Money is weird. Especially the South Korean won (KRW). If you’ve ever landed at Incheon International Airport and swapped a hundred-dollar bill for a massive stack of 50,000-won notes, you know that feeling of being an "instant millionaire." It’s a rush, sure, but it also points to one of the most misunderstood currencies on the planet.

Why are the numbers so high? Is the economy in trouble because the exchange rate just hit a 15-year low? Honestly, the story of the won is less about "big numbers" and more about a country that’s currently in a tug-of-war with its own success.

As of January 2026, the won is doing some pretty strange things. While the Bank of Korea (BOK) is keeping interest rates steady at 2.50%, the currency is facing a massive identity crisis. It’s not just about trade anymore. It’s about people like you—or at least, your counterparts in Seoul—buying up U.S. tech stocks like there’s no tomorrow.

The 1,400-Won Problem: Why It Won't Stay Down

For a long time, the "comfort zone" for the South Korean won was somewhere between 1,100 and 1,200 per U.S. dollar. Those days feel like ancient history. In mid-January 2026, we’ve seen the rate hovering around 1,470 won to the dollar.

That’s a big deal.

When the won weakens like this, everything South Korea imports—oil, food, raw materials for those fancy semiconductors—gets more expensive. Usually, a central bank would just hike interest rates to fix this. But the Bank of Korea is stuck. If they hike rates, they crush the local housing market and squeeze households that are already buried in debt.

The Scott Bessent "Jawboning" Moment

Just a few days ago, on January 15, 2026, something happened that basically never happens. U.S. Treasury Secretary Scott Bessent hopped on X (the artist formerly known as Twitter) and basically told the world that the won shouldn't be this weak. He called the depreciation "misaligned with fundamentals."

The market freaked out. In a good way. The won strengthened by 10 units almost instantly.

It was a rare moment of "verbal intervention" from Washington. Usually, the U.S. Treasury is yelling at countries for keeping their currency too weak to help exports. This time, they were worried the volatility would hurt Korean investments in American factories. It’s a wild reversal of the usual geopolitical script.

It’s Not a "Debt Crisis," It’s an "Investment Frenzy"

You might hear pundits talking about the won't's slide like it’s 1997 all over again. It isn't. Back then, Korea ran out of dollars. Today, Korea has plenty of dollars—it’s just that the citizens are the ones holding them.

Retail investors in Korea have become a force of nature. In the first ten days of 2026 alone, they dumped $20 billion into foreign stocks, mostly U.S. tech giants. Basically, Koreans are selling their own currency to buy Nvidia and Apple.

- The trade surplus is strong.

- The semiconductor cycle is booming.

- But the "Ants" (the nickname for Korean retail investors) are moving money out faster than Samsung can bring it in.

This creates a "structural" weakness. It’s not that the economy is failing; it’s that the people living in it think they can make more money in Silicon Valley than in Seoul.

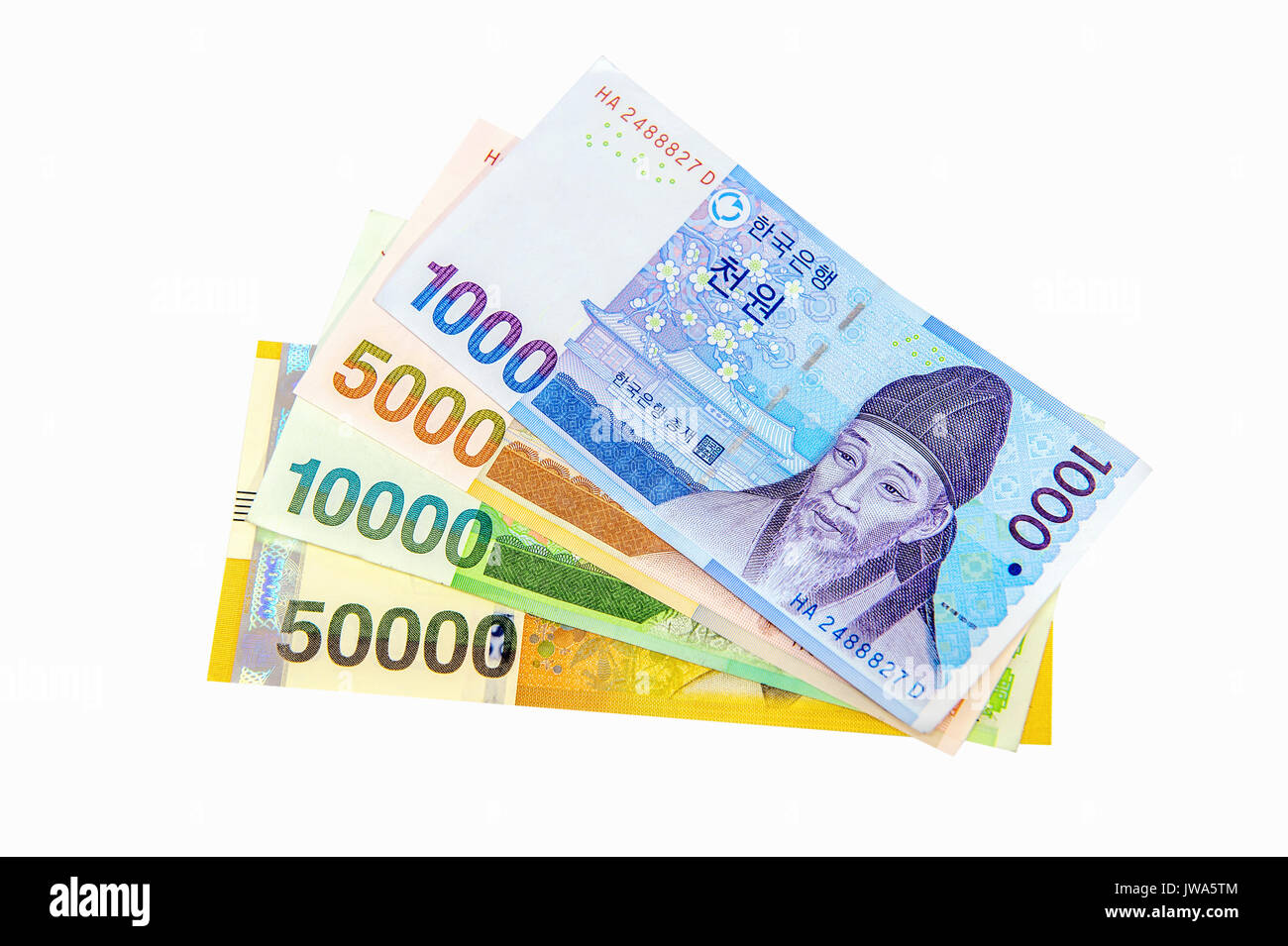

Decoding the Money: From King Sejong to the 50,000 Note

If you’re holding the physical cash, it’s actually some of the most beautiful and high-tech paper in the world. The 50,000 won note (the yellow one) features Shin Saimdang, a famous 16th-century artist and the first woman to appear on a Korean banknote.

The security features are intense. You’ve got:

- Holograms that change color.

- A "windowed" security thread.

- Intaglio printing (that "bumpy" feel).

- Watermarks that are nearly impossible to fake.

The Bank of Korea takes counterfeiting personally. Because the denominations are so high (50,000, 10,000, 5,000, 1,000), a fake bill can do a lot of damage. But why are the numbers so high in the first place?

The "Zero" Confusion

People always ask: "Why doesn't Korea just cut off three zeros?" This is called redenomination.

The won has been "won" since 1962, replacing the old "hwan." Before that, it was the "won" again. It’s been through a lot. The reason there are so many zeros today is mostly historical inflation from decades ago.

There’s been talk for years about making 1,000 won into 1 "new won." But honestly? The government is terrified of the cost. You’d have to update every ATM, every vending machine, and every piece of accounting software in the country. Plus, people tend to freak out and raise prices when you change the currency. For now, Korea is sticking with the zeros.

The Future: Will the Won Go Digital?

We are currently in the middle of a massive experiment. The BOK has been running a pilot for a Central Bank Digital Currency (CBDC), often called the "Digital Won."

💡 You might also like: Dave Portnoy Net Worth: Why He’s Actually Richer Than the Numbers Suggest

In 2025, they ran a test with 100,000 people using "deposit tokens"—basically digital versions of the money in your bank account, backed by the central bank. By late 2025 and into 2026, major banks like Kookmin and Shinhan started forming a joint venture to issue won-pegged stablecoins.

They want to make payments faster and cheaper, especially for things like "Web3" and cross-border transfers. But it’s not just about tech; it’s about control. The government wants to make sure that if everyone stops using paper cash, they're using a digital version of the won, not some random private cryptocurrency.

Real-World Advice for 2026

If you're dealing with the South Korean won right now—whether you're traveling, doing business, or just curious—here’s the "boots on the ground" reality.

For Travelers: The won is cheap right now. Your dollars or euros go much further than they did three years ago. If you see a rate of 1,450 or higher, you’re getting a historical bargain. Just don't expect it to last forever if the BOK starts getting aggressive.

For Investors: Keep an eye on the "K-shaped" recovery. High-tech and semiconductors are carrying the team, but domestic shops and small businesses are hurting because of the weak won and high costs. The won-dollar exchange rate is currently the best barometer for how "nervous" the global market is about Asia.

For Business: The 24/7 foreign exchange market is now a thing. Korea recently opened up its FX market to run basically all night to attract more global investors. This means the won moves more like the Yen or the Euro now—fast and sometimes late at night.

Actionable Next Steps

The South Korean won is in a period of high volatility, but it’s backed by a massive $700 billion export machine. If you need to exchange money or hedge your business risks, here is what you should do:

- Monitor the 1,480 Resistance: Historically, when the won gets near 1,500, the government intervenes heavily. If the rate creeps toward 1,480, expect the Bank of Korea to start selling their dollar reserves to prop the won up.

- Use Digital Payments in Korea: Korea is arguably the most cashless society on Earth. You don't actually need that stack of 50,000-won bills. Use a card or a digital wallet; the exchange rates provided by major credit card networks are often better than the physical booths at the airport.

- Watch the "Ants": If you see news about Korean retail investors pulling back from U.S. stocks, that is your signal that the won is about to get much stronger.

The won isn't just a currency; it's a reflection of a country that is incredibly rich but currently obsessed with investing elsewhere. Whether it stabilizes or continues its slide depends entirely on whether those "Ants" decide to bring their money back home.