You probably just call it "the letter." Or maybe you’ve heard it referred to as an award letter, a budget letter, or even a proof of income letter. Officially, the Social Security Administration (SSA) calls it the Benefit Verification Letter. Honestly, it doesn't matter what you call it until the moment you realize you don't have a current one. Then, it matters a lot.

It’s just a piece of paper. But it's a piece of paper that carries the weight of the federal government behind it.

Most people don't think about their social security benefit letter until they're sitting in a loan officer's office or trying to apply for a low-income housing voucher. Suddenly, that digital or physical document is the only thing standing between you and an approval. It is the definitive, "no-arguments-allowed" proof of how much money is hitting your bank account every month from Uncle Sam.

What is a Social Security Benefit Letter Anyway?

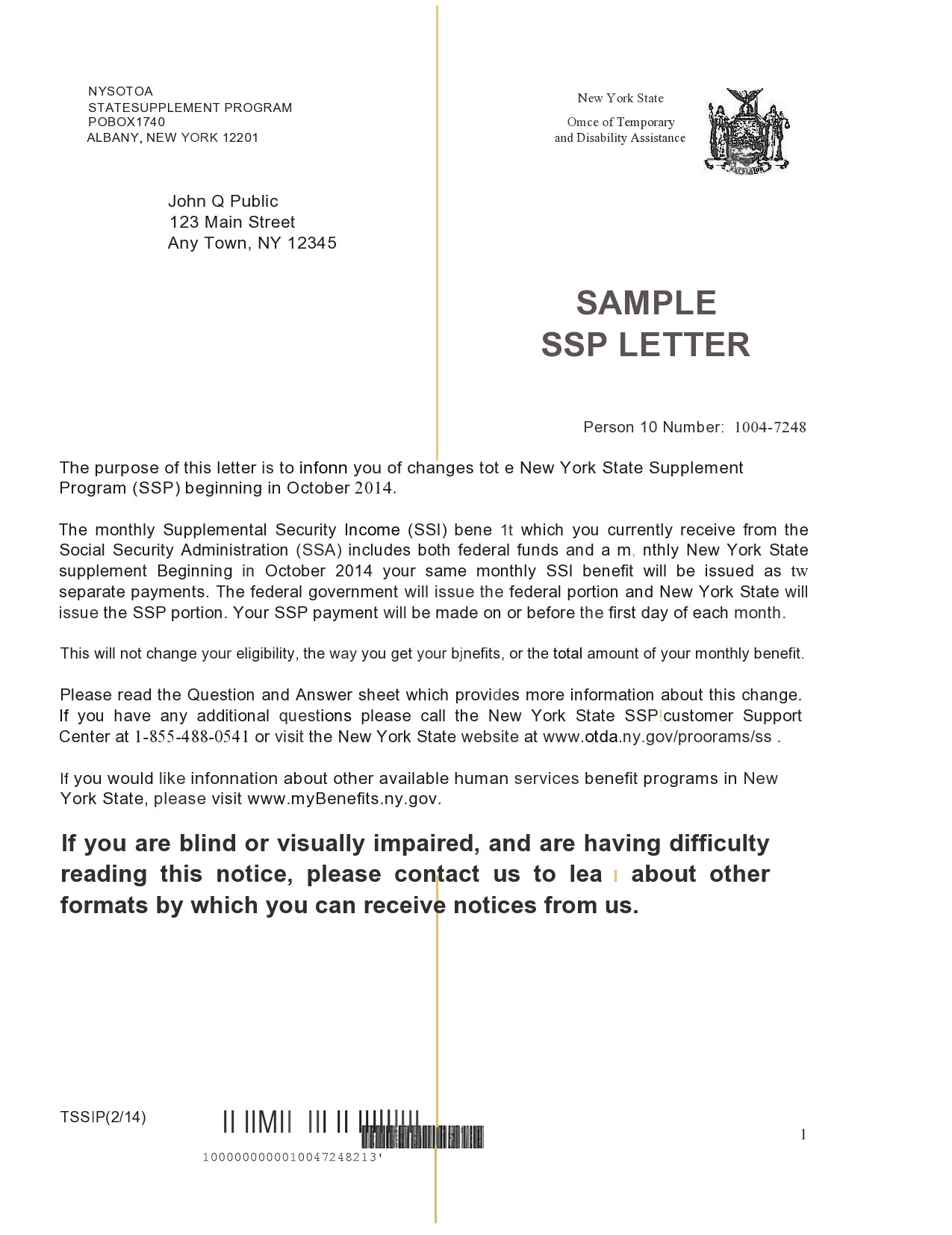

Think of it as a formal receipt for your life’s work. It’s a snapshot. It tells anyone who needs to know exactly what kind of benefits you get—whether that’s retirement, disability (SSDI), or Supplemental Security Income (SSI). It also lists your birth date and, crucially, whether you’re currently enrolled in Medicare Parts A or B.

If you aren't receiving benefits yet, the letter says that, too.

It’s weirdly versatile. You might need it to prove you don't have an income if you’re applying for certain state-level assistance programs. If you've ever tried to get a mortgage while on fixed income, you know the bank doesn't just take your word for it. They want the official letter. They want to see the gross amount, the net amount after Medicare premiums are sliced off, and the date the payments started.

The different "flavors" of the letter

There isn't just one version. The SSA tailors the information based on who is asking and what your status is. For instance, if you’re a retiree, your social security benefit letter will show your monthly check amount before and after tax withholdings. If you’re on SSI, it might look a bit different because those benefits are needs-based and can fluctuate.

📖 Related: Why Your Chief Operating Officer Business Card Still Matters in a Digital World

Don't confuse this with the "Social Security Statement." That's the multi-page document that shows your entire earnings history from that summer job in 1985 through today. The Statement is about the future; the Benefit Verification Letter is about the now.

Why Everyone Seems to Lose This Document

Life happens. You get the annual Cost of Living Adjustment (COLA) notice in December. You glance at it, see the 2.5% or 3.2% increase, and stick it in a "safe place." Six months later, you’re applying for a new apartment, and the landlord wants a "current" letter.

"Current" usually means dated within the last 60 days.

That old letter in the filing cabinet? It's basically a relic. Most agencies won't accept a social security benefit letter that is more than a couple of months old because they know Medicare premiums or COLA adjustments change the math.

Getting a new one isn't the nightmare it used to be

Twenty years ago, you had to get dressed, drive to the local SSA office, take a number, and sit in a plastic chair for three hours. If you were lucky, the printer didn't jam.

Now? You can grab it in about two minutes.

The "my Social Security" account portal is actually one of the few government websites that works pretty well. You log in, click a link, and a PDF pops up. You can print it, save it, or email it. If you’re old school and want it mailed, you can still call the 800 number, but be prepared for some hold music.

The COLA Factor: Why Your Letter Changes Every January

Every year, the Social Security Administration looks at the Consumer Price Index. They want to see if milk and gas got more expensive. If they did, they trigger the Cost of Living Adjustment.

When this happens, every single social security benefit letter in the country becomes obsolete.

The new letters usually start rolling out in the "Message Center" of your online account in early December. This is the peak season for these documents. If you’re planning on making any big financial moves in January or February, you need to make sure you’ve downloaded the version that reflects the new year's rates.

Sometimes the increase is tiny. Other times, like in 2023 when it hit 8.7%, it's massive. Either way, the letter is the only way to prove your new "buying power" to the outside world.

Using the Letter for Healthcare and Housing

Medicaid offices are sticklers. They need to see the "gross" amount—that’s the money before Medicare Part B premiums are taken out. Why? Because many states have "buy-in" programs where they might pay your Medicare premiums for you if your income is low enough.

📖 Related: Colorado Personal Income Tax Explained (Simply): Why Your Tax Bill Just Changed

But they can't help you if they can't see the breakdown.

Your social security benefit letter breaks this down line by line. It shows:

- The total benefit amount.

- The amount deducted for medical insurance (Medicare).

- The actual amount deposited into your bank.

If you’re applying for Section 8 housing or any HUD-sponsored program, they will demand this letter. They won't take a bank statement. A bank statement only shows what was deposited, not what was earned. There's a big difference in the eyes of a government auditor.

What if you don't have a "my Social Security" account?

Some people are wary of the internet. I get it. Identity theft is real. But here's a secret: setting up your account is actually a way to prevent identity theft. If you claim your account, a scammer can't.

If you absolutely refuse to go online, you can call 1-800-772-1213. You tell the automated system you need a "Proof of Income" letter. They’ll mail it to the address the SSA has on file. It takes about 5 to 10 business days. If you’ve moved recently and haven't updated your address, don't bother calling until you fix that, or your sensitive info is going to your old front porch.

Security and Privacy: Don't Just Leave It Lying Around

This letter contains your Social Security Number (usually truncated, but still) and your home address. It’s a goldmine for the wrong people. When you provide your social security benefit letter to a third party, ask how they store it.

Do they scan it into a secure server? Do they toss it in a cardboard box?

If you’re emailing it, please, for the love of everything, don't just attach it to a regular email. Use a secure file-sharing service or at least password-protect the PDF. It feels like extra work, but so is spending 40 hours on the phone with credit bureaus because someone opened a Mazda dealership in your name.

Real-World Scenario: The Mortgage Jump

Let's look at a real-life example. I knew a guy named Arthur who was trying to refinance his condo. He had a solid pension and Social Security. The bank was fine with the pension statement, but they kept rejecting his Social Security "proof."

Arthur was sending them his 1099-SA form from tax season.

The bank kept saying, "We need a current benefit letter." Arthur was frustrated. "It's the same amount every month!" he’d yell. But the bank’s software wouldn't accept the 1099 because it was from the previous tax year. It didn't prove he was still receiving those benefits today.

💡 You might also like: Janus Henderson Group Stock: Why Everyone Is Watching The $7.4 Billion Buyout

He finally logged into the SSA portal, clicked "Replacement Documents," and downloaded the social security benefit letter. The loan was approved 48 hours later.

The moral? Don't fight the bureaucracy. Just give them the specific form they’re asking for.

Common Misconceptions That Cause Headaches

A big one is thinking the letter is only for retirees.

If you are 25 years old and receiving disability benefits because of a car accident, you have a social security benefit letter. If you are a surviving spouse receiving survivor benefits, you have one. Even if you are a representative payee for a child, you can pull a letter for that child’s record.

Another mistake is thinking the letter is permanent.

It’s not. It’s a "living" document. If you start working part-time and your benefits are withheld, or if you move to a different state and your SSI supplement changes, the letter changes. Always check the date at the top right.

How to Get Your Letter Right Now

- Go to the official site. It’s ssa.gov. Don't click on any site that ends in .com or .net claiming they can get it for you for a fee. Those are scams. The letter is free.

- Sign in or Create an Account. You’ll likely need to go through Login.gov or ID.me. It’s a bit of a pain with the two-factor authentication, but it’s for your own protection.

- Find the "Replacement Documents" tab. It’s usually right there on the main dashboard.

- Click "Get a Benefit Verification Letter."

- Choose what to show. You can actually toggle off certain information if you don't want the recipient to see your phone number or your full birth date, though most banks want the full details.

If you’re a representative payee, you can switch between your own account and the person you represent using a dropdown menu. It’s surprisingly intuitive for a government system.

Actionable Steps to Take Today

Stop what you're doing and check if you can log in to your Social Security account. Even if you don't need a letter today, you will eventually.

- Download a fresh copy every January. Just make it a habit, like changing the batteries in your smoke detector. Save it to a secure folder on your computer named "Current Income Proof."

- Check for errors. Occasionally, the SSA might have an old address or an incorrect Medicare status. Finding this out when you’re in a rush to buy a car is the worst possible time.

- Update your "Representative Payee" info. If you’re managing money for a parent, ensure you have legal access to their online portal. It saves weeks of mailing forms back and forth.

- Save it as a PDF. Don't just print it and scan it back in. A digital-original PDF is much easier for banks and agencies to read, and it looks more professional.

The social security benefit letter is more than just a piece of mail. It’s your financial passport in the world of fixed income. Treat it with a little respect, keep a fresh copy on hand, and you’ll bypass about 90% of the stress people usually face when dealing with government red tape.