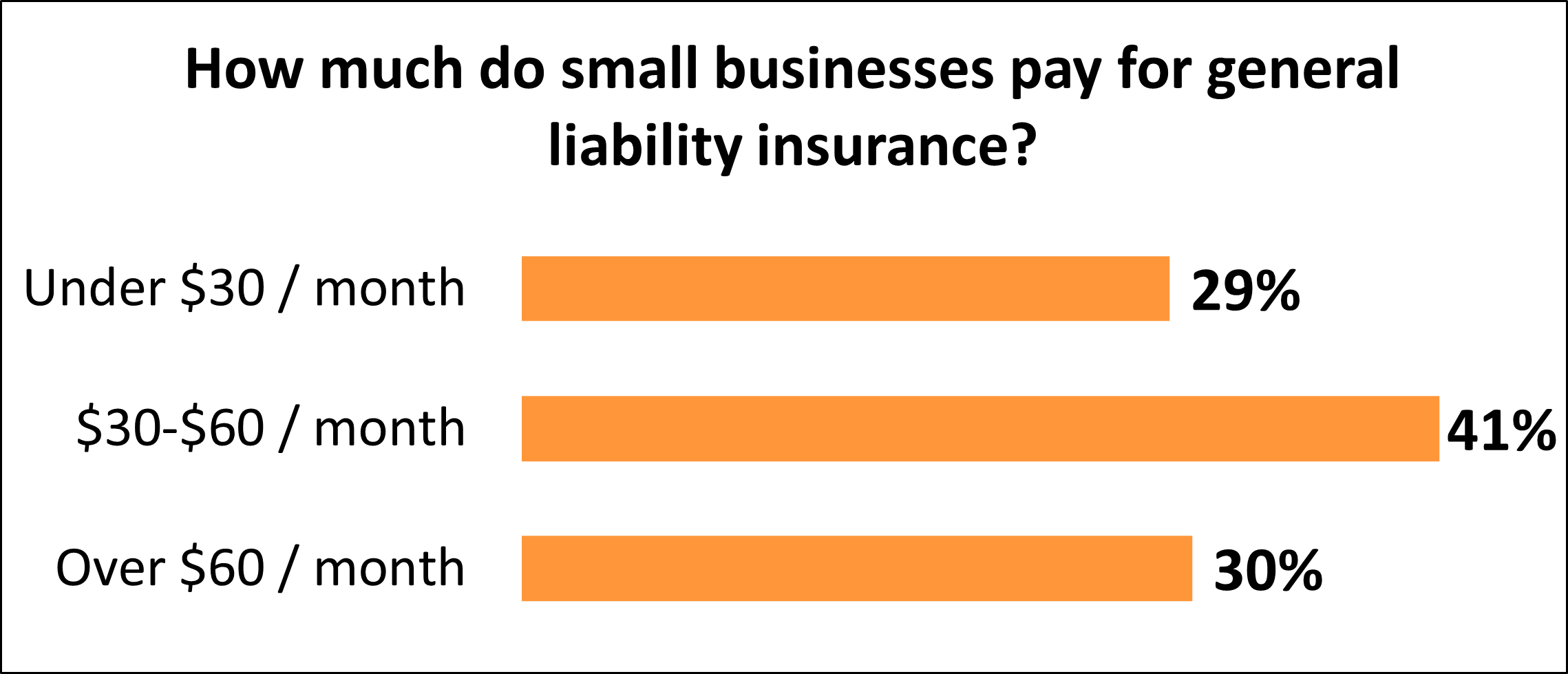

Real talk about the costs

How much does this stuff actually cost? It’s the first question everyone asks.

For a basic General Liability policy, a "micro-business" (think a solo graphic designer or a house cleaner) might pay as little as $300 to $600 a year. But if you’re a general contractor or you run a gym? You’re looking at thousands.

Insurers look at your "class code." This is a numerical value assigned to your industry. If you’re a "clerical office," you’re low risk. If you’re "roofing," you’re high risk. If you misrepresent what you do to get a lower rate—say, telling them you’re a consultant when you actually do light construction—they will deny your claim. They call it "material misrepresentation." It's basically an expensive way to have no insurance at all.

👉 See also: Liz Carmichael Dale Car: What Most People Get Wrong

The hidden factor: Payroll and Revenue

Most policies are "auditable." This means at the end of the year, the insurance company looks at your actual books. If you told them you’d make $100k but you actually made $500k, they’re going to send you a bill for the difference. It’s not a penalty; it’s just how the math works. More revenue usually means more customers, which means more chances for something to go sideways.

What about your home office?

A huge myth is that your homeowners insurance covers your business. It almost certainly doesn't. Most homeowners policies have a very small limit—often $2,500—for business equipment, and they provide zero liability coverage for business-related visitors. If a client falls on your porch while coming over to sign a contract, your home insurance company might just walk away.

You need a "Home-Based Business Endorsement" or a standalone Business Owners Policy (BOP). A BOP is usually the best bang for your buck because it bundles GL with property insurance for your gear.

Beyond the basics: Cyber and Employment risks

We’re living in a time where a data breach is more likely than a fire. If you store customer emails, credit card info, or even just addresses, you have a "Cyber" exposure. Cyber liability insurance doesn't just pay for the hacked data; it pays for the mandatory notifications you have to send out and the credit monitoring for your customers. In some states, the legal requirement to notify people of a breach can cost $200 per record. Do the math on 1,000 customers. It's ugly.

Then there’s the people side. If you have even one employee, you need to think about Employment Practices Liability Insurance (EPLI). This covers things like wrongful termination, harassment, or discrimination claims. Even if you're the "world's best boss," a disgruntled ex-employee can still file a suit.

How to actually shop for this without losing your mind

Don't just go to a big-name website and click "buy."

🔗 Read more: Market Cap of New York Stock Exchange: Why the Big Board Still Wins

- Find an Independent Agent: Unlike "captive" agents who only work for one company (like State Farm or Geico), independent agents shop your info around to dozens of carriers. They can find the weird niches.

- Read the Exclusions First: Don't look at what's covered. Look at what isn't. Some policies exclude "punitive damages" or "assault and battery." If you run a bar, and you don't have assault and battery coverage, your bouncer is a walking liability.

- Check the "Rating" of the Company: Use A.M. Best to check the financial strength of the insurer. You want an "A" or better. You don't want a company that goes bust right when you need them to pay a claim.

- The Certificate of Insurance (COI) Game: If you work with big clients, they’ll ask for a COI. Make sure your policy allows for "Additional Insured" endorsements. Sometimes it costs $25, sometimes it's free, but you'll need it to close big deals.

Actionable Steps to Take Today

The goal isn't just to buy a policy; it's to be protected. Here is exactly what you should do right now:

- Inventory your "stuff": List every laptop, camera, and piece of equipment you use. If you don't have a BOP, these probably aren't covered for theft or damage.

- Audit your contracts: Look at the insurance requirements your clients have asked for in the past. Are you actually meeting those limits?

- Separate your finances: This has nothing to do with insurance directly, but if you don't keep your business and personal money separate, a lawyer can "pierce the corporate veil." If that happens, your personal house and car are on the table in a lawsuit, regardless of your business insurance limits.

- Get three quotes: Insurance is a marketplace. Prices vary wildly for the exact same coverage. Get a quote from a tech-heavy "insurtech" firm (like Next or Hiscox) and one from a local independent agent. Compare the exclusions side-by-side.

Insurance won't make your business successful. Only you can do that. But it will keep you in the game when things get messy. Don't wait until you get a "legal" letter in the mail to figure out what's in your policy. By then, it's usually too late.