You’ve probably heard the old cliché about "buying low and selling high." It sounds great on a bumper sticker. In the real world of trading, though, catching a falling knife usually just gets you a bloody hand. This is where Stan Weinstein stage analysis comes in. Most people think they’re investing when they're actually just gambling on a hope and a prayer. Stan’s whole philosophy, laid out in his 1988 classic Secrets for Profiting in Bull and Bear Markets, is about timing the market by understanding its DNA.

He basically argues that every stock, index, or crypto coin goes through four distinct life cycles. If you’re buying in Stage 4, you’re essentially trying to swim against a tsunami. If you’re buying in Stage 2, you’ve got a massive tailwind. Honestly, once you see these stages on a chart, you can't unsee them. It’s like the Matrix.

The Foundation: The 30-Week Moving Average

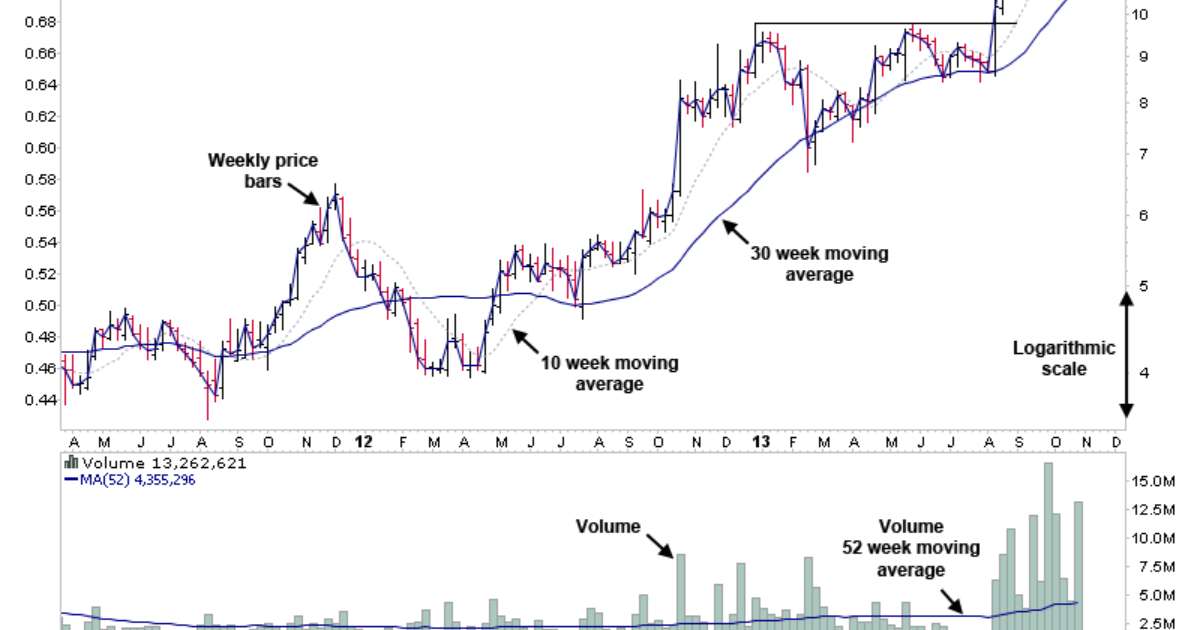

Before we dive into the stages, you need the right lens. Weinstein doesn't care about the noise of daily charts. He’s a weekly chart guy. His "holy grail" is the 30-week simple moving average (SMA).

Why 30 weeks? It’s long enough to filter out the "fake" moves but responsive enough to show you when the big money—the institutions—are changing their minds. Think of the 30-week SMA as the line in the sand. If the price is below a declining 30-week SMA, you shouldn't touch it. Period. No matter how "cheap" the P/E ratio looks.

📖 Related: CFPB Fired Employees Reinstatement: What Really Happened Behind Closed Doors

Stage 1: The Basing Area (The Boring Part)

Stage 1 is where everyone loses interest. The stock has stopped crashing, but it isn't going anywhere yet. It’s basically just "basing."

The price oscillates sideways. It’s a tug-of-war between the last of the panicked sellers and the smart money quietly accumulating shares. The 30-week SMA starts to flatten out. Volume usually dries up because nobody cares about the stock anymore.

A lot of traders make the mistake of buying here because they want to "get in early." But a stock can stay in Stage 1 for months, even years. Look at Intel (INTC) or some of the legacy energy stocks in the mid-2010s. They spent forever doing nothing. Buying here ties up your capital. You aren't losing money, but you aren't making it either.

Stage 2: The Advancing Phase (The Money Maker)

This is the only place you want to be. Stage 2 starts with a breakout.

For it to be a real Weinstein-approved breakout, two things must happen:

- The price must clear the top of the Stage 1 resistance.

- Volume must explode.

If it breaks out on low volume? It’s probably a "head fake." You want to see "a tiger in the tank," as Stan says. Once Stage 2 is in full swing, the 30-week SMA starts sloping upward. Every pullback toward that moving average is a potential buying opportunity.

Take a look at Nvidia (NVDA) during its massive run throughout 2023 and 2024. It stayed firmly in Stage 2, consistently bouncing off its rising moving averages. That is where the real wealth is created. You don't need to be a genius; you just need to stay on the horse.

Stage 3: The Top Area (The Danger Zone)

Everything is great. Your neighbors are talking about the stock. The news is glowing. But on the chart, things are getting shaky.

In Stage 3, the upward momentum stalls. The 30-week SMA flattens out again. The price starts making wild swings—huge up days followed by even bigger down days on heavy volume. This is "distribution." The big institutions are quietly unloading their positions onto retail traders who are FOMO-ing (Fear Of Missing Out) in late.

The price might still be near all-time highs, but the character of the move has changed. It's no longer a smooth climb; it’s a dogfight. This is when you should be tightening your stop-losses or taking partial profits.

Stage 4: The Declining Phase (The Disaster)

Stage 4 is where accounts go to die. It begins when the price breaks below the 30-week SMA and the SMA itself starts to slope downward.

There’s a common trap here. The stock drops 20%, and people say, "It’s a bargain!" Then it drops another 30%. In Stage 4, "oversold" doesn't mean "buy." It just means "stop-loss orders are being triggered."

Look at Peloton (PTON) or Zoom (ZM) after the 2021 bubble popped. They entered Stage 4 and just kept sinking. The 30-week SMA acted like a ceiling; every time the price tried to rally, it hit that declining line and got rejected. Weinstein is very clear: you never, ever buy a stock in Stage 4.

Why Relative Strength Matters

Stan Weinstein stage analysis isn't just about price. He uses a tool called Mansfield Relative Strength.

Basically, this compares the stock to the S&P 500. If the market is up 10% but your stock is only up 2%, your stock is a "laggard." You want "leaders." You want the stocks that are outperforming the index.

📖 Related: Jay-Z Net Worth 2025: Why Most People Get His Wealth Strategy Wrong

He also looks at "Group Strength." If you're looking at a tech stock, you want the whole tech sector to be in Stage 2. Buying the strongest stock in the strongest group is the secret sauce. It’s like betting on the fastest horse in the fastest race.

Common Pitfalls and Misconceptions

Kinda funny how people try to overcomplicate this. They add 50 different indicators and lose the plot.

- The "Cheap" Trap: People think Stage 4 stocks are "on sale." They aren't. They're usually broken companies or sectors in secular decline.

- Ignoring Volume: A breakout without volume is like a car without gas. It might roll down a hill for a bit, but it won't go far.

- Impatience: Trying to "anticipate" Stage 2. Wait for the breakout. Let the market prove it to you first.

How to Apply This Right Now

If you want to start using this today, stop looking at 5-minute charts. They’re just noise and stress.

- Open a weekly chart of a stock you like.

- Add a 30-week Simple Moving Average.

- Look at the slope. Is it up, down, or flat?

- Check the price relative to that line.

- Look at the volume on the last few big moves.

If the stock is below a declining 30-week SMA, get out or stay out. If it’s just starting to break above a flat SMA on huge volume, you might have found a winner.

To take this a step further, start scanning your watchlist for "Stage 1 Bases." These are the launching pads for the next big winners. Look for sectors that are starting to show relative strength against the S&P 500. When you find a stock that aligns with both a Stage 2 breakout and a strong industry group, that's your high-probability entry point.