You've probably heard the old advice to just "wait until 65" to retire. It's classic. It's also, honestly, totally outdated. If you were born in 1960 or later, your magic number isn't 65 anymore—it’s 67. The world has changed, and so have the rules for social security benefits by age.

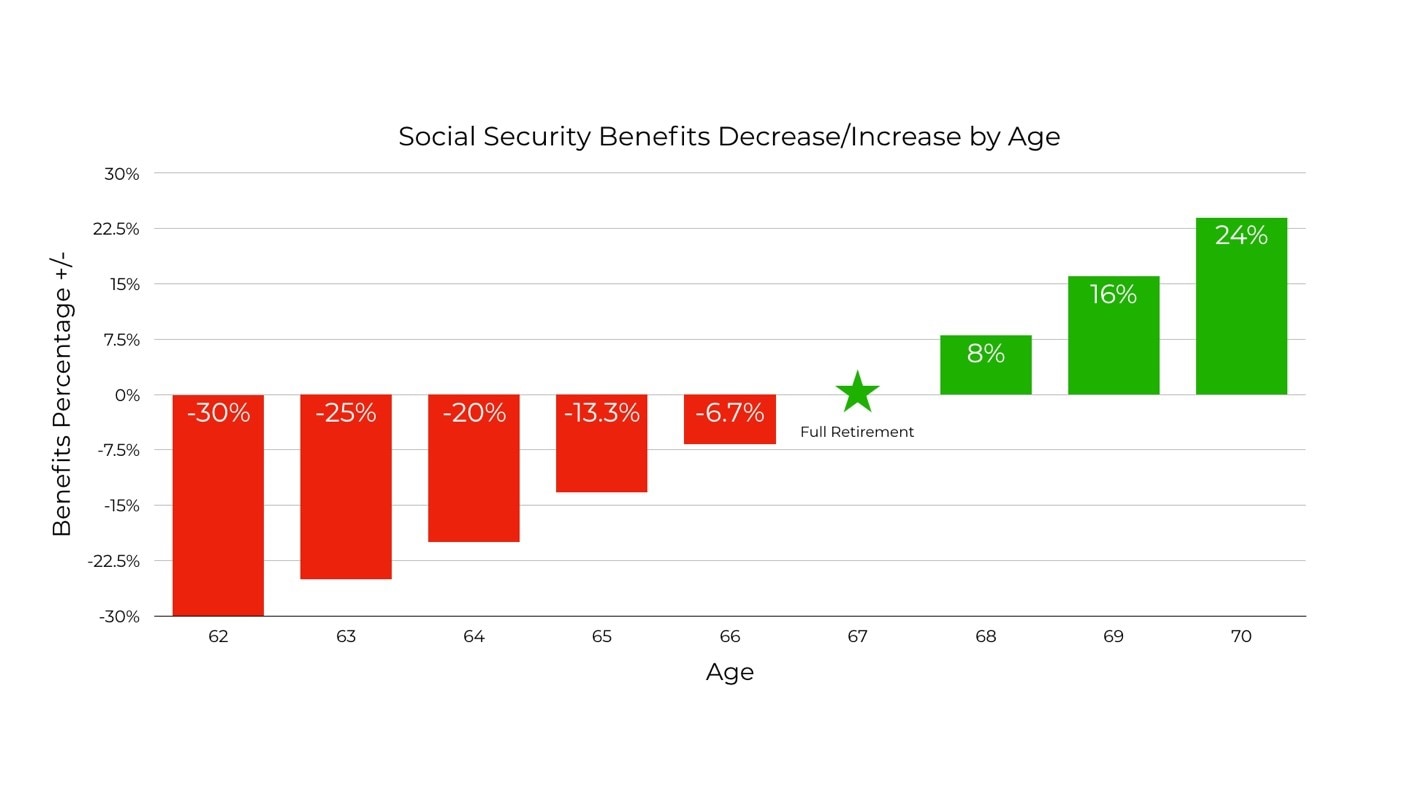

Deciding when to pull the trigger on your benefits is basically the biggest financial gamble of your life. Start at 62? You’re looking at a permanent 30% pay cut. Wait until 70? You’re getting a massive bonus every single month until the day you die. It's a lot to process. Most people kind of just guess or follow what their neighbor did, but the math is pretty cold and unforgiving.

The 62 vs. 67 vs. 70 Showdown

The Social Security Administration (SSA) doesn't care about your "retirement" date; they care about your "filing" date.

If you decide to claim at 62—the earliest possible second—you’re accepting the smallest check you’ll ever get. For someone born in 1960, claiming at 62 means you only get 70% of your primary insurance amount. If your full benefit was supposed to be $2,000, you’re now living on $1,400. Forever. Well, plus whatever inflation adjustments come along.

Then there’s the Full Retirement Age (FRA). For anyone hitting retirement age now or in the next few years, that’s 67. This is the baseline. This is where you get 100% of what you earned. No penalties, no bonuses. Just the straight-up amount you worked decades to build.

But then, things get interesting. If you can hold out past 67, the SSA basically says "thanks for waiting" and gives you an 8% raise for every year you delay. This lasts until you hit 70. There is absolutely no benefit to waiting until 71. If you wait until 70, you’re getting 124% of your base benefit. That’s a 77% higher monthly check than if you had started at 62.

Think about that. $1,400 versus roughly $2,480. That’s a lot of grocery money.

Why people take it early anyway

Honestly, sometimes life just happens. Maybe you lost your job. Maybe your health isn't great. If you don't think you're going to live into your late 80s, taking the money early can actually result in more total cash over your lifetime. It’s a "break-even" calculation. Usually, that break-even point is somewhere around age 77 to 80. If you live longer than that, you'll regret taking it at 62. If you don't, you won. It's a morbid way to think about it, but that's the reality of social security benefits by age.

The 2026 Reality Check: Numbers You Need

The year 2026 brought some specific changes that affect your wallet. Thanks to a 2.8% Cost-of-Living Adjustment (COLA), the average check is moving up.

The maximum possible benefit for someone retiring at 70 in 2026 is now a staggering $5,181. To get that, you’d need to have earned the "taxable maximum" (which is $184,500 for 2026) for at least 35 years. Most of us aren't hitting that peak, but it shows how high the ceiling can go.

For the rest of us, the average retirement check is hovering around $2,016 as we head into the year.

Working while collecting (The trap)

If you're under 67 and you think you’ll collect Social Security while still working a part-time job, be careful. The SSA has an "earnings test." In 2026, if you are under your full retirement age for the whole year, they’ll take away $1 in benefits for every $2 you earn over $24,480.

✨ Don't miss: 1978 Queen Elizabeth the Second Coin Value: What Most People Get Wrong

Once you hit that birthday month where you turn 67, the handcuffs come off. You can earn a million dollars a year and they won't touch your Social Security check.

Special Rules and Weird Nuances

It isn't just about you. If you're married, or even if you're divorced (after 10 years of marriage), your spouse’s age matters too.

Spousal benefits are capped at 50% of the worker’s full retirement age amount. Even if your spouse waits until 70 to get their own "delayed credits," you don't get a piece of that extra 8% a year. You’re stuck at the 50% mark based on their age 67 benefit.

And survivors? That’s different. If a high-earning spouse waits until 70 to collect and then passes away, the widow or widower gets that full, beefed-up amount. Delaying isn't just about your own monthly check; it's often the best life insurance policy you can leave for a spouse who might outlive you by a decade.

The Tax Man still wants a cut

One thing nobody tells you is that your Social Security isn't always tax-free. If your "combined income" (your adjusted gross income + tax-exempt interest + half of your Social Security) is over $34,000 as an individual or $44,000 as a couple, up to 85% of your benefits could be taxed.

It feels sort of like a double tax since you paid into it with taxed dollars, but it's been the law since the 80s.

Actionable Steps for Your Timeline

Don't just wing this. Here is what you should actually do right now:

- Create a "my Social Security" account. Go to the official SSA website. It’s the only way to see your actual earnings history. If there's a mistake from a job you had in 1994, it’s costing you money right now.

- Run the "Break-Even" math. Use a calculator to see if your health and family history suggest you'll live past 80. If yes, wait. If no, consider filing earlier.

- Coordinate with your spouse. If one person was a much higher earner, they should almost always wait as long as possible to maximize the survivor benefit for whichever of you lives longer.

- Check your 2026 earnings. if you're 63 or 64 and making more than $24,480, you might want to hold off on filing so you don't just "give" the money back to the government in the form of withheld benefits.

Understanding social security benefits by age isn't about finding a "right" answer. It's about finding the answer that doesn't leave you broke when you're 85. The difference between age 62 and age 70 is massive. Take the time to look at your own numbers before you sign those papers.