Honestly, looking at the tesla motors stock history is like watching a decade-long fever dream. It’s not just a line on a chart. It’s a saga of "production hell," flamethrowers, tweets that cost billions, and a company that almost went bankrupt more times than Elon Musk would probably like to admit.

If you bought in at the IPO back in 2010, you aren't just an investor. You're a survivor.

The $17 Gamble: 2010 to 2013

When Tesla went public on June 29, 2010, the ticker TSLA opened at a humble $17.00. Back then, they weren't even "Tesla Inc." yet—they were Tesla Motors. They had one car, the original Roadster, which was basically a Lotus Elise stuffed with laptop batteries.

Wall Street was skeptical. Most analysts figured they’d be swallowed up by Ford or GM within three years.

🔗 Read more: U.S. Steel Edgar Thomson: Why This Mon Valley Legend Still Refuses to Rust

Then came 2013. This was the year everything changed. Tesla reported its first-ever quarterly profit. The stock price, which had been flat-lining for years, suddenly woke up. It jumped from around $30 to over $150 in months. Short sellers—people betting the company would fail—got absolutely crushed. It was the first of many "short squeezes" that would define the stock's volatility.

Model 3 and the "Production Hell" Era

Fast forward to 2017. Tesla officially dropped "Motors" from its name. They were a tech company now. An energy company. But the stock was a mess because of the Model 3.

Elon Musk famously called this period "production hell." The company was burning cash like it was going out of style. In 2018, the stock was swinging wildly every time Musk tweeted. Remember the "funding secured" tweet? That $420 price point he mentioned (partly as a joke, partly as a serious threat to take the company private) led to a massive SEC lawsuit and a $20 million fine.

💡 You might also like: How Much is 2 in US Dollars? Why the Simple Answer is Just the Start

- 2018 Low: Shares dipped toward $250 (pre-split).

- The Narrative: Critics said Tesla would run out of money in weeks.

- The Reality: They squeezed through by the skin of their teeth.

The Great Vertical Climb: 2020 and Beyond

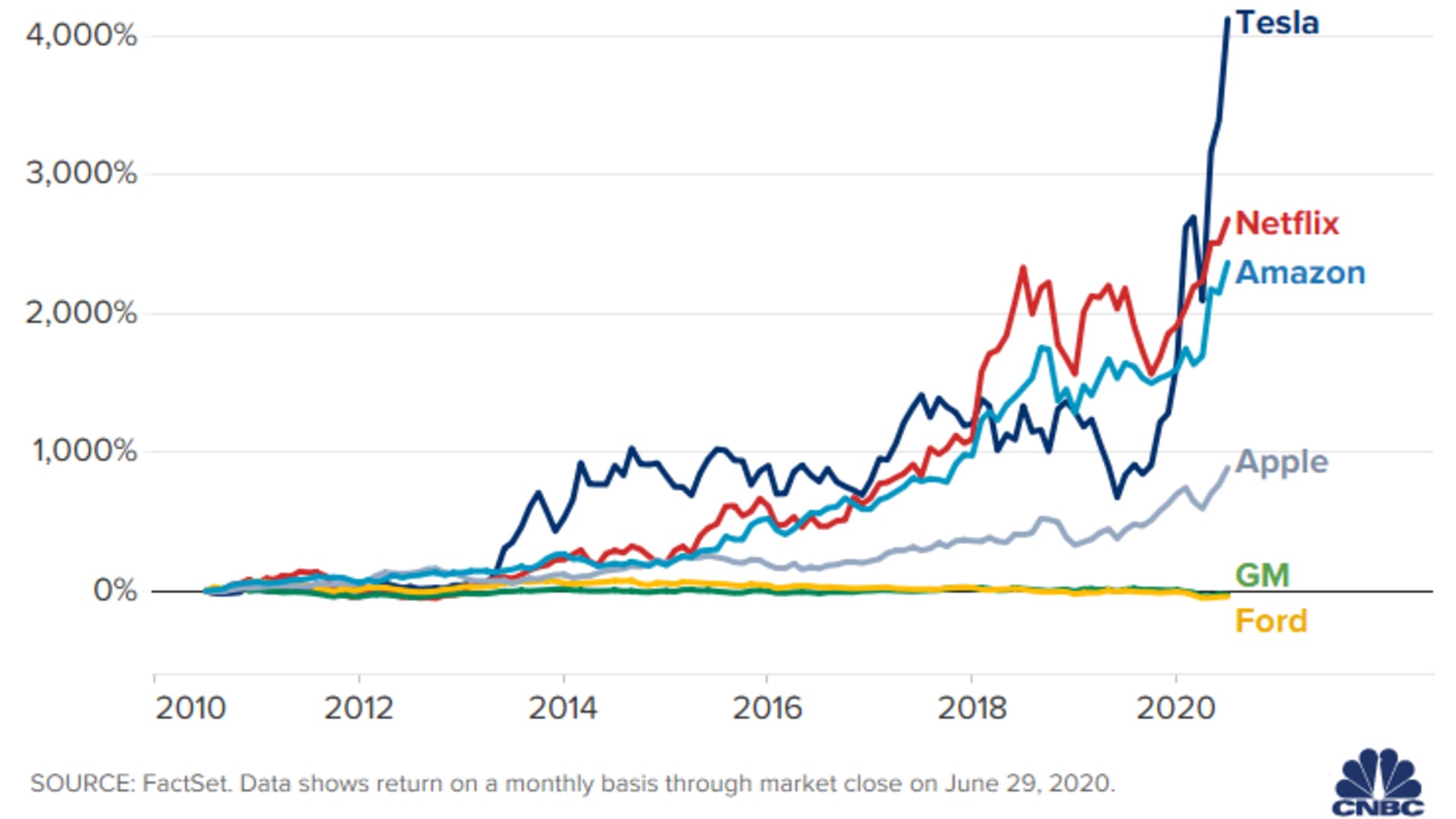

If 2019 was about survival, 2020 was about total domination. The stock didn't just go up; it went vertical.

Basically, three things happened at once. First, the Shanghai Gigafactory started pumping out cars ahead of schedule. Second, Tesla finally proved it could make a profit consistently. Third, they were finally added to the S&P 500 in December 2020.

Because of the meteoric rise, Tesla executed a 5-for-1 stock split in August 2020. This made the shares look "cheaper" to retail investors, even though the company's value stayed the same. By the end of 2020, the stock had surged over 700%.

The Trillion-Dollar Club and the 2022 Hangover

In October 2021, Tesla hit a $1 trillion market cap. It was a milestone few thought possible. Hertz announced a massive order for 100,000 cars, and the stock price flew past $1,000 (pre-split).

But 2022 brought everyone back to earth. Rising interest rates and Musk's acquisition of Twitter (now X) sent the stock into a tailspin. By the end of that year, Tesla had lost nearly 65% of its value. It was a brutal reminder that even giants can bleed.

Where We Are Now (2024-2026)

As of early 2026, the tesla motors stock history has entered a "mature" but still chaotic phase. The days of 700% annual gains are likely over, replaced by a focus on AI, the Optimus robot, and Full Self-Driving (FSD) tech.

The stock has seen a recovery from the 2024 lows, often trading in a range between $400 and $480. However, competition from Chinese manufacturers like BYD and a cooling EV market have kept the "perma-bulls" on their toes.

✨ Don't miss: Is Phil Knight Still Alive? What the Nike Legend is Doing in 2026

Actionable Insights for Investors

If you're looking at Tesla today, you've gotta understand it's no longer just a car company. It's a bet on autonomy.

- Watch the Margins: Don't just look at how many cars they sell. Look at how much profit they make per car. If they keep cutting prices to fight competition, the stock usually suffers.

- The "Musk Risk": Musk’s attention is split between SpaceX, X, and xAI. Any major shift in his focus or personal brand directly impacts TSLA’s ticker.

- Mind the Splits: Tesla has done two major splits (5-for-1 in 2020 and 3-for-1 in 2022). When looking at historical charts, always make sure you're looking at split-adjusted prices or you'll get very confused by the "drops."

Basically, don't put money in Tesla if you have a weak stomach. It’s a high-beta stock, meaning it moves way more than the general market. It’s been a goldmine for some and a nightmare for others.

To get a real sense of where the price might head next, your best move is to dig into the quarterly Letter to Shareholders. That's where they hide the real data on battery cost reductions and FSD take rates. Start by comparing the last three quarters of "Automotive Gross Margin" to see if the downward trend is finally reversing.