The S&P 500 isn't what it used to be. Honestly, if you think you're buying a diversified slice of the American economy when you grab a standard SPY or VOO share, you're only half right. You're actually buying a massive bet on about seven tech companies. That’s where the S&P 500 equal weight strategy comes in, and lately, it’s become the go-to move for investors who are getting a little twitchy about how top-heavy the market has become.

It's simple.

In a standard market-cap-weighted index, the bigger the company, the more it matters. Apple and Microsoft move the needle; the guy running a mid-sized utility company in Ohio doesn't. But with an equal-weight approach, every single company—from the trillion-dollar behemoths down to the "smaller" firms like News Corp or Ralph Lauren—gets the exact same slice of the pie. Usually, that’s about 0.2% of the total index.

The Concentration Crisis Nobody Wants to Admit

We are living through a period of historic concentration. You've probably heard of the "Magnificent Seven." Nvidia, Amazon, Meta, and the rest of that crew have been carrying the entire market on their backs for the better part of two years. If they stumble, the whole index trips. That is the fundamental risk of market-cap weighting. It’s a momentum strategy disguised as a passive one.

When you look at the S&P 500 equal weight index (tracked by the ticker RSP), you see a much different version of reality. It’s a version where the "average" stock actually matters. In 2023, the gap between the cap-weighted S&P 500 and the equal-weighted version was one of the largest in history. The tech giants surged while the rest of the market basically spent the year treading water.

Does that mean equal weight is "better"? Not always. It just means it's honest.

It tells you what the broad economy is doing, not just what a few guys in Silicon Valley are doing. Howard Marks of Oaktree Capital often talks about the importance of bargain hunting and avoiding "crowded trades." Right now, the top of the S&P 500 is the definition of a crowded trade. If you’re buying the standard index today, you’re paying a premium for winners that have already won.

How the Math Actually Works

Let's break down the rebalancing because that’s where the magic—or the frustration—happens. Every quarter, the S&P 500 equal weight index resets. It sells the stocks that went up and buys the ones that went down to get everyone back to that 0.2% target.

It’s a built-in "buy low, sell high" mechanism.

Think about that for a second. In a cap-weighted index, you are forced to buy more of a stock as it gets more expensive. You’re essentially doubling down on the winners. Equal weight does the opposite. If Nvidia has a monster quarter and grows to 0.5% of the portfolio, the fund managers sell off that excess and redistribute the cash to the laggards.

This sounds great in theory. In practice, it means you might miss out on the "moon missions" where a stock goes up 400% and stays there. You’re constantly trimming your best performers. But, you're also protecting yourself from the inevitable moment when those high-flyers come crashing back to earth.

S&P 500 Equal Weight vs. The Heavy Hitters

Investors often ask why they should bother with equal weight when tech is clearly the future. Well, look at the early 2000s. After the Dot-com bubble burst, the cap-weighted S&P 500 spent years in the wilderness. It was dragged down by the wreckage of overvalued tech stocks.

The S&P 500 equal weight index, however, recovered much faster.

Why? Because the other 490 companies in the index weren't actually in a bubble. They were just boring companies making money. By not being over-exposed to the crash at the top, equal-weight investors slept a lot better.

It's about the "size factor." In the world of academic finance, specifically the Fama-French Three-Factor Model, it’s argued that smaller companies tend to outperform larger ones over very long periods because they have more room to grow. By equal-weighting the S&P 500, you are effectively tilting your portfolio toward the smaller end of the "large-cap" spectrum. You're giving more weight to the "Value" and "Size" factors.

- Standard S&P 500: Top 10 holdings often make up over 30% of the index.

- Equal Weight S&P 500: Top 10 holdings make up exactly 2% of the index.

That is a staggering difference in diversification.

The Hidden Cost of Being Fair

Now, don't think this is a free lunch. There are downsides. First, the turnover is higher. Because the fund has to sell and buy every quarter to keep the weights equal, it generates more trading costs and potentially more capital gains taxes if you're holding it in a taxable account.

Second, the expense ratio is usually higher. Invesco’s RSP, the most famous equal-weight ETF, has an expense ratio of around 0.20%. Compare that to the 0.03% you’ll pay for a standard Vanguard index fund. Is 17 basis points a big deal? Over thirty years, yeah, it adds up. You have to decide if the "rebalancing alpha" is worth the extra fee.

Then there’s the "quality" argument. Some folks, like those at Quality-focused firms, argue that market-cap weighting is actually a feature, not a bug. They say the market is "smart" and that the biggest companies are big because they are the best, most profitable businesses in the world. By equal weighting, you’re intentionally giving more money to "worse" companies. It’s a fair point. Do you really want as much exposure to a struggling retailer as you have to a company printing money through cloud computing?

When Does Equal Weight Shine?

Historically, the S&P 500 equal weight strategy outperforms when the market rally "broadens out."

We use that term a lot in finance. It basically means a market where more than just tech is doing well. If industrials, materials, and mid-sized banks start to pick up steam, RSP will likely smoke the standard S&P 500. We saw this in the post-pandemic recovery and during various cycles in the mid-2000s.

If you think the "AI trade" is getting a bit frothy, moving some capital into an equal-weight fund is a logical defensive play. It’s not "timing the market" so much as it is "re-adjusting your risk."

Check out the sector allocations. In the standard S&P, Technology is usually over 28% or even 30% of the total. In the equal-weight version, Tech drops to about 13-15%. Meanwhile, sectors like Industrials and Real Estate get a massive boost. You’re basically trading Big Tech for a more "main street" economic profile.

Real World Performance Reality Check

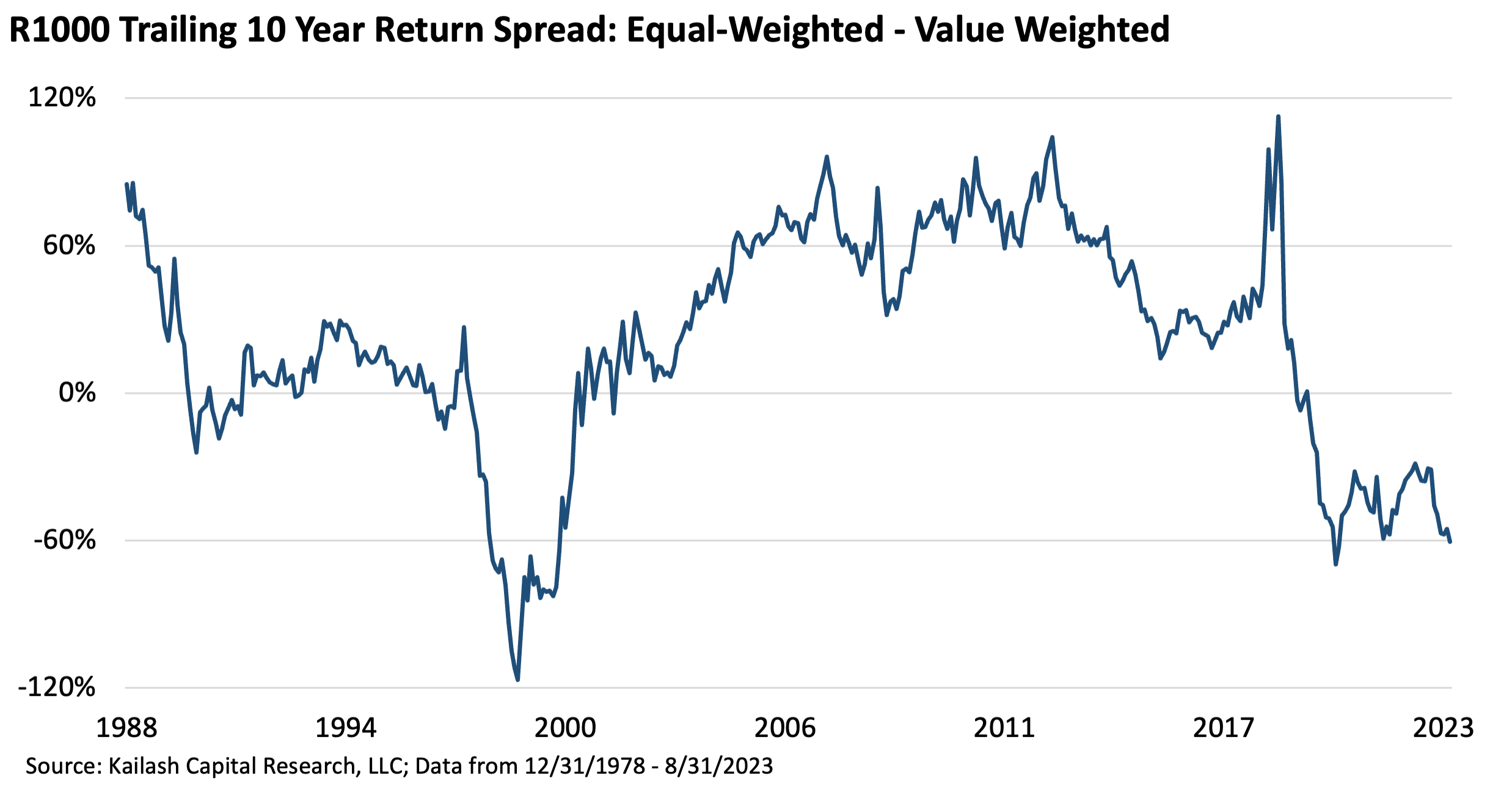

If you look at a 20-year chart, the two indices often end up in a similar spot, but the paths they take are wildly different. There are "Equal Weight Decades" and "Cap Weight Decades."

The 2010s were a Cap Weight Decade. Low interest rates and the rise of the platform economy made mega-cap tech untouchable. If you held an equal-weight fund then, you probably felt like an idiot. You were watching the Nasdaq go to the moon while you were stuck holding equal parts of a lumber company and a grocery chain.

But the 2000s? That was an Equal Weight Decade. The tech crash and the subsequent value-driven recovery meant the "boring" stocks won.

The question you have to ask yourself is: Which decade are we in now?

If you think the Magnificent Seven can grow at 20% forever, stay with the standard index. If you think the laws of gravity still apply to P/E ratios, the S&P 500 equal weight is your safety net.

Actionable Steps for the Modern Investor

Don't feel like you have to choose just one. Most sophisticated portfolios use a "Core and Satellite" approach or just split the difference. Here is how you can actually apply this knowledge without blowing up your brokerage account.

1. Check your "Overlap" Risk

Go look at your portfolio. If you own an S&P 500 fund, a QQQ (Nasdaq 100) fund, and some individual shares of Apple or Nvidia, you are dangerously concentrated. You don't have a diversified portfolio; you have a Tech portfolio. Use a tool like Morningstar’s "Instant X-Ray" to see your true exposure.

💡 You might also like: Dow Jones Industrial Average: What Most People Get Wrong About the 49,000 Milestone

2. The 50/50 Split

A common tactic for people who want the growth of tech but the safety of diversification is to split their large-cap allocation 50/50 between a cap-weighted fund (like VOO) and an equal-weighted fund (like RSP). This gives you a "middle ground" where you still benefit from the winners but aren't ruined if they crater.

3. Use it as a Sentiment Indicator

Watch the "Line" between RSP and SPY. When the equal-weight index starts performing better than the cap-weighted one, it usually means the "bull market" is getting healthier and broader. If SPY is going up but RSP is going down, that’s a "divergence." It’s often a sign that the rally is fragile and built on a foundation of just a few stocks.

4. Tax-Loss Harvesting Considerations

If you have big gains in your standard S&P 500 fund, switching to equal weight might trigger a massive tax bill. Do this inside a Roth IRA or 401(k) where you can trade without Uncle Sam taking a cut. If you're in a taxable account, consider just directing new money into the equal-weight fund instead of selling your old ones.

5. Watch the Interest Rates

Equal-weight funds have more exposure to smaller companies that often carry more debt than the cash-rich tech titans. When rates stay "higher for longer," the smaller players in the equal-weight index might struggle more than a company like Microsoft, which basically sits on a mountain of cash.

The S&P 500 equal weight isn't a get-rich-quick scheme. It’s a tool for people who are tired of the "Winner Take All" mentality of the modern stock market. It’s a way to bet on America as a whole, rather than just betting on a handful of CEOs in hoodies. If you’re looking for a smoother ride over the next ten years, it’s at least worth a look.