Money makes the world go 'round, right? But honestly, if you’ve ever looked at a flickering green and red screen on CNBC and felt like you were staring at the Matrix, you aren’t alone. Stock exchanges are basically the massive, high-tech plumbing systems of the global economy. Without them, your 401(k) wouldn't exist, and companies like Apple or Tesla would have a much harder time building the gadgets you use every day.

Think of a stock exchange as a giant, hyper-regulated flea market. But instead of dusty old records and vintage clothes, people are buying and selling tiny pieces of ownership in massive corporations.

The Simple Reality of Trading Ownership

At its core, a stock exchange is a centralized location where buyers and sellers meet to trade "shares." A share is exactly what it sounds like: a slice of the pie. When you buy a share of a company on an exchange, you’re becoming a part-owner. You’ve got skin in the game.

Back in the day, this happened in person. You’ve probably seen the old movies with guys in colored vests screaming and waving slips of paper at each other on the floor of the New York Stock Exchange (NYSE). It was chaotic. It was loud. It was very human. Today? It’s mostly rows of servers in data centers in places like Mahwah, New Jersey, or Carteret. The "screaming" now happens via fiber-optic cables at speeds humans can't even comprehend.

🔗 Read more: Why $7.25 in 2009 today is the most frustrating number in American economics

Why Do We Even Need These Things?

Imagine you wanted to sell your car. You’d post it on a marketplace, wait for calls, haggle over the price, and eventually sign over the title. Now imagine trying to do that with 10% of a multi-billion dollar company. You’d never find enough buyers on your own.

Stock exchanges solve the "liquidity" problem. Liquidity is just a fancy way of saying "how fast can I turn this thing into cash without getting ripped off." Because millions of people are looking at the same exchange at the same time, you can usually sell your stocks in milliseconds.

Capital formation is the other biggie.

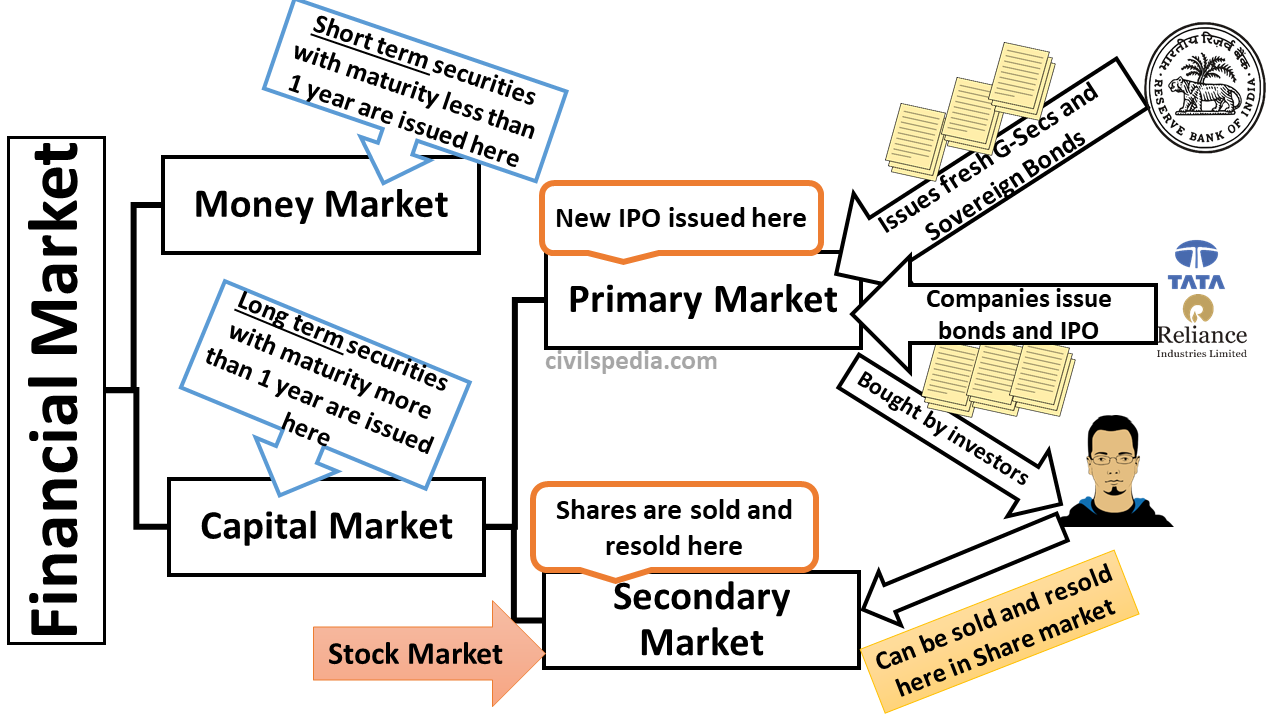

When a company "goes public" through an Initial Public Offering (IPO), they aren't just doing it for the fame. They are raising massive amounts of cash. They use that money to build factories, hire engineers, and expand into new countries. The exchange is the platform that allows this massive transfer of wealth from investors to innovators.

The Big Players You Know (and Some You Don't)

You’ve definitely heard of the NYSE and the Nasdaq. They are the titans of the US market, but they operate differently. The NYSE is the "Big Board," the old-school prestige play located at 11 Wall Street. It uses a "designated market maker" system, which is a fancy term for a middleman who ensures there's always a fair price for a stock.

The Nasdaq, on the other hand, was the world's first electronic exchange. It doesn't have a physical floor. It’s where the tech giants live—think Google (Alphabet), Amazon, and Microsoft.

But the world is bigger than New York.

- The Tokyo Stock Exchange (TSE) handles the Japanese giants like Toyota.

- The London Stock Exchange (LSE) is one of the oldest in the world, dating back to coffee houses in the 17th century.

- The Shanghai Stock Exchange (SSE) has become a monster in the last two decades as China’s economy exploded.

How the Price Actually Changes

Why did your favorite stock drop 5% this morning? It usually comes down to the "bid-ask spread."

✨ Don't miss: t rowe rmd calculator: What Most People Get Wrong

- The Bid is the highest price a buyer is willing to pay.

- The Ask is the lowest price a seller is willing to accept.

When those two numbers meet, a trade happens. If a company releases a bad earnings report, suddenly everyone wants to sell and nobody wants to buy. To find a buyer, the sellers have to lower their "ask." This chain reaction is what you see as a falling line on a graph. It’s supply and demand in its purest, most brutal form.

The Gatekeepers and the Rules

You can't just walk onto an exchange and start trading. It’s a closed club. Only "broker-dealers" who are members of the exchange can execute trades. That’s why you use apps like Fidelity, Schwab, or Robinhood. They act as your representative, sending your orders to the exchange.

Also, the government is always watching. In the US, the Securities and Exchange Commission (SEC) keeps everyone in line. They make sure companies aren't lying about their profits and that insiders aren't cheating the system. It’s not perfect—hey, look at 2008 or the FTX collapse—but it’s a lot better than the "Wild West" era of the 1800s.

Misconceptions That Get People in Trouble

A lot of people think the stock exchange is the economy. It isn't.

The market is a reflection of what people think will happen in the future. That’s why the stock market can go up even when unemployment is high. Investors might be looking six months ahead, betting that things will get better.

✨ Don't miss: Federal Withholding Tax Tables: Why Your Paycheck Looks So Weird Right Now

Another big mistake? Thinking you can "beat" the exchange. High-frequency trading (HFT) firms use algorithms to trade in microseconds. If you're trying to day-trade based on a news headline you just read on Twitter, you're already too late. The machines beat you to it.

The Dark Side: Dark Pools and Flash Crashes

Since we're being honest, it’s not all sunshine and dividends. Large institutional investors (like massive pension funds) sometimes use "Dark Pools." These are private exchanges where they can trade huge blocks of shares without telling the public until the trade is done. This prevents the price from swinging wildly before they finish their move, but it also means the "average Joe" doesn't always see the full picture of what's happening.

Then there are "Flash Crashes." Sometimes, the algorithms get into a feedback loop and start selling all at once for no apparent reason. In May 2010, the Dow Jones dropped nearly 1,000 points in minutes only to recover almost as fast. It was a wake-up call that the digital "plumbing" of our stock exchanges can sometimes burst.

Actionable Steps for the Everyday Investor

If all of this sounds overwhelming, take a breath. You don't need to be a math genius to benefit from stock exchanges.

- Stick to Index Funds: Instead of trying to pick the "winning" stock on the exchange, buy an ETF (Exchange Traded Fund) like the VOO or SPY. This lets you own a tiny piece of the top 500 companies at once.

- Check the Fees: Every time you trade on an exchange, someone is making money. Make sure your broker isn't hitting you with hidden commissions.

- Look at the Long Game: Stock exchanges are volatile in the short term. Over decades, however, the US market has historically returned about 10% annually before inflation.

- Understand "Market Orders" vs. "Limit Orders": If you use a market order, you're saying "buy this now at any price." If you use a limit order, you're saying "only buy this if it hits $50." Use limit orders to protect yourself from weird price spikes.

Stock exchanges are complicated, messy, and occasionally frustrating. But they are also the most powerful tool ever created for building wealth. By providing a fair, regulated place to trade, they give everyone—from a billionaire hedge fund manager to a college student with $50—a chance to own a piece of the future.

Summary of Key Takeaways

The stock exchange is more than just a place to gamble on tickers. It is a vital infrastructure that provides liquidity, enables companies to grow, and offers a transparent pricing mechanism for the world's most valuable assets. While the technology has moved from paper slips to fiber optics, the fundamental human drive to trade and value ownership remains the same. Understanding the mechanics—from the bid-ask spread to the role of the SEC—is the first step in moving from a spectator to a confident participant in the global market.

To start your journey, open a brokerage account with a reputable firm, research low-cost index funds, and commit to a long-term investment strategy that ignores the daily noise of the trading floor. Success in the market rarely comes from outsmarting the exchange; it comes from having the patience to let the exchange work for you.