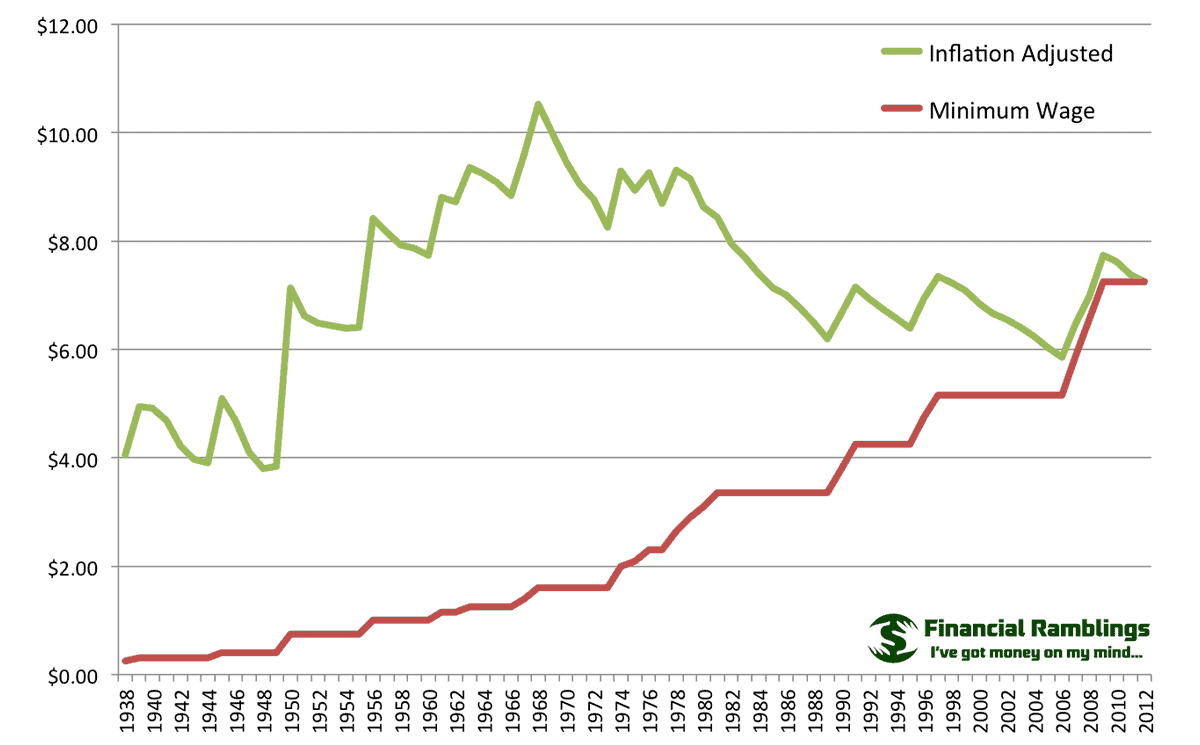

It has been over fifteen years. That is the first thing you have to wrap your head around. Since July 2009, the federal minimum wage has sat motionless at $7.25 an hour, even as the price of a gallon of milk or a modest one-bedroom apartment has soared into the stratosphere. If you feel like we are living through a weird glitch in the economic matrix, you are right. Most people assume there is some kind of automatic adjustment or a cost-of-living trigger that kicks in when inflation goes nuts, but there isn't. The federal minimum wage increase isn't a math problem solved by a computer; it is a political grenade that nobody in Washington seems to want to catch.

Honestly, the situation is kind of absurd when you look at the raw numbers. Since the last time Congress gave the green light to a raise, the dollar has lost about 40% of its purchasing power. To have the same buying power as $7.25 did in 2009, you would need well over $10 today. Yet, here we are. The gap between the federal floor and what people actually need to survive has become a canyon.

The Massive Divide Between States and the Feds

While the federal government remains paralyzed, the states have basically said, "Fine, we’ll do it ourselves." This has created a fractured economic map of the United States. If you are flipping burgers in Seattle, you might be making over $20 an hour. If you drive twenty minutes across a state line into a region that defaults to the federal standard, your value—at least in the eyes of the law—drops by more than half. It’s wild.

Thirty states, plus D.C., have moved past the $7.25 mark. In 2024 and 2025, we saw a massive wave of "inflation indexing." Places like Arizona, Colorado, and Maine now have laws where the wage goes up automatically based on the Consumer Price Index (CPI). It’s a smart move because it takes the politics out of it. But for the roughly 20 states that still stick to the federal minimum, workers are essentially taking a pay cut every single year as prices rise.

Think about the "tipped wage" for a second. That is even crazier. The federal tipped minimum wage is still $2.13. It hasn't moved since 1991. If you're a server in a state that doesn't have its own labor laws, you're relying on the generosity of strangers to make up a gap that has existed for over three decades.

Why the Federal Minimum Wage Increase Still Hasn't Happened

You’ve probably heard the standard arguments. On one side, advocates say a federal minimum wage increase to $15 or $17 would lift millions out of poverty and stimulate the economy because low-income workers spend every dime they make. On the other side, business groups—especially the National Restaurant Association—argue that it would lead to "wage-push inflation" and forced layoffs.

But there is a more nuanced reality. Economists like Arindrajit Dube at the University of Massachusetts Amherst have studied this for years. His research suggests that moderate increases in the minimum wage don't actually lead to the massive job losses that critics fear. Why? Because when workers are paid more, they stay longer. You save money on recruiting. You save money on training. The "quit rate" drops.

👉 See also: The US Unemployment Rate: Why the Official Numbers Don’t Tell the Whole Story

The real roadblock isn't just "big business." It’s the Senate filibuster and the way the Byrd Rule affects budget reconciliation. Back in 2021, there was a huge push to include a $15 minimum wage in the American Rescue Plan. The Senate Parliamentarian ruled it couldn't be part of the bill because its impact on the federal budget was "merely incidental." That one procedural ruling basically killed the momentum for years.

The $15 Threshold is Already Outdated

Here is the kicker: by the time the federal government actually agrees on a $15 minimum, it might already be too late. In many major metro areas, $15 is no longer a "living wage"—it’s barely a "survival wage."

- Some activists are already pivoting the conversation toward $20 or $25 an hour.

- Large corporations like Amazon, Costco, and Target have already set their internal floors at $15 or higher to compete for talent.

- The "Fight for $15" started in 2012. Fourteen years later, the target has moved.

When the market starts paying more than the legal minimum just to get people to show up, the federal law becomes somewhat symbolic for a large chunk of the country. But for workers in rural areas or in industries with zero competition for labor, that $7.25 floor is still a very real, very painful ceiling.

What a Raise Would Actually Do to Your Grocery Bill

One of the biggest fears people have is that a federal minimum wage increase will make a Big Mac cost $15. It’s a common talking point, but it's mostly a myth. Research shows that a 10% increase in the minimum wage usually results in a price increase of less than 0.5% for most goods. Businesses usually absorb the cost through a mix of slightly higher prices, slightly lower profits, and much lower employee turnover.

Take a look at Denmark. McDonald's workers there make the equivalent of over $20 an hour, get five weeks of vacation, and have pension plans. The price of a Big Mac? It’s often within 50 cents of the U.S. price. The "labor cost" excuse often hides the fact that U.S. companies have become very used to a low-wage subsidy provided by the government. When workers can't live on their wages, they rely on SNAP (food stamps) and Medicaid. Basically, taxpayers are subsidizing the payroll of profitable companies.

The 2026 Outlook: Is Change Coming?

As we move through 2026, the pressure is mounting. We are seeing a weird phenomenon where "red" states are passing minimum wage hikes via ballot initiatives even when their legislatures refuse to touch the issue. Voters in Florida—a state that has trended significantly conservative—voted to raise their wage to $15 by 2026. This shows that the federal minimum wage increase isn't actually as partisan as the news makes it seem. Voters, regardless of their party, generally think people should make enough to pay rent.

There is also the "Raise the Wage Act of 2023" (and its subsequent iterations), which aimed to gradually hike the federal floor to $17 over five years. It’s been sitting in legislative limbo. With the 2026 midterm elections looming, you can bet this will become a massive talking point again.

What You Should Do Right Now

If you are an employer or an employee, waiting for the federal government to act is a bad strategy. The feds are slow. The market is fast.

For Business Owners: Stop looking at the federal minimum as your benchmark. If you’re still trying to hire at $7.25 or even $10, you are likely getting the "bottom of the barrel" in terms of reliability. High turnover is more expensive than a $3 hourly raise. Audit your "cost per hire." You’ll probably find that paying $16 an hour and keeping an employee for two years is cheaper than paying $10 and replacing them every three months.

For Workers: Knowledge is your only leverage. Check the Department of Labor’s "Wage and Hour Division" website to see if your state has a higher requirement than the federal one. Many people are actually being underpaid simply because they—and their bosses—don't realize their state or city has passed a new local ordinance.

For Policy Watchers: Keep an eye on the "Cost of Living Index" (COLI) in your specific region. Even if a federal raise happens, it won't be a silver bullet. The real movement is happening at the local level. If you want to see change, ballot initiatives have proven to be way more effective than waiting for a miracle in the Senate.

The bottom line is that the $7.25 rate is a relic. It belongs in a museum next to the iPod Nano and the Blackberry. Whether it changes this year or next, the economic reality has already moved on, and eventually, the law will have no choice but to catch up.

Actionable Insights for Navigating the Current Wage Landscape:

- Audit Your Pay Geography: If you work remotely or manage a remote team, remember that "nexus" laws usually require you to pay the minimum wage of the state where the work is performed, not where the company is headquartered.

- Watch the "Salary Basis" Test: Minimum wage isn't just for hourly workers. The Department of Labor often updates the salary threshold for "exempt" status. If you earn a salary but it falls below a certain yearly amount, you might actually be entitled to overtime pay regardless of your job title.

- Monitor Local Ballots: Check your upcoming local and state election ballots for wage-related referendums. These are often buried at the bottom but have a more direct impact on your wallet than almost any other vote.

- Negotiate Based on "Real Wages": When asking for a raise, bring inflation data to the table. Showing that your $15 an hour from two years ago is now worth $13.50 in "real" dollars is a powerful, fact-based negotiation tactic that is hard for a manager to ignore.