Looking at a tesla stock history chart for the first time is a bit like staring at a cardiac monitor during a marathon. It's erratic. It’s violent. Honestly, it’s probably the most polarizing piece of financial data of the last two decades. You’ve got people who think Elon Musk is a generational genius and others who are convinced the whole thing is a house of cards. But if you actually strip away the Twitter drama and the cult of personality, the numbers tell a much more calculated story about scaling a hardware business in a software world.

Most folks see the massive vertical lines and think "luck." They're wrong.

The Early Days: Surviving the Valley of Death

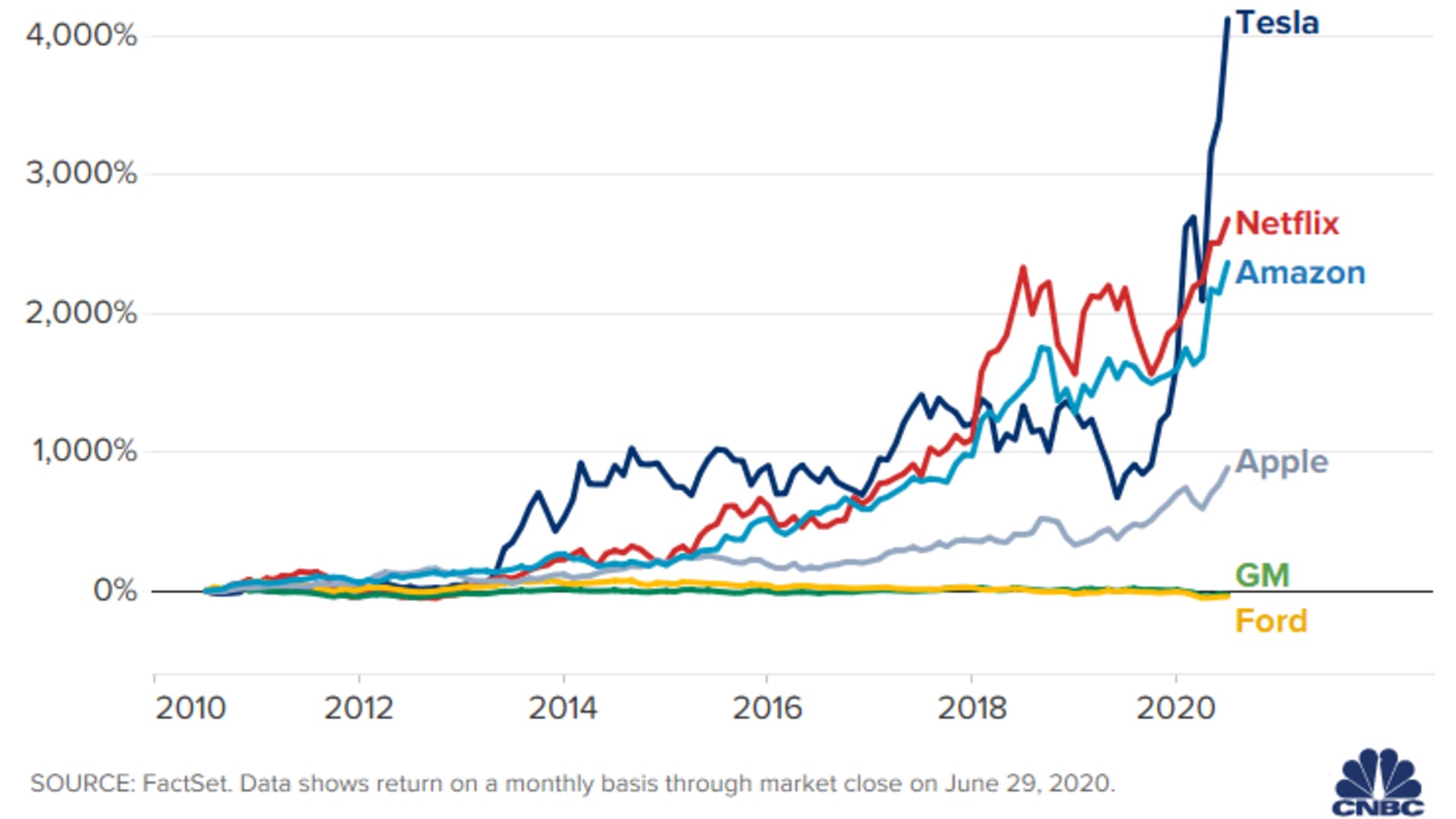

When Tesla went public on June 29, 2010, at $17.00 per share, it wasn't a "Magnificent Seven" titan. It was a scrappy startup with one expensive toy—the Roadster—and a lot of debt. If you adjust for the stock splits we've seen since then, that IPO price is basically pennies. Back then, the tesla stock history chart was a flatline. For years, the market didn't know what to do with them. Between 2010 and 2013, the stock barely moved because everyone was waiting for the Model S to fail.

Then came 2013. Tesla reported its first-ever quarterly profit. The stock shot from around $30 to over $180 in months. Short sellers—the guys betting the price would go down—got absolutely demolished. This was the first "short squeeze" in a long history of them. It’s a pattern you’ll see repeated: Tesla does something "impossible," the stock jumps, and the people betting against Elon lose their shirts.

Breaking Down the Big Splits

If you look at a raw chart today, you’ll notice the price isn't in the thousands. That’s because of splits. Tesla has split its stock twice to keep it accessible for retail investors—the regular people like us.

- August 31, 2020: A 5-for-1 split.

- August 25, 2022: A 3-for-1 split.

Basically, if you owned one share before 2020, you’d have 15 shares today. That’s why comparing a price from 2015 to a price in 2026 requires "split-adjusted" data. Without it, the chart makes no sense.

The 2020 Moonshot

The year 2020 was weird for everyone, but for Tesla, it was legendary. While the rest of the world was in lockdown, Tesla was scaling. They opened Gigafactory Shanghai in record time. They started delivering the Model Y. Suddenly, the tesla stock history chart went from a steady climb to a vertical wall.

The stock surged over 700% in a single year.

Why? It wasn't just about cars. The market started valuing Tesla as a tech company, not a car company. Tech companies get higher valuations because software scales faster than steel. With "Full Self-Driving" (FSD) and energy storage becoming real parts of the narrative, the "valuation multiple" exploded.

The 2022 Reality Check and the 2025 Recovery

But what goes up usually gets a haircut. 2022 was brutal. Rising interest rates and Musk’s acquisition of Twitter (now X) sent the stock tumbling from its highs near $400 (split-adjusted) down to the $100 range by early 2023. It was a "correction" in every sense of the word. Investors were worried Elon was distracted. They were worried about competition from BYD in China and Rivian in the US.

But look at where we are now in early 2026. After a volatile 2024 and 2025, the stock has found a new rhythm. As of January 16, 2026, the price sits around $437. Tesla’s revenue for late 2025 hovered around $95 billion. It's not just a car company anymore; it’s an infrastructure play. They’ve opened their Supercharger network to Ford, GM, and everyone else. That’s "high-margin recurring revenue," which is a fancy way of saying they're becoming the gas station of the future.

👉 See also: Justin Wolfers University of Michigan: What Most People Get Wrong About Economics

Surprising Stats Most People Miss

- Compound Growth: If you put $1,000 into the IPO in 2010, you’d be looking at over $270,000 today.

- Profitability: For years, the bears said Tesla couldn't make money. In 2023, they cleared nearly $15 billion in net income.

- Volatility: Tesla’s "Beta" (a measure of how much it moves compared to the market) is usually double the S&P 500. It’s a rollercoaster. Sorta scary, honestly.

What the Chart Tells Us About the Future

A tesla stock history chart isn't just a record of prices; it’s a record of sentiment. Right now, the chart shows a company that has moved past the "Will they survive?" phase and into the "How much can they dominate?" phase.

The big question for 2026 is FSD. Elon recently announced that FSD will move to a subscription-only model. This is huge for the chart. If millions of people start paying $100+ a month for software that’s already been built, the profit margins will look more like Microsoft's than Toyota's.

However, you've gotta be careful. Competition is fiercer than ever. BYD is breathing down their neck in Europe and Asia. The "Magnificent Seven" labels are starting to fray, and Tesla has to prove it belongs in that elite group every single quarter.

Actionable Insights for Investors

If you're looking at the tesla stock history chart and wondering what to do next, here’s the expert take. Stop looking at the daily candles. They'll give you an ulcer. Instead, focus on these three things:

- Delivery Growth: Is the "Model 2" or the cheaper $25k platform actually happening? That’s the next volume driver.

- Energy Storage: This segment is growing faster than the car segment. Watch the Megapack deployments.

- Regulatory Environment: With policy shifts in 2025 and 2026, EV tax credits are a moving target. Keep an eye on the legislative tailwinds (or headwinds).

Tesla remains a high-beta, high-reward play. It’s not for the faint of heart, but the historical chart proves one thing: betting against their ability to scale has been a losing game for sixteen years straight.

To get a better handle on your own position, pull up a 10-year view of the chart and overlay it with Tesla’s quarterly revenue growth. You’ll see that while the price swings wildly, the revenue line is remarkably consistent. That’s the "signal" in all the noise. Focus on the deliveries and the margins, and the chart usually takes care of itself.