The sun goes down, the closing bell rings at 4:00 PM ET, and most people think the stock market just goes to sleep. It doesn't. Not even close. If you’re staring at the S&P 500 index after hours, you’re watching a weird, thin, and sometimes totally deceptive shadow-play of the actual market. It’s where the "smart money" supposedly plays, but honestly? It’s often just a place where retail investors get chopped up by volatility they weren't expecting.

Most people check their phones at 6:00 PM, see the SPY or VOO tickers moving, and panic. Or they get excited. They see a 1% drop and think the world is ending tomorrow morning. But here's the thing: after-hours trading is a different beast entirely because the liquidity—the actual amount of shares being bought and sold—is basically a puddle compared to the ocean of the regular session.

📖 Related: New Delhi Television Share Price: What Most People Get Wrong

What Actually Happens to the S&P 500 Index After Hours?

Technically, the S&P 500 is just a math formula. It’s an index. You can’t trade the "index" itself after the New York Stock Exchange shuts its doors. What you’re actually looking at are the derivatives and the ETFs. We're talking about the SPDR S&P 500 ETF Trust (SPY) or the E-mini S&P 500 futures.

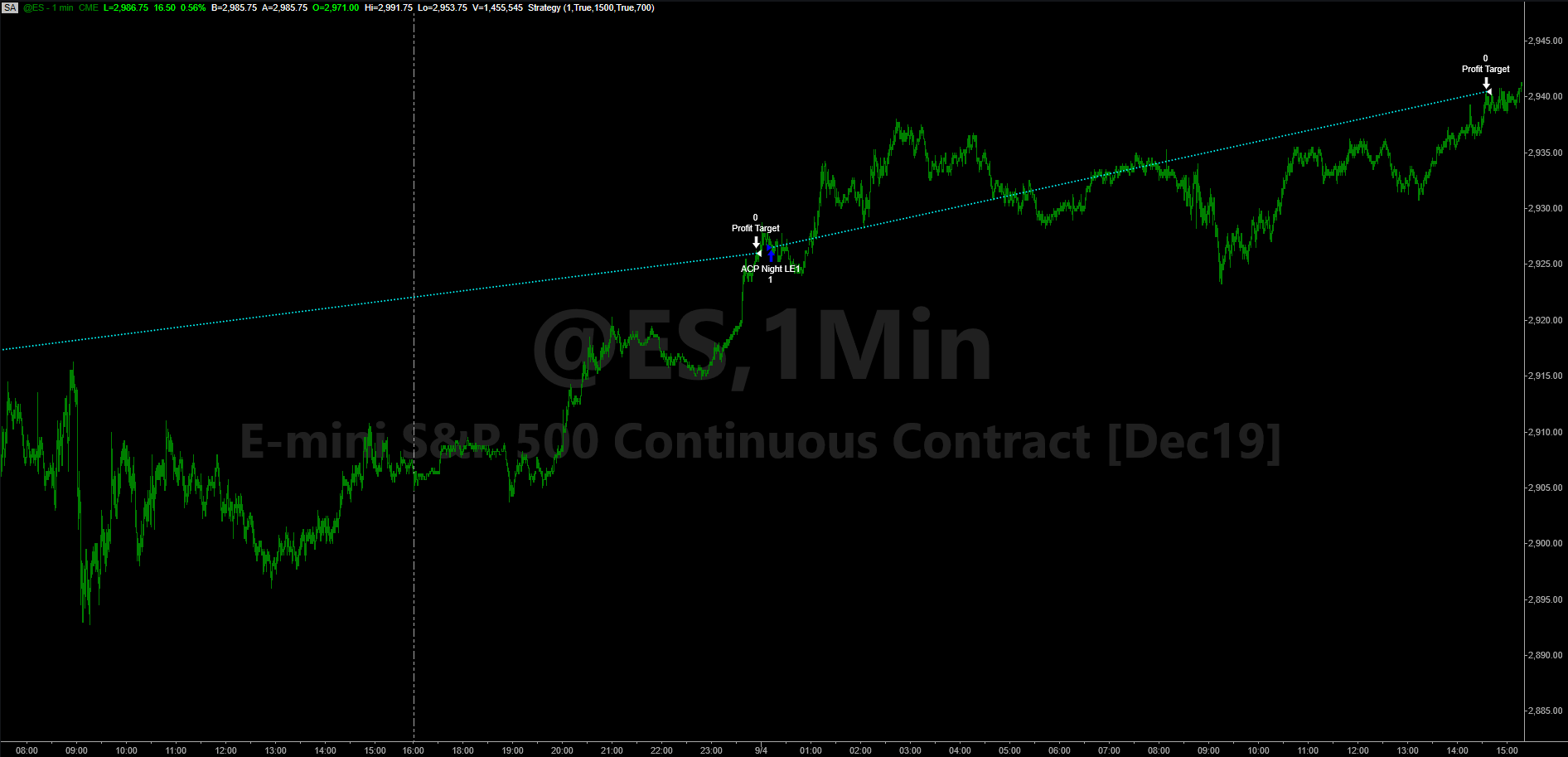

The futures market is the real engine here. It trades almost 24 hours a day. When people talk about the "market being down" at 11:00 PM on a Tuesday, they are looking at futures contracts. These move based on global news, like a surprise manufacturing report from China or a late-night policy shift from the European Central Bank.

The "after-hours" session for stocks specifically runs from 4:00 PM to 8:00 PM ET. During this window, electronic communication networks (ECNs) match buyers and sellers directly. There is no middleman on the floor of the NYSE making sure things stay orderly. It’s the Wild West. Prices can jump 2% on a single large sell order because there aren't enough buyers standing in line to absorb the blow.

Why the Price You See Might Not Be "Real"

Think about it like this. During the day, thousands of people are bidding on a loaf of bread. The price stays steady at $3.00. At 2:00 AM, there’s only one guy selling bread and one guy who is starving. If the starving guy pays $10, does that mean all bread is now worth $10? No. It means two people made a weird deal in the dark.

This happens constantly with the S&P 500 index after hours. A company like Apple or Microsoft—huge components of the index—might release earnings at 4:01 PM. The stock might tank 5%. Because these companies carry so much weight, they drag the "quoted" value of the index down with them. But by 9:30 AM the next morning, the "real" market might decide that the earnings weren't that bad, and the price snaps right back.

Professional traders at firms like Citadel or Goldman Sachs use this time to position themselves, but they aren't usually "gambling" the way a guy on his phone is. They’re hedging.

The Danger of Low Liquidity and Wide Spreads

The "spread" is the gap between what a seller wants and what a buyer is willing to pay. In the middle of the day, for a liquid asset like the S&P 500, that gap is a fraction of a penny. After hours? That gap can yawn wide open.

📖 Related: Ford Motor Corporate Office: What It’s Actually Like Behind the Glass House

If you try to buy the S&P 500 index after hours using a market order, you are asking for trouble. You might think you're buying at $500, but the ECN fills you at $505 because that was the only guy selling. You’re down 1% before the sun even comes up.

Most brokerage platforms like Schwab, Fidelity, or Robinhood allow after-hours trading, but they force you to use limit orders for a reason. They don't want the liability of you getting filled at a joke price. It’s dangerous. It’s thin. It’s prone to "head fakes"—those price movements that look like a new trend but vanish as soon as the opening bell rings.

Major After-Hours Catalysts

- Earnings Reports: This is the big one. Since 90% of S&P 500 companies report outside of market hours, the index moves violently between 4:00 PM and 4:30 PM ET.

- Economic Data: Sometimes international data drops overnight. If Germany’s GDP looks like a car crash, the S&P 500 futures will feel it at 3:00 AM.

- Geopolitical Events: Wars, elections, or sudden central bank interventions don't wait for the NYSE to open.

Do After-Hours Moves Predict the Next Day?

Sometimes. But not as often as you’d think. There’s a phenomenon traders call "fading the move."

If the S&P 500 is up 1.5% in the after-hours because of one hyped-up earnings report, institutional investors often spend the pre-market session (4:00 AM to 9:30 AM ET) selling into that strength. By the time the "regular" Joe opens his app at 9:31 AM, the move is already over. The price starts dropping. The latecomers get trapped.

Research into market anomalies often shows that a significant portion of the S&P 500’s long-term returns actually happens overnight. It’s called the "Night Effect." If you only held the index during the day (9:30 to 4:00), your returns over decades would actually be lower than if you just held it 24/7. This suggests that the "gap up" or "gap down" at the open is where the real value adjustment happens, rather than the slow grind of the daytime session.

How to Trade the S&P 500 Index After Hours Without Losing Your Mind

If you're going to touch this stuff, you need a plan that isn't based on adrenaline. First, stop looking at the line on your screen as the "absolute truth." It's an indication.

Check the volume. If the S&P 500 tracking ETF (like SPY) is moving but the volume is only 5,000 shares, ignore it. That’s nothing. That’s a few people in their basements or one small algo misfiring. You need to see hundreds of thousands of shares moving to believe a price change has any "legs."

Second, use limit orders. Always. If you want to buy SPY at $510, set your limit at $510. If the market skips over you, let it go. Chasing a price in the after-hours is like chasing a shadow in a dark alley; you’re probably going to run into a wall.

The Mental Game

It's easy to get sucked into the "overnight" drama. You see the S&P 500 index after hours bleeding red, and you can't sleep. You're calculating how much money you've lost. But remember: you haven't lost anything until you sell. And selling at 8:00 PM when liquidity is at its lowest is usually the worst possible time to make a rational decision.

Expert traders like Peter Lynch always preached that the "market" is there to serve you, not to inform you. The after-hours price is just a suggestion. It’s an offer. If it’s a bad offer, you don't have to take it.

Actionable Steps for the Night Watch

- Watch the Futures, Not Just the ETF: The ES (E-mini) futures are a much better barometer of "real" sentiment than the after-hours price of an ETF. They represent more volume and more institutional activity.

- Identify the Source: If the index is moving, find out why. Is it a specific stock? If Microsoft is down because of a bad cloud forecast, the whole S&P 500 might dip. But is a bad cloud forecast at Microsoft really a reason to sell your shares of an oil company or a bank that are also in the index? Probably not.

- Wait for the "London Open": At 3:00 AM ET, the London markets open. This usually brings a fresh wave of liquidity. If the move that started at 5:00 PM the night before is still holding strong when London opens, it’s much more likely to be a "real" trend for the day ahead.

- Ignore the Noise: If there is no major news and the index is drifting, it’s just noise. Markets drift when nobody is home. Don't read deep geopolitical meaning into a 0.2% move at midnight.

The S&P 500 index after hours is a tool, but it's a sharp one. It can help you see where the wind is blowing, but it shouldn't be the reason you make a panicked trade. Stay skeptical of the price until the "big money" shows up at 9:30 AM to confirm it.

The most successful investors aren't the ones staying up until 2:00 AM staring at flickering red and green lights. They are the ones who understand that the night market is a thin, volatile, and often misleading representation of what a company—or 500 companies—is actually worth.

🔗 Read more: Euro or Dollar: Which One is Actually Worth More Right Now?

Keep your limit orders tight, your emotions tighter, and maybe just put the phone away after 5:00 PM. The market will still be there in the morning, and it’ll be a lot more honest then.

Next Steps for You:

- Check the volume on your trading platform's "Extended Hours" view to see if a price move is backed by real money.

- Set up price alerts instead of hovering over the chart; this prevents emotional overtrading.

- Review your "Market on Open" vs. "Limit" order strategies to ensure you aren't getting slippage during the 9:30 AM volatility spike.