Gold is weird. You’d think by 2026 we would have scraped every shiny pebble out of the dirt, but the world gold deposits map is actually getting more crowded, not less. It’s not just about some guy with a pan in a river anymore. We are talking about massive, deep-earth structural anomalies that geologists spend decades trying to decode. Honestly, if you look at a global map of where gold actually sits, it doesn't follow country borders. It follows ancient scars in the Earth’s crust.

Most people think of the Klondike or maybe the Wild West. That’s old news. Today, the map is dominated by "cratons"—the oldest, most stable parts of the continental lithosphere. If you aren't looking at the Yilgarn Craton in Western Australia or the Abitibi Gold Belt in Canada, you're basically looking in the wrong place. These are the heavy hitters.

Why the World Gold Deposits Map Keeps Changing

The map isn't static. It’s a living document. Ten years ago, nobody was really talking about the potential in the Tethyan Belt stretching across SE Europe and Asia as much as they are now. Why? Because the technology to "see" underground has gotten scary good. We use hyperspectral imaging and seismic tomography now. It’s like giving the world a giant X-ray.

Gold likes to hide in specific neighborhoods. You’ve got your orogenic deposits, which happen when plates collide and squeeze gold-bearing fluids into cracks. Then you have porphyry deposits, usually linked to volcanoes. These are huge but lower grade. If you’re looking at a world gold deposits map, the giant red circles in the Andes? Those are mostly porphyries. They are a pain to process but they last for half a century.

The Big Players You Already Know (And Some You Don't)

China is currently the world’s top producer, but their "map" is a bit of a mystery because they keep a lot of data close to the chest. The Shandong Province is their powerhouse. But if we talk about pure geological wealth, the Witwatersrand Basin in South Africa is the undisputed king of history. It has produced about 40% of all the gold ever mined. Let that sink in. However, it’s getting harder. The mines there are now nearly 4 kilometers deep. It’s hot, it’s dangerous, and it’s expensive.

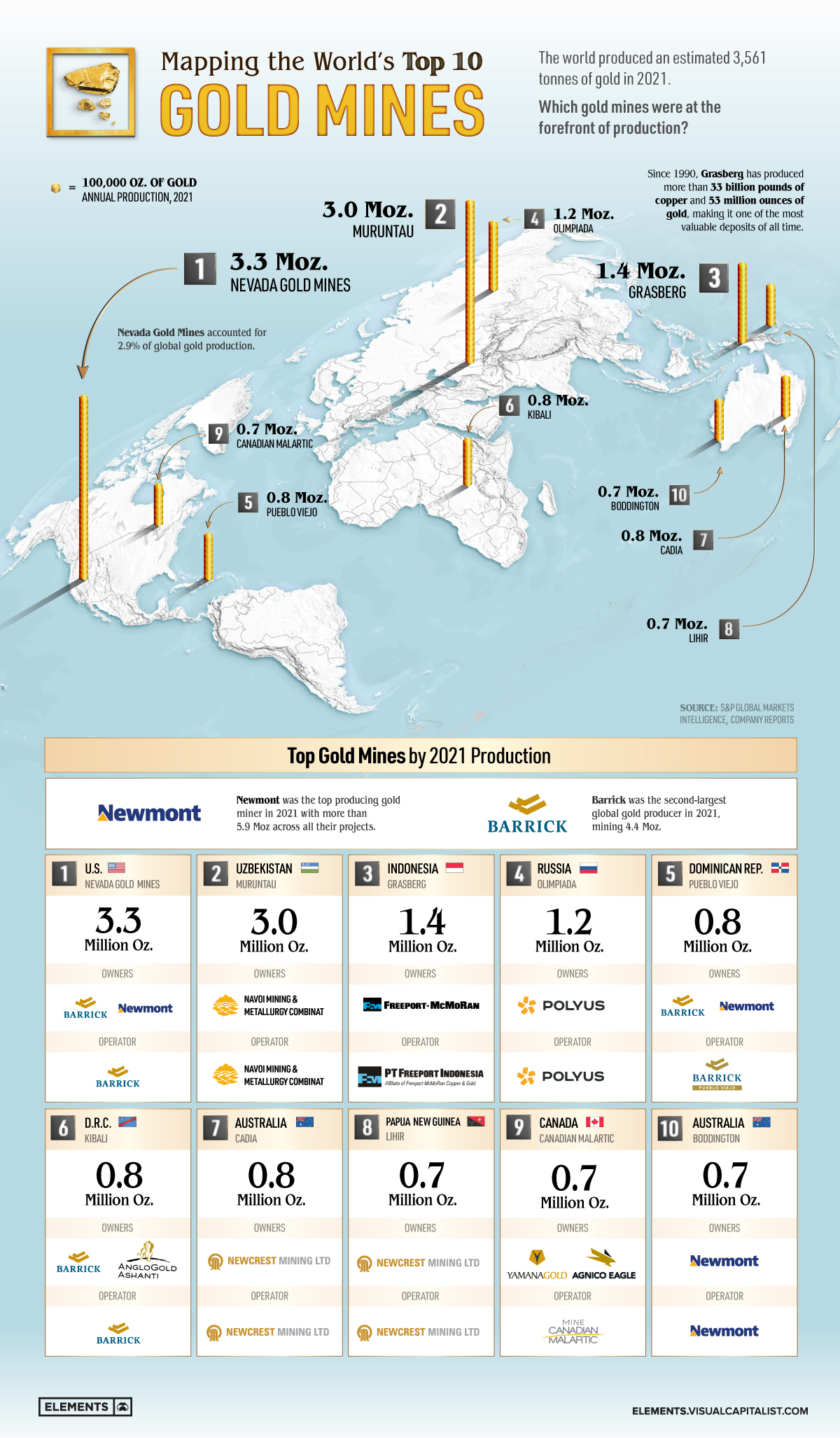

Russia is another massive variable. The Olimpiada mine in the Krasnoyarsk region is a monster. But geopolitical shifts mean that the Russian portion of the world gold deposits map is basically a "no-go" zone for Western investment right now. That’s shifting the focus toward "safer" jurisdictions like Nevada. The Carlin Trend in Nevada is legendary. It’s a specific type of deposit where the gold is "invisible"—it’s so small you need an electron microscope to see it. But there is a lot of it.

💡 You might also like: Current Dow Jones Live: Why the Blue Chips Just Sapped the Bear Energy

The Invisible Gold of the Oceans

Here is something that gets ignored: the map doesn't stop at the beach. The seafloor is littered with massive sulfide deposits. We know exactly where they are—mostly along mid-ocean ridges and back-arc basins. But mining them? That’s a logistical and environmental nightmare. Companies like Nautilus Minerals tried it and it was a bit of a train wreck. Still, the gold is there. Millions of ounces.

When you look at a world gold deposits map, you have to realize you’re only seeing what is "economically recoverable." There is gold in seawater, too. About 20 parts per trillion. It sounds like nothing, but it adds up to roughly 20 million tons of gold. We just don't have a way to get it out without spending more than the gold is worth.

Greenstone Belts: The Geologist's Best Friend

If you want to find gold, find the greenstone. These are zones of metamorphosed volcanic rocks. They look green because of minerals like chlorite and epidote. The Abitibi belt in Ontario and Quebec is the poster child for this. It’s produced over 180 million ounces.

- Val-d'Or: Literally means "Valley of Gold."

- Timmins: Home to the Big Three mines that started the rush.

- Kirkland Lake: Where the high-grade stuff lives.

The fascinating thing about these belts is that they are billions of years old. They are the bones of the planet. When you look at the world gold deposits map, you are looking at a history of where the Earth was literally ripping itself apart or smashing itself together.

Environmental and Social Roadblocks

You can't just dig a hole because the map says there is gold there. The "social license to operate" is the new gold standard. Look at the Pascua-Lama project on the border of Chile and Argentina. It’s one of the biggest deposits on the world gold deposits map, but it’s stuck in a legal purgatory because of glacier protection laws.

The map is also being redrawn by ESG (Environmental, Social, and Governance) scores. A deposit in a high-risk jurisdiction with poor water management is basically worthless to a major mining company like Newmont or Barrick. They would rather buy a smaller, "cleaner" deposit in Australia than a massive one in a conflict zone.

🔗 Read more: Charles E. Smith Management Corporation: Why Crystal City Looks the Way It Does

Artisanal Mining: The Dark Map

There is a whole other world gold deposits map that isn't in the corporate brochures. This is the world of artisanal and small-scale mining (ASM). We are talking about 15 to 20 million people globally. In places like the Democratic Republic of Congo or parts of the Amazon, ASM is a primary economy. It’s also where a lot of the environmental damage happens—mercury pollution is a massive issue here. These sites often don't show up on official USGS or British Geological Survey maps, but they contribute about 20% of the world's annual gold supply.

Where is the Next "Super-Deposit"?

Everyone is hunting for the next Grasberg or Yanacocha. The smart money is currently looking at the Golden Triangle in British Columbia. It’s rugged, it’s icy, and it’s remote. But as glaciers retreat (a grim reality of climate change), they are uncovering rock that hasn't been seen in millennia. New discoveries like the Brucejack mine have proven that the map still has secrets.

Ecuador is another one to watch. For a long time, it was the "quiet neighbor" of Peru and Chile—two mining giants. But with the discovery of Fruta del Norte, Ecuador has firmly landed on the world gold deposits map. It’s a high-grade epithermal vein system, which is basically the "holy grail" for miners because you get a lot of gold for relatively little rock moved.

How to Actually Use This Information

If you're an investor, or just a nerd about geology, don't just look for where the gold is. Look for where the gold is being found.

- Check the S&P Global Market Intelligence reports on exploration spending. If companies are pouring money into the Gawler Craton in South Australia, there’s a reason.

- Follow the "near-mine" exploration. It’s much cheaper to find more gold next to an existing mine than to start a new one in the middle of nowhere.

- Watch for infrastructure. A world gold deposits map is useless if there are no roads, no power, and no water. This is why the Ring of Fire in Northern Ontario is taking so long to develop.

The reality of gold is that it’s finite. We aren't making more of it—at least not until we figure out how to mine asteroids (which, honestly, is a whole other map). For now, the terrestrial map is what we have. It’s a puzzle of plate tectonics, chemistry, and sheer luck.

📖 Related: Converting 200 000 rupees to dollars: What the banks aren't telling you about the mid-market rate

The most important takeaway? The world gold deposits map is a guide, not a guarantee. Just because there is gold in the ground doesn't mean it’s coming out. You have to account for the depth, the chemistry of the rock (refractory gold is a nightmare to process), and the local politics.

If you want to track this in real-time, the best move is to monitor the USGS Mineral Resources Program or the Geological Survey of Canada. They release updated shapefiles and spatial data that define these trends. For the casual observer, just remember: follow the cratons. That’s where the old, deep, and heavy wealth of the planet is buried.

Start by looking at the Nevada Division of Minerals reports or the Western Australia Department of Mines databases. These regions have the most transparent data and provide the clearest picture of how a world gold deposits map translates from a bunch of dots on a screen to a multi-billion dollar operation.