Honestly, trying to pin down exactly when your check hits your bank account feels like solving a riddle. You’d think the government would just pick a day and stick to it, right? But the social security schedule 2025 is actually a giant logic puzzle based on your birthday, the type of benefit you’re getting, and whether or not the first of the month happens to land on a Saturday. It's a lot.

If you’re one of the 72.5 million Americans relying on these payments, the stakes are high. Rent doesn't wait. Neither do the groceries. For 2025, everything changed slightly because of the 2.5% Cost-of-Living Adjustment (COLA). That’s about an extra $50 a month for the average retiree. It’s not a fortune, but in this economy, nobody's turning it down.

The Basic Math of the Social Security Schedule 2025

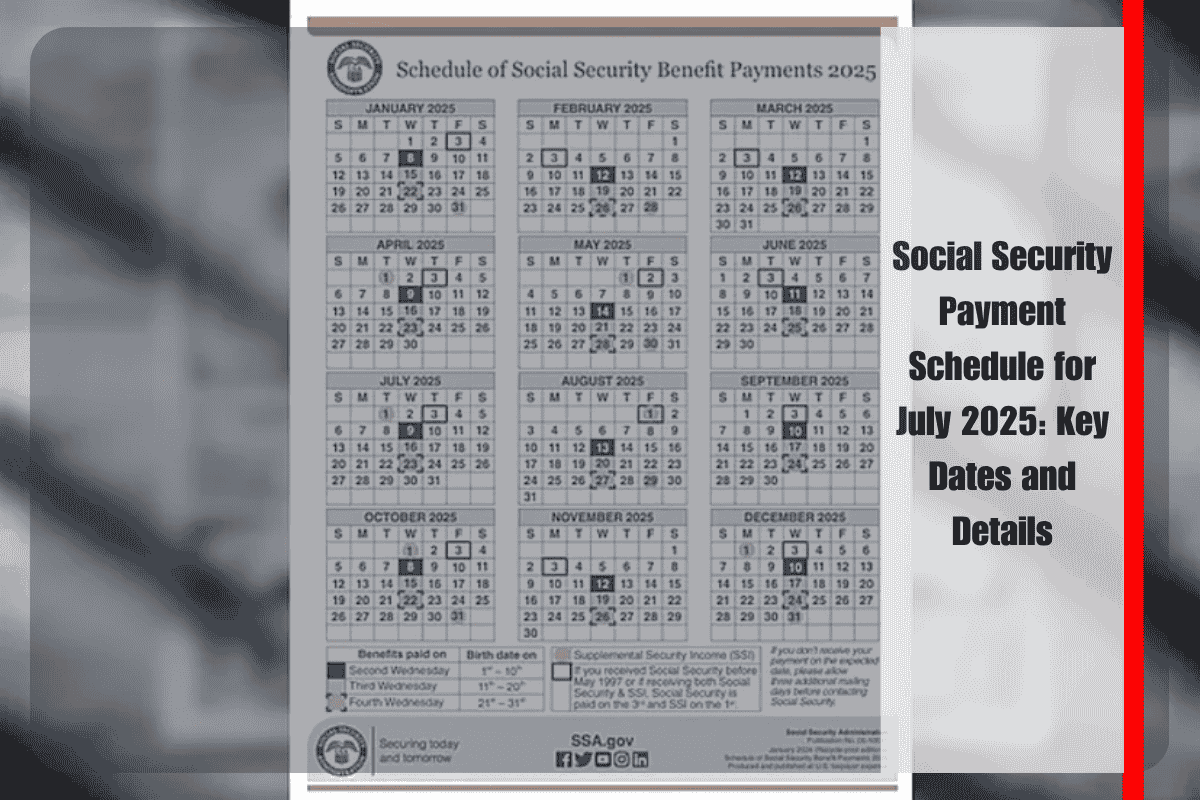

The Social Security Administration (SSA) doesn't just blast out every payment at once. That would probably break their systems. Instead, they use a staggered system. If you started receiving benefits after May 1997, your "payday" is basically dictated by the day you were born.

It’s pretty simple once you see it laid out.

📖 Related: How Much is Dow Jones Stock? What Most People Get Wrong

- Born between the 1st and 10th: You’re in the first wave. Your money arrives on the second Wednesday of every month.

- Born between the 11th and 20th: You’re in the middle. Look for your payment on the third Wednesday.

- Born between the 21st and 31st: You’re the last group. You’ll see your funds on the fourth Wednesday.

Wait. There’s a catch.

What if you’re on Supplemental Security Income (SSI)? Or what if you started getting benefits before May 1997? Then this Wednesday business doesn't apply to you at all. SSI is almost always paid on the first of the month. If you’re a "pre-1997" beneficiary or you receive both Social Security and SSI, your Social Security check usually lands on the third of the month.

Why Your January Check Looked a Little Different

The first payment of the year is always the big one because it reflects the COLA. For 2025, that 2.5% increase meant the average retired worker’s benefit jumped from $1,927 to about **$1,976**.

But here’s where people get confused. Since January 1st is a federal holiday, the SSI payment for January 2025 actually arrived on December 31, 2024. If you saw two checks in December, don't spend it all at once—that second one was just your January money showing up early.

The 2025 Calendar: Month by Month

Let's look at some of the weird spots in the 2025 calendar.

February 2025 is straightforward. The first is a Saturday, so SSI recipients got paid on January 31. The third is a Monday, so that’s when the older beneficiaries got their cash. Then the Wednesdays roll out on the 12th, 19th, and 26th.

June 2025 is a bit of a headache. June 1 is a Sunday. That means SSI goes out on Friday, May 30. The 19th is Juneteenth, a federal holiday. If your birthday falls between the 11th and 20th, your "third Wednesday" is actually June 18th because the banks are closed on the holiday.

November 2025 has Veterans Day on a Tuesday. This usually doesn't mess with the Wednesday schedule, but it can slow down mail delivery if you still get a paper check. (Seriously, get direct deposit. It’s 2025).

Hidden Changes You Might Have Missed

It isn't just about the schedule. There are rules that change every year alongside the social security schedule 2025 that can actually take money out of your pocket if you aren't careful.

Take the "Taxable Maximum." In 2025, the amount of earnings subject to the Social Security tax increased to $176,100. If you’re a high earner, you’re paying more into the system this year.

Then there’s the "Retirement Earnings Test." If you’re under full retirement age and still working, you can only earn so much before the SSA starts clawing back your benefits. For 2025, that limit is $23,400. For every $2 you earn over that, they take $1 back. It feels harsh, but that's the law. Once you hit full retirement age, that limit vanishes, and you can earn as much as you want without a penalty.

Is the COLA Enough?

The 2.5% hike for 2025 was a bit of a letdown for some, especially after the massive 8.7% jump we saw a couple of years ago. Experts like Mary Johnson, a long-time Social Security policy analyst, often point out that the CPI-W (the index used to calculate COLA) doesn't always reflect what seniors actually spend money on—like healthcare and housing.

Medicare Part B premiums also play a role. These are usually deducted directly from your Social Security check. In many years, the Medicare premium increase eats up a huge chunk of the COLA. So, while your "gross" benefit went up $50, your "net" take-home pay might have only gone up $30.

✨ Don't miss: Why Your Cover Letter Retail Example Is Failing and How to Fix It

What to do if your payment is late

Don't panic. The SSA is a massive bureaucracy, and glitches happen.

First, check the calendar again. Did a holiday shift the date? Second, wait three mailing days. The SSA won't even talk to you about a "missing" payment until three days have passed from the scheduled date. If it’s still not there, you can call them at 1-800-772-1213.

Honestly, the best way to stay on top of this is through a "my Social Security" account. They’ve updated the portal for 2025 to be way more user-friendly. You can see your exact payment date and a breakdown of your deductions without waiting on hold for two hours.

Actionable Steps for 2025

To make sure you're getting every penny you're owed under the social security schedule 2025, you need to be proactive.

- Check your COLA notice: The SSA sent these out in December. If you missed yours, log into your online account. It tells you your exact new monthly amount.

- Adjust your tax withholdings: If that 2.5% bump puts you into a higher tax bracket (it happens), you might want to increase the amount of federal tax withheld from your check to avoid a surprise bill next April.

- Watch the "Full Retirement Age" (FRA) clock: If you’re turning 66 or 67 this year, your earnings limits change. Make sure you know your exact FRA date so you don't accidentally trigger a benefit reduction by working too much.

- Update your info: If you moved or changed banks, tell the SSA immediately. A one-month delay in benefits because of a closed bank account is a nightmare you don't want to deal with.

The system is complicated, but the schedule is the one thing you can actually plan for. Mark those Wednesdays—or the first of the month—and keep a close eye on those holiday shifts.