You’ve worked decades. You paid in. Now, you finally get that check, only to realize the IRS might want a piece of it back. It feels wrong, doesn't it? Honestly, the biggest shock for most new retirees isn't the cost of healthcare—it’s finding out their "tax-free" retirement income isn't actually tax-free.

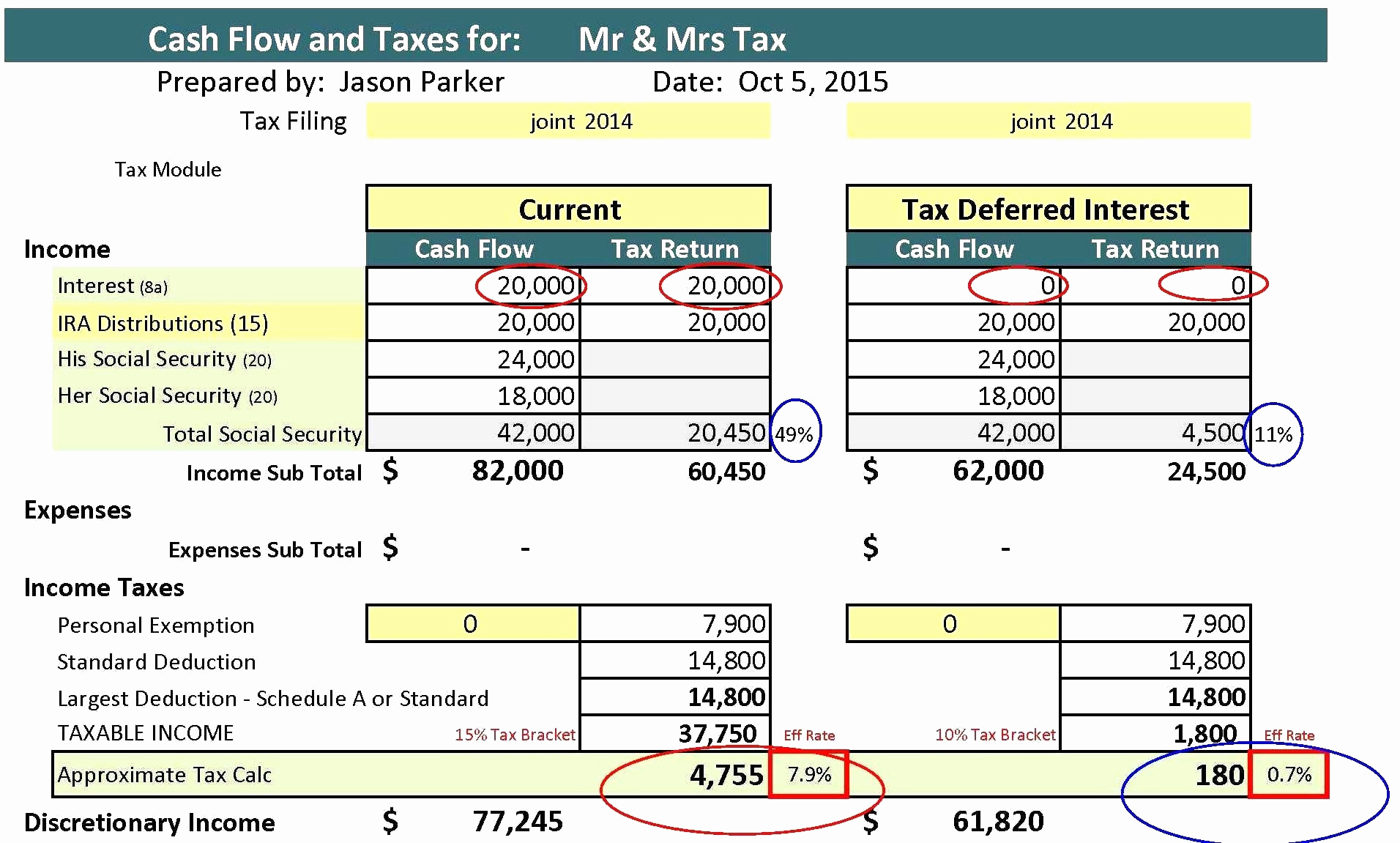

Basically, if you have other income—like a part-time job, a pension, or those 401(k) withdrawals—you might be looking at a surprise bill. Using a tax on social security calculator can help you avoid that "oops" moment in April. But you have to know what numbers to feed it.

The math isn't straightforward. It’s not just your "income." The IRS uses something called combined income.

How the Math Actually Works (It’s Weird)

To figure out if you owe, you can’t just look at your W-2 or your 1099. You need to calculate your "provisional income." Here is the formula the IRS uses:

Your Adjusted Gross Income (AGI) + Nontaxable Interest + 50% of your Social Security benefits.

If that total stays under $25,000 for individuals or $32,000 for married couples filing jointly, you're usually in the clear. Zero federal tax.

💡 You might also like: S\&P 500 Close Today: Why the Market Finally Snapped Its Losing Streak

But once you cross those lines? Things get sticky.

If you're single and make between $25,000 and $34,000, up to 50% of your benefits could be taxed. Go over $34,000, and up to 85% of that check is fair game for Uncle Sam. For married couples, the 50% bracket is $32,000 to $44,000. Above $44,000? Again, 85% is the max.

One thing to keep in mind: The IRS doesn't take 85% of your check. They just count 85% of the amount as taxable income. You then pay your regular tax rate on that portion.

The "Tax Torpedo" is Real

Financial planners call it the "tax torpedo." It happens because as your income rises, you aren't just paying tax on the new money—you're also triggering taxes on more of your Social Security. It’s a double whammy.

Imagine you take an extra $1,000 out of your IRA. That $1,000 might actually cost you way more than your 12% or 22% bracket suggest, because it suddenly makes $500 or $850 of your Social Security benefits taxable too.

Why 2026 is Different

The rules haven't changed much in decades, which is actually the problem. These income thresholds—the $25k and $32k marks—haven't been adjusted for inflation since 1983. Back then, very few people paid tax on benefits. Now? More than half of beneficiaries do.

However, 2026 brings some state-level shifts. For example, West Virginia has finally finished phasing out its tax on Social Security. If you live there, your state tax return just got a lot simpler (and cheaper).

As of right now, only eight states still tax Social Security to some degree:

🔗 Read more: Pornhub Earnings: What Most People Get Wrong About the Payouts

- Colorado

- Connecticut

- Minnesota

- Montana

- New Mexico

- Rhode Island

- Utah

- Vermont

Each of these has its own weird rules. In Colorado, if you're 65 or older, you can usually subtract your full Social Security amount from your taxable income anyway. In Minnesota, the thresholds are much higher than the federal ones, so middle-income earners often escape the state hit.

Using the Calculator Effectively

Don't just plug in your monthly check and call it a day. To get an accurate result from a tax on social security calculator, you need three specific things:

- Your SSA-1099: This shows exactly what you received last year.

- Your 1099-INT: Don't forget that "tax-exempt" municipal bond interest. The IRS still counts it for this specific calculation.

- Your Required Minimum Distributions (RMDs): If you're over 73, you have to take money out of your traditional IRA or 401(k). This is the biggest "gotcha" that pushes people into the 85% taxable tier.

Can You Avoid the Tax?

You can't change the law, but you can change your strategy. Honestly, most people just accept the tax as a fact of life, but a little planning goes a long way.

Roth Conversions

If you haven't started taking Social Security yet, consider moving money from a Traditional IRA to a Roth IRA. Why? Because Roth withdrawals don't count toward your combined income. If your "income" on paper is lower, your Social Security stays untaxed.

Qualified Charitable Distributions (QCDs)

If you're already 70½ or older and you give to charity, don't write a check from your bank account. Use a QCD. This sends money directly from your IRA to the charity. The money never hits your AGI, so it doesn't trigger the Social Security tax.

Withholding

If you know you're going to owe, don't wait for a surprise in April. You can file Form W-4V with the Social Security Administration. You can ask them to withhold 7%, 10%, 12%, or 22% of your monthly payment for federal taxes. It’s way less painful than a lump sum later.

Actionable Next Steps

Start by grabbing your most recent tax return. Look at your AGI. Then, do a quick "back of the napkin" calculation using the formula above.

If you find yourself right on the edge of the $25,000 or $32,000 thresholds, talk to a tax pro before December 31st. A small change in how you take your year-end distributions could save you thousands.

Check your state’s specific rules for 2026. If you're in one of the eight states that still tax benefits, look into their specific age-based exemptions. Many offer a "subtraction" that wipes out the tax for anyone over 65, even if the federal government still takes their cut.