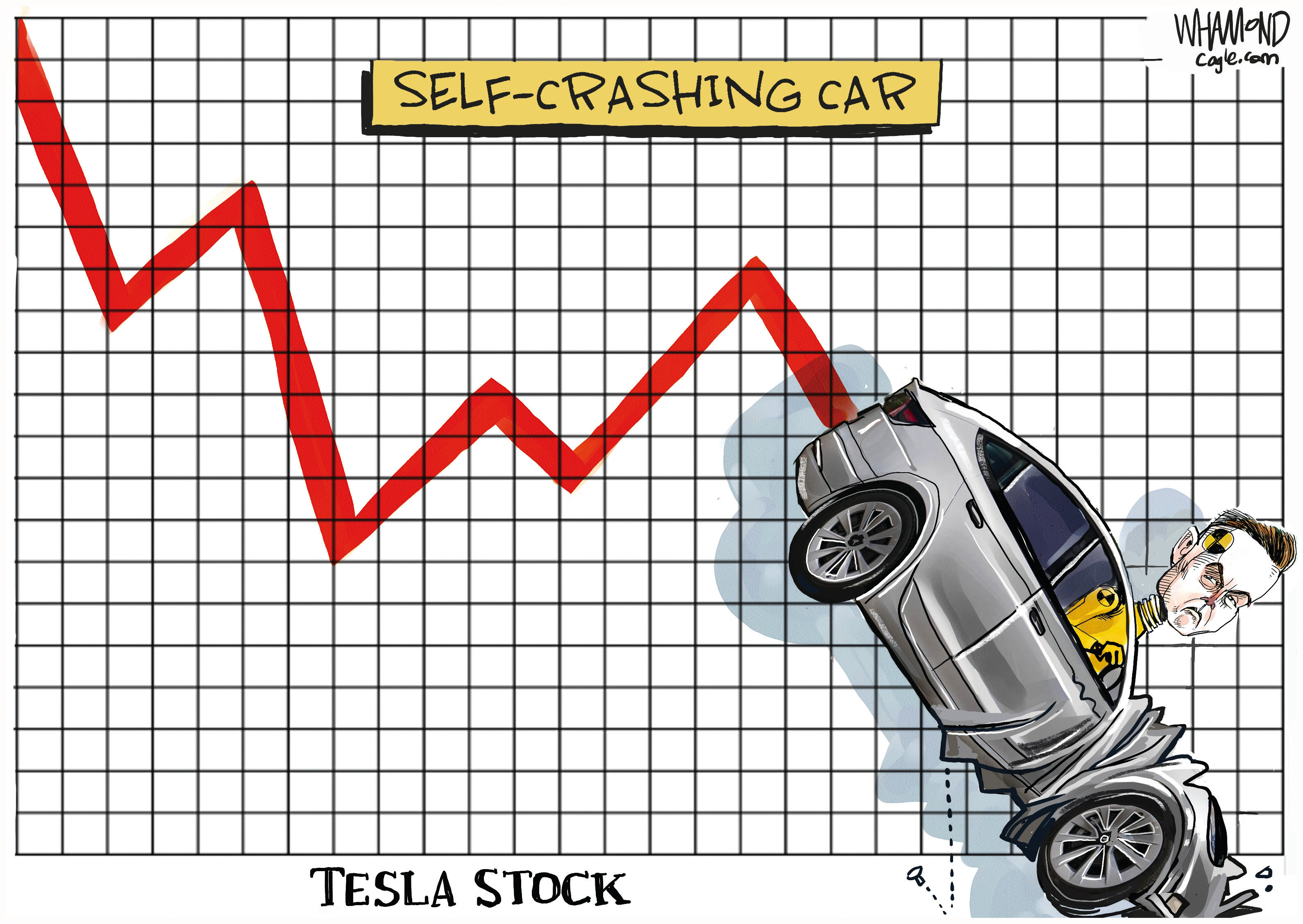

So, it's finally happening. Or maybe it’s been happening and we just didn't want to admit it. If you’ve looked at your portfolio this morning, you probably saw a lot of red, specifically around the letters TSLA.

Tesla stock crashing today isn't just a random blip on the radar. It feels like a reckoning. As of mid-January 2026, the stock has been hovering in a volatile range, lately dropping toward the $430 mark. It’s a far cry from those euphoria-fueled highs of 2025. Honestly, it’s kinda wild to think that just a year ago, everyone was betting on the "AI Chapter" to save the day. Now? That day has arrived, and the receipts are looking a little light.

The big elephant in the room is the upcoming Q4 earnings report on January 28. But the market isn't waiting for the official PDF to start panic-selling. We already have the delivery numbers. They aren't great. Tesla delivered about 1.63 million vehicles in 2025—an 8.5% drop from the year before. That is the largest annual sales decline in the company’s history. Two years of straight declines. For a "growth" company, those are scary numbers.

Why the Hype is Leaking Out

For a long time, Tesla wasn't valued like a car company. It was valued like a tech miracle. But the miracle is hitting some very real-world walls.

Basically, the "cheap" Tesla (the Model 2 or whatever we’re calling it this week) is still mostly a ghost. Meanwhile, BYD is absolutely eating Tesla’s lunch in Europe and China. In 2025, BYD moved 2.26 million battery-electric vehicles. Tesla? 1.63 million. You do the math. The crown didn't just slip; it was snatched.

Then there's the Nvidia situation. Just last week at CES 2026, Nvidia basically told the world that their "DRIVE" platform is ready for any automaker to use. If every Ford, GM, and Toyota can suddenly "plug in" to world-class autonomy, Tesla’s "moat" starts looking more like a puddle. Investors are starting to realize that the Cybercab might not be the only game in town when it actually hits the road—if it ever does.

The xAI Drama is Bubbling Over

You've probably heard the whispers about xAI, Elon’s private AI startup. Well, the whispers turned into a roar this month. There’s a massive amount of drama regarding a potential "talent drain" and the diversion of H100 chips from Tesla to xAI.

- The Breach of Fiduciary Duty: Shareholders are suing. They're saying Elon is hollowing out Tesla to build his private AI empire.

- The "Brain" Problem: If xAI is building the "intelligence" for the Optimus robot, what does Tesla actually own? Just the metal arms and legs?

- The $1 Trillion Pay Package: Even with the record-breaking compensation plan approved, investors are nervous that the CEO's attention is split ten different ways.

It’s messy. It’s really messy.

💡 You might also like: US dollar exchange rate in Mexico: Why the Peso is Defying the Odds in 2026

Let's Talk About FSD and the $99 Pivot

Elon recently made a move that caught a lot of people off guard. As of February 2024, you can't buy Full Self-Driving (FSD) for a flat fee anymore. It's subscription only. $99 a month. Take it or leave it.

On one hand, it’s a smart way to get recurring revenue. On the other, it’s a sign that the "unsupervised" dream is still miles away. Musk said they need 10 billion miles of training data to get there. They're at about 7.2 billion right now. We're still waiting for that "Austin without safety drivers" promise that was supposed to happen by the end of 2025.

Is There a Bottom?

Some analysts, like those over at Zacks, have slapped a "Sell" rating on the stock. They’re looking at a projected 40% drop in earnings per share compared to last year. If the automotive gross margins (the profit they make on each car) haven't stabilized by the January 28 call, we could see another leg down.

However, it's not all doom. In the U.S., Tesla has actually reclaimed some market share—roughly 60%—because federal tax credits for competitors like Ford and GM dried up. Without those $7,500 subsidies, legacy auto is struggling even harder than Tesla.

What you should actually do right now:

- Watch the Margins, Not the Deliveries: When the earnings report drops on Jan 28, ignore the "number of cars" headline. Look for "Automotive Gross Margin (ex-credits)." If that's below 16%, the bleeding isn't over.

- Track the xAI Lawsuit: Any court ruling that forces Elon to "re-unify" the AI efforts could actually be a massive catalyst for Tesla stock.

- Assess Your Horizon: If you’re in this for the 2030 "Robotaxi" world, today is just noise. If you’re trading on margin or need the cash in six months, the current trend is your enemy.

- Look at the Energy Sector: Tesla Energy deployed a record 14.2 GWh of storage in Q4. It's the only part of the business that's actually "mooning" right now.

Tesla is no longer the "only" EV stock. It’s now a legacy EV company trying to transition into a robotics firm while fighting a multi-front war with China and its own CEO’s side projects. It’s gonna be a bumpy ride.