If you’ve been checking your bank account every second Wednesday of the month and wondering why the numbers shifted, you aren't alone. It happens every year. The Social Security Administration (SSA) tweaks the dials, inflation does its thing, and suddenly your "normal" check has a new face. Honestly, keeping up with the social security 2025 payment schedule and the technical shifts behind it feels like a part-time job.

But it matters. For millions of retirees and disability recipients, these payments aren't just "extra" money; they're the foundation. In 2025, we’re seeing a 2.5% Cost-of-Living Adjustment (COLA). While that’s smaller than the massive jumps we saw during the peak inflation years of 2023 and 2024, it’s still an extra $50 a month for the average retired worker.

$50 doesn't buy a steak dinner every night, but it covers a couple of grocery trips.

When exactly does the money hit?

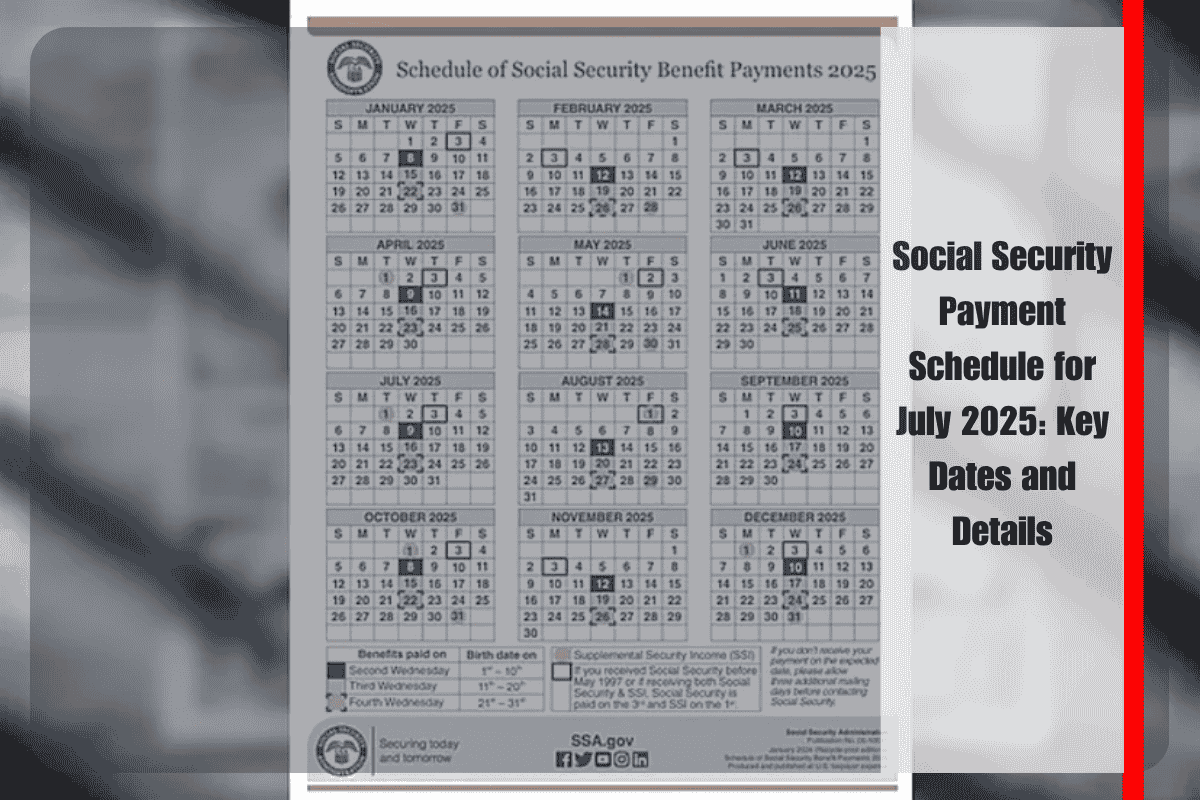

The SSA is nothing if not predictable, but their calendar can look like a secret code if you don't have the key. Basically, the day you get paid depends on your birthday.

If you were born between the 1st and the 10th of your birth month, you’re in the first wave. Your money arrives on the second Wednesday of every month. For those born between the 11th and the 20th, it’s the third Wednesday. If your birthday falls anytime from the 21st to the end of the month, you’re waiting until the fourth Wednesday.

🔗 Read more: Why an Amazon Driver Dumps Packages in the Woods and What It Says About the Last Mile

There are always exceptions that trip people up.

If you started receiving benefits before May 1997, or if you receive both Social Security and Supplemental Security Income (SSI), your payment date is usually the 3rd of the month. SSI-only recipients get their money on the 1st.

But what if the 1st or 3rd falls on a Saturday?

The SSA doesn't make you wait until Monday. They pay you early. For example, if you're an SSI recipient, your January 2025 payment actually landed on December 31, 2024, because New Year's Day is a holiday. It’s a nice little bonus for New Year’s Eve, but you have to remember that money has to last you all the way through January.

The 2025 math you should know

The 2.5% COLA is the headline, but it's not the only number moving.

The maximum taxable earnings limit—the amount of your salary that actually gets taxed for Social Security—jumped to $176,100 for 2025. Last year, it was $168,600. If you’re a high earner, you’re paying into the system for a little longer this year.

Also, the "Earnings Test" limits have shifted. This is huge for people who are working while collecting benefits before they hit Full Retirement Age (FRA).

- If you’re under FRA all year: You can earn up to $23,400 before the SSA starts withholding $1 for every $2 you earn over the limit.

- If you reach FRA in 2025: That limit jumps to $62,160. They only withhold $1 for every $3 you earn above that, and they only count the months before your birthday.

Once you hit your Full Retirement Age birthday? The "test" vanishes. You can earn a million dollars a year and keep every penny of your Social Security.

The Medicare "Squeeze"

Here is the part most people find annoying. You get a 2.5% raise from Social Security, but Medicare Part B premiums usually go up too. For 2025, the standard monthly premium for Medicare Part B is $185.

That is a $10.30 increase from 2024.

So, if your Social Security check was supposed to go up by $50, you might only see about $39 or $40 of that in your actual take-home pay because Medicare takes its cut before the money even hits your account. It’s sort of a "one step forward, half a step back" situation.

A massive change for government workers

Something happened recently that hasn't gotten nearly enough press. For decades, teachers, police officers, and firefighters were hit by two rules: the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). These rules basically slashed Social Security benefits for people who also had a pension from a job where they didn't pay Social Security taxes.

📖 Related: PPL Paycheck Problems: What Really Happened to Personal Assistant Pay

Well, the Social Security Fairness Act has changed the landscape.

While the legal battle and implementation have been complex, the goal is to stop penalizing public servants for having a pension. If you’ve had your benefits "haircut" in the past because of a teaching pension, 2025 is the year to double-check your statements. Nuance matters here—the SSA has been working on adjusting these amounts, and for many, it means a significant boost that goes way beyond a simple COLA.

Don't get scammed in 2025

I hate that I have to mention this, but the more the payment schedule changes, the more the scammers come out of the woodwork.

You might get a call or a "very official" looking email saying your social security 2025 payment is suspended until you "verify your identity" or "apply for the COLA."

Do not fall for it.

The SSA will never:

- Threaten to arrest you over the phone.

- Ask you to pay a fee to receive your COLA (it’s automatic).

- Demand payment in gift cards or wire transfers.

If you want to know what’s actually happening with your check, the only place you should go is SSA.gov and log into your "my Social Security" account. It's actually a pretty decent portal now—you can download your benefit verification letter and see exactly what your 2025 numbers look like without waiting for the mail.

Moving forward with your benefits

Understanding your payment is more than just knowing the date. It’s about managing the flow.

If you’re still working, keep an eye on that $23,400 threshold if you’re under full retirement age. Going $1,000 over means losing $500 in benefits—that's a steep "tax" for working hard.

📖 Related: 1 JPY to BDT: Why the Yen is Acting So Weird Lately

Also, take a moment to look at your tax withholding. Social Security is taxable if your "combined income" (adjusted gross income + nontaxable interest + half of your Social Security benefits) is above $25,000 for individuals or $32,000 for couples. Many people forget to have taxes withheld and end up with a nasty surprise in April. You can file a Form W-4V with the SSA to have 7%, 10%, 12%, or 22% of your monthly benefit held for federal taxes.

Take 10 minutes this week to log into your online account. Check that your mailing address is current—even if you use direct deposit—and look at your new 2025 benefit statement to see exactly how the COLA and Medicare premiums balanced out for your specific situation.