Waiting for that deposit notification can be stressful. Honestly, it shouldn't be. The Social Security Administration (SSA) isn't trying to be mysterious about it, but their calendar system is... well, it’s government work. It’s consistent, yet just confusing enough to make you double-check your bank account every Wednesday morning. If you are trying to map out your budget for the next twelve months, understanding the social security payment schedule 2025 is basically the first thing you need to do.

It's not just about one date.

The system is a patchwork. It depends on when you were born, whether you're on Supplemental Security Income (SSI), or if you’ve been in the system since before 1997. If you’re a newer retiree, your birthday is the golden ticket. If you’ve been retired for decades, you’re in a totally different lane.

The Wednesday Rule: Birthdays and Timing

Most people fall into the "Birthday Rule" category. If your birthday is between the 1st and the 10th of the month, you’re looking at the second Wednesday. Those born between the 11th and 20th get paid on the third Wednesday. Everyone else? The fourth Wednesday.

It sounds simple. Until a holiday hits.

In 2025, for instance, January 1st is a Wednesday. Since the banks are closed, the SSA doesn't just make you wait; they push payments earlier. This creates a weird "two checks in one month" situation that often tricks people into thinking they got a bonus. They didn't. It’s just an advance. If you spend both checks in December, January is going to feel very, very long.

Why the 1997 Cutoff Matters

There’s a group of "legacy" beneficiaries. If you started receiving benefits before May 1997, or if you live in a foreign country, your check usually arrives on the 3rd of the month.

Wait.

There's a catch here too. If the 3rd falls on a weekend—which it does in May and August of 2025—the payment moves to the Friday before. For example, August 3, 2025, is a Sunday. You won’t see that money on Sunday. You won't see it on Monday. You’ll see it on Friday, August 1st.

The SSI Quirk and the Double-Payment Myth

SSI recipients have it different. Their payments are scheduled for the 1st of the month. Because January 1, 2025, is New Year's Day, that payment actually lands on December 31, 2024.

Don't let the headlines fool you.

You'll see "Extra Check in January!" all over social media. It's clickbait. You are not getting more money; you are just getting your money early. The SSA budget remains the same. If you see two payments in your account in one calendar month, check the calendar for the following month. You’ll likely see a "missing" payment because you already spent it.

Breaking Down the 2025 Calendar Months

Let’s look at some specific quirks in the social security payment schedule 2025.

In January, the 1st is a holiday. SSI comes early.

In February, the schedule is tight. It’s a short month, but the Wednesdays remain the 12th, 19th, and 26th.

June is a big one. June 19th is Juneteenth. If your payment was supposed to land on that Thursday, and it’s a holiday-adjacent date, usually the Wednesday payments aren't affected unless the holiday falls specifically on a Wednesday. In 2025, Juneteenth is a Thursday. Your Wednesday payments on the 18th should be fine.

The 2025 COLA Factor

We have to talk about the Cost of Living Adjustment (COLA). By the time you’re reading this in early 2025, you’ve already seen the 2.5% bump in your check. It wasn't the massive 8.7% we saw a few years back, but it’s something.

Is it enough? Probably not for most.

The average monthly benefit increased by about $50. That’s a couple of bags of groceries or a tank of gas. The 2.5% increase applies to the base amount, but remember that Medicare Part B premiums are usually deducted directly from your Social Security check. If Part B premiums go up significantly, they can eat a large chunk of that COLA "raise."

When the Check Doesn't Show Up

It happens.

The SSA advises waiting three mailing days before calling them. If your electronic deposit isn't there by the afternoon of your scheduled Wednesday, don't panic immediately. Check your bank's "pending" transactions. Most modern banks like Chase, Wells Fargo, or digital-first ones like Chime show the funds pending a day or two early.

If it’s truly missing, the number is 1-800-772-1213.

Expect a wait. Honestly, their phone lines are a nightmare on payment days. If you can use the "my Social Security" online portal, do it. It’s much faster to verify if a payment was sent than waiting on hold for two hours.

Direct Express vs. Direct Deposit

Most of us use direct deposit. It’s fast. It’s safe. But some people still use the Direct Express debit card.

The schedule remains the same.

However, the "settlement time" can vary. Direct deposit into a traditional checking account is almost always there by 8:00 AM on the scheduled Wednesday. Debit cards might see it hit at midnight or even the night before.

Navigating the Specific Dates

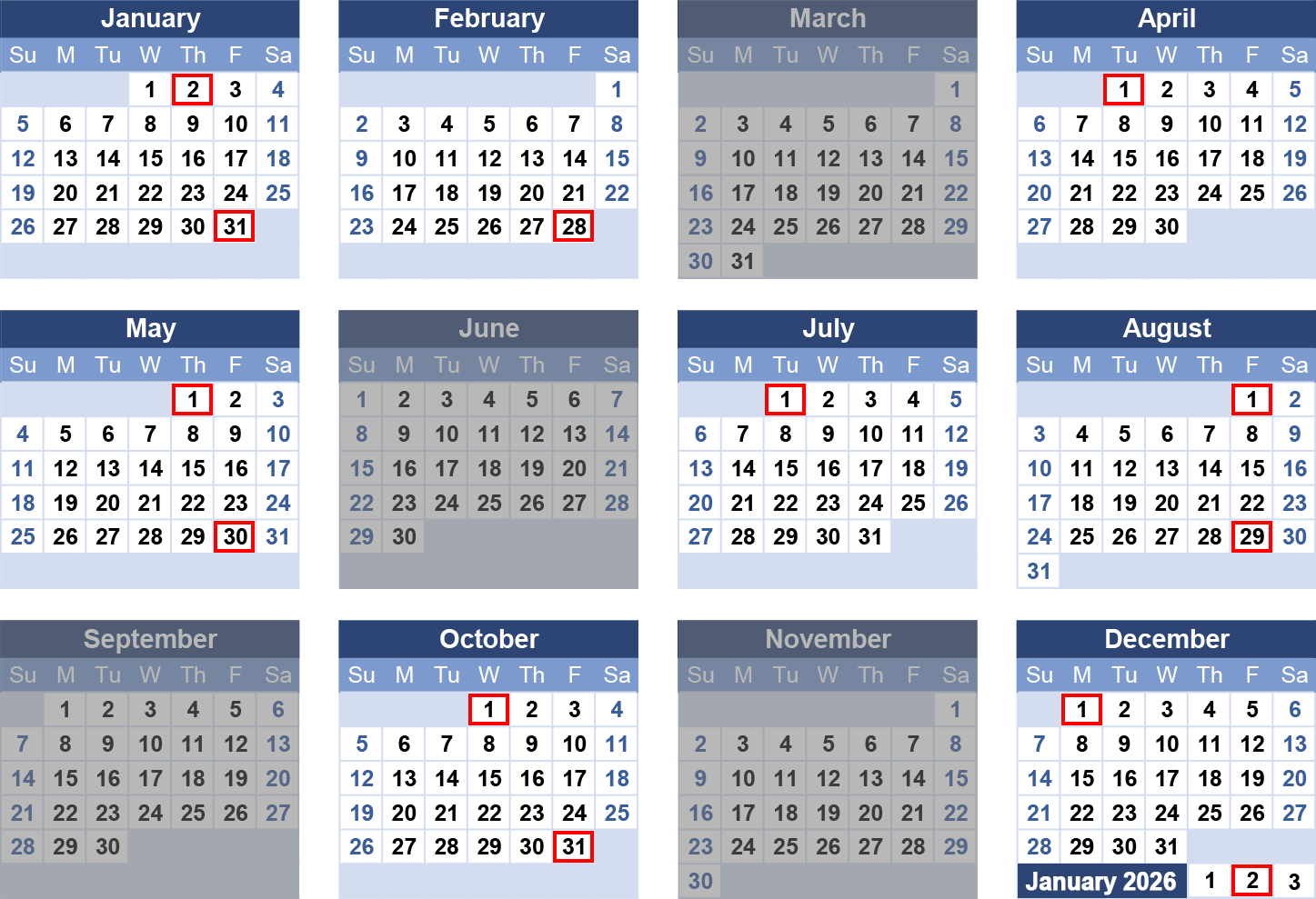

Looking at the social security payment schedule 2025, here are some specific dates to circle:

- Second Wednesday: Jan 8, Feb 12, Mar 12, Apr 9, May 14, Jun 11, Jul 9, Aug 13, Sep 10, Oct 8, Nov 12, Dec 10.

- Third Wednesday: Jan 15, Feb 19, Mar 19, Apr 16, May 21, Jun 18, Jul 16, Aug 20, Sep 17, Oct 15, Nov 19, Dec 17.

- Fourth Wednesday: Jan 22, Feb 26, Mar 26, Apr 23, May 28, Jun 25, Jul 23, Aug 27, Sep 24, Oct 22, Nov 26, Dec 24.

Notice December 24th. Christmas Eve. The banks are technically open, but many have limited hours. The SSA generally processes these on time, but if your bank closes early, you want to make sure you’ve accounted for that if you need cash for last-minute shopping.

Survivor Benefits and Disability (SSDI)

If you are receiving Social Security Disability Insurance (SSDI), you follow the same birthday-based schedule as retirees.

Survivor benefits follow the birthday of the deceased worker. This is a common point of confusion. If you are a widow receiving benefits based on your late husband's work record, your payment date is tied to his birthday, not yours.

Addressing the Solvency Elephant in the Room

You've heard it. "Social Security is going bankrupt."

Relax. Sorta.

The trust funds are projected to be depleted in the mid-2030s, but that doesn't mean payments stop. It means the system would only be able to pay out about 77% to 83% of scheduled benefits from incoming payroll taxes. For 2025, your money is safe. The government isn't going to miss a payment date in 2025. It would be political suicide and economic chaos.

Real-World Budgeting Advice

Knowing the date is half the battle. Managing the gap between them is the other half.

Since most months have four weeks but some have five, you’ll occasionally have a long stretch between payments. For example, if you are paid on the second Wednesday, the gap between May 14 and June 11 is exactly four weeks. But look at October to November. If you get paid on October 22nd and the next payment is November 26th, that is a five-week stretch.

That fifth week kills budgets.

I always suggest setting aside 10% of the "short month" checks to cover that extra week when the calendar stretches out. It’s a boring piece of advice, but it works.

Actionable Steps for 2025

First, log into your my Social Security account. Ensure your mailing address and bank info are current. Even if you use direct deposit, the SSA sends important tax documents (the 1099-SSA) to your physical home.

Second, download a PDF of the official 2025 calendar from the SSA website. Print it. Put it on the fridge.

Third, if you’re still receiving paper checks, stop. Seriously. They are prone to theft and mail delays. In 2025, there is no reason to be waiting on a mail carrier for your livelihood. Sign up for direct deposit through your bank or the Direct Express card program immediately.

🔗 Read more: Franchise Fee for McDonald's: What Most People Get Wrong

Finally, keep an eye on the Medicare Part B premium announcements for the following year, which usually happen in late autumn. This is the "hidden" variable that determines how much of your scheduled payment actually hits your pocket. Stay informed, watch the Wednesdays, and plan for those five-week months.