The bell rings at 4:00 PM EST. Most people think the day is done. They’re wrong. Honestly, for the people making the real money—the institutional whales and the hyper-focused retail crowd—the period between 4:00 PM and 8:00 PM is where the actual chaos lives. This is the world of stock after hours movers, a frantic, low-liquidity landscape where a single earnings miss can vaporize billions in market cap before most people have even finished their first post-work beer.

It’s weird.

Prices jump 10% on a whim. They crater 15% because a CEO sounded "uncertain" on a conference call. If you’ve ever woken up to find your portfolio bleeding out before the sun is even up, you’ve felt the sting of the after-hours session. It’s a ghost town compared to the regular session, but the ghosts have heavy pockets.

The Brutal Reality of After-Hours Trading

Trading doesn't stop just because the floor of the NYSE goes dark. Electronic Communication Networks (ECNs) keep the lights on. But here’s the kicker: the rules are totally different. In the regular session, you have thousands of participants, tight spreads, and a sense of "fair" pricing. Once you hit 4:01 PM, that safety net vanishes.

Liquidity dries up.

Think of it like trying to buy a loaf of bread at a 24-hour gas station in the middle of a blizzard versus a crowded supermarket at noon. The price is going to be higher, the options are fewer, and you’re probably going to get a raw deal. Because there are fewer buyers and sellers, even a relatively small order can send a stock’s price screaming in one direction. That’s why stock after hours movers often show massive percentage gains or losses that don't always hold up when the market opens the next morning at 9:30 AM.

Professional traders call this "thin" trading. It’s dangerous for the uninitiated. You’ll see a "bid-ask spread"—the gap between what someone wants to pay and what someone wants to sell for—that is wide enough to drive a truck through. If you aren't using limit orders, you're basically asking to get fleeced.

Why Stocks Actually Move After the Bell

Companies aren't stupid. They know that if they drop a massive bombshell at 1:00 PM on a Tuesday, the resulting panic will halt trading and cause a literal riot. So, they wait. They wait for the "quiet" of the post-market.

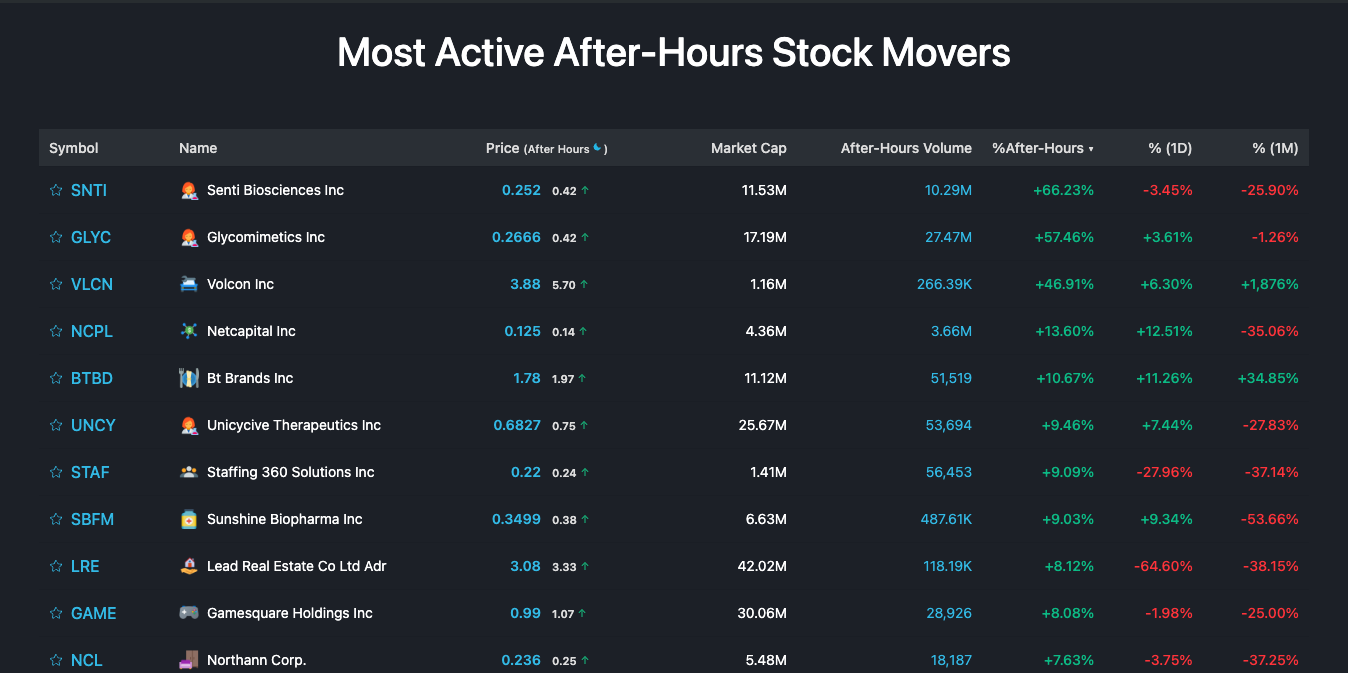

Earnings reports are the primary engine for stock after hours movers. Take Nvidia (NVDA) or Tesla (TSLA) as examples from recent years. When these giants report after the bell, the volatility is sickening. You’ll see the stock tick up 2%, then drop 4% as the press release hits, then skyrocket 8% once the CFO starts talking about "AI integration" or "margin expansion" during the live call.

It isn't just earnings, though.

- FDA Approvals: Small-cap biotech stocks are the kings of after-hours volatility. A single "Complete Response Letter" from the FDA at 4:30 PM can send a stock down 70% in three minutes.

- Secondary Offerings: Nothing kills a rally like a company announcing they’re printing more shares to raise cash. They almost always do this after hours to avoid the immediate scrutiny of the day-trading crowd.

- Index Rebalancing: When the S&P 500 or the Nasdaq-100 adds or removes a stock, the forced buying from ETFs creates massive ripples in the late session.

The "Morning Fade" and Why It Happens

Have you ever seen a stock up 12% at 6:00 PM, only to open at +2% the next morning? This is the "fade."

Retail traders see the green numbers and get FOMO (Fear Of Missing Out). They jump in at 7:45 PM, buying at the top of an illiquid spike. But by 9:00 AM the next day, the "pre-market" traders and the big banks have had time to digest the news. They realize the earnings weren't that good, or they decide to take profits.

Suddenly, the momentum dies.

This is why looking at stock after hours movers requires a skeptical eye. You have to ask: Who is buying this right now? Is it a hedge fund repositioning based on a fundamental shift, or is it a bunch of panicked individuals reacting to a headline they didn't actually read? Usually, it's the latter.

How to Actually Play the After-Hours Session

If you’re going to trade this, you need to be smart. First, check your broker. Not all of them allow full access. Robinhood and WeBull have made it easier for the "average Joe," but firms like Fidelity or Charles Schwab have specific rules about when and how you can participate.

You absolutely must use Limit Orders.

🔗 Read more: Manheim El Paso El Paso TX: What Dealers Actually Experience at the Border

A market order in the after-hours session is financial suicide. If the "ask" price is $50.00 but the only person selling is asking for $55.00 because liquidity is low, a market order will fill you at $55.00. You’re down 10% the second the trade executes. A limit order ensures you only pay what you want.

Also, watch the volume. A stock moving 20% on 1,000 shares traded is meaningless. That’s just one person making a weird bet. If you see a stock moving 5% on 2 million shares, that’s a signal. That means the big boys are at the table.

The Tools You Need

You can't just refresh your portfolio page and hope for the best. You need real-time data. Websites like CNBC, MarketWatch, and Nasdaq’s official site offer decent after-hours quotes, but they can be laggy.

Serious people use:

- TradingView: Excellent for visualizing the "Extended Hours" (look for the 'Ext' button on the bottom of the chart).

- BenZinga Pro: They have a dedicated "Squawk" box that shouts out news the second it hits the wire.

- Bloomberg Terminal: If you have $25k a year to spare, this is the gold standard. For the rest of us, Twitter (X) and specialized Discord servers are where the fast info lives.

What Most People Get Wrong

People think after-hours trading is "illegal" or "secret." It’s not. It’s been around for decades. It used to be the exclusive playground of institutional investors, but the internet democratized the chaos.

The biggest misconception is that the after-hours price is the "real" price.

✨ Don't miss: USD to Kina: Why Your Money Doesn't Go as Far as It Used To

It’s just a suggestion. The real price is discovered at 9:30 AM when the "Total Addressable Market" of investors shows up. Think of the after-hours session as a dress rehearsal. Sometimes the lead actor falls off the stage, but they’re fine by opening night. Other times, the whole theater burns down.

Actionable Steps for the "After-Hours" Curious

Stop gambling. Start observing.

- Enable Extended Hours: Go into your brokerage settings tonight and make sure you can at least see the extended hours data. You don't have to trade it, but you need to see what's happening to your money.

- The 4:15 PM Rule: Never buy a stock in the first 15 minutes after the bell. This is when the most emotional, knee-jerk reactions happen. Let the initial "algorithm war" settle down before you even think about clicking 'buy.'

- Verify the News: If you see a "mover," find the source. Is it a real SEC filing or just a rumor on a message board? Check the SEC’s EDGAR database if you want to be 100% sure.

- Watch the "Sympathy Play": If Apple (AAPL) misses earnings and drops, watch what happens to its suppliers like Cirrus Logic (CRUS) or Skyworks (SWKS). Often, the "movers" aren't just the companies reporting, but the ones tethered to them.

Trading stock after hours movers isn't about being first; it's about being right. Most people are just fast, and in the stock market, being fast and wrong is the quickest way to go broke. Stick to limit orders, keep an eye on the volume, and for the love of everything, don't chase a 20% spike at 7:59 PM. The sun always comes up tomorrow, and usually, it brings a much clearer picture with it.

Next Steps to Secure Your Strategy:

Identify three stocks currently on your watchlist and track their price action between 4:00 PM and 5:00 PM EST for one week. Note the "spread" between the bid and ask prices during this time compared to noon. This exercise will visually demonstrate why liquidity matters before you ever put actual capital at risk in the extended session. For high-volatility events, cross-reference the after-hours price with the next day's "Opening Cross" to see how often the late-night momentum actually sustains into the regular session.