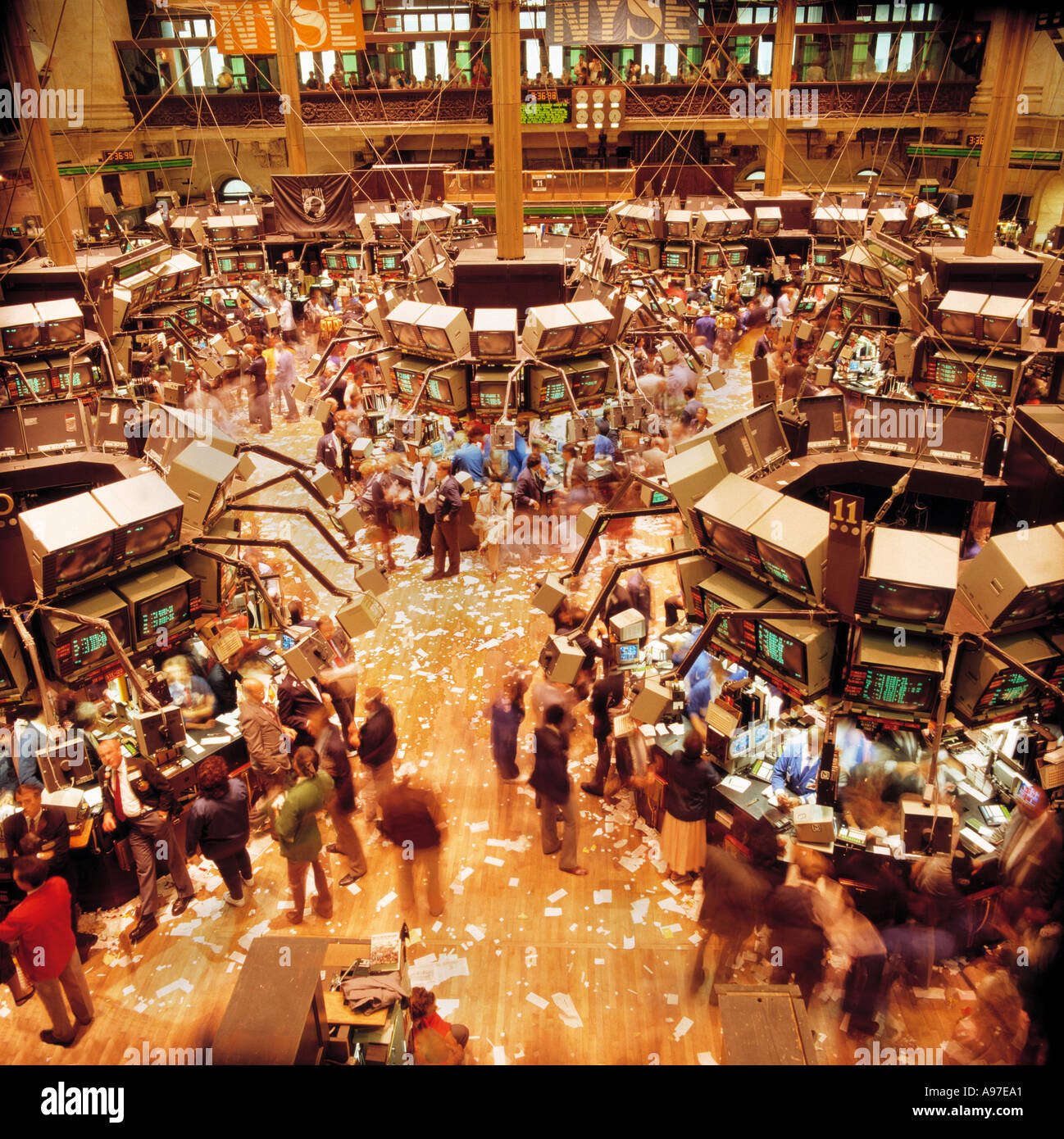

Walk into 11 Wall Street and you'll feel it immediately. The air is different. Most people think the New York Stock Exchange trading floor is a relic—a cinematic backdrop for news anchors to stand in front of while they talk about interest rates. You’ve seen the movies. Traders screaming, papers flying, everyone looking like they’re having a collective heart attack. But here’s the thing: it’s still there. In an era where billions of dollars move through server farms in New Jersey in microseconds, that physical room in Lower Manhattan remains the most famous square footage in global finance.

It isn't just for show.

Sure, the noise has changed. The "open outcry" system, where humans literally barked orders at each other like auctioneers on espresso, is mostly gone. It's quieter now. You hear the hum of cooling fans and the rhythmic tapping of keys. But the NYSE remains the only major exchange in the world that still uses a "high-touch" model. They call it a hybrid market. It mixes high-speed algorithms with actual human judgment. If you think that sounds redundant, you haven't seen what happens when a "flash crash" hits and the computers lose their minds.

What Really Happens on the New York Stock Exchange Trading Floor?

Forget the idea of a guy holding two phones and screaming "Sell! Sell! Sell!" That’s 1987. Today, the New York Stock Exchange trading floor is populated by Designated Market Makers (DMMs) and Floor Brokers.

DMMs are the evolved version of the old "specialists." They have a specific job. They are responsible for maintaining a fair and orderly market for the stocks assigned to them. When you buy shares of Coca-Cola or Disney, there is a specific person—and a specific firm like Citadel Securities or GTS—tasked with making sure that trade happens smoothly. They provide liquidity. If everyone wants to sell and nobody wants to buy, the DMM is often required to step in with their own capital to bridge the gap.

Human intervention is the "secret sauce."

📖 Related: Superstore All Sales Final: What You Actually Need to Know Before Heading to the Checkout

Floor brokers work for the big banks or independent "boutique" firms. They represent institutional clients—think massive pension funds or insurance companies. Why would a billion-dollar fund use a guy on the floor instead of just clicking a button? Because of "size." If you’re trying to dump five million shares of a blue-chip stock, you don't just dump it into the electronic ether. You'd move the price against yourself. Instead, you send it to a floor broker. They use their "feet" and their relationships to find the other side of that trade quietly. It’s about nuance. It’s about feeling the room.

The Geography of the Room

The floor is actually split into different rooms, including the Main Room and the "Garage." If you look at the floor today, you'll see "pods" or "trading posts." These are high-tech workstations surrounded by a halo of screens.

Everything is monitored. The SEC has eyes everywhere. There are cameras, obviously, but the digital trail is what matters. Every sneeze is recorded in the audit trail. But the physical layout still encourages "crowds." When a company goes public (an IPO), the action centers around a specific post. The DMM for that stock will manually "open" the stock. They look at the buy orders and sell orders coming in from all over the world and find the price that clears the most volume.

It’s a moment of pure human-machine collaboration.

The Myth of the "Dead" Floor

Critics have been calling for the closure of the New York Stock Exchange trading floor since the late 1990s. They say it's expensive. They say it's slow. They're half right, but they miss the point of tail risk.

During the COVID-19 pandemic in 2020, the floor actually closed for a bit. Everything went 100% electronic. Did the world end? No. But volatility increased. Spreads—the difference between the buy and sell price—widened. When the humans aren't there to provide that "buffer," the machines tend to get a bit twitchy.

Algorithms are great at following rules. They’re terrible at handling "unprecedented" events.

A human trader can look at a news headline about a geopolitical crisis and understand context. A machine just sees a spike in data points and might pull its liquidity entirely to protect itself. That’s how you get "air pockets" where stock prices drop 10% in seconds for no fundamental reason. The NYSE argues—and many institutional traders agree—that the physical presence of DMMs prevents these "mini-flash crashes."

🔗 Read more: The Primary Secondary Tertiary Sectors of Economy: Why Most People Get It Backward

The IPO Ritual and the "First Trade"

You’ve seen the celebrities ringing the bell. It’s a great photo op. But the real work happens about an hour after the bell rings.

When a company like Snowflake or Airbnb goes public, the stock doesn't start trading at 9:30 AM. There is a period of "price discovery." This is the pinnacle of the New York Stock Exchange trading floor's utility. The DMM sits at the post, surrounded by brokers. They are looking at the "book"—the massive list of orders.

The DMM will call out "indications."

"We're looking at 45 to 47!"

"Now 48 to 50!"

They are testing the water. They wait until the buy and sell interest is balanced. This prevents the stock from "gapping" too wildly. It’s a manual process that can take two hours. It’s stressful. It’s loud. And it’s incredibly efficient at finding the "true" price of a company. Nasdaq, which is entirely electronic, does this with an automated "cross" or auction. It’s faster, sure, but it lacks the human "price discovery" that the NYSE prides itself on.

The Blue Jackets and the Culture

The "smocks" are the uniform. Traditionally, different colors or patterns meant different things. Today, the dark blue jackets are the standard. It’s a bit of a fraternity. Many of the people on that floor have been there for thirty years. They’ve survived the 1987 crash, the 2000 tech bubble, the 2008 financial crisis, and the 2010 flash crash.

There is a massive amount of institutional memory in that room.

When things go wrong—and in finance, things always go wrong—you want people who have seen "crazy" before. You want the person who didn't panic when the Dow dropped 1,000 points in minutes. That’s the intangible value of the floor. It’s a pressure cooker that breeds a very specific kind of calm.

Why Investors Should Care

You might think, "I'm just a retail investor with a Robinhood account, why does a room in New York matter to me?"

It matters because of execution quality.

The NYSE's model generally leads to lower volatility and better prices for the end investor. Because DMMs have "skin in the game," they are incentivized to keep the market stable. When you buy a stock listed on the NYSE, you are benefiting from a system that is designed to prevent "gaps" in pricing.

📖 Related: The Truth About Doing Your Taxes with H and R Block This Year

Also, the floor acts as a massive marketing machine. The media presence—CNBC, Bloomberg, Fox Business—all broadcast from the floor. This creates a "branding" effect for NYSE-listed companies. Being "on the floor" gives a company a sense of prestige that a ticker symbol on a server just can't match.

The Technology Under the Floorboards

Don't let the old architecture fool you. Beneath those 19th-century aesthetics is some of the fastest technology on the planet. The NYSE uses the Pillar trading platform. It's designed for "ultra-low latency."

Traders on the floor use handheld devices—basically super-encrypted, ruggedized tablets—to execute trades. They aren't writing on paper tickets anymore. They are using "Point of Sale" systems that communicate instantly with the data centers in Mahwah, New Jersey.

It is a "cyborg" environment. The human makes the decision; the machine executes it at the speed of light.

Common Misconceptions About the NYSE Floor

People get a lot wrong about Wall Street. Honestly, the biggest one is that the floor is where "all" the trading happens. It isn't. The physical floor handles a fraction of the total daily volume of the US stock market. Most trading happens in "dark pools" or on electronic exchanges like BATS or IEX.

However, the NYSE floor handles the important stuff.

It handles the "Opening Cross" and the "Closing Bell." These are the two most important minutes of the trading day. The closing auction at 4:00 PM determines the "official" closing price for thousands of stocks. Trillions of dollars in index funds and mutual funds use that specific price to calculate their Net Asset Value (NAV). If the floor messed up the close, the entire global financial system would have a nervous breakdown.

- The Floor is "Rigged": No. It's actually one of the most regulated places on Earth. Every trade is transparent and auditable.

- It's Only for Big Banks: While big firms dominate, floor brokers often represent smaller institutional clients who want "boutique" service.

- It's Going to Close Next Year: People have said this every year since 2005. It’s still there. The NYSE recently invested millions in renovating the floor spaces. They aren't leaving.

How to "Use" This Information

If you’re an active trader or just someone curious about how your 401k works, understanding the New York Stock Exchange trading floor helps you understand market structure.

- Watch the Open and Close: Notice how volatility spikes at 9:30 AM and 4:00 PM. That is the "human" element of the floor interacting with the "digital" world.

- Respect the DMM: When a stock is "halted" due to news, remember there is a human DMM at a post on the floor working to reopen it. They aren't "blocking" you; they are trying to prevent a price collapse.

- Value the "Listing": There is a reason why the world's biggest companies—Berkshire Hathaway, Walmart, J.P. Morgan—choose to stay on the NYSE despite the higher listing fees compared to Nasdaq. They want the floor. They want the DMM. They want the stability.

The trading floor is an anomaly. It's a 18th-century concept wrapped in 21st-century silicon. It shouldn't work, but it does. In a world that is becoming increasingly automated and "faceless," the NYSE reminds us that sometimes, you just need a human in the room to make sure things don't go off the rails.

To get a better sense of how this impacts your own portfolio, you should look into "Price Discovery" mechanisms. Most brokerage apps don't show you the "auction" process, but seeing the "Order Book" in real-time can give you a hint of the pressure those traders feel on the floor every single morning. If you ever get the chance to take a tour—do it. It's the closest thing finance has to a holy site.

Start by checking your own holdings. Are they NYSE or Nasdaq listed? Notice if the NYSE ones seem to "behave" differently during high-volatility events. You might be surprised at the difference a few humans on a floor can make.