Everyone thinks they want growth. It sounds better, right? You’re at a dinner party and someone mentions they’re "investing for growth," and they sound like a visionary. Nobody brags about their "value" portfolio while nursing a drink. But when you look at the S&P 500 Growth Index, the reality is way more nuanced than just "buying companies that go up fast." It's a specific, rules-based machine that kicks out companies the moment they stop acting like teenagers and start acting like adults.

Most people treat the S&P 500 Growth Index as a synonym for "the best tech stocks." It’s not.

Actually, it’s a subset of the broader S&P 500, curated by S&P Dow Jones Indices based on three very specific metrics: sales growth, the ratio of earnings change to price, and momentum. If a company doesn't check those boxes, it's out. Simple as that. But that simplicity hides a lot of volatility that catches casual investors off guard.

The Brutal Logic of Index Rebalancing

Imagine you’re a scout for a professional sports team. You don't care about loyalty. You don't care about what a player did three years ago. If their stats drop this season, they’re off the roster. That is exactly how the S&P 500 Growth Index operates. It rebalances annually, and that process can be absolute chaos for the fund's composition.

Look at 2023. It was a weird year. Because of how the math worked out, heavy hitters like Amazon and Alphabet actually saw their weightings in the growth index slashed or shifted because their "value" characteristics became more prominent after the 2022 market tech wreck.

📖 Related: Currency New Zealand Dollar to Pound: Why the Kiwi-Sterling Trade is Changing in 2026

It’s a momentum game.

The index doesn't buy what will grow; it buys what has grown. That distinction is everything. By the time a stock makes it into the growth index, it has already done a lot of the heavy lifting. You're often buying at the peak of the hype cycle. Is that bad? Not necessarily. It just means you’re riding the wave, not catching it before it breaks.

Growth vs. Value: The Eternal Tug-of-War

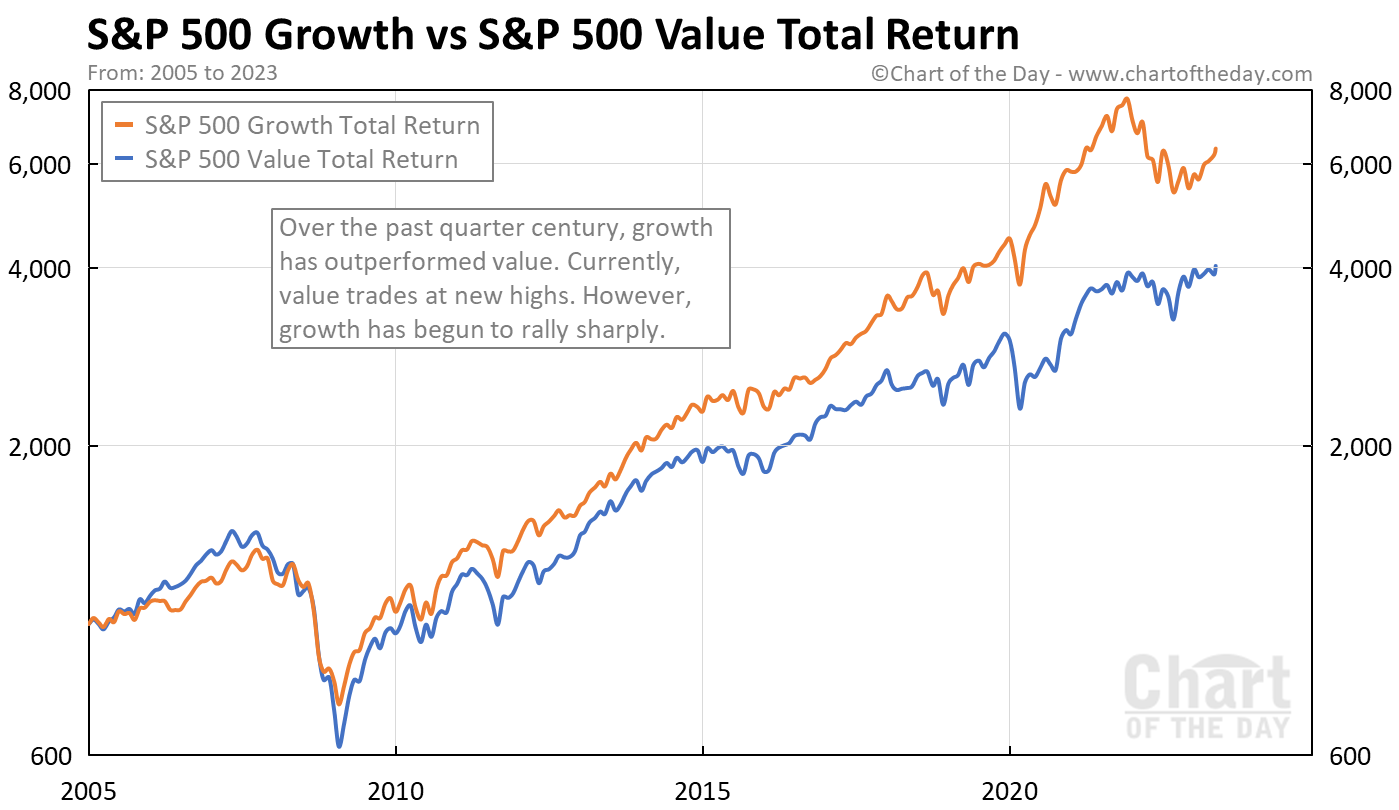

We’ve lived through a decade where growth absolutely demolished value. It wasn't even close. Between 2010 and 2021, if you weren't overweight in growth, you were basically leaving money on the sidewalk. Companies like Nvidia, Apple, and Microsoft drove the bus.

But then 2022 happened.

Interest rates started climbing. Suddenly, the "future earnings" that growth stocks promise looked a lot less attractive when you could get a guaranteed 5% from a Treasury bill. The S&P 500 Growth Index took a massive hit. It reminded everyone that growth is expensive. You're paying a premium—a "growth multiple"—for the privilege of owning these companies.

When the market decides those multiples are too high? Ouch.

The S&P 500 Value Index, by contrast, looks for the unloved. The boring stuff. Banks, energy companies, utilities. Historically, these two indices trade leadership like a game of hot potato. Sometimes growth leads for ten years. Sometimes value reigns for a decade. Right now, we are in a high-interest-rate environment that, according to experts like Howard Marks of Oaktree Capital, represents a "sea change." This means the easy money era for growth might be over, or at least, it’s going to be a lot harder to find.

What’s Actually Inside the Box?

If you pull back the curtain on the S&P 500 Growth Index, you’ll find it’s incredibly top-heavy. As of late, a huge chunk of the index is concentrated in just a handful of names. We're talking about the "Magnificent Seven."

💡 You might also like: Ghanaian Currency Explained (Simply): Why the Cedi is More Than Just Money

When you buy an ETF that tracks this index, like the IVW or VOOG, you aren't getting a broad slice of the American economy. You're getting a concentrated bet on Big Tech.

- Technology dominance: Usually accounts for over 40% of the index.

- Consumer Discretionary: Think Amazon and Tesla.

- Communication Services: Meta and Alphabet.

If you already own a standard S&P 500 fund, and then you buy a growth-specific fund, you are effectively doubling down on the same five or six companies. It’s called "overlap," and it’s the silent killer of diversification. You think you're safe because you own two different funds, but if Apple sneezes, your whole portfolio catches a cold.

The Momentum Trap

The index uses something called a "growth score." They look at the three-year change in earnings per share and the three-year sales growth per share. Then they look at the 12-month price change (momentum).

Here is the kicker: momentum is fickle.

A company can have great earnings, but if the stock price stagnates for a year, its growth score drops. It might get kicked out of the index right before it starts another bull run. This "buying high and selling low" is an inherent risk of any style-based index. It’s purely mechanical. There is no human manager saying, "Hey, wait, Tesla is about to launch a new product, let's keep them." The spreadsheet says no, so they go.

The Cost of Staying Fast

Growth companies don't usually pay dividends. They don't have "extra" cash sitting around because they are supposed to be reinvesting every cent into R&D, acquisitions, or scaling their infrastructure.

For an investor, this means you are 100% dependent on price appreciation.

If the S&P 500 Growth Index stays flat for five years, you made zero dollars. If the S&P 500 Value Index stays flat for five years, you probably collected a 3% or 4% dividend yield along the way. That’s the "safety net" growth investors give up. You are essentially betting that the "Greater Fool Theory" or genuine innovation will keep pushing the P/E ratios higher.

It's a high-stakes game.

Honestly, it’s kinda stressful if you’re watching it day-to-day. The swings are violent. While the broader market might move 1%, growth can move 3%. It’s great on the way up. It’s a nightmare on the way down.

Why Quality Matters More Than Ever

In 2026, the definition of "growth" is shifting. It used to be "growth at any cost." Burn through VC cash, capture market share, worry about profits later. Those days are dead.

The companies currently dominating the S&P 500 Growth Index are "Quality Growth" firms. They have massive moats, high margins, and—crucially—they actually make a lot of money. They aren't the speculative "zombie companies" of 2021.

👉 See also: Dave and Buster's Stock: Why the Arcade Giant is Still a Wild Ride

But even quality has a price.

Legendary investor Jeremy Grantham has often warned about "the cost of overpaying for greatness." Even if a company is world-class, if you pay 50 times its earnings, your future returns are likely to be mediocre. The index doesn't care about valuation; it only cares about the growth metrics. That is a massive blind spot for anyone using it as their sole investment vehicle.

Practical Steps for Your Portfolio

If you're looking at the S&P 500 Growth Index as a way to juice your returns, you need a plan that isn't just "set it and forget it."

First, check your overlap. Go to a tool like Morningstar or even a basic X-ray tool and see how much of your "growth" fund is already in your "total market" fund. If it’s more than 70%, you’re just paying extra fees for the same stocks.

Second, consider the "Core and Satellite" approach. Keep 80% of your money in a boring, broad S&P 500 or Total World fund. Then, use the growth index for that extra 20%. This gives you the upside of the high-fliers without the risk of a 50% drawdown ruining your retirement plans.

Third, watch the macro environment. Growth loves low interest rates. If the Fed is cutting, growth usually flies. If they’re holding or hiking, it’s a slog.

Don't buy into the "growth is always better" narrative. It’s a tool. Like a hammer, it’s great for some jobs and terrible for others. If you're 25 years old, you can probably handle the volatility. If you're 60, seeing the S&P 500 Growth Index tank during a tech correction might be more than your blood pressure can handle.

Actionable Insights for the Long Haul

- Rebalance with the index: Every December, look at what S&P Dow Jones has added or removed. It tells you where the market's "heat" is moving.

- Don't chase past performance: Just because growth beat value for the last decade doesn't mean it will for the next. The "lost decade" for growth (2000-2010) saw the index do basically nothing.

- Mind the P/E ratios: If the average P/E of the growth index is double the long-term average (which is roughly 18-20x), be cautious. You’re buying at a premium.

- Tax Efficiency: Growth funds are generally more tax-efficient than value funds because they have lower turnover and fewer dividends, meaning fewer taxable events if you hold them in a brokerage account.

The S&P 500 Growth Index is a powerful reflection of American innovation, but it is not a "sure thing." It’s a mechanical, cold, and often volatile slice of the market. Use it wisely, understand the concentration risk, and never assume that "growth" always means "profit" for the individual investor.

Final thought: Stop looking at the daily tickers. Growth is a marathon run at a sprinter's pace—it's exhausting to watch, but if you have the stomach for the swings, the historical trend line is hard to ignore. Just make sure you aren't the one holding the bag when the music stops and the "growth" metrics suddenly turn into "value" realities.