If you are looking at college costs in California, you've probably realized that the "sticker price" is basically a myth. Honestly, nobody actually pays the number they show on the front page of the brochure. When you start digging into Stanislaus State university tuition, it’s easy to get overwhelmed by the rows of numbers and the yearly hikes.

The CSU Board of Trustees recently made a big move, approving a 6% annual tuition increase that started back in 2024 and runs through 2029. This means the price you see today isn't the price you'll see next year. But here is the thing: Stan State is still widely considered one of the best "bang for your buck" schools in the country. Let’s break down what’s actually happening with the money.

The Reality of Stanislaus State University Tuition in 2026

For the 2025-2026 academic year, a full-time undergraduate student (taking more than 6 units) is looking at a base tuition of roughly $6,838. This is just the "systemwide" fee—the flat rate set by the California State University system.

But you can't just pay that and walk into a classroom. Every campus has its own "mandatory fees." At Stan State, these fees cover things like the University Student Center, Health Services, and Athletics. For this year, those extra campus fees tack on another $2,240 or so.

So, your starting line for a year of classes is actually closer to $9,078.

📖 Related: Dollar to Rial Iran Explained: What Really Happened to the Currency

Graduate and Professional Costs

If you are sticking around for a Master’s or a teaching credential, the math changes. Credential students are paying about $7,488 in base tuition, while graduate students are closer to $8,064.

And if you’re eyeing a doctorate? The prices jump significantly. A Doctor of Education (Ed.D.) at Stanislaus State is roughly $13,296 per year, while specialized programs like the Doctor of Nursing Practice (DNP) can hit over $17,000. It’s a lot, but still cheaper than most private institutions in the Central Valley.

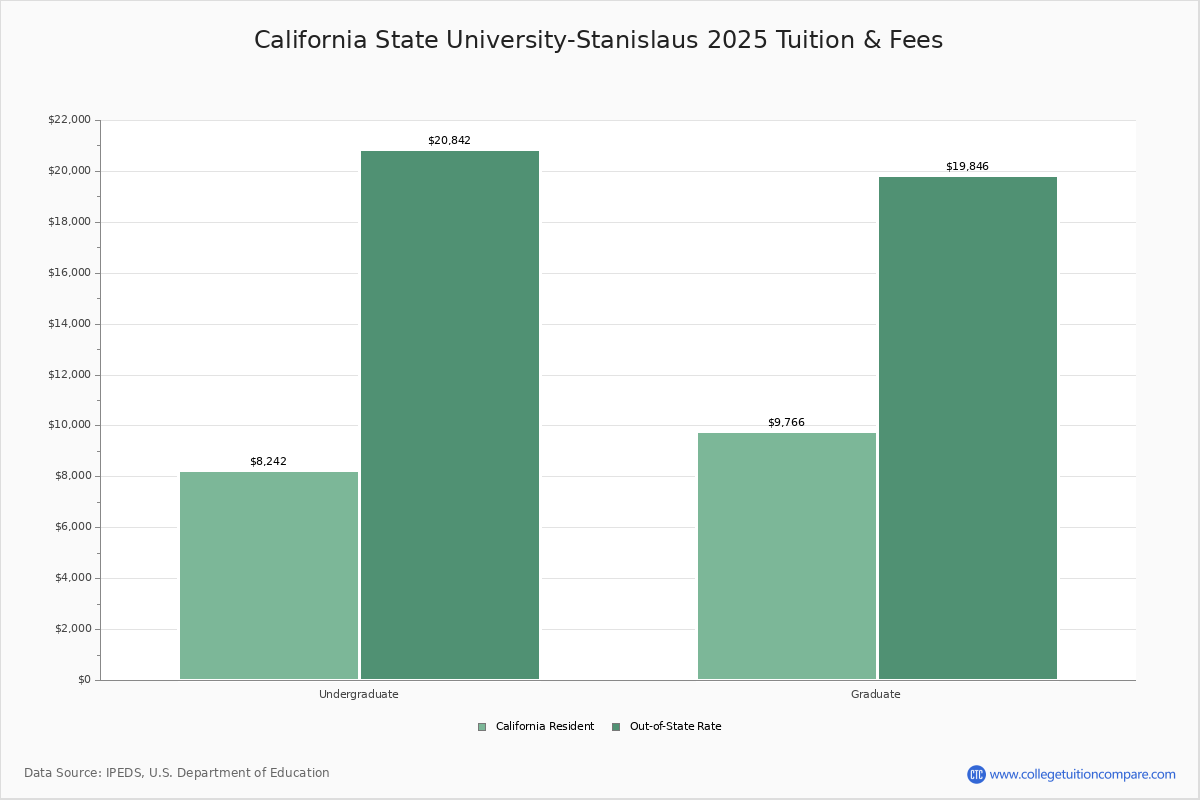

What About Out-of-State Students?

If you’re coming from outside of California, the bill gets much heavier. Non-residents have to pay the standard tuition plus an additional fee for every single unit they take.

Right now, that non-resident fee is $444 per unit.

If you take a standard 15-unit load per semester, you’re adding over $13,000 to your annual bill. Most out-of-state students end up with a total "sticker price" of roughly $22,000 to $25,000 just for tuition and fees.

However, there is a loophole: the Western Undergraduate Exchange (WUE). If you live in a participating western state (like Nevada, Oregon, or Arizona), you might qualify for a massive discount that brings your tuition down to about 150% of the in-state rate. It’s worth checking if you’re eligible before you panic at the out-of-state totals.

The "Hidden" Costs: Housing and Living Expenses

Tuition is just the appetizer. The real meal—the one that hurts the wallet—is housing.

Stan State offers a few different vibes for living on campus. A "Triple Suite," which is basically three people in a room, is the cheapest option at about $5,414 for the academic year. If you want a bit more privacy, like a single apartment in Village 1, you’re looking at nearly $9,500.

Don't Forget the Food

You also have to eat. On-campus residents are required to have a meal plan. The "Gold" or "Silver" plans for 2026 are running about $4,968.

When you add it all up—tuition, fees, a decent room, and a meal plan—the "Cost of Attendance" (COA) for a student living on campus is roughly $26,000 to $28,000 a year.

- Living with parents: ~ $17,000 - $18,000 (Mostly just tuition, books, and gas)

- Living on campus: ~ $26,000 - $28,000

- Living off campus: ~ $35,000+ (Turlock rentals have gotten pricey lately!)

Why the "Net Price" is the Only Number That Matters

Okay, I just threw some scary numbers at you. But here is the secret: 76% of Stan State students receive financial aid.

Washington Monthly recently ranked Stan State #4 in the nation for "Best Bang for the Buck." Why? Because for a huge chunk of the student body, the actual out-of-pocket cost is incredibly low.

💡 You might also like: 11600 W Park Place Milwaukee WI: Why This Office Hub is Changing

If your family makes less than $30,000 a year, your "Net Price"—what you actually pay after grants and scholarships—often drops to around **$3,200**. Even for families making $75,000 to $110,000, the average net price hovers around **$15,000**, which is far below the $26k sticker price.

Most students here graduate with a median debt of about $13,540. Compare that to the national average of nearly $30,000, and you start to see why people choose the Warriors over a fancy private school.

Practical Steps to Lower Your Bill

You shouldn't just accept the bill the university sends you. There are ways to chip away at it.

- The FAFSA/CADAA is Mandatory: You have to fill this out every single year. Even if you think you make too much money, do it. This is how you get access to the Middle Class Scholarship, which can cover up to 40% of mandatory tuition and fees.

- Apply for the "General Scholarship": Stan State has one application that puts you in the running for hundreds of internal scholarships. It usually closes in early March. Don't miss it.

- Watch the Units: You pay the same tuition for 7 units as you do for 18 units. If you can handle the workload, taking more units per semester "buys" you a cheaper degree by letting you graduate a semester or two early.

- Appeal Your Aid: If your family’s financial situation changed recently—maybe a job loss or medical bills—talk to the Financial Aid office. They can do what’s called a "Professional Judgment" to adjust your aid package.

Basically, the Stanislaus State university tuition is going up, but it remains one of the most accessible paths to a degree in California. Between the Cal Grants, Pell Grants, and local scholarships, the goal is to make sure the "sticker price" doesn't stop you from showing up on move-in day.

To get your specific cost, use the Net Price Calculator on the Stan State Financial Aid website. It takes about five minutes and will give you a much more realistic estimate based on your family's actual income rather than the general averages listed here.