Scott Galloway is a guy who doesn't mind being the loudest person in the room. In fact, he’s made a whole career out of it. If you’ve ever watched his "No Mercy, No Malice" videos or listened to him rant on a podcast, you know the vibe: high energy, slightly cynical, and incredibly sharp. When he released The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google, he wasn't just writing another business book to sit on a shelf. He was sounding an alarm.

Honestly, the core premise is kinda terrifying.

We think these companies are successful because they make cool stuff. We think they’re "innovative." Galloway says that's mostly crap. He argues that The Four—Amazon, Apple, Facebook, and Google—didn't get to the top by being the first or even the best at technology. They got there by tapping into our most primal, caveman-level instincts. It’s evolutionary psychology disguised as a stock ticker.

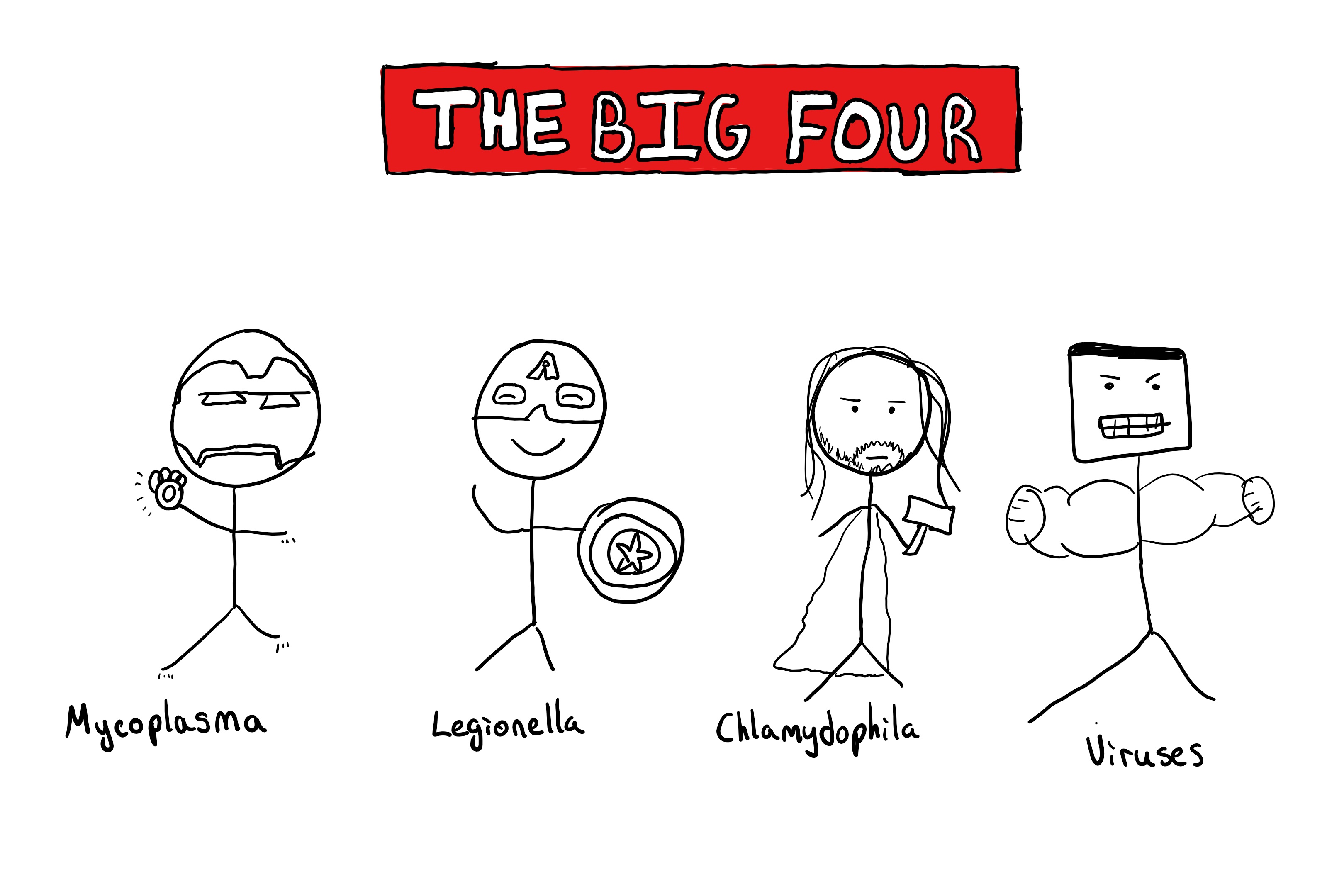

The Four Horsemen and Our Lizard Brains

Galloway calls them the "Four Horsemen." It’s a bit dramatic, sure, but he backs it up. He maps each company to a specific part of the human anatomy.

Take Google. Galloway calls Google our "modern-day God."

Think about it. Who else do you trust with your deepest, darkest secrets? You might lie to your priest, your spouse, or your doctor, but you don't lie to your search bar. You tell Google about that weird rash, your late-night anxieties, and your secret political leanings. We turn to it for answers to everything, and because it answers us (unlike the traditional God, who usually stays pretty quiet), we trust it implicitly.

Then you have Facebook. (Now Meta, though the book’s core thesis on social connection still hits hard). This is the "Heart."

Humans are social animals. We have a desperate, biological need to be loved and to belong. Facebook tapped into that by digitizing our relationships. It’s the platform of "empathy," or at least the digital simulation of it.

💡 You might also like: Staking Crypto Explained: Why Most People Gamble Without Realizing It

Amazon is the "Stomach."

Our ancestors survived by gathering more than they needed. We are hardwired to hoard. Amazon makes the act of "gathering" so frictionless that it feels like a superpower. You want it? Click. It’s at your door. It appeals to our hunter-gatherer instinct to consume without the effort of the hunt.

And then there's Apple.

This is where Galloway gets really spicy. He argues Apple isn't a tech company at all. It’s a luxury brand. It’s the "Genitals."

Wait, what?

Basically, humans use luxury goods as signaling devices. A MacBook or an iPhone 15 Pro Max is a way of telling the world, "I am part of the innovation class. I have resources. I am a high-value mate." Apple has a 38% profit margin not because their chips are magic, but because they’ve successfully positioned themselves as the ultimate signal of status and intelligence.

Why They Can't Be Stopped (Sorta)

Why does the stock market forgive these companies for things that would bankrupt anyone else?

If a mid-sized retailer lost as much money as Amazon did in its early years, it would have been liquidated. If a traditional media company allowed the kind of misinformation that floats on Facebook, they’d be sued into oblivion.

Galloway points to a few "moats" that keep them safe:

- Cheap Capital: Investors give these companies a "long leash" because they believe in the story. This allows them to outspend anyone.

- The T-Algorithm: Galloway’s framework for what makes a "trillion-dollar" company. It includes things like "vertical integration" (controlling the whole experience) and "AI" (using data to get better with every use).

- Regulatory Prerogative: For a long time, we let them slide because they felt "liberal" and "progressive." They were the "good guys" fighting the old guard.

It’s a "Benjamin Button" economy. Most products get worse as they age—your car depreciates, your shoes wear out. But The Four get better the more we use them. Every search makes Google smarter. Every post makes Facebook’s data more valuable. They age in reverse.

The Dark Side of the "Great"

It’s not all praise. Not even close.

Galloway is pretty vocal about the fact that these companies are "job destroyers."

Amazon's efficiency is legendary, but for every job it creates in a warehouse, it kills multiple jobs in traditional retail. Google and Facebook have basically strip-mined the advertising industry, leaving traditional journalism (like the New York Times, where Galloway once served on the board) struggling for scraps.

He’s also skeptical of their "do good" missions.

Remember when Apple refused to unlock the San Bernardino shooter's iPhone? The media framed it as a stand for privacy. Galloway argues it was a brilliant marketing move to protect their luxury "fortress" and keep the brand's allure intact.

The concentration of wealth is the real kicker. In 2017, Galloway noted that only six countries had a GDP larger than the combined market cap of The Four. Today, that number hasn't exactly gotten more comforting.

Is There a Fifth Horseman?

The book spends some time wondering who gets the next seat at the table.

He looks at Microsoft (which he says "lost its mojo" for a while but found it again by focusing on the workplace), Alibaba, and even Tesla.

Interestingly, he didn't see the AI explosion coming quite like this, though he correctly identified that whoever controls the data and the "interface" (like voice or search) wins the game.

What This Means for Your Career

Galloway doesn't just leave you depressed about the state of the world. He actually gives some pretty blunt career advice in the final chapters.

- Move to a City: That’s where the "oxygen" (capital and talent) is.

- Get Certified: Whether it’s a degree or a high-value skill, you need a "credential" that the Four (and their satellites) respect.

- Pimp Your Career: Be your own brand. Use the tools they built to make yourself visible.

- Equity is Everything: You won't get rich on a salary. You get rich by owning a piece of the machine.

Putting the Insights to Work

If you're looking to apply the lessons from The Four, start by auditing your own business or career through the lens of their "moats." Are you building a "Benjamin Button" product that gets better with use? Are you appealing to a fundamental human instinct—the brain, the heart, the stomach, or the genitals?

Most importantly, recognize the "low cost of capital" trap. You can't outspend the Horsemen. You have to differentiate by doing the things they can't—usually the "analog" stuff that doesn't scale. Apple’s retail stores are a great example of an analog moat protecting a digital product.

Check your reliance on their platforms. If 90% of your leads come from Google or Facebook, you don't own a business; you own a lease on their property. Start building your own "walled garden" by collecting direct data (like email lists) and fostering true brand loyalty that doesn't depend on an algorithm. Understanding how the DNA of these giants works is the first step toward not getting crushed by them.

✨ Don't miss: BTBT Stock Price Today: Why This Pivot to AI Actually Matters

To get the most out of these concepts, try mapping your current competitors to Galloway's "parts of the body" framework. Identify which primal instinct they are neglecting—that's usually where your biggest opportunity for disruption lives. Look for the "friction" in your industry that the giants haven't smoothed over yet.