You’ve seen the headlines. You’ve probably seen the Cybertrucks creeping through traffic like low-poly video game assets. But when people talk about Tesla stocks, they aren't just talking about a car company. They are talking about a cult, a software house, an energy giant, and a massive bet on a future where robots do our laundry.

Honestly, it’s a lot to wrap your head around.

If you look at the ticker symbol TSLA on the Nasdaq right now, you’re seeing a company that basically refuses to behave like a normal stock. One day it’s up because of a tweet; the next, it’s down because of a steering wheel recall or a macro-economic sneeze. It is volatility personified.

What Is Tesla Stocks and How Do They Actually Work?

At its simplest, buying Tesla stock means you own a tiny piece of Elon Musk’s empire. As of January 2026, Tesla is trading around $437, though that number changes faster than a Model S Plaid in Ludicrous Mode.

When you buy a share, you aren’t just getting a piece of the Gigafactory in Austin or Berlin. You are buying into a "trinity" of business segments:

- Automotive: The bread and butter. Think Model 3, Model Y, and the ramping production of the Semi and Cybercab.

- Energy: This is the sleeper hit. They make Megapacks for power grids and Powerwalls for homes. It’s growing way faster than the car side lately.

- AI and Robotics: This is where the valuation gets crazy. Between the Optimus humanoid robot and Full Self-Driving (FSD), investors are betting Tesla becomes the world's largest AI company.

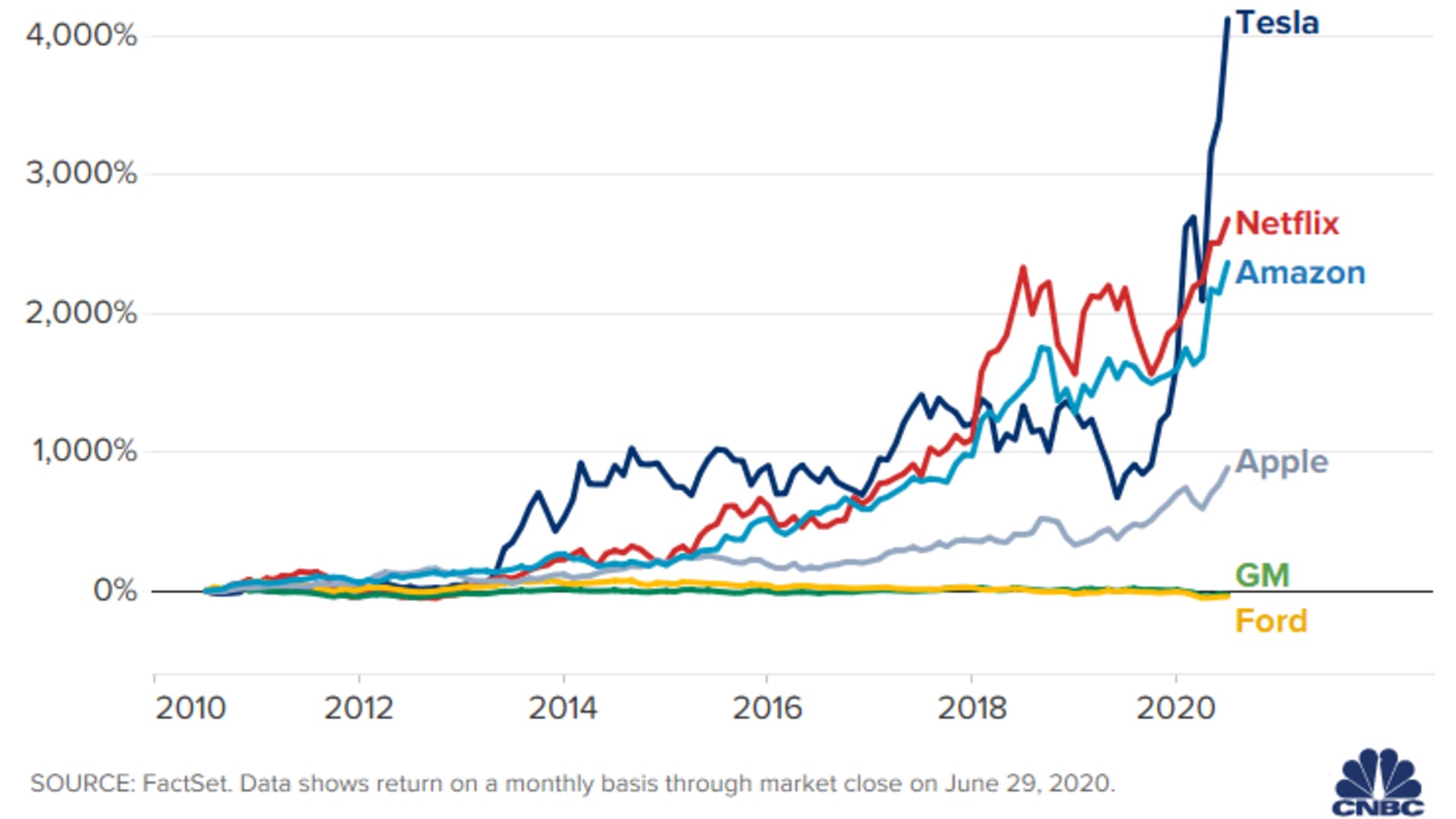

Is it a car company? Sorta. But the stock market treats it more like a tech startup that happens to have four wheels and a chassis. That is why its Price-to-Earnings (P/E) ratio—a way to measure if a stock is expensive—is often ten times higher than legacy companies like Ford or GM.

The Ownership Reality: Who Really Calls the Shots?

Most people assume Elon Musk owns the whole thing. He doesn't. He is the largest individual shareholder, holding roughly 15.3% of the company, but he has plenty of bosses in the form of massive investment firms.

💡 You might also like: Finding the W.W. Grainger Corporate Office: What You Actually Need to Know

Wall Street heavyweights like Vanguard and BlackRock hold huge chunks of the pie—about 7% and 6% respectively. These institutional investors provide a bit of a "floor" for the stock price, but they also demand results.

Then there’s the "retail" crowd. That’s people like you and me. Around 36% of Tesla is owned by the general public. This is unusually high for a trillion-dollar company. It means the stock is heavily influenced by "hype" and retail sentiment, which explains why it swings so wildly on social media news.

The Big Shift in 2026

Something weird is happening this year. For a long time, the story was "Tesla will sell the most cars." But in 2025, Chinese rivals like BYD actually started outselling Tesla in total electric vehicles.

So, what is Tesla stocks doing now? It's pivoting. The narrative has shifted toward autonomy. If you are looking at the stock today, you are looking at the "Robotaxi" era. Musk has basically staked the company's future on the idea that your car will earn money for you while you sleep. It’s a bold claim, and the market is currently split 50/50 on whether he can actually pull it off.

Why Does the Price Move So Much?

It's a rollercoaster. No other way to put it.

- Interest Rates: When rates are high, people can't afford car loans. Tesla feels that hit immediately.

- The "Elon Factor": Everything the CEO does—from SpaceX launches to political comments—bleeds into the TSLA ticker.

- Delivery Numbers: Every quarter, the world holds its breath to see how many cars Tesla "delivered." If they miss the estimate by even 1%, the stock can tank 5% in minutes.

- AI Milestones: In early 2026, everyone is watching the Optimus robot. If that robot starts doing real work in factories, the stock could fly. If it stays a prototype, expect a correction.

How to Get Involved (The Practical Bit)

If you're thinking about jumping in, don't just "buy the hype." You've gotta be smart about it.

First, you need a brokerage account (think Schwab, Robinhood, or Fidelity). You can't buy shares directly from Tesla. Most people start with fractional shares, which means you can put in $10 or $50 instead of paying the full $400+ price tag for a single share.

But here is the real kicker: Tesla doesn't pay dividends.

They never have.

If you buy TSLA, you aren't getting a check in the mail every three months. The only way you make money is if the stock price goes up and you sell it for more than you paid. It is a "growth" play, pure and simple.

What Most People Get Wrong

People think Tesla is "too expensive" because of the share price. "It's $400, that's more than Coca-Cola!" That’s not how it works. You have to look at Market Cap.

Tesla is worth well over $1 trillion. To double your money, the company has to become a $2 trillion company. That is a massive hill to climb. It's not like buying a small penny stock where a single contract can double the value.

Also, watch out for the competition. Nvidia is now moving into the autonomous driving space. This isn't a one-horse race anymore.

Moving Forward With Tesla

If you want to track this stock like a pro, stop looking at the daily price. It’ll just give you a headache. Instead, watch the January 28th earnings report. That's when we see the hard data on profit margins.

Keep an eye on Energy Storage deployments. Most people ignore the battery side of the business, but it’s becoming the most stable part of their income.

✨ Don't miss: Noble and Kelsey Funeral Home Salisbury: What Most Families Don’t Realize

Before you put a single dollar in, ask yourself: "Am I okay with this stock dropping 20% in a week?" Because with Tesla, that happens. Often. If you're a long-term believer in the AI revolution, the volatility is just noise. If you're trying to make a quick buck, you might be walking into a buzzsaw.

Check the delivery consensus versus actuals every quarter—that's the real pulse of the company.