You’ve heard the 10% rule. Financial advisors love it. They tell you the stock market returns 10% every year, basically like clockwork. But if you actually look at the S&P 500 by year, you’ll realize that "average" is a dirty word in finance. The market almost never returns 10% in a single calendar year. It’s usually either a rocket ship or a car wreck, and rarely anything in between.

In 2025, for instance, the S&P 500 capped off a wild three-year winning streak with a total return of 17.9%. That’s nowhere near 10%. Before that, 2024 saw a 25.02% jump, and 2023 clocked in at 26.29%. If you were waiting for a "normal" 10% year, you missed out on a 100% total return since the bull market kicked off in late 2022.

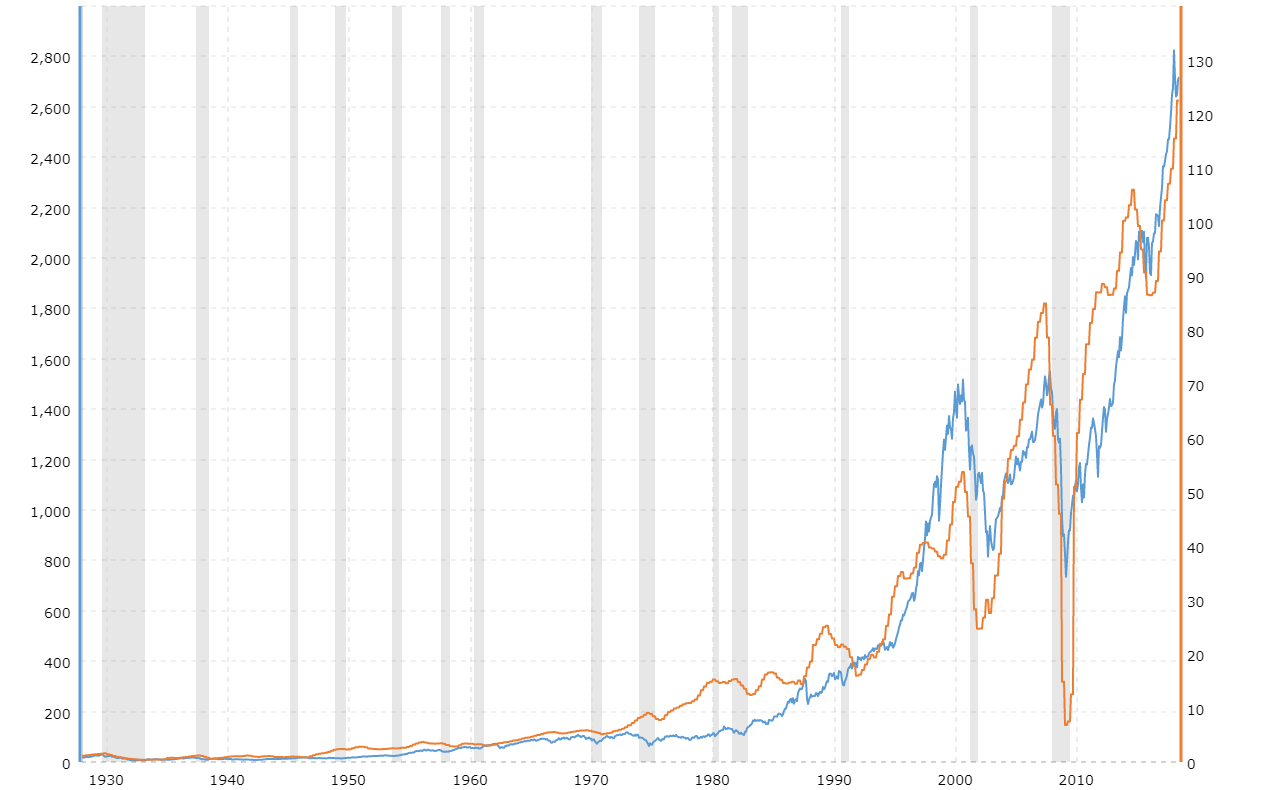

Investing is messy. The history of the S&P 500—which actually started as a 90-stock index back in 1926 before expanding to 500 in 1957—is a graveyard of "sure things" and a testament to the power of just sitting on your hands. Honestly, the real story isn't the average; it's the volatility.

The Recent Rollercoaster: 2020 to 2026

The last few years have been a fever dream for investors. You had the pandemic crash and the instant recovery in 2020. Then 2022 happened—a brutal -18.11% slap in the face that made everyone question if the 40-year bull run was finally dead.

📖 Related: King of Cars New Jersey: What You Should Know Before Buying

Spoiler: It wasn't.

Looking at the S&P 500 by year since the turn of the decade, the numbers are jarring:

- 2020: 18.40% (Despite a global shutdown)

- 2021: 28.71% (The era of "easy money")

- 2022: -18.11% (Inflation and rate hikes finally bit back)

- 2023: 26.29% (The AI boom begins)

- 2024: 25.02% (Growth stocks on steroids)

- 2025: 17.88% (Driven by earnings, not just hype)

By early January 2026, the index was hovering around the 6,900 mark. We’ve seen a market where a handful of tech giants—the so-called "Magnificent Seven"—did the heavy lifting. In 2025, companies like NVIDIA and Alphabet were responsible for a huge chunk of the gains, though the market started to broaden out slightly toward the end of the year.

👉 See also: Why Your Local Dairy Queen Closing in Texas Isn't Exactly What It Seems

Why Dividends Change Everything

If you only look at the price of the index, you're missing about a third of the story. Total return includes dividends. Without them, the historical average drops significantly. For example, in the last 100 years, the S&P 500’s annualized return with dividends reinvested is about 10.48%. Without dividends? It’s closer to 8.5%.

Over decades, that 2% gap isn't just a rounding error. It’s the difference between retiring comfortably and working until you’re 80.

The "Lost Decades" Nobody Likes to Mention

Everyone talks about the 1990s when the market felt like a money-printing machine. But the S&P 500 by year also shows periods where you could have waited ten years just to get back to zero.

Take the period from 2000 to 2010. It’s often called the "Lost Decade."

You had the DotCom bubble burst in 2000, leading to three straight years of losses: -9.10%, -11.89%, and -22.10%. Just as things started looking up, 2008 arrived with a -37% haymaker. If you invested $10,000 in January 2000, you would have had less than $10,000 by the end of 2009.

This isn't meant to scare you. It’s meant to ground you. The market isn't a bank account. It’s a collective bet on human ingenuity that occasionally gets its teeth kicked in.

The Worst Years in History

It’s easy to be a long-term investor when the line is going up. It's a lot harder when you're looking at these:

✨ Don't miss: Currency for China: What Most People Get Wrong

- 1931: -43.34% (The Great Depression was no joke)

- 2008: -37.00% (The Global Financial Crisis)

- 1937: -35.03% (The "recession within the depression")

- 1974: -26.47% (Oil embargo and stagflation)

Inflation: The Silent Tax on Your Returns

Here is the kicker. A 10% return isn't actually a 10% increase in your buying power. When you adjust the S&P 500 by year for inflation, the "real" return historically sits around 6.5% to 7%.

In 2022, when the market was down 18% and inflation was peaking at 9%, investors were effectively losing 27% of their purchasing power in a single year. That’s why people panicked. Conversely, in years like 2024 and 2025, where inflation cooled but returns stayed high, the "real" gains were massive.

How to Actually Use This Data

Looking at a table of historical returns is a bit like looking at a map of a mountain range while you're standing at the base. It looks flat on paper, but the climb is steep.

If you’re trying to plan for the future, stop looking for "average" years. They don't exist. Instead, look at the probability of success over time. Historically, if you hold the S&P 500 for any 20-year period, your chance of a negative return has been zero. Not "low." Zero.

Even the worst 20-year stretch in history (ending in 1979) still yielded about 6.4% annually.

Actionable Steps for Your Portfolio

- Check your "Magnificent Seven" exposure: By 2025, these few stocks made up over 30% of the S&P 500's weight. If you own an S&P 500 index fund AND individual tech stocks, you might be more concentrated than you realize.

- Ignore the "Price" return: Always look for "Total Return" (TR) versions of the index. If your tracker doesn't account for dividends, you're tracking a ghost.

- Rebalance after the big years: After the massive runs of 2023-2025, your portfolio is likely heavy on equities. If you're nearing retirement, the data suggests that three years of double-digit gains are often (but not always) followed by a period of "mean reversion"—basically, the market taking a breather.

- Don't time the exit: 2025 was a great example of why timing is impossible. The market dropped nearly 19% in the spring due to tariff fears, only to surge 39% from the April lows through the end of the year. If you sold in April, you missed the best part of the decade.

The S&P 500 by year is a story of resilience. It tells us that the world is always ending—wars, pandemics, bubbles—yet the companies in the index keep finding ways to squeeze out profit. Your job isn't to predict the next 1931 or the next 1995. Your job is to make sure you're still invested when the latter inevitably happens.