Honestly, if you blinked during the summer of 2025, you might have missed one of the biggest shifts in American financial history. Everyone was talking about the GENIUS Act vote time, but the real drama wasn't just on the clock. It was in the backrooms of the Capitol.

We are talking about the Guiding and Establishing National Innovation for U.S. Stablecoins Act.

People were refreshing C-SPAN like it was a Super Bowl finish. Why? Because for the first time, the "Wild West" of crypto was actually getting a sheriff. Not the kind of sheriff that shuts down the town, but the kind that finally paves the roads and puts up streetlights.

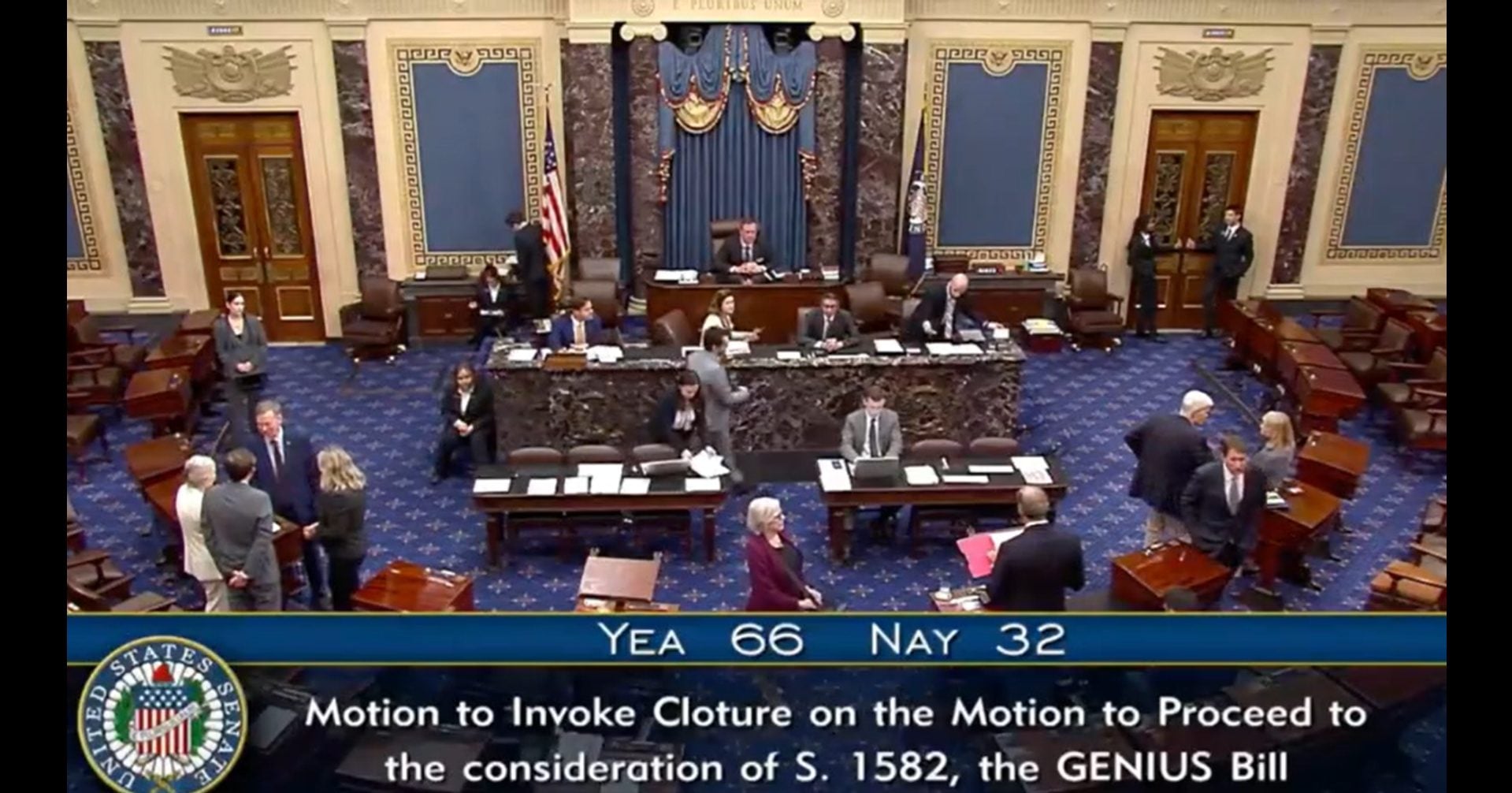

When the GENIUS Act Vote Time Finally Arrived

The timeline was a total rollercoaster. You’ve probably heard conflicting dates, but here is the actual breakdown of how the GENIUS Act vote time played out in real-time.

The Senate actually moved first. On June 17, 2025, they passed the bill with a surprising 68-30 bipartisan majority. It was a massive win for Senators like Bill Hagerty (R-TN) and Cynthia Lummis (R-WY), who had been pushing this for ages.

Then came the House.

The House of Representatives had their own version called the STABLE Act. Things got heated. On July 17, 2025—exactly a month after the Senate—the House finally held its floor vote. It wasn't a sure thing. A group of holdouts kept the vote open for nearly 10 hours.

Ten hours of staring at a tally board.

Ultimately, the House passed it 308-122. President Trump didn't wait around; he signed it into law the very next day, July 18, 2025. This turned the bill into Public Law No: 119-27.

Why the 2026 Deadlines Matter Now

Fast forward to right now, January 2026. If you are searching for the GENIUS Act vote time today, you’re likely looking for the implementation deadlines or the new "Clarity Act" votes happening this week.

The GENIUS Act gave regulators a ticking clock. It officially takes effect either 18 months after signing or 120 days after the final rules are published. We are staring down a November 2026 deadline for full enforcement.

🔗 Read more: Ben Stace Semantic SEO Expert: Why Modern Content Strategy Is Moving Beyond Keywords

Basically, the "vote" is over, but the "fight" is just starting.

What This Law Actually Changes for You

Most people think this is just some boring bank stuff. It’s not. It literally changes how digital dollars work in your pocket.

Before this, stablecoins—digital tokens meant to stay at $1.00—were in a legal gray area. Was it a security? Was it a commodity? Nobody knew. The GENIUS Act fixed that. It explicitly says a "payment stablecoin" is NOT a security.

- 1:1 Backing: Issuers must keep 100% of the value in US dollars or short-term Treasuries.

- Monthly Proof: Companies have to show their receipts every single month. No more "trust us, we have the money."

- Bank Rules: Banks can now issue these tokens under their existing charters.

It’s about legitimacy. If a stablecoin company goes belly up tomorrow, the law now says the holders (that’s you) get priority in the bankruptcy. You aren't just an "unsecured creditor" anymore. You’re first in line.

The Friction in the Room

Not everyone is happy. Senator Elizabeth Warren has been a vocal critic, arguing that the bill doesn't go far enough to stop "shadow banking." There’s also a big debate right now in early 2026 about "interest."

💡 You might also like: Manoj Bhargava: The Monk Who Built 5-hour Energy and Why He’s Giving it All Away

Some crypto firms are trying to offer "rewards" on stablecoins. The banking lobby is freaking out. They say this is just interest by another name and could suck $6 trillion out of traditional community banks.

The 2026 "Clarity Act" Connection

If you’re watching the news this week (January 2026), you’re seeing the "Clarity Act" hitting the floor. Think of this as the sequel. While the GENIUS Act vote time settled stablecoins, the Clarity Act is trying to settle the rest of the market—like exchanges and decentralized finance (DeFi).

We just saw the Senate Banking Committee meeting on January 15, 2026. They are debating whether the GENIUS Act rules for audits are strong enough. Lynn Turner, a former SEC Chief Accountant, recently warned that the current language might let some firms dodge real oversight.

It’s messy. It's politics.

Your Action Plan for the New Era

If you hold digital assets or run a business, you can't just ignore this. The transition period is ending.

- Check Your Wallet: If you hold stablecoins, find out if the issuer is a "permitted issuer" under the new federal guidelines. If they aren't, they might be forced out of the US market by the end of this year.

- Watch the OCC: The Office of the Comptroller of the Currency is the new big player here. Watch for their "conditional approvals" of trust banks.

- Audit the Auditors: Make sure the platforms you use are using PCAOB-registered firms. The law requires it now.

The era of "moving fast and breaking things" in digital finance is officially dead. The GENIUS Act vote time was the funeral. What we have now is a regulated, boring, and hopefully much safer financial system.

Stop waiting for the "moon" and start looking at the compliance. That’s where the real money is going to be in 2026.