You finally scored those Eras Tour tickets. Or maybe it was a front-row seat to a rare reunion tour. Then, life happened—you couldn't go, so you listed them on Ticketmaster. They sold fast. The money hit your bank account, and you felt like a genius. But then, a nagging thought creeps in. You’ve heard whispers about the IRS, the $600 rule, and those 1099-K forms that seem to haunt every online side hustle these days.

Honestly, the Ticketmaster seller tax details are a bit of a mess right now.

It’s not just you. Between shifting federal thresholds and specific state laws, trying to figure out if you owe Uncle Sam for a pair of nosebleed seats is enough to give anyone a headache. Let’s get one thing straight: selling tickets isn't just "trading up" anymore in the eyes of the government. It’s reportable income. Most people think they can just fly under the radar because they aren't "professional scalpers." That’s a risky bet to take in 2026.

The $600 Threshold Chaos

For years, the IRS had this high bar. You didn't get a 1099-K unless you hit $20,000 in sales and 200 transactions. It was a safe zone for the casual fan. Then, the American Rescue Plan changed everything, dropping that threshold to a measly $600.

The implementation has been a literal rollercoaster.

The IRS delayed it. Then they delayed it again. They even suggested a "phase-in" threshold of $5,000 for a while to keep the tax season from turning into a total riot. But here is the reality you have to face: Ticketmaster is a massive, compliant corporation. They aren't going to risk their business to save you a few bucks on taxes. If you sell more than the current federal or state limit, they will ask for your Taxpayer Identification Number (TIN), which is usually just your Social Security number. If you don't give it to them? They’ll freeze your payouts. Simple as that.

State Laws Might Get You First

Don't think you're safe just because the IRS is dragging its feet on the federal level. Several states looked at the federal delays and said, "No thanks, we want our cut now." If you live in places like Massachusetts, Vermont, or Maryland, you might see a 1099-K for as little as $600 regardless of what the folks in D.C. are doing.

It's kind of wild. You could sell two tickets to a playoff game, make a $200 profit, and suddenly you're dealing with tax paperwork. Always check your local Department of Revenue site. Seriously.

Is It All Taxable Profit?

This is where people panic for no reason. Getting a 1099-K doesn't mean you owe taxes on the entire amount listed on that form.

The 1099-K reports gross proceeds. That is a fancy way of saying "the total amount of money that passed through the platform." It doesn't account for what you originally paid for the tickets. It doesn't account for Ticketmaster’s outrageous "seller fees" (we all know the pain). It doesn't account for the cost of the original delivery.

Calculating Your Basis

To figure out if you actually owe money, you need to find your "cost basis."

- Original Ticket Price: What you paid on the primary market (including those initial fees).

- Platform Fees: The cut Ticketmaster took when you sold the ticket.

- Other Expenses: Did you pay for a fan club membership just to get the presale code? Some tax pros argue that’s a deductible cost of doing business.

If you bought a ticket for $300 and sold it for $500, but Ticketmaster took $50 in fees, your actual gain is $150. You only pay taxes on that $150. If you sold the ticket for $250—taking a loss because the band's lead singer got sick or the hype died down—you owe zero. Zip. Nada. In fact, for most casual sellers, these "personal losses" aren't even deductible, but they definitely aren't taxable income.

The Form 1040 Trap

When you get that 1099-K in January or February, it doesn't just disappear. The IRS gets a copy too. If you don't mention it on your tax return, their automated systems will eventually flag the discrepancy. It might take a year or two, but they’ll send a "Notice CP2000." It basically says, "Hey, we saw you made $1,200 on Ticketmaster but didn't tell us. Here's a bill for the taxes plus interest."

Avoid the drama.

Even if you didn't make a profit, you should report the 1099-K amount on your Schedule 1 and then "zero it out" by showing the cost basis. It tells the IRS, "Yes, I saw the money, but no, it wasn't profit."

Why Your SSN is Required

You might notice a red banner on your Ticketmaster account lately. It’s demanding your tax info. Some people get sketched out and think it’s a scam or an invasion of privacy. It's actually a requirement under Section 6050W of the Internal Revenue Code.

If you hit the threshold, Ticketmaster is legally obligated to collect your info. If they don't, they are required to perform "backup withholding." This means they take roughly 24% of your sale price right off the top and send it to the IRS themselves. You definitely don't want that. It's a nightmare to get that money back if you didn't actually owe it.

Common Misconceptions About Ticketmaster Seller Tax Details

One of the biggest myths is that "friends and family" payments or "gifting" tickets avoids the tax. If you sell the tickets through the Ticketmaster marketplace, the transaction is logged. There is no "gift" button for a commercial sale.

Another big one? "I'm just a hobbyist, so I don't have to pay."

✨ Don't miss: Is Trump Giving Stimulus Checks 2025: What Most People Get Wrong

The IRS changed the rules on hobby income a few years back. You used to be able to deduct hobby expenses against hobby income, but the Tax Cuts and Jobs Act of 2017 mostly nuked that for individuals. Now, if it’s considered "income," it’s often just straight-up income. However, for most ticket sellers, these are "capital assets." Selling a ticket is more like selling a stock or a piece of art than running a bakery.

Real-World Scenario: The Taylor Swift Effect

Let's look at a hypothetical (but very common) situation.

Imagine you bought two tickets for $500 total. You sold them for $3,000 because the market went crazy. Ticketmaster takes a 15% seller fee ($450). You receive a 1099-K for $3,000.

Your taxable gain:

$3,000 (Gross) - $450 (Fees) - $500 (Original Cost) = **$2,050 taxable profit.**

If you're in the 22% tax bracket, you’re looking at a tax bill of roughly $451. If you didn't set that money aside, April is going to hurt.

Actionable Steps for Ticket Sellers

Don't wait until tax season to scramble for receipts. If you're moving tickets on Ticketmaster, you need a system.

1. Digital Paper Trail

Save your original purchase confirmation emails. If you bought tickets at the box office (rare, I know), scan the receipt. You need proof of what you paid to establish your cost basis.

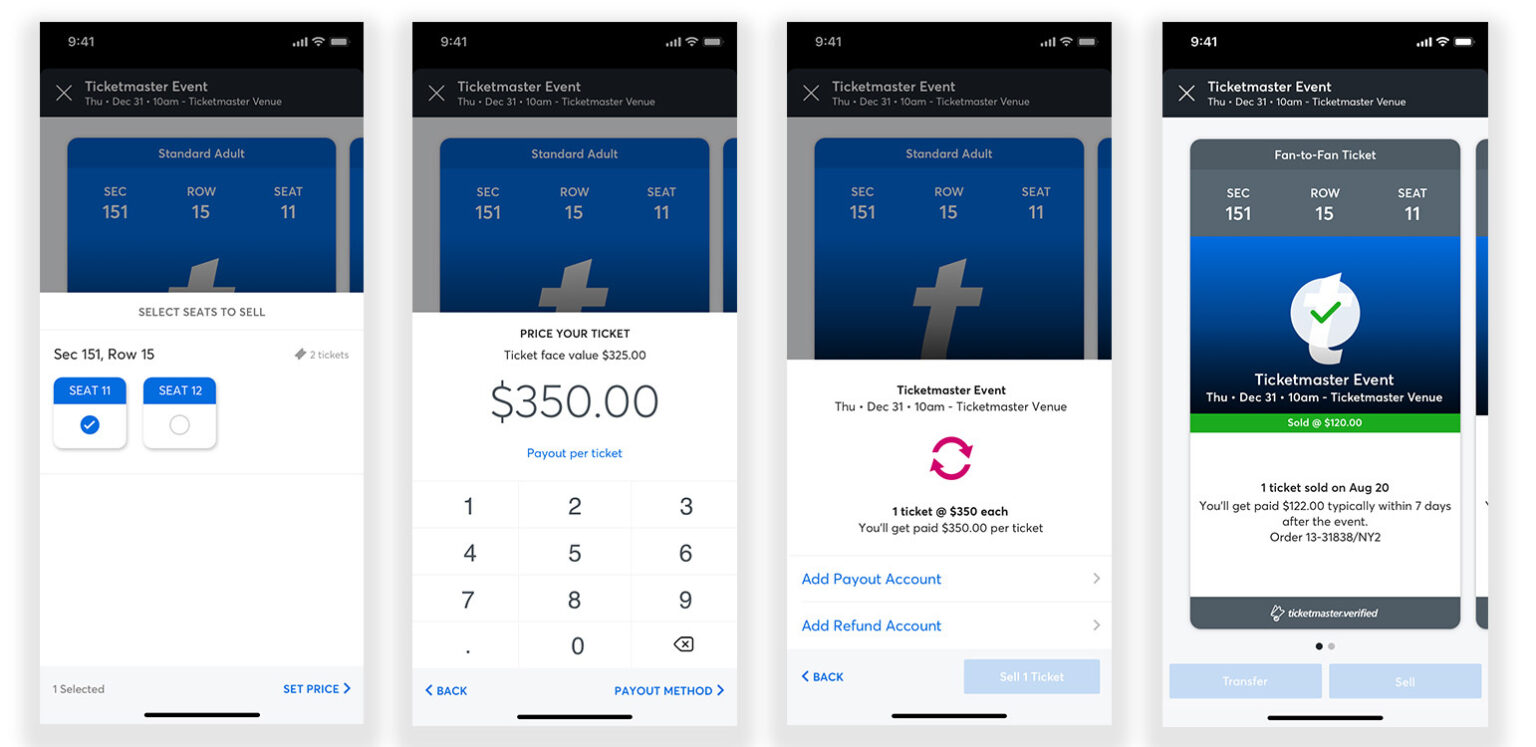

2. Screenshot Your "Sold" Listings

Ticketmaster's internal dashboard can be clunky. Screenshot the final breakdown of your sale, showing exactly how much was taken out in fees. This makes life way easier for your accountant.

3. Update Your Profile Now

Go into your Ticketmaster "Seller Settings" and ensure your address and TIN are correct. If you moved recently, a lost 1099-K is a recipe for an IRS audit.

4. Check Your State Threshold

Verify if your state is one of the "strict" ones (like IL, NJ, or VA) that requires reporting at lower amounts than the federal level.

💡 You might also like: Why Martha Layne Collins Still Matters: The Kentucky Governor Who Bet Big on Global Business

5. Consult a Professional

If you sold dozens of tickets this year, you aren't a "casual fan" anymore in the eyes of the law. You're a small business. A CPA can help you figure out if you can deduct part of your internet bill, travel to the venue, or other "business" expenses that a casual seller can't touch.

The days of tax-free ticket flipping are effectively over. The technology caught up with the marketplace, and the IRS is hungry. Staying organized is the only way to make sure a "big win" on a ticket sale doesn't turn into a big loss during an audit. Keep your receipts, understand the forms, and always assume the government is watching your digital wallet.