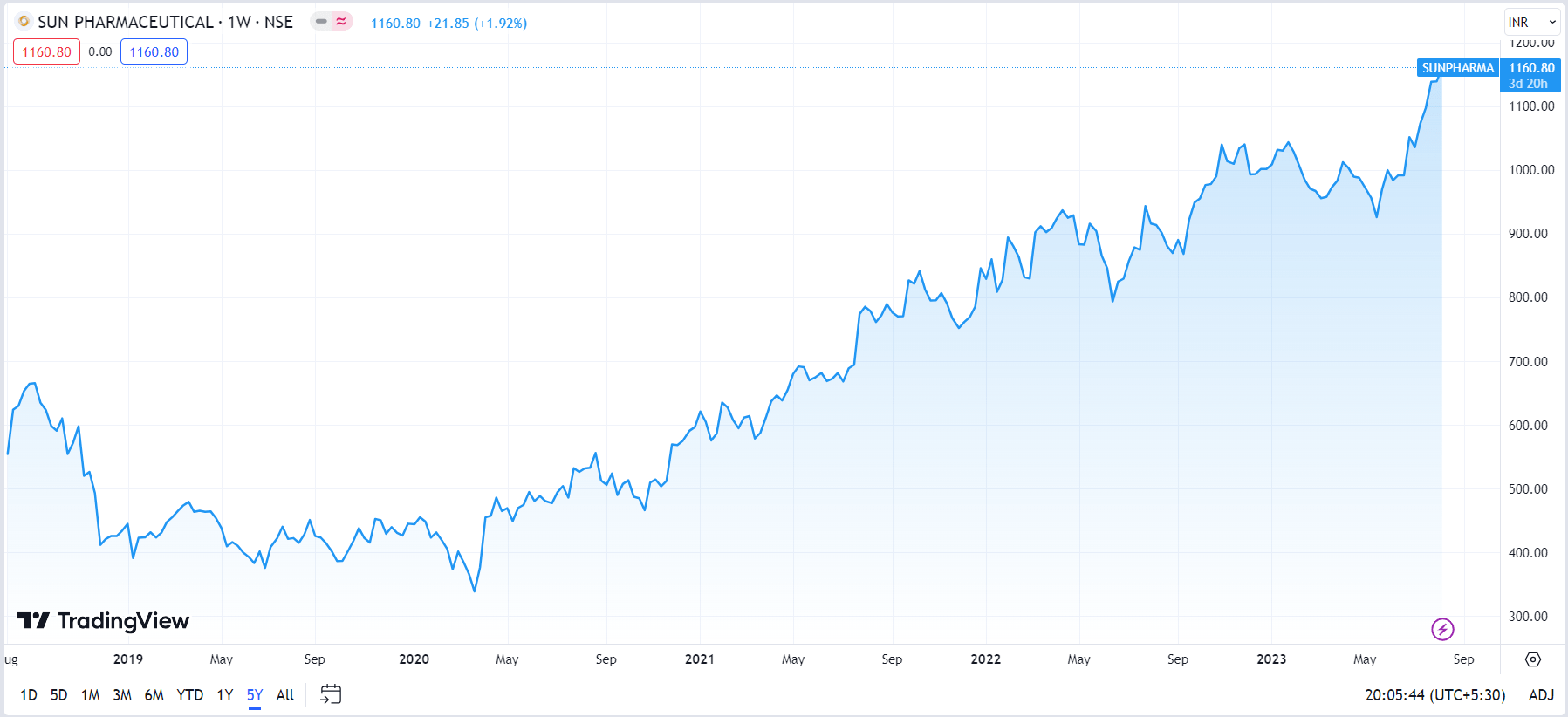

You’ve probably seen the tickers flashing red or green, but the Sun Pharma share value is doing a lot more than just bouncing around on a screen. Honestly, if you're looking at the ₹1,668.90 price tag from mid-January 2026 and thinking it’s just another "buy the dip" moment, you might be missing the bigger picture. This isn't just a generic drug maker anymore. It's a complex machine that's currently wrestling with US regulators while simultaneously trying to dominate the global obesity market.

Markets are weird right now. One day everyone is shouting about Trump’s potential 100% tariffs on patented drugs, and the next, they're piling back into pharma stocks because the valuation looks "cheap" compared to the Nifty. But let’s get real. Sun Pharma has been a bit of a rollercoaster lately.

The Recent Slide and the Baska Factor

Why did the stock drop nearly 3% in a single day recently? Two words: Baska facility.

The US FDA basically slapped a "Official Action Indicated" (OAI) status on Sun’s Baska plant in Gujarat after an inspection in late 2025. In the world of pharma, an OAI is like a yellow card in soccer. It doesn't mean the game is over, but the ref is watching every single move you make. Sun says they’re still shipping approved drugs to the US, but investors hate uncertainty.

When a facility gets OAI status, new drug approvals from that site usually get stuck in the mud. That’s why we saw the Sun Pharma share value tumble from the ₹1,780 levels down to where it sits now. It’s a classic case of regulatory friction slowing down a high-performance engine.

💡 You might also like: Memphis Cash & Carry: Why This Local Secret Still Matters

Is the P/E Ratio Lying to You?

Sun Pharma is currently trading at a Price-to-Earnings (P/E) ratio of around 37 to 38. To put that in perspective, the broader sector is often hovering closer to 22.

- Premium Pricing: Is it overvalued? Some say yes.

- Specialty Growth: Others argue you’re paying for the "specialty" portfolio—think Ilumya and Cequa—which have much better margins than boring old generics.

- Taro Integration: They finally finished buying out the rest of Taro for about $348 million, which simplifies the books but also means they own all the risks in the US dermatology space.

If you just look at the raw numbers, the return on equity is around 14%. That's solid, but not "world-beating" compared to some high-growth tech firms. But pharma is a defensive play. People need medicine whether the economy is booming or crashing.

The GLP-1 Gold Rush

Here’s the thing nobody was talking about five years ago: obesity.

Sun Pharma’s Managing Director, Kirti Ganorkar, has been pretty vocal about GLP-1 receptor agonists (the fancy name for weight-loss and diabetes drugs) being the next big growth engine. India is quickly becoming a hub for these treatments. Sun is pouring billions into R&D—we’re talking a cumulative target of ₹320 billion.

They aren't just making copies of Ozempic; they are pushing their own innovative pipeline. If they land a hit in the obesity or chronic dermatology space, that ₹1,668 share price might look like a bargain in retrospect.

What the Analysts Are Actually Saying

I’ve been digging through the latest brokerage reports from January 2026. The consensus is still surprisingly bullish, despite the FDA headaches.

| Firm | Outlook | Target Price |

|---|---|---|

| Emkay | Buy | ₹2,400 |

| ICICI Securities | Buy | ₹1,895 |

| BOB Capital | Buy | ₹2,086 |

| Average Consensus | Moderate Buy | ₹1,964 |

There's a massive gap between the low-end forecasts (around ₹1,570) and the high-end ones. That gap represents the "risk" of more FDA warnings versus the "reward" of their specialty drug sales taking off.

Why the US Market is a Double-Edged Sword

The US is Sun’s biggest market, accounting for about 45% of its sales. But it’s also its biggest headache. Beyond the FDA audits, there's the "GUARD" and "GLOBE" pricing models being proposed in Washington. Basically, the US government wants to pay "most favored nation" prices—meaning if a drug is cheap in Europe, they want it cheap in the US too.

Since Sun has the highest exposure to branded pharmaceuticals among its Indian peers, it’s more vulnerable to these price caps. It's a bit of a catch-22. You want the high margins of branded drugs, but those are exactly what the politicians are targeting.

Putting it All Together

So, what should you actually do?

The Sun Pharma share value isn't going to double overnight. It’s a slow-burn story. If you're a day trader, the volatility around FDA announcements is a nightmare. But if you’re looking at a 2-to-3-year horizon, you’re betting on Dilip Shanghvi’s ability to pivot the company from a generic powerhouse to a global specialty player.

Next Steps for Investors:

- Monitor the Baska Remediation: Watch for any updates on the OAI status. If the FDA moves it to VAI (Voluntary Action Indicated), the stock will likely pop.

- Track Specialty Sales: Every quarterly report lists "Global Specialty Sales." If this number isn't growing at double digits, the premium P/E ratio isn't justified.

- Watch the Dividend: They recently declared an interim dividend of ₹10.5. It's not a massive yield (less than 1%), but it shows the cash flow is healthy.

- Set Alerts for 1,550: Technically, ₹1,550 to ₹1,580 has been a strong support zone. If it hits that level without a new disaster, it’s historically been a decent entry point.

The company is fundamentally strong with a debt-to-equity ratio of almost zero (0.03). It’s not going anywhere. Just don't expect a smooth ride while the regulators are in town.