If you’ve spent any time staring at a stock market last 12 months graph, you’ve probably noticed something weird. It doesn't look like the "smooth ride" the headlines promised back in early 2025. Honestly, it looks more like a cardiac event.

Most people see that line moving from the bottom left to the top right and assume everything was great. But the reality is that the last year—specifically from January 2025 to January 2026—was one of the most stressful "bull markets" in recent memory. We saw the S&P 500 climb about 13.4%, which sounds nice on paper, but that number hides a brutal 20% correction that almost wiped out the "AI is everything" narrative by springtime.

What the Stock Market Last 12 Months Graph Is Actually Telling You

Basically, the graph is a tale of two halves.

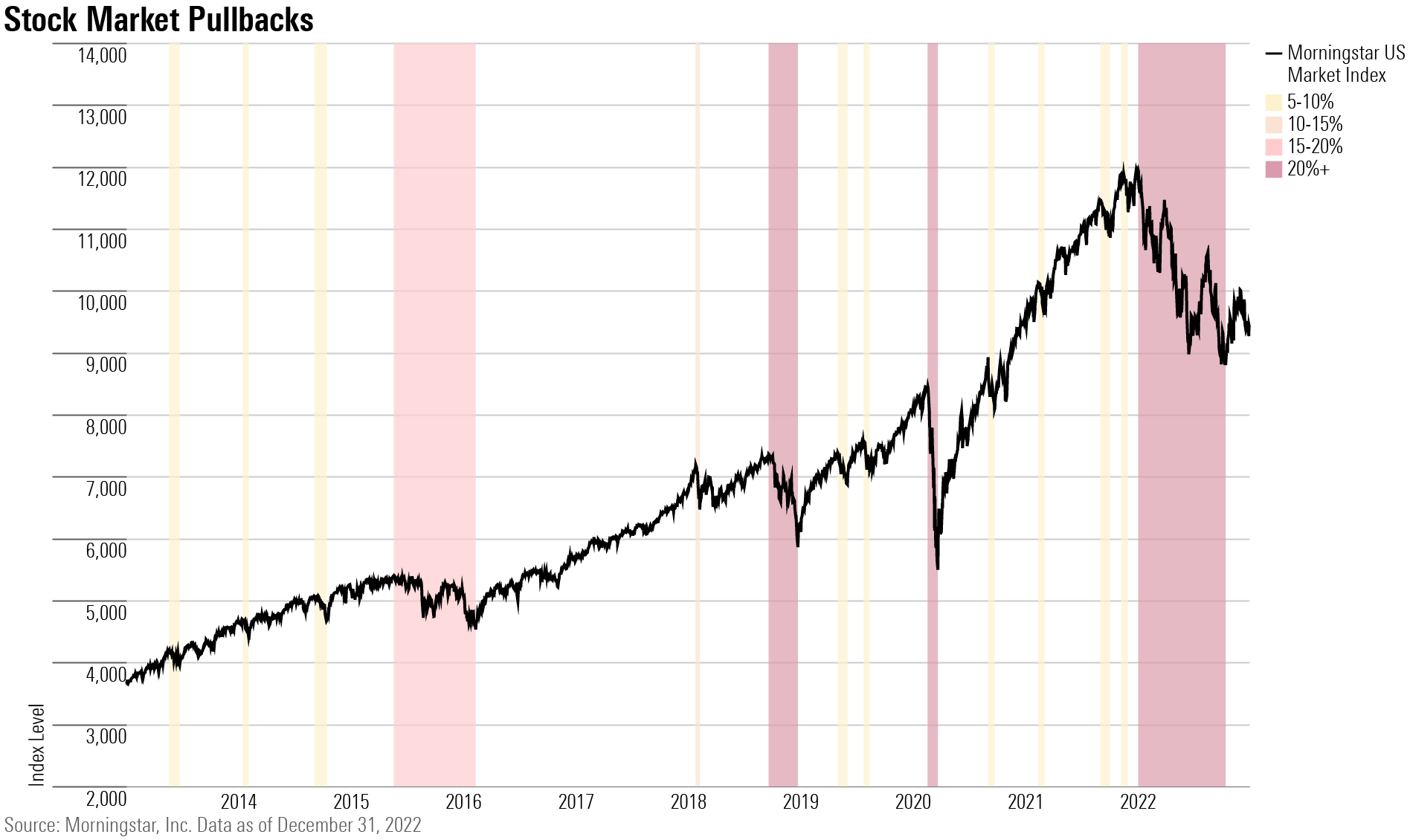

The first half of 2025 was a mess. Between February and April, the market took a massive hit. The S&P 500 dropped nearly 20% in just a couple of months. Why? Because the "Magnificent Seven" trade started to feel crowded, and everyone got spooked by the idea that the AI bubble was finally popping. You can see it on any technical chart: a sharp, jagged drop that looks like a cliff.

But then, things stabilized.

💡 You might also like: How Much Does Elon Musk Make Per Minute: The Reality Behind the $700 Billion Fortune

The Federal Reserve, led by Jerome Powell—who is currently facing some pretty unique legal scrutiny from the new administration—decided to get aggressive. They cut rates three times in 2025, bringing the federal funds rate down to a range of 3.5% to 3.75%. That was the "fuel" the market needed. By the time we hit the summer of 2025, the graph started its long, steady climb back to the record highs we’re seeing here in January 2026.

The Nvidia Factor and the $4 Trillion Milestone

You can’t talk about the last 12 months without mentioning Nvidia (NVDA).

While the broader market was struggling with tariff concerns and political shifts, Nvidia was just printing money. In late 2025, the company hit a record $57 billion in quarterly revenue. Think about that. Most of that—over $51 billion—came just from selling chips to data centers.

By the first week of January 2026, Nvidia became the first company to hit a $4 trillion market cap. It even hopped over Apple and Microsoft in the process. When you look at a 12-month graph of the tech sector, Nvidia’s line is basically a vertical rocket ship compared to the rest of the pack.

The Surprising Winners Nobody Talked About

While everyone was obsessed with AI, some "boring" sectors quietly did a lot of the heavy lifting.

- Cyclical Stocks: As the U.S. economy proved it wasn't going into a recession, sectors tied to the middle-income consumer started to rally.

- Energy and Materials: These were volatile, especially with the news of mining giant Rio Tinto trying to merge with Glencore in early 2026, but they provided a much-needed hedge when tech felt too expensive.

- The "Equal-Weight" Surprise: Interestingly, the Invesco S&P 500 Equal Weight ETF (RSP) actually outperformed the tech-heavy versions of the index during certain months in 2025. This happens when the "average" company does better than the giants like Google or Meta.

Breaking Down the Numbers

Let's look at the raw data for the S&P 500 over this period:

✨ Don't miss: Payroll Take Home Pay Calculator: Why Your Check Never Looks Like Your Salary

- January 2025: The index was sitting around 6,118.

- April 2025 (The Low Point): It dipped all the way down to 4,982. That was the "danger zone" where people started panic-selling.

- October 2025: A recovery to 6,671 as AI adoption moved from "hype" to "actual corporate earnings."

- January 2026: We are currently hovering around 6,940, hitting new records.

The total return for the last 12 months is roughly 13.4% to 16% depending on dividends. It’s a solid gain, but it’s definitely lower than the 25% we saw back in 2024.

Why the "January Effect" Is Kinda Messy This Year

There’s an old saying on Wall Street: "As goes January, so goes the year."

In 2026, January has been incredibly strong. The Dow and S&P 500 have already set new closing records in the first two weeks. We saw a 1.6% jump in just five sessions.

But be careful. Historical data shows that while a positive January usually leads to a positive year (about 82% of the time), it’s not a guarantee. In 2025, we had a decent January, but then that 20% correction in February caught everyone off guard. Don't let a green line on a graph today make you think the rest of 2026 will be a straight shot up.

The "One Big Beautiful Bill" and Tariffs

Politics played a huge role in the shape of that graph.

The "One Big Beautiful Bill Act" passed in late 2025 provided a massive fiscal stimulus. It included corporate tax deductions that helped boost earnings reports in the fourth quarter. However, the market also had to digest new tariffs. In December 2025, President Trump authorized Nvidia to sell advanced H200 chips to China, but with a catch—the U.S. government now takes a 25% cut of those revenues.

This mix of deregulation and protectionism has created a "bumpy" graph. It’s not the smooth curve of the 2010s. It’s a series of sharp reactions to Truth Social posts and surprise jobs reports.

Actionable Insights for Your Portfolio

So, what do you actually do with this information?

👉 See also: Cost of Apple Shares: Why the Market is Acting So Weird Right Now

- Check your concentration. If your "last 12 months" performance looks exactly like Nvidia's, you aren't diversified. You're just lucky. If AI spending slows down (and Goldman Sachs predicts it might decelerate this year), you're going to feel it.

- Watch the 10-Year Yield. The 10-year Treasury yield is currently around 4.19%. Some experts think it will drop below 3.5% by the end of 2026. If that happens, growth stocks usually get a second wind.

- Look for Value. After a huge run-up in mega-cap tech, "Value" stocks—companies that are actually profitable but trade at lower multiples—are looking a lot more attractive.

- Don't ignore the "January Barometer," but don't bet the house on it. Use the current momentum to trim some winners and rebalance into sectors like Industrials or Financials that benefit from a "neutral" interest rate environment.

The biggest lesson from the stock market last 12 months graph is that resilience matters more than timing. The people who made the most money over the last year weren't the ones who timed the bottom in April; they were the ones who didn't sell when the line started heading south.

Check your asset allocation today. Make sure you have enough cash on hand so that if another "April 2025" style correction happens, you're buying the dip instead of fearing the crash. Look at your sector weights and ensure you aren't over-leveraged in just one theme, no matter how "revolutionary" it feels.