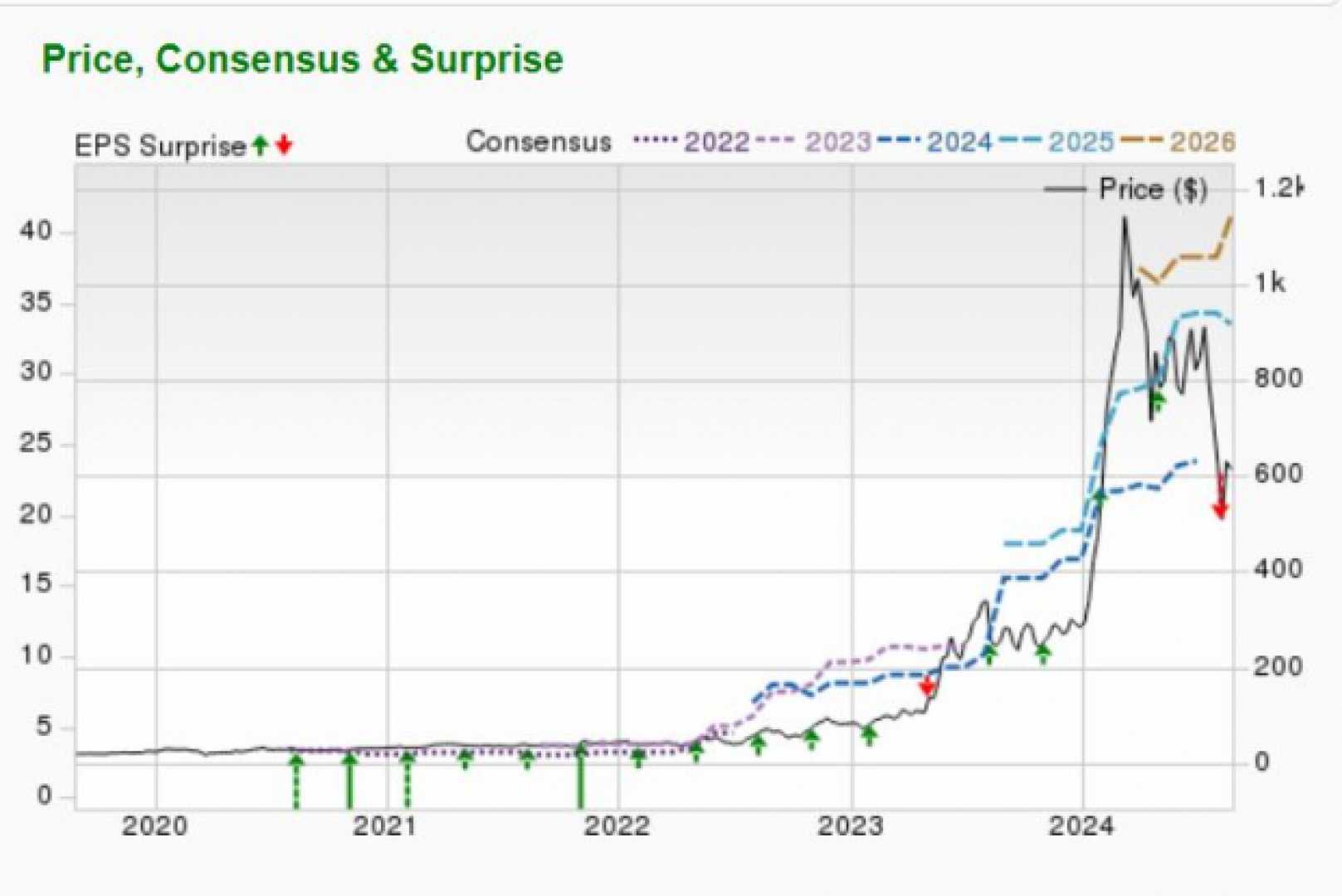

If you’ve spent any time watching the ticker for Super Micro Computer Inc stock price lately, you know it’s been a total rollercoaster. Honestly, calling it a "rollercoaster" might be an understatement. It’s more like a bungee jump where nobody is quite sure how long the cord is.

One day, the stock is up 5% because of some hype around liquid cooling or a massive order of Nvidia Blackwell chips. The next? It’s cratering because an analyst at Goldman Sachs decided the profit margins look like a leaky bucket.

As of mid-January 2026, the price is hovering around that $29 mark.

🔗 Read more: Chase Bank Fraud Protection Number: What to Call and When to Panic

It's a weird spot to be in. Just a couple of years ago, SMCI was the undisputed darling of the AI world, outperforming even the likes of Nvidia for a hot minute. Now, investors are basically squinting at their screens, trying to figure out if this is a bargain-bin deal or a falling knife.

Why Super Micro Computer Inc stock price feels so erratic right now

The drama isn't just about the numbers. It’s about trust.

You might remember the absolute chaos back in late 2024 and 2025. Hindenburg Research dropped that short report alleging "accounting red flags," and the auditor, EY, famously jumped ship. That pushed the company to the brink of a Nasdaq delisting.

They managed to get a reprieve, hiring BDO as the new auditor and scrambling to meet filing deadlines. But that kind of trauma doesn't just go away. Even though an independent committee eventually said, "Hey, we didn't find actual fraud," the market has a long memory.

The Super Micro Computer Inc stock price is currently reflecting a "show me" phase. Investors aren't just looking for revenue growth anymore—they want to see if the internal controls are actually solid.

The margin squeeze nobody wants to talk about

Here is the thing: SMCI is selling a ton of servers. Like, a massive amount. They’re looking at a revenue target of roughly $36 billion for fiscal 2026.

But there’s a catch. To keep that market share away from giants like Dell and HPE, Supermicro has been getting aggressive. Maybe too aggressive.

- Gross margins have tumbled from a healthy 13% down to about 9.3%.

- Competition is getting fierce as Dell and HPE finally wake up to the AI server demand.

- Costs associated with scaling up production and supporting new liquid-cooled designs are eating into the bottom line.

Basically, they are moving more boxes but keeping less of the cash. Goldman Sachs analyst Katherine Murphy recently slapped a "sell" rating on the stock with a $26 price target, specifically citing this "limited visibility into profitability." It's hard to get excited about record sales if the profit per sale is getting thinner every quarter.

The Nvidia connection: A blessing and a curse

Supermicro's biggest flex has always been their relationship with Jensen Huang and the team at Nvidia. They get the latest chips—like the Blackwell B300 and GB300—into their server racks faster than almost anyone else.

This "first-to-market" advantage is why they’ve seen design wins exceeding $12 billion recently.

📖 Related: Apply for Supplemental Security Income: What Most People Get Wrong About the Process

But being tethered to Nvidia means you're at the mercy of their supply chain. If there’s a delay in chip delivery, SMCI’s quarterly revenue takes a hit. We saw this happen in late 2025 when some customer orders got pushed back, causing the stock to tank after an earnings miss.

It’s a high-stakes game. You’ve got to be fast, but if you stumble, the market is ready to pounce.

What the bulls are saying (and why they might be right)

Despite the gloom, there’s a reason SMCI still has a vocal group of supporters. The valuation is, frankly, kind of nuts for a high-growth tech stock.

It’s currently trading at a forward P/E ratio of around 13x or 14x. For context, the rest of the computer technology sector is usually up in the 20s. If Supermicro can actually hit its fiscal 2027 earnings targets—some analysts think they could hit $2.99 per share—the stock looks incredibly cheap at under $30.

Also, they are the leaders in liquid cooling. As AI data centers get hotter and more power-hungry, traditional fans just won't cut it. CEO Charles Liang has been shouting from the rooftops that 30% of new data centers will need liquid cooling within the next year. If he’s right, Supermicro is sitting on a goldmine of proprietary tech that Dell and HPE are still trying to replicate at scale.

💡 You might also like: 469 7th Ave NYC: Why This Garment District Anchor Still Commands Attention

Actionable steps for the cautious investor

If you're looking at the Super Micro Computer Inc stock price and wondering whether to pull the trigger, you need a plan that doesn't involve pure gambling.

- Watch the February 25 deadline. This is the big "make-it-or-break-it" moment for their financial filings. If they miss this or have to restate old numbers, expect a lot of pain. If they pass, it could be a massive relief rally.

- Monitor the gross margin trend. Don't just look at the top-line revenue. If the margin drops below 9%, the "growth at any cost" strategy might be failing.

- Check the Blackwell rollout. Follow the news on Nvidia’s shipping schedules. Since SMCI is a "pure play" on AI servers, their fate is tied to those shipments more than any other hardware company.

- Size your position for volatility. This isn't a "set it and forget it" index fund. If you’re going to play, expect 5-10% swings in a single day.

Ultimately, the Super Micro Computer Inc stock price is a battleground between those who see a broken company and those who see a misunderstood giant. It’s a classic high-risk, high-reward scenario. Just make sure you aren't the last one holding the bag if the margins don't recover.

The next few months will likely define the company's trajectory for the rest of the decade. Either they solidify their spot as the nimble king of AI infrastructure, or they get squeezed into irrelevance by the old-guard hardware titans. Keep your eyes on those SEC filings and the margin numbers—that's where the real story is hidden.

Next Steps:

- Review the latest 8-K filings on the Supermicro Investor Relations page to see if there are any updates on the auditor's progress before the February deadline.

- Compare SMCI’s forward P/E against Dell and HPE to see if the valuation discount still justifies the risk.

- Listen to the upcoming Q2 2026 earnings call specifically for management's commentary on liquid cooling adoption rates.