You've probably heard everyone at the water cooler—or on Discord—raving about the S&P 500. It’s the gold standard. But here is the thing: most people don't actually realize what they are buying when they click "trade" on a standard S&P 500 index fund. They think they’re getting a piece of the 500 best companies in America, all working together in a nice, balanced soup.

They aren't.

They’re mostly buying a handful of massive tech companies that have outgrown the rest of the world. That is where the S&P 500 equal weight index comes in, and honestly, it’s the version of the market most people think they own but don't. While the standard index lets the big dogs like Apple and Nvidia run the whole show, the equal weight version treats every single company like they’re on the same team. Whether it’s a trillion-dollar behemoth or a "small" $20 billion mid-cap firm, they all get an equal seat at the table.

The Concentration Problem Most Investors Ignore

The stock market has a weight problem. It’s top-heavy. If you look at the standard S&P 500 (the market-cap-weighted one), the top 10 companies currently make up about 30% to 35% of the entire index. That is wild. It means if Microsoft has a bad day, your whole portfolio feels it, even if 490 other companies are doing just fine.

Think of it like a sports team. A market-cap index is like a basketball team where one superstar takes 80% of the shots. If he sprains an ankle, the game is over. The S&P 500 equal weight strategy is more like a team where every player has to pass the ball. Everyone gets 0.2% of the "shots."

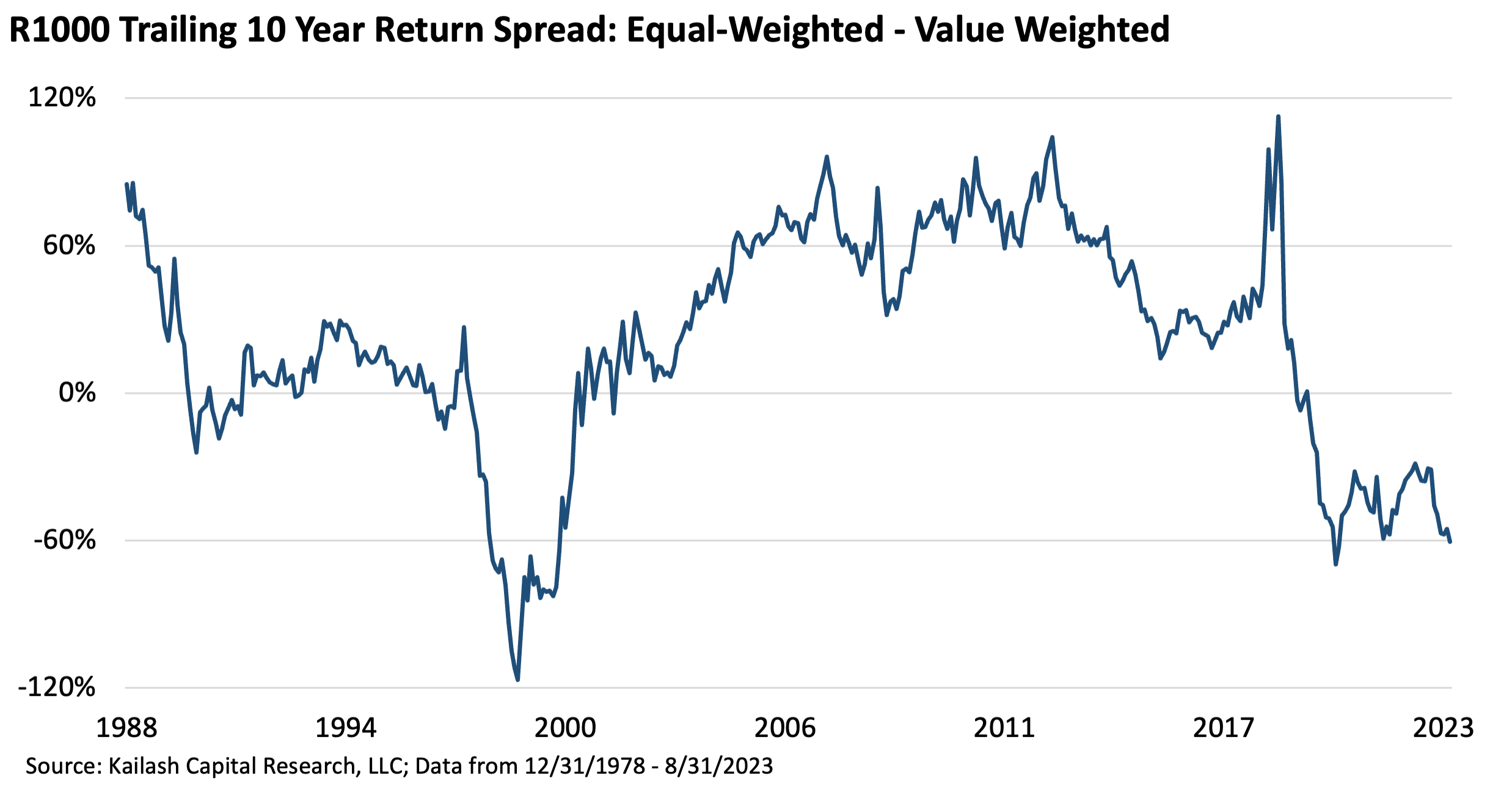

This matters because of something called "concentration risk." When a few stocks drive all the gains, the market looks healthier than it actually is. In 2023 and early 2024, we saw the "Magnificent Seven" carrying the entire weight of the US economy on their backs. If you weren't holding those seven stocks, you were basically standing still. But history tells us that trees don't grow to the sky. Eventually, the giants stumble.

How the S&P 500 Equal Weight Actually Works

It’s pretty simple, actually.

In a market-cap-weighted index, you calculate a company's "size" by multiplying its share price by the number of shares out there. Bigger company = bigger slice of the pie. In the S&P 500 equal weight index (tracked by the ticker RSP, managed by Invesco), the math is discarded. Every quarter, the fund managers rebalance. They sell the winners that have grown too large and buy the losers that have shrunk.

Wait. Read that again.

They sell high and buy low. Automatically.

Every three months, the fund resets so that every company—from the massive tech giants to the utility companies in Ohio—accounts for exactly 0.2% of the fund. This creates a natural "mean reversion" strategy. It forces the portfolio to stop chasing the hottest, most expensive stocks and instead look for value in the rest of the market.

The Performance Gap: Who Actually Wins?

If you look at the long-term data, the results might surprise you. From the inception of the S&P 500 Equal Weight Index in 2003 through various market cycles, there have been long stretches where it absolutely crushed the standard index.

✨ Don't miss: Red Lobster Tyler TX: What Really Happened to the Loop 323 Spot

Why? Because smaller companies (the "bottom" 400 of the S&P 500) generally have more room to grow than a company that is already worth $3 trillion. It’s a lot easier for a $30 billion company to double in size than it is for a titan of industry to do the same.

- The Dot-Com Crash Aftermath: After the tech bubble burst in the early 2000s, equal weight outperformed for years because the "big" stocks were the ones getting slaughtered.

- The 2020s Surge: Conversely, in years like 2023, the equal weight version lagged behind. When AI hype sent Nvidia and Meta into the stratosphere, the equal weight index—which only gave them a 0.2% stake—couldn't keep up with the market-cap version that gave them 7% or 8% stakes.

Rob Arnott, the founder of Research Affiliates and a bit of a legend in the "smart beta" world, has often pointed out that market-cap weighting is inherently flawed because it overweight’s overvalued stocks and underweights undervalued ones. By definition, if a stock is in a bubble, a market-cap index will hold more of it right before it pops. The S&P 500 equal weight avoids that specific trap.

Sector Diversification: Not Just Tech

Another huge difference is what sectors you’re actually betting on.

If you buy the standard S&P 500 right now, you are heavily betting on Information Technology. It’s almost a tech fund at this point. If you go with the S&P 500 equal weight, your exposure shifts dramatically. You get more Industrials. You get more Financials. You get more Healthcare.

It’s a much "flatter" bet on the American economy as a whole rather than a bet on Silicon Valley's ability to keep inventing new ways to show us ads or run LLMs. For an investor who is worried about a tech bubble or a change in interest rates that might hurt high-growth tech more than boring old-school companies, the equal weight version is a massive safety net.

The Hidden Cost of Being Equal

Nothing is free in the stock market. You've got to consider the downsides.

First, there is the turnover. Because the fund has to rebalance every quarter—selling what went up and buying what went down—it generates more trading costs. It also tends to be slightly less tax-efficient than a "buy and hold" market-cap fund, though for most retail investors in an IRA or 401k, that doesn't really matter.

Second, there is the expense ratio. The most popular S&P 500 fund, VOO (from Vanguard), costs next to nothing—about 0.03%. The leading S&P 500 equal weight ETF, RSP, usually carries an expense ratio around 0.20%. That is still cheap, but it’s nearly seven times more expensive than the "free" version.

Third, you have to have the stomach for it. There will be years—maybe even decades—where the "Mega Caps" lead the way, and you will look like a fool for holding the equal weight version. You’ll see the S&P 500 up 20% while your equal-weight fund is only up 12%. That hurts. But the reverse is also true. When the "Nifty Fifty" or the "Dot-Com Darlings" eventually fail, the equal weight investor is the one laughing.

Which One Should You Actually Own?

It isn't necessarily an "either-or" situation.

A lot of sophisticated investors use the S&P 500 equal weight as a diversifier. If you already have a lot of exposure to tech through your job or other investments, adding an equal-weight fund helps balance out that risk. It gives you a "value" tilt without having to actually pick individual stocks.

If you believe that the "Magnificent Seven" are overvalued and that the "other 493" companies in the S&P 500 are overdue for a rally, then equal weight is your best friend. It’s essentially a bet on the breadth of the market.

Actionable Steps for Your Portfolio

If you're looking to change up your strategy, don't just dump everything at once. Taxes will eat you alive if you're in a taxable brokerage account.

1. Check your concentration. Look at your current holdings. If you own an S&P 500 fund and a "Total Stock Market" fund, you might be surprised to find you have 40% of your money in just ten companies. Use a tool like Morningstar’s "Instant X-Ray" to see your true exposure.

2. Consider the 50/50 split. Some investors choose to split their "Large Cap" allocation right down the middle—half in the standard S&P 500 (like VOO or SPY) and half in the S&P 500 equal weight (like RSP). This gives you some of the "moonshot" potential of the tech giants while maintaining a floor of diversification.

3. Watch the rebalance dates. RSP and similar funds usually rebalance in March, June, September, and December. You don't necessarily need to trade around these dates, but understand that the fund's internal buying and selling might create slight volatility or "tracking error" compared to the standard index.

📖 Related: MYR to USD: Why Your Exchange Rate Always Feels Like a Rip-off

4. Use it for "Value" exposure. Instead of buying a specific "Value" ETF, which often uses weird filters or social scores, use the equal weight index. It naturally tilts toward value by selling stocks as they become expensive (relative to their previous size) and buying those that have become cheaper.

The reality is that the S&P 500 equal weight is the "democratized" version of the stock market. It assumes that nobody knows which company will be the next big winner, so it gives everyone an equal chance. In a world where everyone is chasing the same five stocks, being the person who owns "everything else" is often the smartest move in the room. Even if it feels boring at the time. Over the long haul, boring usually wins.