Tax season hits differently when the numbers actually shift. Honestly, most people just assume the government takes a flat chunk of their change and calls it a day. That’s not how it works. For the tax brackets 2024 IRS release, we saw some of the most significant inflationary adjustments in decades. It wasn't just a minor tweak. The IRS bumped the brackets up by about 7.1% to prevent "bracket creep," which is basically a fancy way of saying they didn't want you paying higher taxes just because your boss gave you a cost-of-living raise.

It’s weirdly personal. You work hard, you get a 3% raise, and suddenly you’re staring at a tax bill that eats the whole gain. That sucks. To stop that, the IRS shifts the goalposts every year based on the Consumer Price Index. For 2024—the taxes you’re likely filing or thinking about right now—those goalposts moved quite a bit.

How the Tax Brackets 2024 IRS Shifts Actually Function

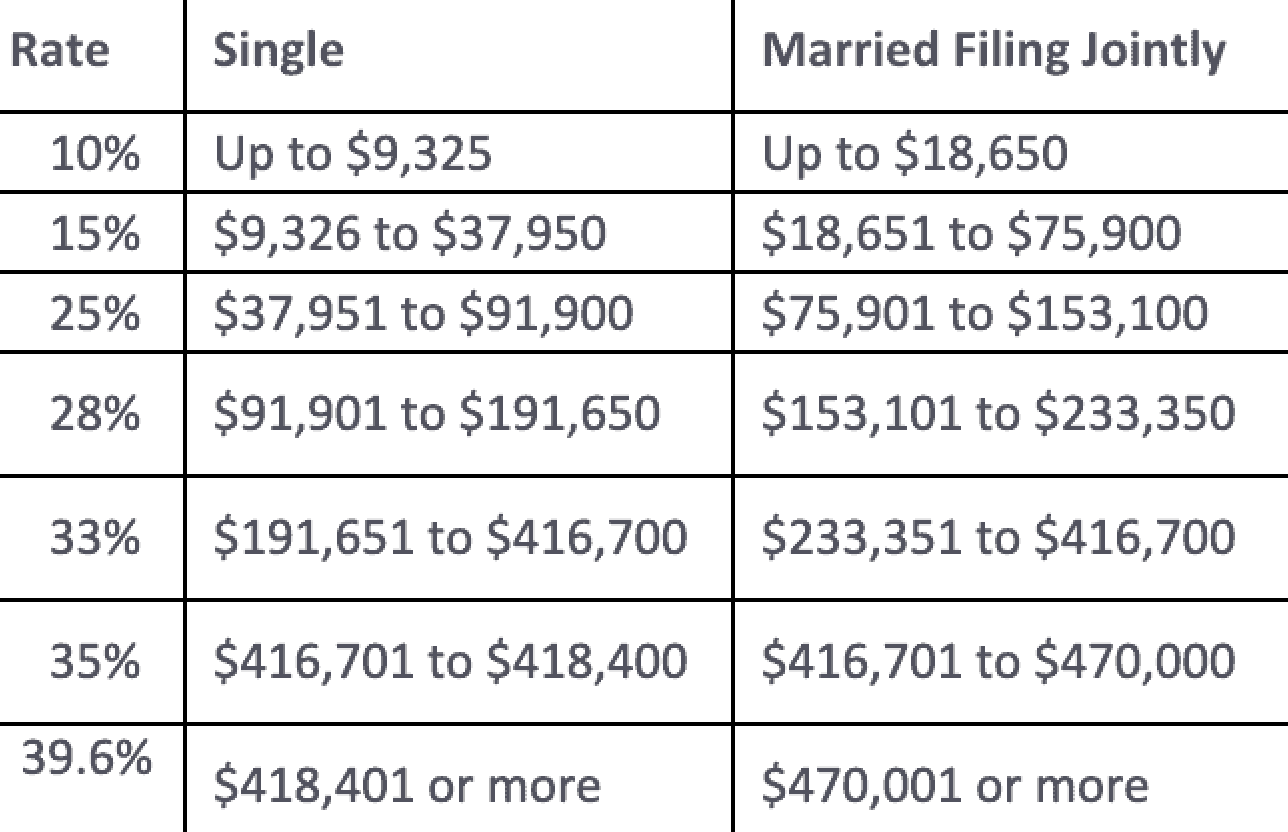

Here’s the deal. We have a progressive tax system. You don't just "hit" a bracket and pay that rate on everything you earned. That is a massive misconception that keeps people from taking overtime. I’ve heard people say, "I don't want the raise because it puts me in a higher bracket and I’ll take home less money."

That is almost never true.

Let’s look at a single filer. In 2024, the lowest 10% rate applies to the first $11,600 you make. If you earn $11,601, only that one extra dollar is taxed at 12%. The first $11,600 is still taxed at 10%. See how that works? It’s a ladder. You only pay the higher rate on the "overflow" into the next bucket.

For 2024, the IRS set seven specific rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

If you're filing as a married couple, those ranges are way wider. For instance, the 22% bracket for married couples filing jointly starts at $94,301 and goes all the way up to $201,050. If you’re single, that same 22% rate kicks in much earlier, at $47,151. It’s a massive gap.

The Standard Deduction is the Real Hero

Most people obsess over the brackets, but the standard deduction is what actually keeps your taxable income low. For 2024, the IRS raised this to $14,600 for single filers. If you're married and filing jointly, it’s a whopping $29,200.

Think about that.

If you and your spouse made $100,000 together, you aren't actually taxed on $100,000. You subtract that $29,200 right off the top. Now you’re only being taxed on $70,800. That’s a huge difference. It basically moves you down a whole "rung" on the tax ladder. Heads of households get a bit of a middle ground here, with a standard deduction of $21,900 for 2024.

The 24% Trap and Why It Matters

There is a weird jump in the American tax system. Most of the jumps are incremental—10% to 12%, for example. But then you hit the 22% and 24% brackets. These are the "middle class" brackets where most professional earners live.

In the tax brackets 2024 IRS update, the 24% bracket for individuals starts at $100,526. If you're a high-earner in a city like Chicago or Charlotte, you’re probably dancing right on the edge of this.

Why do I call it a trap? Because once you pass the 24% mark, the next jump is to 32%. That’s an 8% increase in one go. That’s where it starts to hurt. People earning between $191,950 and $243,725 (single) are in that 32% zone. If you find yourself in this range, you really need to be looking at 401(k) contributions or Health Savings Accounts (HSAs) to drag your taxable income back down into the 24% territory.

Tax Brackets for 2024 vs. 2023: What Changed?

It’s actually kinda cool how much the IRS moved the needle this time. In 2023, the 12% bracket for singles capped out at $44,725. For 2024, that same bracket goes up to $47,150.

What does that mean for your wallet?

It means about $2,425 of your income that would have been taxed at 22% last year is now being taxed at only 12%. That’s a 10% tax savings on that specific chunk of money. It might only be a few hundred bucks in your pocket, but hey, that’s a car payment or a nice dinner out. These adjustments are designed to keep the "real" value of your income steady even as prices for eggs and gas go up.

Capital Gains and the "Other" Tax Brackets

We can't talk about the tax brackets 2024 IRS rules without mentioning investments. If you sold stock or crypto in 2024, you aren't necessarily paying those 10% to 37% rates. You're likely dealing with Long-Term Capital Gains rates.

These are much friendlier.

If your total taxable income is below $47,025 (as a single person), your capital gains rate is actually 0%. Yes, zero. You could sell a stock you’ve held for over a year, make a profit, and pay nothing to the IRS if your total income is low enough. For most people, the rate is 15%. Only the very wealthy—those making over $518,900—hit the 20% capital gains mark.

Don't Forget the Marginal vs. Effective Rate

This is where people get tripped up. Your "marginal" rate is the highest bracket you touched. If you’re a single person making $60,000, your marginal rate is 22%.

📖 Related: Do Credit Cards Require a PIN? What Most People Get Wrong About Security

But you aren't paying 22% of $60,000.

Your "effective" rate is the actual percentage of your total income that goes to the IRS. After the standard deduction and the lower brackets are filled, that $60,000 earner might only be paying an effective rate of around 10% or 11%. If you're looking at your tax return and feeling depressed, look for the effective rate. It’s usually much lower than the scary number you see in the news headlines.

Credits vs. Deductions: The 2024 Reality

While brackets dictate the rate, credits and deductions dictate the balance. The Child Tax Credit remains a massive factor for 2024. It’s generally $2,000 per qualifying child.

Note the difference: A deduction (like the standard deduction) lowers the income you’re taxed on. A credit (like the Child Tax Credit) is a dollar-for-dollar reduction in the tax you owe.

If the IRS says you owe $5,000 and you have two kids, you now owe $1,000. That is way more powerful than a deduction. For 2024, the refundable portion of the Child Tax Credit—the part you get back even if you owe zero taxes—increased to $1,700.

Actionable Steps for the 2024 Tax Year

Understanding the tax brackets 2024 IRS structure is only half the battle; you have to actually use the info. If you haven't filed yet or are planning for the rest of the year, there are specific moves to make.

First, check your withholding. If you got a big raise in 2024, the new brackets might mean you’re overpaying or underpaying. Use the IRS Tax Withholding Estimator. It’s a clunky tool, honestly, but it’s accurate. Adjusting your W-4 at work can put more money in your monthly paycheck instead of waiting for a refund in 2025.

Second, max out your traditional IRA or 401(k) if you're close to a bracket "jump." If you're $2,000 into the 32% bracket, putting $2,000 into a traditional 401(k) effectively "hides" that money from the IRS this year, saving you $640 in taxes immediately.

Third, keep an eye on the Earned Income Tax Credit (EITC). For 2024, the maximum credit for low-to-moderate-income filers with three or more children is $7,830. That’s a life-changing amount of money for some families.

👉 See also: Pound in Pakistani Rs: Why the Rate Is Moving This Way

Finally, look at your state taxes. These federal brackets don't apply to your state return. Some states have a flat tax, others have their own progressive brackets, and some (like Florida or Texas) have no income tax at all. Your total tax burden is a cocktail of all these different rules.

The 2024 tax year is defined by these wider, inflation-adjusted brackets. It’s a rare moment where the IRS rules actually worked in favor of the taxpayer’s purchasing power.

Final Checklist for 2024 Filing

- Verify your filing status; "Head of Household" often saves more than "Single" if you have dependents.

- Gather all 1099 and W-2 forms to ensure you aren't missing income that could trigger an audit.

- Check if you qualify for the increased 2024 Standard Deduction before trying to itemize; most people—about 90%—are better off taking the standard.

- Use tax software or a CPA to double-check "above-the-line" deductions like student loan interest or educator expenses, which you can take even if you don't itemize.