You’ve probably played the game in your head while stuck in traffic. What would I do if I had to spend 100 billion dollars? Most of us think about the easy stuff first. We buy the superyachts, the private islands, the Gulfstream G700s, and maybe a professional sports team just for the vibes. But here is the weird thing: after you buy the most expensive house in the world (The Holme in London or perhaps a sprawling Bel Air estate), you’ve barely scratched the surface. You haven't even spent 1% of the pile.

That is the scale we are talking about. It’s a number so large it stops being money and starts being infrastructure. To actually move the needle on a hundred billion, you have to stop thinking like a consumer and start thinking like a nation-state or a massive institutional fund.

The sheer physics of the math

A billion is a thousand million. A hundred billion is a hundred of those. If you spent $100,000 every single day, it would take you about 2,739 years to finish the job. You’d need to have been spending since the Iron Age just to go broke today.

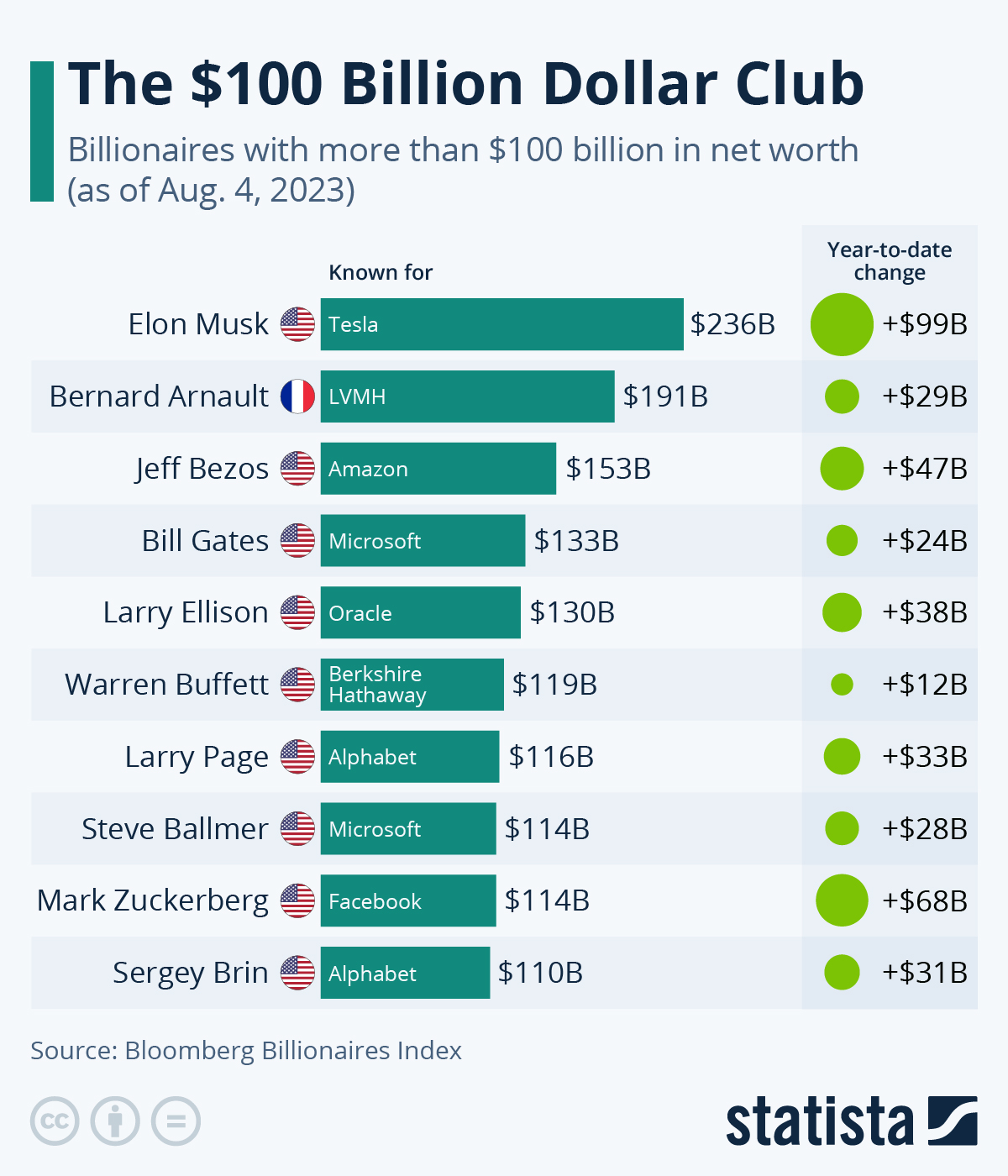

Most people don't realize that the world’s richest individuals, like Elon Musk, Jeff Bezos, or Bernard Arnault, don't actually have this sitting in a checking account. Their wealth is tied up in equity—Tesla stock, Amazon shares, LVMH holdings. If they tried to spend 100 billion dollars tomorrow by selling all their stock at once, the market would panic. The price would crater. They might start with 100 billion on paper and end up with 40 billion in cash after the dust settles and the IRS takes its cut. It’s a liquidity trap.

But let's pretend the cash is just sitting there in a vault, Scrooge McDuck style. How do you actually get rid of it without just setting it on fire?

Buying the "Unbuyable"

If you want to move large chunks of capital quickly, you go after assets that have high maintenance costs and massive entry barriers. Real estate is the classic play, but not just "houses." We are talking about entire city districts.

Take the Hudson Yards project in New York City. It’s one of the most expensive real estate developments in US history, costing roughly $25 billion. You could build four of those. You’d own a significant chunk of the Manhattan skyline. But even then, you’ve still got 75 billion left.

What about sports? The Washington Commanders sold for $6.05 billion recently. You could buy every single team in the NFL. All 32 of them. Well, you couldn't actually because of ownership rules and anti-trust concerns, but purely from a price tag perspective, the entire league is worth less than your total budget.

The problem with "Stuff"

Buying things creates more problems. A $500 million yacht requires about $50 million a year just to keep the lights on and the crew fed. If you buy ten of them, you’re burning half a billion a year in "carrying costs." This is where the money starts to disappear naturally. High-end assets are basically black holes for cash.

But honestly, even with a fleet of planes and a dozen mansions, you’re still rich. You’re frustratingly rich.

The Institutional Route: Where the money actually goes

When people like Bill Gates or Warren Buffett talk about how to spend 100 billion dollars, they aren't talking about shopping. They are talking about capital allocation. This is where you start looking at global problems.

💡 You might also like: USD to Kenya Shillings Exchange Rate Today: What Most People Get Wrong

Eradicating disease

The Global Fund to Fight AIDS, Tuberculosis and Malaria typically looks for roughly $18 billion every three years to keep their programs running. If you stepped in with $100 billion, you could theoretically fund the entire global response to these three major killers for nearly two decades.

That is world-changing. You aren't just buying stuff; you’re buying a different version of the future.

Scientific moonshots

We could talk about the International Space Station (ISS). Its total cost over its lifetime has been estimated at around $150 billion, split between several nations. With your budget, you could almost build your own ISS from scratch, launch it, and keep it manned for a decade.

Or look at nuclear fusion. The ITER project in France, which is trying to master the energy of the stars, has seen its cost estimates soar toward $25 billion or more. You could fund four or five different competing fusion designs to ensure humanity gets clean, limitless energy.

The Logistics of Giving It All Away

There is a concept in philanthropy called "absorptive capacity." It basically means that an organization can only handle so much money at once before it becomes inefficient or corrupt.

If you give a small local charity $1 billion, they will likely collapse. They don't have the staff, the accountants, or the legal team to manage it. To spend 100 billion dollars effectively on charity, you have to build a massive bureaucracy just to give the money away. The Bill & Melinda Gates Foundation has thousands of employees for this exact reason. Giving money away is a full-time job for a small army of experts.

💡 You might also like: The Mortgage Rate Historical Chart: What 40 Years of Data Actually Tells Us

Impact on the economy

If you suddenly injected $100 billion into a specific niche market—say, you decided to buy every vintage Ferrari in existence—you would distort the market so badly that the money would lose its meaning. You’d be paying $500 million for a car that was worth $30 million yesterday because you’re the only buyer and you have an infinite checkbook.

This is why ultra-high-net-worth individuals have to be quiet about their spending. The moment the market knows you have $100 billion to burn, the price of everything you want doubles.

A Realistic "Spend" List

Let’s get granular. If you actually had to liquidate and spend it all within a decade, here is what a balanced "spend" might look like. No lists, just the raw breakdown of how that capital moves.

You’d probably start by dropping $10 billion on a "Personal Sovereign Wealth Fund" just to ensure you never actually run out of gas, but since the goal is to spend it, let’s pivot. You put $20 billion into a private space program because rockets are expensive and they blow up a lot. That is a great way to "lose" money for a good cause. Next, you earmark $30 billion for a global high-speed rail initiative in a developing region. Infrastructure is a massive cash sink.

Then you go for the vanity. You buy a media conglomerate for $15 billion so you can control the narrative about why you’re spending so much. You spend $5 billion on the world’s most extensive private art collection, outbidding every museum on Earth for the next ten years.

Finally, you put the remaining $20 billion into a "Universal Basic Income" experiment in a mid-sized country. You could literally give every person in a nation like Greece or Portugal a few thousand dollars and see what happens to the economy. It’s a giant social science experiment.

The Psychological Burden

There is a real thing called "wealth fatigue." After the tenth mansion, the marble floors don't feel cold anymore. After the fifth private jet, the novelty of skipping TSA wears off. Most people who have attempted to spend 100 billion dollars (or at least manage it) report that it becomes a burden of responsibility.

You aren't a person anymore. You are an institution. You are a target for every lawsuit, every scammer, and every government looking for tax revenue.

How to actually approach this scale of wealth

If you ever find yourself in the position to spend 100 billion dollars, your best bet isn't to look at a catalog. It is to look at the systems that run the world.

- Prioritize Systemic Change Over Charity: Don't just buy food for the hungry; buy the farms, the logistics networks, and the seed technology to ensure the hunger doesn't come back.

- Focus on Longevity: Use the money to fund "Longtermist" projects, like seed banks or deep-time archives, that protect human knowledge for thousands of years.

- Diversify the Spend: If you spend it all in one sector, you’ll break that sector. Spread the wealth across technology, biology, art, and infrastructure.

- Hire a Team: You cannot manage this alone. You need a "family office" on steroids—hundreds of lawyers, tax experts, and investment officers whose only job is to track the flow of cash.

Spending a hundred billion isn't a shopping spree. It’s an exercise in engineering. It requires a level of planning that most governments struggle to achieve. But if done right, that kind of money doesn't just buy things—it buys a legacy that outlasts the person who signed the checks.

The real challenge isn't finding things to buy. It's making sure that when the money is gone, the world is actually better than it was when you started. Otherwise, you’re just a guy with a very expensive garage and a lot of empty rooms.

The next step is to look at the tax implications of such spending. You'll need to consult with a specialized firm that handles multi-family offices to understand how "Step-up in basis" and "Gift Tax" would impact a hundred-billion-dollar outflow. Researching the Giving Pledge is a good way to see how current billionaires are attempting to structure this exact problem without crashing the global economy.