Money isn't what it used to be. Honestly, if you look at your bank account and feel like those numbers are losing their "punch," you aren't imagining things. The US dollar in decline is a phrase that scares some people and makes others roll their eyes, but the reality is way more nuanced than a simple "yes" or "no" answer. It's a mess of geopolitics, debt, and digital shifts.

The dollar has been the king of the mountain since the Bretton Woods Agreement in 1944. For decades, it was as good as gold—literally, until Nixon took us off the gold standard in '71. But lately? The crown is looking a little rusty. Central banks around the world are starting to look at their vaults and wonder if they should be holding something else. Maybe some Euros. Maybe some Gold. Maybe even a digital currency they control themselves.

Why the US dollar in decline isn't just a conspiracy theory

We have to talk about the "exorbitant privilege." That’s what French Finance Minister Valéry Giscard d'Estaing called it back in the 60s. Because the world uses the dollar for trade, the US can basically print money to pay for things while everyone else has to actually produce goods to get those dollars. It’s a sweet deal. But the world is getting tired of it.

🔗 Read more: Elon Musk DOGE Staff Expansion: What Really Happened with the Hiring Blitz

Look at the BRICS nations—Brazil, Russia, India, China, and South Africa. They’ve been very vocal about "de-dollarization." They aren't just talking, either. In 2023, for the first time, China’s use of the yuan in its cross-border transactions actually surpassed its use of the dollar. That’s huge. It’s not just a small shift; it’s a tectonic move in how global trade functions. When Saudi Arabia starts hinting that they might accept currencies other than the dollar for oil? That’s when the "Petrodollar" system, which has propped up US influence for fifty years, starts to feel shaky.

People often think a currency "collapses" like a building in a movie. It doesn't. It’s more like a slow leak in a tire. You can still drive on it for a while, but eventually, you’re on the rim. The US national debt is currently screaming past $34 trillion. To put that in perspective, the interest payments alone are starting to cost more than the entire defense budget. When a country owes that much, the value of its currency usually takes a hit because people lose faith in its ability to pay it back without just printing more and inflating the value away.

The Weaponization of Finance

There’s another weird angle here: the US actually caused some of this. When the US froze Russian central bank assets after the invasion of Ukraine, it sent a shockwave through every other "non-aligned" country. They realized that if the US doesn't like what you're doing, they can basically turn off your money.

👉 See also: Why Big Fat and Almost Dead Stocks Are Suddenly Dominating Your Portfolio

Nations like India and Indonesia looked at that and thought, "Wait, we need a Plan B." You can't blame them. If your entire economy depends on a system that someone else can flip a switch on, you're going to look for an exit. This "weaponization" of the dollar has accelerated the hunt for alternatives faster than any economic factor ever could.

The Digital Threat and the Rise of Gold

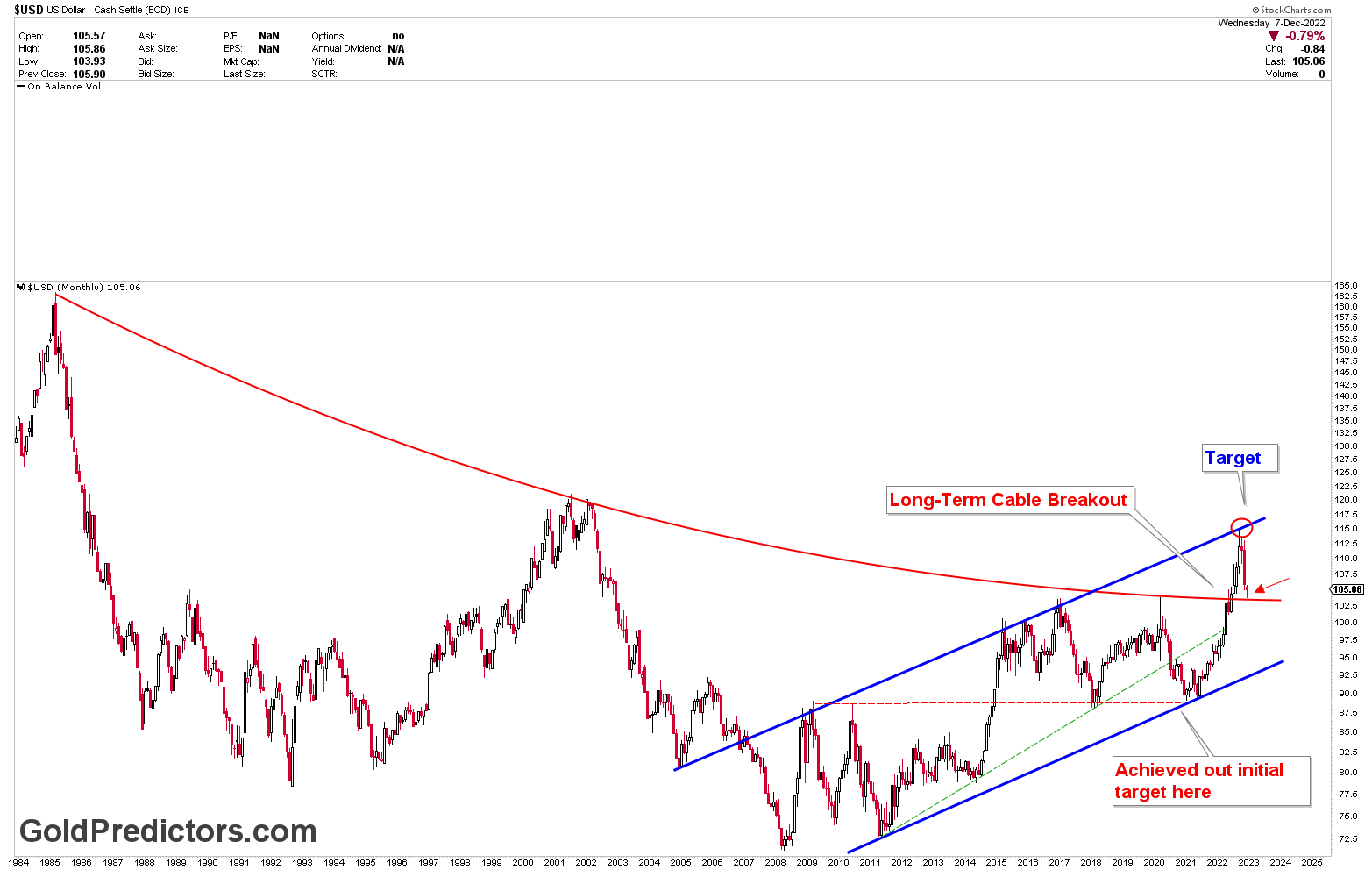

Gold is back. It’s funny because for years, tech bros and modern economists called gold a "pet rock." Well, that rock is hitting record highs. Central banks bought a record 1,037 tonnes of gold in 2023. Why? Because you can't freeze gold in a digital vault and you can't print more of it. It’s the ultimate hedge against a US dollar in decline.

Then you have Central Bank Digital Currencies (CBDCs). This isn't Bitcoin. This is the Chinese e-CNY or the potential "Digital Euro." These systems allow countries to trade directly with each other without touching the SWIFT system, which is the plumbing of the global dollar trade. If you can bypass the plumbing, you don't need the dollar.

- China is already testing the e-CNY with millions of citizens.

- The mBridge project is looking at how to link different digital currencies for instant trade.

- Even the Fed is looking at "FedNow," though they're trailing behind the curve.

Inflation is the invisible tax

You feel the US dollar in decline every time you go to the grocery store. Inflation is basically the currency losing its purchasing power. While the Fed tries to keep it at 2%, the reality for the average person feels much higher. If your $100 buys 20% less beef than it did three years ago, the dollar has declined for you, regardless of what the DXY (Dollar Index) says against the Yen or the Pound.

It's a weird paradox. Sometimes the dollar looks strong on paper because every other currency is also doing poorly. It’s like being the "least sick" person in a hospital ward. You're still in the hospital. If the Euro is struggling with energy costs and the Yen is battling deflation, the Dollar wins by default. But winning by default isn't the same as being healthy.

What actually happens if the dollar loses its status?

If the dollar loses its "Reserve Currency" status, things change for Americans. Fast.

Imports get way more expensive. That iPhone? Those sneakers? The price goes up because the companies making them don't want your "weak" dollars anymore. Interest rates would likely stay permanently higher. Currently, the US can borrow money cheaply because there is a massive global demand for Treasury bonds. If that demand disappears, the US has to offer much higher interest rates to attract buyers. That means your mortgage, your car loan, and your credit card debt all get much, much heavier.

It's not all doom and gloom, though. A weaker dollar actually helps US manufacturers. If the dollar is cheaper, American-made cars and software are cheaper for people in Europe or Asia to buy. It could lead to a weird sort of "re-industrialization" of the US, but the transition would be painful. Very painful.

Actionable Steps for the "Post-Dollar" Mindset

You shouldn't panic, but you should probably stop keeping 100% of your net worth in a single currency. That’s just basic risk management. Even if you love the US, diversification is the only "free lunch" in finance.

- Diversify your cash. Look into holding a bit of physical gold or silver. It doesn't have to be a pirate chest; even small coins work as a "break glass in case of emergency" fund.

- Globalize your investments. If all your stocks are US-based (S&P 500), you're doubling down on the dollar. Consider international index funds or emerging market ETFs.

- Hard Assets. Real estate, land, or even high-quality tools and equipment hold value when paper money doesn't.

- Skills are the ultimate currency. If the economy goes sideways, the ability to fix a plumbing leak or write code is worth more than a stack of depreciating bills.

The US dollar in decline is a story about the end of an era. We’ve lived in a "unipolar" world for so long we forgot that empires and currencies have lifespans. The British Pound was the world's currency once. Before that, it was the Dutch Guilder. History doesn't stop just because we're living in it. The shift might take another twenty years, or it might happen in five, but the smart move is to stop assuming the dollar's dominance is a law of nature. It’s just a policy, and policies change.

🔗 Read more: La Hora de la Verdad: Why Your Business Strategy Fails When Customers Actually Show Up

Protecting your purchasing power means looking past the headlines and understanding that "wealth" isn't just a number on a screen—it's what that number can actually buy you in the real world. Keep your eyes on the central bank gold purchases; they usually know something the rest of us don't.