Honestly, it’s just a number on a screen. But for some reason, that specific flickering green or red digit for the S&P 500 index today basically dictates whether half the country feels rich or poor by dinner time. It’s the heartbeat of Wall Street. If you’ve ever looked at your 401(k) and wondered why it suddenly took a 3% dive while you were getting coffee, you’re looking at the S&P 500. It isn't just a list of companies. It’s a massive, $40-trillion-plus psychological experiment that tracks the 500 largest publicly traded companies in the United States.

Markets are weird right now.

We’ve moved past the era where a "good" earnings report meant a stock went up. Now, we’re dealing with the "higher for longer" interest rate hangover, AI fever dreams, and a consumer base that is—quite frankly—starting to look a bit tired of paying seven dollars for a bag of chips. When you check the S&P 500 index today, you aren't just seeing a price. You're seeing a live-action vote on the future of the American economy.

The Big Tech Shadow Over the S&P 500 Index Today

You can’t talk about the index without talking about the "Magnificent Seven." Or maybe it's the "Fab Five" this week? It changes. The point is, the S&P 500 is market-cap weighted. That’s a fancy way of saying the big guys carry the heavy bags. If Apple, Microsoft, and Nvidia have a bad Tuesday, the other 497 companies could all be having the best day of their lives, and the index will still look like a car crash.

It’s skewed.

Some analysts, like those over at Goldman Sachs, have spent a lot of time pointing out this "concentration risk." If you own an S&P 500 index fund, you don't actually own a "balanced" slice of America. You own a massive tech ETF with some banks and oil companies glued to the side. When people scream about the S&P 500 index today being at all-time highs, they often forget that if you stripped out the top ten stocks, the "average" stock is actually doing... okay. Just okay.

Why the "Equal Weight" Version Tells a Different Story

There is a version of this index called the RSP. It gives every company the same vote. It's the democracy version. Often, when the standard S&P 500 is ripping higher, the equal-weight version is just limping along. This divergence is what keeps hedge fund managers awake at night. It suggests that the "breadth" of the market is thin. A house built on three massive pillars is sturdier than a house built on one, but right now, we’re relying on a handful of AI-adjacent companies to keep the entire roof from caving in.

Inflation, The Fed, and Your Wallet

The Federal Reserve is the main character in this story. Jerome Powell speaks, and the S&P 500 index today reacts like a nervous cat. The relationship is pretty simple: when interest rates are high, borrowing money is expensive. When borrowing is expensive, companies grow slower. When companies grow slower, their stock price usually takes a hit.

But there’s a lag.

Economists often talk about the "long and variable lags" of monetary policy. It’s like turning the dial on a shower—you move it, wait ten seconds, and then you get burned. We are currently in the waiting period. Everyone is trying to guess if the Fed can pull off a "soft landing." That's the mythical scenario where inflation goes away but nobody loses their job. It’s like trying to land a 747 on a postage stamp.

The Earnings Mirage

Company profits look great on paper. But look closer. A lot of that growth in the S&P 500 index today comes from "margin expansion." Basically, companies raised prices because of inflation, but they didn't raise wages quite as fast. They got more efficient. They used AI—or at least told investors they were using AI—to cut costs.

But you can only squeeze a lemon so much before it’s dry.

If the American consumer finally hits a wall and stops spending, those earnings are going to slide. We’re already seeing it in the retail sector. Target and Walmart are telling two very different stories about what’s happening in the aisles. One is seeing "value-seeking behavior" (people buying generic bread), and the other is seeing a resilient shopper. It’s a mess of conflicting data.

What Most People Get Wrong About "The Market"

The most common mistake? Thinking the S&P 500 is the economy. It isn't.

The economy is your local dry cleaner, the unemployment rate in Ohio, and the price of eggs. The S&P 500 is a reflection of corporate profits. A company can be doing great while the world around it is struggling. In fact, sometimes the S&P 500 index today goes up because things are bad. If unemployment rises, the market might bet that the Fed will cut interest rates to help. Bad news for workers becomes good news for stock prices. It’s cynical, but that’s how the plumbing works.

- Valuations Matter: The Price-to-Earnings (P/E) ratio is the "price tag" of the market. Historically, the S&P 500 trades around 16x or 17x earnings. Lately, we’ve been flirting with 20x or higher. That means you’re paying a premium for every dollar of profit these companies make.

- Dividends are the Unsung Heroes: About 1.5% to 2% of your return usually comes from dividends. Over 30 years, that’s a massive chunk of wealth, but it’s not "sexy" enough for the headlines.

- The VIX Factor: The "Fear Gauge." When the VIX is low, everyone is complacent. When it spikes, the S&P 500 usually craters. Keeping an eye on the VIX gives you a sense of how much "insurance" big traders are buying against a crash.

How to Actually Use This Information

Stop checking it every hour. Seriously.

👉 See also: Car Loan for Second Hand Cars: Why Banks Keep Saying No and How to Change That

If you are a long-term investor, the S&P 500 index today is mostly noise. It's a snapshot of a race that lasts forty years. However, if you're looking for an entry point or trying to rebalance, you have to look at the sectors. Not all of the 500 companies are the same.

Right now, Energy and Financials are looking vastly different from Tech and Healthcare. Financials love a certain type of interest rate environment (the "steep yield curve"), while Tech hates it. If you’re just buying the whole index, you’re betting that tech wins forever. That might be a good bet! But it’s a specific bet nonetheless.

Actionable Steps for the "Today" Investor

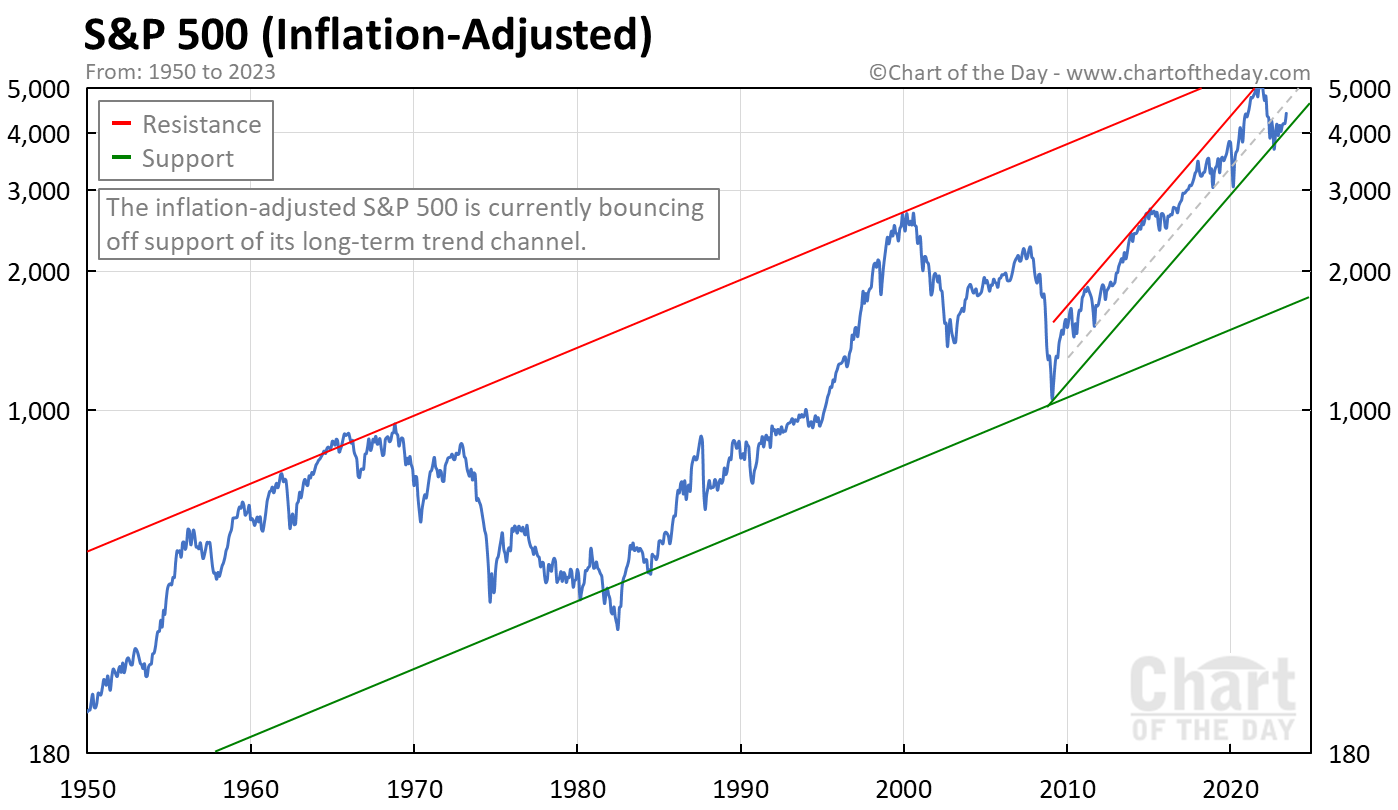

- Check the 200-Day Moving Average: This is the "trend line." If the S&P 500 index today is trading well above its 200-day average, the market is "extended." It might be due for a breather. If it’s below, it’s in a downtrend, and you might want to wait for signs of life before dumping fresh cash in.

- Look at the Dollar (DXY): Most S&P 500 companies get a huge chunk of their revenue from overseas. If the US Dollar is super strong, those foreign sales are worth less when converted back to dollars. A surging dollar is often a "headwind" for the index.

- Review Your Sector Exposure: Use a tool like Morningstar or even your brokerage’s basic X-ray tool. If 40% of your portfolio is in "Information Technology," you aren't diversified. You're a tech speculator.

- Ignore the "Recession is Tomorrow" Doomers: People have predicted 20 of the last 2 recessions. The market usually bottoms out before the economy starts to feel better. If you wait for the news to be good, you’ve already missed the rally.

The S&P 500 is a survivor. It kicks out the losers and adds the winners. It’s why companies like Sears and Kodak are gone, and Tesla and Uber are in. By the time you read this, the number will have changed again. The key isn't knowing exactly where it’s going tomorrow—it’s knowing why it’s moving at all. Stay skeptical of the hype, but don't bet against the collective engine of the 500 biggest companies on the planet for too long. They usually find a way to make money.

Next Steps for Your Portfolio:

Perform a "concentration check" on your current holdings. Identify how much of your total wealth is tied to the top 10 stocks in the S&P 500. If that number exceeds 25%, consider diversifying into mid-cap or international funds to hedge against a potential tech-led correction. Set a limit order for your preferred entry price rather than "market buying" during periods of high volatility to ensure you aren't catching a falling knife.